Market Overview

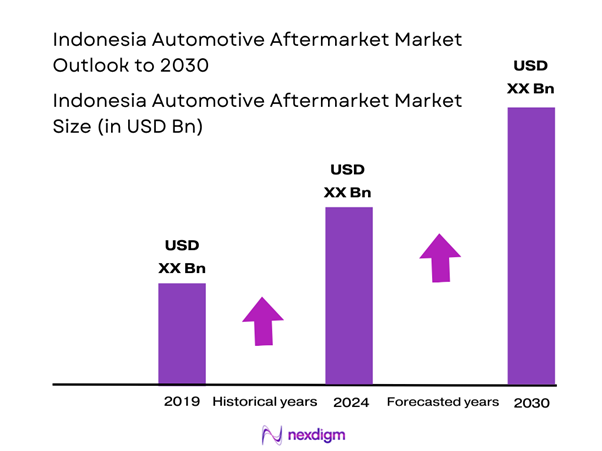

The Indonesian automotive aftermarket market is valued at USD 4.6 billion in 2024 with an approximated compound annual growth rate (CAGR) of 5.2% from 2024-2030, demonstrating strong growth due to the rising number of vehicles on the road and the increased demand for vehicle maintenance and accessories. This market is driven by consumers’ inclination toward maintaining their vehicles to maximize performance and lifespan, alongside a rise in e-commerce platforms facilitating the accessibility of parts and services.

Jakarta, Surabaya, and Bandung are the dominant cities in the Indonesian automotive aftermarket. Jakarta leads due to its immense population density and urban infrastructure that supports a high number of vehicle registrations. Surabaya and Bandung also contribute significantly due to their status as major economic centers, where both commercial and passenger vehicles are prevalent. The combination of these cities’ economic activities and vehicle concentration has created robust demand for automotive aftermarket products and services.

The rapid expansion of e-commerce platforms in Indonesia has transformed the automotive aftermarket landscape. In 2023, online retail sales reached USD 64 billion, an increase driven by a significant surge in internet penetration, which has now approached 75%. The ease of online shopping allows consumers to access a wider array of automotive products and services conveniently. For instance, platforms like Tokopedia and Bukalapak have begun to include automotive parts and accessories, contributing to higher sales volumes in this segment.

Market Segmentation

By Component Type

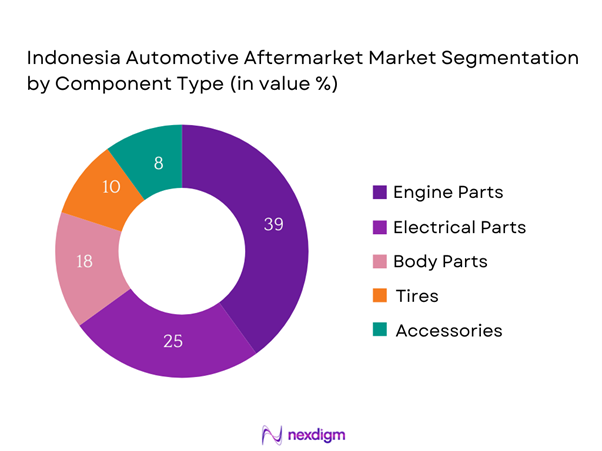

The Indonesian automotive aftermarket market is segmented by component type into engine parts, electrical parts, body parts, tires, and accessories. The engine parts segment holds a dominant market share, driven by the necessity of maintaining vital vehicle performance. Given that engine components are among the most critical infrastructure of a vehicle, regular replacements and upgrades become imperative. With an increasing focus on vehicle longevity and performance enhancement, brands offering high-quality engine parts have seen significant growth, catering to the growing consumer inclination towards investing in premium vehicle components.

By Vehicle Type

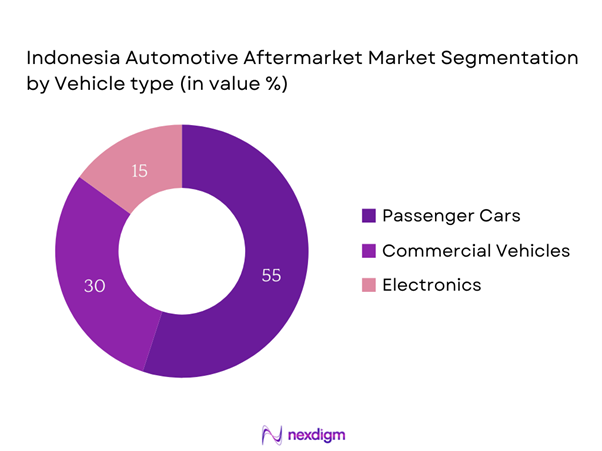

The market is further segmented by vehicle type, consisting of passenger cars, commercial vehicles, and two-wheelers. Passenger cars capture a significant share of the market due to the increasing purchasing power of Indonesian consumers and the population’s growing preference for personal vehicles over public transportation. Additionally, the expanding variety of passenger car models suited for various segments has driven demand in the aftermarket for parts and accessories, as owners seek to customize and maintain their vehicles. This growth is fueled by a youthful demographic increasingly investing in personal mobility.

Competitive Landscape

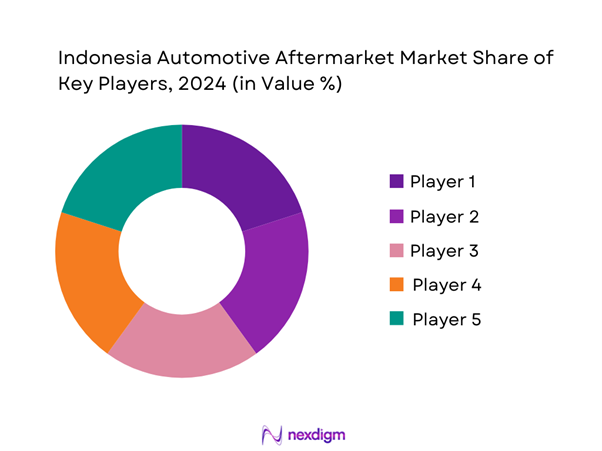

The Indonesian automotive aftermarket market is characterized by a robust competitive landscape featuring a mix of local and international players. This competitive environment is underscored by a range of established brands offering diverse products and services. Notable manufacturers include Astra International, which leads with its extensive portfolio and distribution network, along with global brands enhancing market competitiveness through technological advancements and customer service.

| Company | Establishment Year | Headquarters | Product Focus | Market Share % | Distribution Channels | Notable Achievements |

| Astra International | 1957 | Jakarta | – | – | – | – |

| Toyota Astra Motor | 1971 | Jakarta | – | – | – | – |

| Honda Prospect Motor | 1999 | Jakarta | – | – | – | – |

| Suzuki Indomobil | 1970 | Jakarta | – | – | – | – |

| Mitsubishi Motors | 1970 | Tokyo, Japan | – | – | – | – |

Indonesia Automotive Aftermarket Market Analysis

Growth Drivers

Increasing Vehicle Ownership

Indonesia has experienced a notable increase in vehicle ownership, with the total number of registered vehicles reaching approximately 15.4 million in 2023. The growing middle-class population, projected to account for nearly 23% of the total population by end of 2025, significantly contributes to this trend, as consumers increasingly invest in personal vehicles for convenience and mobility. The rise in urbanization is also a factor; cities like Jakarta see an influx of people who require transportation for daily commutes. This surge in ownership is helping to stimulate demand in the automotive aftermarket as vehicles require maintenance, parts, and accessories throughout their lifecycle.

Rising Disposable Income

Rising disposable income across the Indonesian population is a strong driver for growth in the automotive aftermarket sector. The average annual income in Indonesia grew to USD 4,100 in 2023, up from USD 3,800 in 2022, indicating a steady rise in consumer purchasing power. The expectation is for further gradual increases in income as the economy rebounds from the pandemic. More affluent consumers tend to invest more in aftermarket services and products, further driving growth in this sector as they seek better quality and performance enhancements for their vehicles.

Market Challenges

Counterfeit Products

The prevalence of counterfeit automotive parts presents a serious challenge to the Indonesian aftermarket. In 2023, it was estimated that counterfeit products could represent over 30% of the total parts sold in the market, gravely impacting both safety and consumer trust. The lack of stringent regulations and enforcement poses risks not only to manufacturers of genuine products but also puts consumers at risk of vehicle failures and accidents. This challenge accelerates the need for stricter enforcement of intellectual property rights, a key area where government initiatives should focus in order to protect consumers and legitimate manufacturers alike.

Economic Fluctuations

Economic fluctuations pose a significant concern for the Indonesian automotive aftermarket. The country’s GDP growth was projected to be around 5.1% in 2023 but faced potential adjustments due to inflationary pressures and global economic uncertainties. Such fluctuations in the economy impact consumer spending behavior—when economic conditions become volatile, individuals may prioritize essential expenses over discretionary spending on vehicle maintenance and aftermarket products. This economic instability necessitates that automotive players remain vigilant and adaptable to maintain their market positions and profitability.

Opportunities

Increasing Demand for Eco-friendly Products

The growing trend towards sustainability is driving demand for eco-friendly automotive products in Indonesia. In 2023, sales of hybrid and electric vehicles saw a notable increase by 12%, reflecting changing consumer attitudes towards environmentally-friendly alternatives. As consumers become increasingly aware of their environmental impact, the automotive aftermarket is likely to see enhanced sales of eco-friendly parts and accessories, including bio-based lubricants and sustainable tires. This shift presents significant opportunities for manufacturers who can meet this burgeoning demand, thereby positioning themselves favorably in the market.

Growth of Electric Vehicles

The adoption of electric vehicles (EVs) is gaining momentum within Indonesia, with projections indicating about 15,000 EV units sold in 2023. The Indonesian government aims to boost the electric vehicle market through its target of having 20% of all vehicles on the road be electric by end of 2025. This governmental push creates opportunities for the automotive aftermarket, particularly in terms of maintenance and parts supply that cater specifically to EVs. As more consumers transition to electric vehicles, there will be an increasing need for specialized aftermarket components and technical services, fostering growth and innovation in this segment of the market.

Future Outlook

Over the next five years, the Indonesian automotive aftermarket market is expected to see substantial growth, driven by emerging consumer trends emphasizing vehicle maintenance and personalization. With an upsurge in vehicle ownership, especially among younger demographics, the demand for quality aftermarket products and services is set to rise. Additionally, advancements in automotive technologies, combined with increasing internet penetration facilitating online purchases, will significantly influence the market landscape, enhancing accessibility and customer engagement.

Major Players

- Astra International

- Toyota Astra Motor

- Honda Prospect Motor

- Suzuki Indomobil

- Mitsubishi Motors

- Daihatsu

- Nissan Motor Indonesia

- Yamaha Indonesia

- Isuzu Astra Motor Indonesia

- Polytron

- Tunas Ridean

- Indomobil Sukses Internasional

- Hino Motors

- TRC Group

- GM Indonesia

Key Target Audience

- Automotive Parts Manufacturers

- Vehicle Owners

- Distributors and Wholesalers

- E-commerce Platforms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Industry, Ministry of Transportation)

- Automotive Service Providers

- Fleet Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the critical variables influencing the Indonesian automotive aftermarket market. This is accomplished through extensive desk research, analyzing secondary data and proprietary databases to compile information on market dynamics. The objective is to pinpoint key stakeholders and their interactions within the market ecosystem, ensuring a comprehensive foundation for analysis.

Step 2: Market Analysis and Construction

This phase entails gathering and evaluating historical data related to the automotive aftermarket. Key factors, such as market penetration, the ratio of aftermarket components to vehicles in service, and revenue generation from different segments, are assessed. This thorough analysis provides a clearer picture of the market and validates the understanding of consumer behavior and preferences in purchasing automotive products and services.

Step 3: Hypothesis Validation and Expert Consultation

Proposed hypotheses regarding market trends and forecasts will be validated through consultations with industry experts and stakeholders using computer-assisted telephone interviews (CATIs). These discussions aim to extract firsthand insights into operational practices, competitive strategies, and financial performance across the sector, reinforcing the accuracy and reliability of the prevailing data.

Step 4: Research Synthesis and Final Output

The concluding phase involves engaging directly with key automotive aftermarket players to gather insights into product characteristics, sales data, and consumer sentiment. By synthesizing this qualitative information with quantitative data derived from previous steps, a holistic report of the Indonesian automotive aftermarket market is constructed, offering actionable insights and strategic recommendations.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Vehicle Ownership

Rising Disposable Income

Expansion of E-commerce Platforms - Market Challenges

Counterfeit Products

Economic Fluctuations - Opportunities

Increasing Demand for Eco-friendly Products

Growth of Electric Vehicles - Trends

Digital Transformation in Repair Services

Increasing Consumer Awareness - Government Regulation

Compliance with Safety Standards

Environmental Legislation - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component Type (In Value %)

Engine Parts

– Filters (Air, Oil, Fuel)

– Spark Plugs & Glow Plugs

– Gaskets & Seals

– Engine Belts & Chains

Electrical Parts

– Batteries

– Alternators & Starters

– Lighting Systems (Headlights, Tail Lights)

– Wiring & Sensors

Body Parts

– Bumpers & Fenders

– Mirrors & Windshields

– Grilles & Panels

– Doors & Handles

Tires

– Radial Tires

– Bias Tires

– Tubeless Tires

– Performance Tires

Accessories

– Seat Covers & Mats

– Infotainment Systems

– Car Cameras & Sensors

– Roof Racks & Tow Hooks - By Vehicle Type (In Value %)

Passenger Cars

– Hatchbacks

– Sedans

– SUVs

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy Commercial Vehicles (HCVs)

Two-wheelers

– Motorcycles

– Scooters - By Distribution Channel (In Value %)

Online Stores

– OEM E-commerce Portals

– Aftermarket Platforms (e.g., Tokopedia, Shopee Auto)

Retail Stores

– Auto Parts Chains

– Independent Spare Parts Shops

Wholesalers

– Authorized Distributors

– Independent Parts Wholesalers - By Service Type (In Value %)

Maintenance Services

– Scheduled Oil Changes

– Filter Replacements

– Battery Checks & Tyre Rotation

Repair Services

– Brake & Suspension Repair

– Transmission & Engine Overhaul

– Electrical System Repair

Installation Services

– Accessory Installation (audio systems, GPS)

– Performance Enhancement Parts

– Lighting System Upgrades - By Region (In Value %)

Java

Sumatra

Bali

Sulawesi

Kalimantan

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Component Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Total Revenues, Revenues by Segment, Number of Touchpoints, Distribution Channels, Unique Value Offering, Digital Presence & E-commerce Integration, After-Sales Services & Customer Support Capabilities, Logistics & Supply Chain Efficiency, Geographic Footprint, Partnerships with OEMs / Garages / Insurance Players)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Astra International

Toyota Astra Motor

Daihatsu

Honda Prospect Motor

Suzuki Indomobil

Mitsubishi Motors

Nissan Motor Indonesia

Yamaha Indonesia

Isuzu Astra Motor Indonesia

Hino Motors

Tunas Ridean

Indomobil Sukses Internasional

Polytron

Sojitz Corporation

TRC Group

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030