Market Overview

The Indonesia automotive industry is valued at USD 2.06 billion in 2024, based on a comprehensive analysis of historical data and market fundamentals. This market is driven by increasing consumer demand for personal mobility, the rise of the middle class, and government initiatives to promote the automotive sector. Extensive urbanization in the country further fuels auto sales as cities like Jakarta, Surabaya, and Bandung dominate vehicle registrations due to their large populations and economic significance.

Major cities such as Jakarta and Surabaya are the leading hubs of the Indonesia automotive industry. Jakarta is a significant economic center offering substantial purchasing power influenced by a growing middle class. Simultaneously, Surabaya serves as a key trade artery with expanding infrastructure, supporting the transportation needs of a burgeoning population. The combination of economic activity and demographic trends makes these regions pivotal in shaping the automotive market landscape.

The Indonesian government is keen on reducing carbon emissions and promoting electric vehicles (EVs). It has implemented several initiatives to support EV adoption, such as the provision of tax incentives and the establishment of a target to provide 2.1 million electric vehicles by 2030. In 2023, the government allocated IDR 1.5 trillion (approximately USD 100 million) to support EV battery technology and charging infrastructure development.

Market Segmentation

By Vehicle Type

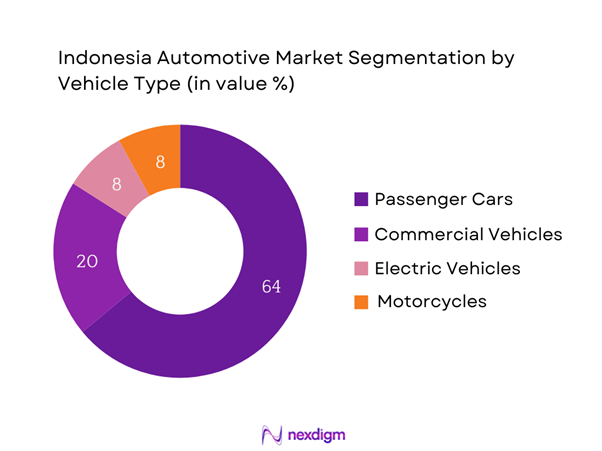

The Indonesia automotive market is segmented by vehicle type, encompassing passenger cars, commercial vehicles, electric vehicles (EVs), and motorcycles. In 2024, passenger cars are expected to hold the dominant market share, accounting for 64%. This segment’s leadership is attributed to the strong consumer preference for personal vehicles, coupled with brands like Toyota and Honda offering a wide range of affordable models. The increasing urbanization and significant investments in road infrastructure further enhance the demand for passenger cars.

By Fuel Type

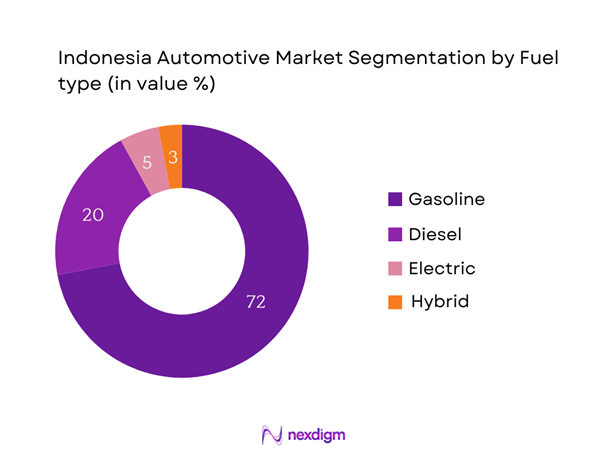

The market further segments by fuel type, which includes gasoline, diesel, electric, and hybrid vehicles. Gasoline-powered vehicles dominate, holding a market share of 72% in 2024. This is due to the long-standing market infrastructure and supply chain for gasoline distribution, making it the most accessible fuel type. As consumer preferences shift gradually towards more sustainable options, electric vehicles are gaining momentum, driven by government incentives and a growing awareness of environmental issues.

Competitive Landscape

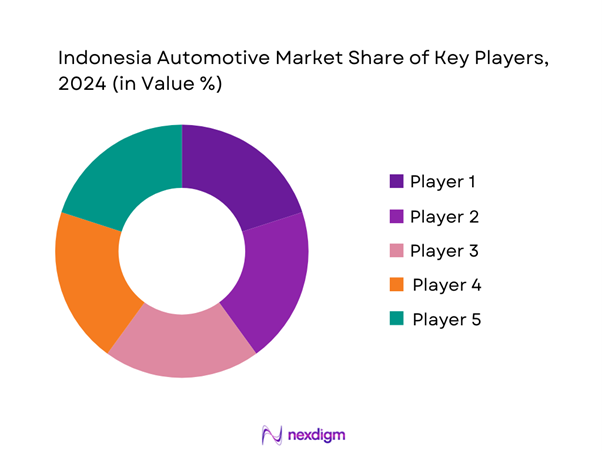

The Indonesian automotive market is characterized by intense competition among a handful of dominant players, including both local manufacturers and international automotive giants such as Toyota, Honda, and Daihatsu. This consolidation highlights the significant influence of key companies that have established strong brand recognition and extensive distribution networks within the country.

| Company | Establishment Year | Headquarters | Product Offering | 2024 Revenue (USD bn) | Market Strategy | Key Partnerships |

| Toyota Indonesia | 1971 | Jakarta | – | – | – | – |

| Honda Prospect Motor | 1998 | Jakarta | – | – | – | – |

| Daihatsu Indonesia | 1978 | Jakarta | – | – | – | – |

| Mitsubishi Motors | 1970 | Jakarta | – | – | – | – |

| Suzuki Indomobil Motor | 1970 | Jakarta | – | – | – | – |

Indonesia Automotive Industry Market Analysis

Growth Drivers

Increasing Middle-Class Population

The growing middle class in Indonesia is a significant driver of the automotive market. With an expanding economy, it is projected that by end of 2025, around 81 million people will belong to the middle class, increasing their purchasing power and, consequently, vehicle ownership. This demographic shift has led to heightened demand for personal transportation, evident in the fact that in 2022, the number of registered vehicles surpassed 15 million units. The rise of consumer spending, evidenced by an increase in per capita income, is fueling this trend further, prompting manufacturers to cater to this burgeoning market segment.

Urbanization Trends

Urbanization in Indonesia is driving vehicle ownership as more people move to cities for better employment opportunities and living standards. Currently, around 56% of the population resides in urban areas, which is expected to reach 68% by 2030. The urban landscape, characterized by rapid infrastructure development, has led to increased demand for personal vehicles for commuting and leisure. Cities like Jakarta continuously invest in traffic management and road development projects, making them more accessible and enhancing the need for automobiles, which led to vehicle registration increasing by 9% over the last year.

Market Challenges

Regulatory Barriers

Despite the growth potential, regulatory barriers pose significant challenges to the automotive market. Complex vehicle registration and licensing processes can delay market entry for new manufacturers and investors. According to the National Police of Indonesia, the process takes an average of 15 days to complete, which can deter investment in the automotive sector. Furthermore, stringent emission and safety standards complicate compliance for manufacturers looking to introduce new models, limiting their operational agility. These hurdles lead to increased operational costs and can stifle innovation within the market.

Competition from Imports

The local automotive market faces stiff competition from imported vehicles, which present unique challenges for domestic manufacturers. In 2022, imports accounted for about 25% of the total vehicle sales in Indonesia, as consumers gravitate towards foreign brands presumed to offer higher quality and advanced technologies. This trend is exacerbated by lower import tariffs under ASEAN Free Trade Agreements, which allows foreign manufacturers to easily penetrate the market and cater to the evolving tastes of Indonesian consumers. As a result, local automakers may struggle to compete on price and technology levels without significant innovation and adaptation.

Opportunities

Emerging EV Market

The electric vehicle market in Indonesia is ripe for growth. With the government’s goal of having 2.1 million electric vehicles on the road by 2030 and current sales projections indicating a shift towards EVs, opportunities for both manufacturers and suppliers abound. For example, in 2023, investment in EV charging infrastructure rose to IDR 1 trillion (around USD 67 million), showing a commitment to enhancing the ecosystem for electric vehicles. This environment is ideal for businesses focused on sustainable transport solutions, offering multiple avenues for growth such as the production of EV components and supporting technologies.

Innovations in Autonomous Driving

The push for automotive innovation, particularly in autonomous driving technology, presents significant opportunities for market players. As consumer preferences evolve towards safety and convenience, automotive companies investing in research and development for autonomous features are likely to gain a competitive edge. In 2022, investments in autonomous technology by key players in the Indonesian market totaled IDR 500 billion (approximately USD 33 million), reflecting a growing commitment to innovation. As infrastructure improves, integrating these technologies into urban environments will enhance traffic safety and management, attracting more investment in automated transport solutions.

Future Outlook

Over the next five years, the Indonesia automotive industry is poised for substantial growth, spurred by continuous government support for electric vehicle infrastructure, advancements in automotive technology, and the increasing consumer demand for eco-friendly transportation solutions. The market is expected to continue evolving with innovations in electric vehicles and autonomous driving features, providing new opportunities for all players in the automotive landscape.

Major Players

- Toyota Indonesia

- Honda Prospect Motor

- Daihatsu Indonesia

- Mitsubishi Motors

- Suzuki Indomobil Motor

- BMW Group

- Nissan Motor Indonesia

- Isuzu Astra Motor

- Hino Motors Indonesia

- Ford Motor Indonesia

- Hyundai Motor Indonesia

- MG Motor Indonesia

- Wuling Motors

- Chery Automobile Indonesia

- Tesla Indonesia

Key Target Audience

- Automotive manufacturers

- Automotive suppliers and OEMs

- Investors and venture capitalist firms

- Government and regulatory bodies (Ministry of Transportation, Ministry of Industry)

- Distributors and dealerships

- Auto accessory and parts suppliers

- Automotive technology firms

- Fleet operators

Research Methodology

Step 1: Identification of Key Variables

The first phase includes constructing an ecosystem map consisting of all key stakeholders within the Indonesia automotive industry. Desk research is utilized to gather comprehensive industry-level information from secondary and proprietary databases. This step focuses on identifying and defining critical variables that influence market dynamics such as consumer preferences, regulatory landscapes, and economic indicators.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data related to the Indonesia automotive industry. We will assess market penetration rates, the ratio of vehicle types sold, and revenue generation figures. A thorough evaluation of statistics on sales volume, service quality, and economic conditions will ensure the reliability and accuracy of our revenue estimates for various segments of the market.

Step 3: Hypothesis Validation and Expert Consultation

We will develop market hypotheses and validate them through consultations with industry experts. This includes conducting computer-assisted telephone interviews (CATIs) with representatives from prominent companies in the automotive sector. The insights obtained will provide operational and financial perspectives that are critical in refining our data, aiding in confirming assumptions about market trends and dynamics.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with multiple automotive manufacturers and suppliers to acquire a deeper understanding of product segments, sales performance, consumer preferences, and critical market trends. This engagement will allow us to verify and complement statistics derived from both top-down and bottom-up approaches, ensuring a comprehensive and accurate analysis of the Indonesia automotive market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Middle-Class Population

Urbanization Trends

Government Incentives for EV Adoption - Market Challenges

Regulatory Barriers

Competition from Imports - Opportunities

Emerging EV Market

Innovations in Autonomous Driving - Trends

Sustainability Initiatives

Technological Advancements in Manufacturing - Government Regulation

Emission Standards

Safety Regulations - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Cars

– Hatchbacks

– Sedans

– SUVs

– MPVs

Commercial Vehicles

– Light Commercial Vehicles (LCVs)

– Heavy-Duty Trucks

– Buses

Motorcycles

– Standard/Commuter Bikes

– Scooters

– Sports Bikes

– Electric Motorcycles

Electric Vehicles (EVs)

– Battery Electric Vehicles (BEVs)

– Electric Scooters

– Electric Commercial Vans

Hybrid Vehicles

– Plug-in Hybrid Electric Vehicles (PHEVs)

– Mild Hybrid Vehicles

– Full Hybrid Vehicles - By Fuel Type (In Value %)

Gasoline

Diesel

Electric

Hybrid - By Application (In Value %)

Personal Use

Ride-Hailing Services

Cargo Transportation - By Region (In Value %)

Java

Sumatra

Bali

Sulawesi - By Distribution Channel (In Value %)

Direct Sales

– OEM Sales to Government & Corporates

– Fleet Sales

Dealerships

– Authorized Dealers

– Multi-brand Showrooms

Online Platforms

– Manufacturer Websites

– E-Commerce Auto Portals (e.g., OLX Autos, Mobil123)

– Aggregator Platforms

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Automotive Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Toyota Indonesia

Honda Prospect Motor

Suzuki Indomobil Motor

Mitsubishi Motors Krama Yudha Indonesia

Daihatsu Indonesia

BMW Group Indonesia

Nissan Motor Indonesia

Isuzu Astra Motor Indonesia

Hino Motors Indonesia

Ford Motor Indonesia

Hyundai Motor Indonesia

MG Motor Indonesia

Wuling Motors

Chery Automobile Indonesia

Tesla Indonesia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030