Market Overview

As of 2024, the Indonesia blood testing market is valued at USD ~ million, with a growing CAGR of 10.4% from 2024 to 2030 and, has been experiencing a steady growth driven by factors such as a surge in chronic diseases and a growing public health awareness among the population. The market is further supported by advancements in technology and the increasing number of hospitals and diagnostic laboratories offering blood testing services. As healthcare expenditures rise, the demand for high-quality blood testing services is expected to continue its growth trajectory.

Major cities like Jakarta, Surabaya, and Bandung dominate the Indonesia blood testing market due to their well-developed healthcare infrastructure and high concentration of healthcare facilities. These urban centers house some of the country’s largest hospitals and diagnostic centers, making them crucial players in the blood testing landscape. Additionally, government initiatives aimed at improving public health support the growing presence of testing services in these metropolitan areas.

Market Segmentation

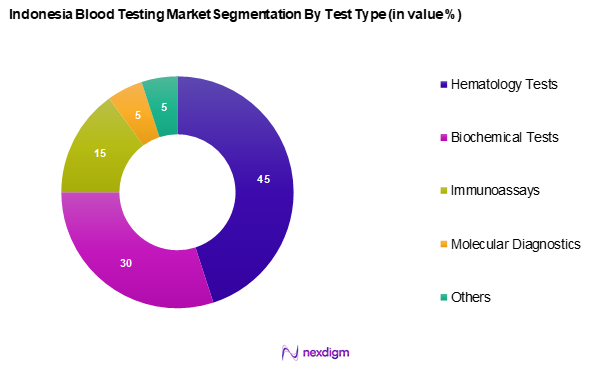

By Test Type

The Indonesia blood testing market is segmented into hematology tests, biochemical tests, immunoassays, molecular diagnostics, and others. Hematology tests hold a dominant market share, primarily due to their essential role in diagnosing various health conditions. These tests are frequently used in clinical settings for blood-related diseases and conditions, leading to a consistent demand among healthcare providers. The ease of access and reliance on these fundamental tests by hospitals and laboratories further reinforces their leading position in the market.

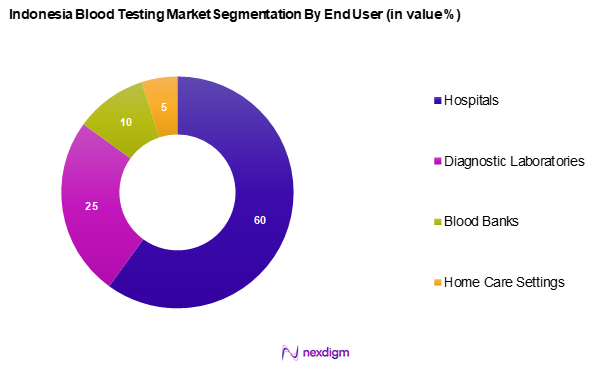

By End User

The Indonesia blood testing market is segmented into hospitals, diagnostic laboratories, blood banks, and home care settings. Hospitals capture the largest share of the blood testing market due to their comprehensive medical services, including laboratory testing capabilities. They serve as the primary point for patients requiring diagnostics and treatment, fostering a continuous demand for blood tests. Hospitals often have advanced facilities and technologies, enabling them to cater to various health needs efficiently.

Competitive Landscape

The Indonesia blood testing market is characterized by a few key players, including both local and multinational companies. This consolidation reflects the influential presence of a handful of dominant organizations that steer the market direction through innovation and competitive practices. Major players involved in the market include P.T. Kalbe Farma Tbk, P.T. Bio Farma, and Roche Diagnostics, each contributing to the sector’s advancements and overall growth.

| Company | Establishment Year | Headquarters | Market Focus | Revenue (USD Mn) | Distribution Channels | Market

Share |

| P.T. Kalbe Farma Tbk | 1966 | Jakarta, Indonesia | – | – | – | – |

| P.T. Bio Farma | 1890 | Bandung, Indonesia | – | – | – | – |

| Roche Diagnostics | 1896 | Basel, Switzerland | – | – | – | – |

| Abbott Laboratories | 1888 | Abbott Park, USA | – | – | – | – |

| Siemens Healthineers | 1847 | Erlangen, Germany | – | – | – | – |

Indonesia Blood Testing Market Analysis

Growth Drivers

Increasing Prevalence of Chronic Diseases

The growing prevalence of chronic diseases, such as diabetes and cardiovascular disorders, is a major factor driving the demand for blood testing services in Indonesia. These conditions contribute significantly to mortality rates, making regular diagnostic testing crucial for effective disease management. As urbanization and lifestyle changes continue to influence public health, the number of individuals affected by these diseases is expected to rise. This situation highlights the essential role of comprehensive blood testing services in monitoring and treating chronic conditions among the population.

Rising Public Health Awareness

Increasing public awareness of healthcare has significantly impacted the demand for blood testing. More Indonesians are recognizing the importance of regular health check-ups, supported by national healthcare initiatives that improve access to medical services. This shift in behavior reflects a growing preference for preventive healthcare measures, encouraging individuals to seek routine blood tests for early detection of potential health issues. As a result, the market for blood testing continues to expand in alignment with the country’s public health goals.

Market Challenges

Regulatory Compliance Issues

Strict regulations governing blood testing laboratories pose a challenge for market growth in Indonesia. Testing facilities must comply with stringent quality assurance protocols set by regulatory authorities. Frequent updates in healthcare policies can create operational complexities, making it difficult for laboratories to meet compliance standards. Non-compliance can lead to penalties or even temporary closures, affecting the availability and reliability of blood testing services across the country.

High Testing Costs

The cost of blood testing remains a significant barrier to access, particularly for lower-income populations. Many individuals are unable to afford specialized diagnostic tests, limiting their ability to seek timely medical intervention. The financial burden associated with blood testing influences the frequency with which individuals undergo these procedures, ultimately affecting early disease detection and overall market expansion.

Opportunities

Increasing Investment in Healthcare Infrastructure

Government initiatives aimed at strengthening healthcare infrastructure present a major growth opportunity for the blood testing market. Investments in building new hospitals and upgrading existing medical facilities are improving access to diagnostic services. Modernization efforts in laboratory services are also creating demand for advanced blood testing technologies, paving the way for greater market participation and enhanced healthcare delivery across the nation.

Expansion of Mobile Testing Services

The development of mobile blood testing services is transforming healthcare accessibility, particularly in rural and underserved areas. With advancements in mobile health technology, healthcare providers are increasingly utilizing mobile units to offer diagnostic services to populations with limited access to traditional laboratories. The integration of these services into the healthcare system is expected to enhance coverage and facilitate early disease detection, ultimately leading to improved public health outcomes.

Future Outlook

Over the next few years, the Indonesia blood testing market is projected to exhibit substantial growth driven by increasing investments in healthcare infrastructure, innovations in blood testing technology, and a heightened focus on preventive healthcare measures. With chronic diseases on the rise and a growing demand for effective diagnostics, both public and private sectors are expected to bolster testing capacities, enhancing accessibility and efficiency.

Major Players

- P.T. Kalbe Farma Tbk

- P.T. Bio Farma

- P.T. Kimia Farma

- Roche Diagnostics

- Abbott Laboratories

- Siemens Healthineers

- Beckman Coulter

- Thermo Fisher Scientific

- QIAGEN

- Ortho Clinical Diagnostics

- Sysmex Corporation

- Mindray Medical International

- Genzyme (Sanofi)

- DiaSorin S.p.A.

- Hologic, Inc.

Key Target Audience

- Healthcare Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health, National Agency for Drug and Food Control)

- Pharmaceutical Companies

- Research Institutions

- Diagnostics Laboratories

- Medical Equipment Suppliers

- Health Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all crucial stakeholders within the Indonesia blood testing market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including current trends, regulatory frameworks, and technological advancements.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data related to the Indonesia blood testing market. This includes assessing market penetration, the ratio of laboratories to healthcare providers, and the resultant revenue generation from various blood testing methodologies. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates, allowing for a clear understanding of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing various companies in the market. These consultations aim to provide valuable operational and financial insights directly from practitioners within the industry, which will be instrumental in refining and corroborating the market data and trends.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple blood testing manufacturers and service providers to obtain detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors affecting the market. This engagement will help verify and complement the statistics derived from both bottom-up and top-down approaches, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia blood testing market.

- Executive Summary

- Research Methodology

- (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Prevalence of Chronic Diseases

Rising Public Health Awareness - Market Challenges

Regulatory Compliance Issues

High Testing Costs - Opportunities

Increasing Investment in Healthcare Infrastructure

Expansion of Mobile Testing Services - Trends

Growth of Laboratory Automation

Rise in Point-of-Care Testing - Government Regulation

Healthcare Policies

Quality Control Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Test Type, (In Value %)

Hematology Tests

Biochemical Tests

Immunoassays

Molecular Diagnostics

Others - By End User, (In Value %)

Hospitals

Diagnostic Laboratories

Blood Banks

Home Care Settings - By Region, (In Value %)

Java

Sumatra

Bali

Kalimantan

Sulawesi - By Technology, (In Value %)

Manual Testing

Automated Testing - By Sample Type, (In Value %)

Whole Blood

Plasma

Serum

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Test Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenue Streams, Distribution Channels, Technological Advancements, Market Differentiation, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Companies

P.T. Kalbe Farma Tbk

P.T. Bio Farma

P.T. Kimia Farma

Roche Diagnostics

Abbott Laboratories

Siemens Healthineers

Beckman Coulter

Thermo Fisher Scientific

QIAGEN

Ortho Clinical Diagnostics

Sysmex Corporation

Mindray Medical International

Genzyme (Sanofi)

DiaSorin S.p.A.

Hologic, Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030