Market Overview

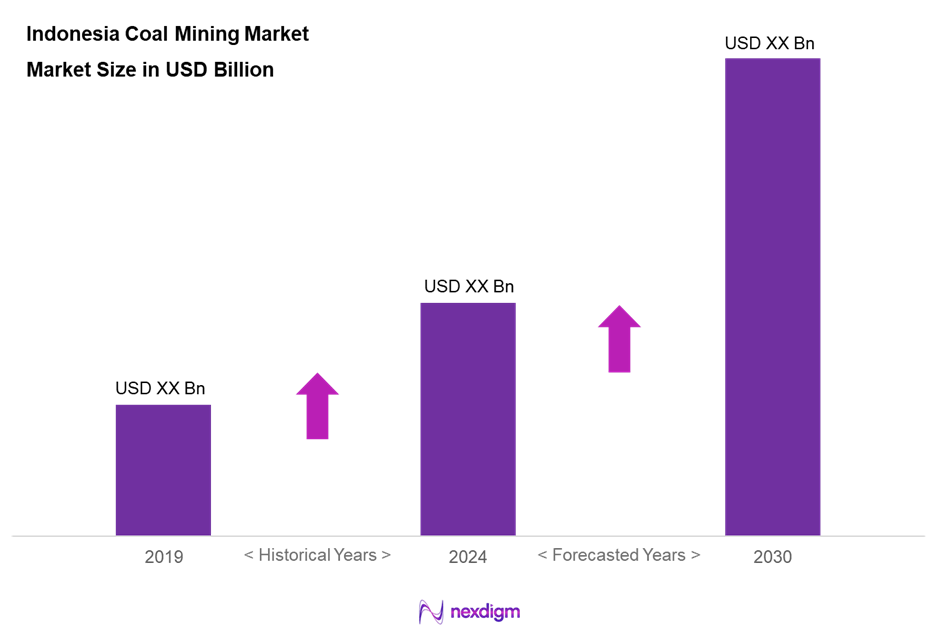

As of 2024, the Indonesia coal mining market is valued at USD 36 billion, with a growing CAGR of 6.1% from 2024 to 2030, supported by robust domestic energy consumption and export demand. The driving forces include an increasing reliance on coal for energy generation and industrial activities, which have surged in response to economic growth, making Indonesia one of the top coal producers in the world. This considerable market valuation reflects the essential role of coal in Indonesia’s energy mix and its continued relevance in global energy discussions.

Major regions such as Sumatra and Kalimantan dominate the Indonesia coal mining market due to their rich deposits of high-quality coal and strategic geographic positioning for export. The infrastructure in these areas supports efficient mining operations and logistics, enabling companies to transport coal to both domestic and international markets. Their established mining networks and investment in technology further solidify their dominance in the coal supply chain.

Market Segmentation

By Coal Type

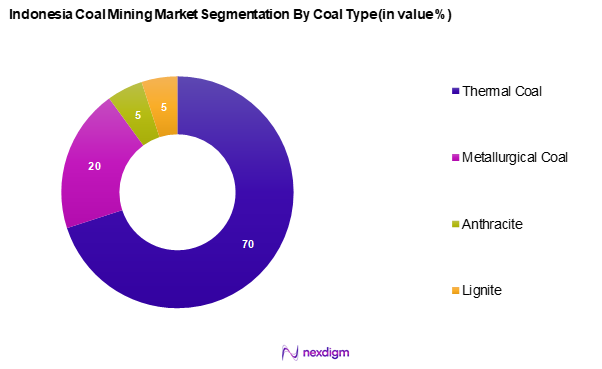

The Indonesia coal mining market is segmented into thermal coal, metallurgical coal, anthracite, and lignite. Thermal coal holds a dominant market share due to its widespread application in power generation, which remains a primary demand driver. Its low cost and availability align with Indonesia’s energy strategy to meet rising electricity needs. As a result of these factors, thermal coal is expected to account for approximately 70% of the market share in 2024.

By Mine Type

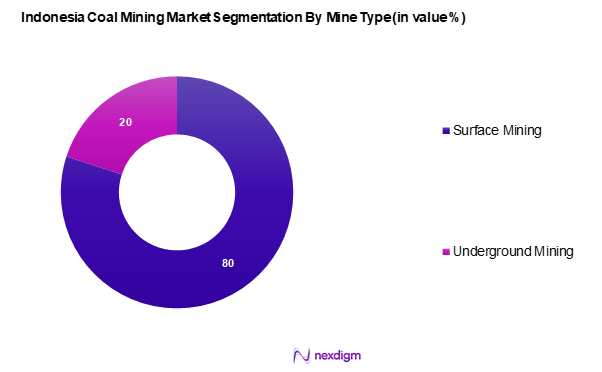

The Indonesia coal mining market is segmented into surface mining and underground mining. Surface mining is currently leading this segment, representing a substantial portion due to the efficiency and safety advantages it offers over underground operations. The techniques utilized in surface mining, such as open-pit and strip mining, allow for quicker extraction processes and lower operational costs. Consequently, surface mining is projected to achieve around 80% market share by 2024.

Competitive Landscape

The Indonesian coal mining market is dominated by a few major players who significantly influence pricing and market dynamics. Key companies include Adaro Energy, Indika Energy, and Bukit Asam, among others. This consolidation highlights the strategic importance of these firms in shaping industry standards, technological advancements, and supply chain efficiencies.

| Company | Establishment Year | Headquarters | Market Segment Focus | Annual Production (MTPA) | Revenue (USD) | Key Products |

| Adaro Energy | 1982 | Jakarta, Indonesia | – | – | – | – |

| Indika Energy | 2000 | Jakarta, Indonesia | – | – | – | – |

| Bukit Asam | 1919 | Tanjung Enim, Indonesia | – | – | – | – |

| Harum Energy | 1995 | Jakarta, Indonesia | – | – | – | – |

| Borneo Lumbung Energi | 1992 | Jakarta, Indonesia | – | – | – | – |

Indonesia Coal Mining Market Analysis

Growth Drivers

Rising Energy Demand

Indonesia’s coal mining industry continues to benefit from the country’s expanding energy needs. With increasing urbanization and industrial development, the demand for electricity has surged across both urban and rural areas. The government’s strong push toward improving electrification throughout the nation further intensifies the need for dependable energy sources. Coal remains a dominant player in the national energy mix due to its availability and reliability, making it indispensable for meeting the country’s growing energy consumption.

Export Opportunities

Indonesia’s position as a leading global coal exporter significantly boosts the sector’s performance. Key international markets across Asia rely heavily on Indonesian coal to meet their thermal energy requirements. The country’s geographical advantage, with access to key maritime trade routes, ensures efficient logistics and timely delivery to major buyers. As global energy demands rise, especially in developing economies, Indonesian coal finds robust demand overseas, reinforcing its role as a vital export commodity and a major contributor to national revenue.

Market Challenges

Environmental Regulations

The push for sustainability and emissions reduction has led to more stringent environmental regulations in Indonesia. Mining companies are under increasing pressure to align operations with national and international environmental commitments. These regulations necessitate investments in cleaner technologies and environmentally responsible mining practices. As a result, operational costs rise, and compliance becomes a more complex undertaking, challenging the traditional ways in which coal mining has been carried out in the country.

Mining Operational Risks

The coal mining industry in Indonesia is frequently exposed to a range of operational risks. Unpredictable geological conditions can lead to safety concerns and disruptions in production. Remote mining locations also suffer from inadequate infrastructure, which complicates transportation and logistics. Moreover, the sector remains vulnerable to external market volatility, where shifts in global coal prices can significantly affect profitability. Navigating these risks requires strategic planning and robust risk management practices.

Opportunities

Technological Advancements in Mining

The integration of modern technologies offers substantial opportunities for Indonesia’s coal mining industry. Automation, digital monitoring systems, and advanced extraction methods are transforming how mines operate, making processes more efficient and safer. These innovations help reduce environmental impact, cut costs, and increase output. Companies that embrace technological transformation can achieve a competitive edge, both domestically and internationally, by optimizing resource use and ensuring regulatory compliance. The industry is increasingly recognizing technology as a key lever for sustainable growth.

Future Outlook

Over the next few years, the Indonesia coal mining market is expected to witness a significant growth trajectory, driven by increasing energy demands for both domestic consumption and exports. The continual expansion of infrastructure projects and the rise in global coal prices will further enhance market dynamics. Additionally, investments in advanced mining technologies and sustainable practices should play a pivotal role in shaping the future landscape of the industry.

Major Players

- Adaro Energy

- Indika Energy

- Bukit Asam

- Harum Energy

- Borneo Lumbung Energi

- Kideco Jaya Agung

- Toba Bara Sejahtera

- Energi Mega Persada

- Mitrabara Adiperdana

- Multi Harapan Utama

- Petrosea

- Jakarta Setiabudi Internasional

- Tahta Minda

- Darma Henwa

- Gunung Bayan Pratama Coal

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Energy and Mineral Resources, Indonesia)

- Mining Equipment Manufacturers

- Construction Companies

- Energy Sector Analysts

- Utility Companies

- Environmental NGOs

- Commodity Traders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Indonesia coal mining market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, such as demand factors, regulatory impacts, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia coal mining market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. This comprehensive analysis allows for an in-depth understanding of current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. Engaging with a variety of sources enhances the robustness of our findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple coal mining companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia coal mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Energy Demand

Export Opportunities - Market Challenges

Environmental Regulations

Mining Operational Risks - Opportunities

Technological Advancements in Mining - Trends

Shift Towards Clean Coal Technology - Government Regulation

Licensing and Compliance - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Coal Type

Thermal Coal

– Low-Calorific Value Thermal Coal

– High-Calorific Value Thermal Coal

Metallurgical Coal

– Hard Coking Coal

– Semi-soft Coking Coal

– Pulverized Coal Injection (PCI) Coal

Anthracite

– Lump Anthracite

– Fine Anthracite

Lignite

– High-Moisture Lignite

– Low-Moisture Lignite - By Mine Type

Surface Mining

– Open-Cut Mining

– Strip Mining

Underground Mining

– Room and Pillar

– Longwall Mining - By Region

Sulawesi

Sumatra

Kalimantan

Papua

Maluku - By End-Use Industry

Power Generation

– Domestic Thermal Power Plants

– Coal-Fired IPPs

Steel Production

– Blast Furnace Applications

– Metallurgical Coke Production

Cement Manufacturing

– Rotary Kilns

– Clinker Processing Units - By Market Structure

Organized Sector

– Public-listed Mining Giants

– International Joint Ventures

Unorganized Sector

– Small-Scale Mines

– Regional Contractors and Miners - By Mining Technology

Surface Mining

– Open-Pit Mining

– Strip Mining

– Auger Mining

– Mountain Removal Mining

Underground Mining

– Room and Pillar

– Longwall Mining

– Retreat Mining - By Grade

Bituminous Coal

– Medium Volatile

– High Volatile

Sub-Bituminous Coal

– Low Moisture

– High Moisture

Lignite

Anthracite

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Coal Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Production Capacity, and Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Coal Grade for Major Players

- Detailed Profiles of Major Companies

Adaro Energy

Harum Energy

Borneo Lumbung Energi

Indika Energy

Jakarta Setiabudi Internasional

Bukit Asam

Kideco Jaya Agung

Energi Mega Persada

Mitrabara Adiperdana

Toba Bara Sejahtera

Petrosea

Multi Harapan Utama

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030