Market Overview

The Indonesia Corporate Wellness Market is valued at USD 58.56 billion in 2024 with an approximated compound annual growth rate (CAGR) of 11.80% from 2024-2030, based on historical analysis of the corporate health sector and comprehensive data. This significant market size is primarily driven by increasing corporate investments in employee health programs, coupled with a growing awareness of mental and physical wellness among the workforce.

Major cities like Jakarta, Surabaya, and Bandung dominate the Indonesia Corporate Wellness Market due to their substantial corporate presence and concentration of businesses. Jakarta, being the capital and a bustling economic hub, has seen the majority of corporate wellness initiatives, leading to partnerships with various wellness service providers. Furthermore, the rapid urbanization in these cities exacerbates the need for health and wellness programs, as companies strive to cultivate a healthier workforce amid the busy urban lifestyles.

To ensure the efficacy of corporate wellness programs, the Indonesian government has begun implementing quality standards for wellness service providers. As of 2023, the Ministry of Health has issued guidelines that mandate wellness program certification, focusing on the provision of safe and effective health services. This initiative was inspired by the need to improve the overall quality of health services in the country, particularly as corporate wellness gains traction across various sectors.

Market Segmentation

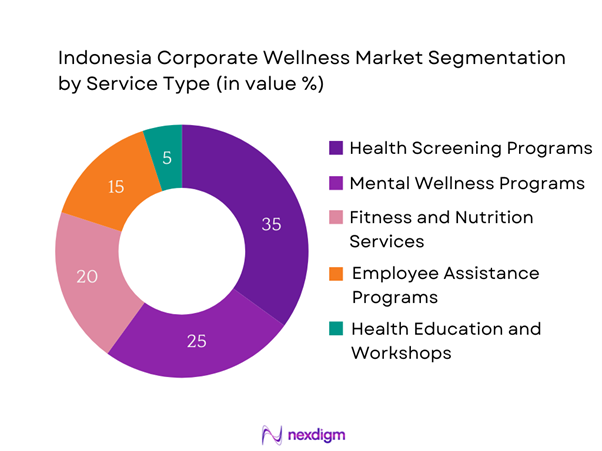

By Service Type

The Indonesia Corporate Wellness Market can be segmented by service type into Health Screening Programs, Mental Wellness Programs, Fitness and Nutrition Services, Employee Assistance Programs (EAP), and Health Education and Workshops. Among these, Health Screening Programs dominate the market due to their proactive approach to employee health management. Companies are increasingly implementing regular health assessments to identify risks early and promote preventive care among their employees. This shift towards preventive health not only mitigates healthcare costs for organizations but also enhances employee satisfaction and productivity. The ability of health screening programs to customize assessments based on specific organizational needs further strengthens their market presence.

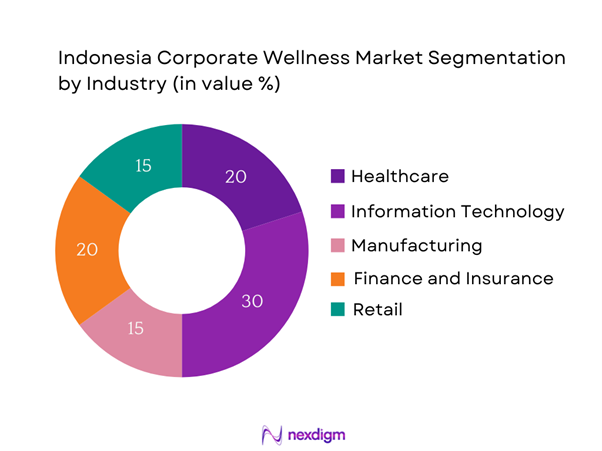

By Industry

The market is also segmented by industry, including Healthcare, Information Technology, Manufacturing, Finance and Insurance, and Retail. The Information Technology sector currently holds a significant market share, driven by the tech industry’s fast-paced and high-stress environment, which demands effective wellness solutions. Companies within this sector are adopting wellness programs to combat workplace stress and burnout, which are prevalent challenges. The increasing use of technology for promoting mental health and fitness solutions further adds to the dominance of this segment, as tech companies leverage innovative tools to enhance employee engagement in wellness activities.

Competitive Landscape

The Indonesia Corporate Wellness Market is competitive and characterized by the presence of major players such as Wellworks, Corporate Wellness Solutions, Health In Harmony, WellNest, and Healthy Mind, Healthy Body. These companies have established themselves through innovative wellness programs that address the diverse needs of businesses and their employees. This consolidation highlights the significant influence of these key players as they provide tailored solutions and integrate advanced technology into their offerings, ensuring that organizations can maintain a proactive approach towards employee well-being.

| Company | Establishment Year | Headquarters | Service Types Offered | Market Strategy | Client Base |

| Wellworks | 2010 | Jakarta | – | – | – |

| Corporate Wellness Solutions | 2012 | Bandung | – | – | – |

| Health In Harmony | 2015 | Surabaya | – | – | – |

| WellNest | 2018 | Jakarta | – | – | – |

| Healthy Mind, Healthy Body | 2016 | Bandung | – | – | – |

Indonesia Corporate Wellness Market Analysis

Growth Drivers

Increasing Health Awareness among Employees

Increased recognition of lifestyle diseases, compounded by an aging population, highlighted the need for preventive health measures among employees. The Indonesian government has promoted health campaigns emphasizing the importance of regular health checks and well-being programs, leading to a more informed workforce. In 2023, the number of active health program participants in workplaces increased, underlining this trend. The financial burden of medical expenses also concerns employers, prompting wellness program initiatives.

Rising Corporate Investment in Employee Well-Being

Corporate spending on employee well-being has intensified, with organizations recognizing that investing in wellness translates to improved productivity and reduced healthcare costs. In 2022, corporate wellness spending in Indonesia reached approximately USD 1.2 billion, supported by stable economic growth, which was marked at 5.3% in 2023 according to the IMF. As Indonesian businesses expand, there is an increasing emphasis on creating healthier work environments that cater to employees’ physical and mental health needs. Consequently, many companies have allocated up to 5% of their annual budgets towards holistic wellness programs to foster a more productive workforce.

Market Challenges

Limited Understanding of Wellness Programs

Despite growing awareness, a considerable number of organizations in Indonesia still lack a comprehensive understanding of the benefits of wellness programs. Reports indicate that 45% of employees in Indonesian corporations surveyed did not participate in health initiatives due to inadequate knowledge about available resources. Many small and medium enterprises (SMEs) remain unaware of the positive impact wellness programs can have on employee efficiency and morale. This situation is exacerbated by the complexity of navigating health regulations, which can deter businesses from investing in comprehensive wellness initiatives.

High Implementation Costs

The implementation costs of wellness programs remain a significant barrier for many Indonesian companies, especially SMEs. In 2022, it was reported that the average budget for corporate wellness initiatives ranged from USD 20,000 to USD 50,000 annually, depending on the scale and type of program implemented. Many firms face financial constraints, especially post-pandemic, which has led to a need for reallocation of resources. With high initial costs and uncertain ROIs, companies may hesitate to invest in these programs despite the long-term benefits.

Opportunities

Growing Trend of Remote Work

The advent of remote work has created unique opportunities for corporate wellness programs in Indonesia. In 2023, remote work was adopted by 62% of companies surveyed, prompting employers to seek innovative wellness solutions that cater to home-based employees. This shift enables organizations to explore flexible wellness options such as virtual fitness classes and mental health support via digital platforms. The growing demand for remote work solutions opens avenues for vendors that can customize wellness programs to meet employees where they are, ultimately enhancing employee engagement and productivity.

Rising Demand for Customized Wellness Programs

As organizations recognize the diversity of their workforce, there is increasing demand for tailored wellness programs in Indonesia. Programs that cater to specific industries or employee needs, such as mental health support for high-stress sectors like IT, are gaining traction. As of 2023, a survey indicated that 70% of companies expressed interest in adopting customized wellness solutions. This trend supports the growth of service providers that can adapt their offerings to different workforce demographics and needs, thereby enhancing overall employee satisfaction and retention.

Future Outlook

Over the next several years, the Indonesia Corporate Wellness Market is expected to show significant growth, driven by increasing corporate recognition of the importance of employee health and well-being, advancements in wellness technologies, and rising consumer demand for comprehensive health solutions. As organizations continue to invest in innovative programs addressing physical, mental, and nutritional health, the market is poised for robust development. Emerging trends such as remote wellness initiatives and the integration of wearable technology are also anticipated to shape the future landscape of corporate wellness in Indonesia.

Major Players

- Wellworks

- Corporate Wellness

- Health In Harmony

- WellNest

- Healthy Mind, Healthy Body

- PH Wellness Partners

- LiveWell Indonesia

- Wellness Innovations

- Mediplus

- Fit2Work

- Wellness Warriors

- Corporate Fit

- Mindful Wellness

- Thrive Wellness Group

- WellBeing Inc.

Key Target Audience

- Corporations looking to invest in employee wellness programs

- Human Resources departments in large and medium enterprises

- Occupational health practitioners and consultants

- Employee benefit program managers

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Health, National Agency for the Placement and Protection of Indonesian Migrant Workers)

- Non-profit organizations focusing on health promotion

- Wellness service providers looking for collaboration opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Corporate Wellness Market. This step relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry information. The primary objective is to identify and define the critical variables that influence market dynamics, including service offerings and target audiences.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Corporate Wellness Market. This includes assessing market penetration, the ratio of wellness service providers to corporate clients, and resultant revenue generation. Further evaluations are conducted on service quality metrics to ensure the credibility of revenue estimates and market assessments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through qualitative consultations and structured interviews with industry experts and key players from diverse sectors. These discussions will provide valuable operational and financial insights directly relevant to the market, helping refine and corroborate the data and analysis compiled earlier.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple corporate wellness service providers to acquire detailed insights into service segment performance, customer preferences, and emerging trends. This interaction serves to verify and complement statistics derived from the market analysis, ensuring a comprehensive, accurate, and validated evaluation of the Indonesia Corporate Wellness Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Awareness among Employees

Rising Corporate Investment in Employee Well-Being

Legislative Support for Worker Wellness Programs - Market Challenges

Limited Understanding of Wellness Programs

High Implementation Costs - Opportunities

Growing Trend of Remote Work

Rising Demand for Customized Wellness Programs - Trends

Digitalization of Wellness Programs

Focus on Mental Health Initiatives - Government Regulation

Labor Laws and Corporate Health Regulations

Quality Standards for Wellness Providers - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Number of Corporate Clients, 2019-2024

- By Service Offerings, 2019-2024

- By Service Type (In Value %)

Health Screening Programs

– Annual Medical Check-ups

– BMI, Blood Sugar, and Cholesterol Tests

– Preventive Risk Assessments

Mental Wellness Programs

– Stress Management Workshops

– On-site Counseling Sessions

– Mindfulness and Meditation Sessions

Fitness and Nutrition Services

– On-site/Online Fitness Classes

– Personalized Diet and Meal Planning

– Gym Partnerships and Corporate Subscriptions

Employee Assistance Programs (EAP)

– Work-Life Balance Counseling

– Substance Abuse Programs

– Grievance and Conflict Resolution Support

Health Education and Workshops

– Ergonomics and Posture Training

– Lifestyle Disease Awareness Sessions

– Smoking Cessation and Wellness Seminars - By Industry (In Value %)

Healthcare

– Hospital and Pharma Staff Wellness

– Doctor and Nurse Burnout Management Programs

Information Technology

– Remote Team Wellness Monitoring

– Screen-Time Fatigue & Workstation Ergonomics

Manufacturing

– Occupational Health Programs

– Injury Prevention and Recovery Initiatives

Finance and Insurance

– High-Stress Role Mental Wellness Focus

– Executive Health Packages

Retail

– Frontline Worker Fitness Incentives

– Shift Worker Health Monitoring Programs - By Region (In Value %)

Java

Sumatra

Bali

Sulawesi

Kalimantan - By Delivery Method (In Value %)

In-Person Services

– On-site Clinics and Check-ups

– Physical Workshops and Fitness Classes

Virtual/Remote Services

– Teleconsultation with Dietitians & Psychologists

– Mobile App-Based Wellness Programs

– Virtual Fitness and Wellness Challenges - By Corporate Size (In Value %)

Small Enterprises

Medium Enterprises

Large Enterprises

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Corporate Wellness Segment, 2024 - Cross Comparison Parameters (Company Overview, Year of Establishment & Headquarters, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Total Revenue, Revenue by Service Line, Client Base, Delivery Model, Technology Stack and App Features, User Engagement and Program Adoption Rates, Unique Value Offerings, Global/Regional Footprint, Certifications, Client Retention Rate, Outcome Measurement & ROI Reporting, others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis Service Offerings for Major Players

- Detailed Profiles of Major Companies

Wellness Solutions Inc.

PT Global Health Indonesia

Corporate Wellness Asia

Sodexo Benefits and Rewards Services

Virgin Pulse

Mercer Indonesia

HealthifyMe

Manulife Indonesia

Prudential Indonesia

AIA Indonesia

IndoWellness

ProAktif Wellness Solutions

FitCompany Indonesia

Amway Indonesia

Thrive Indonesia

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Number of Corporate Clients, 2025-2030

- By Service Offerings, 2025-2030