Market Overview

The Indonesia Data Center market is valued at approximately 0.97 thousand MW in 2025 with an approximated compound annual growth rate (CAGR) of 16.73% from 2025-2030, reflecting a growing demand driven by the rapid digital transformation across sectors such as IT, finance, and e-commerce. With the rise in data consumption and cloud adoption, enterprises are increasingly investing in data centers to enhance their IT infrastructure and operations.

The dominant cities in the Indonesia Data Center market include Jakarta, Bali, and Surabaya. Jakarta leads due to its advanced telecommunication infrastructure, the concentration of business activities, and a high demand for data storage and processing solutions. Bali and Surabaya also contribute significantly due to their emerging markets and increasing technological investments. These urban centers benefit from improved connectivity and heightened interest from global players in establishing data centers to cater to the growing digital economy in Indonesia.

The Indonesian government is actively promoting technological advancements, with policies encouraging investment in data centers and IT infrastructure. A significant initiative includes the “Making Indonesia 4.0” roadmap aimed at enhancing online platforms and digital services across industries. The government allocated approximately USD 1.7 billion for tech innovations and startups in 2023, demonstrating commitment to fostering a pro-digital economy. Moreover, the imposition of regulations that require local data storage enhances the need for more data centers, further propelling market growth.

Market Segmentation

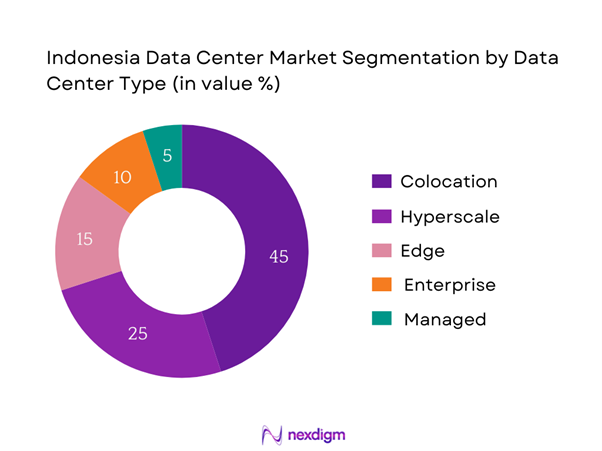

By Data Center Type

The Indonesia Data Center market is segmented by type into colocation data centers, hyperscale data centers, edge data centers, enterprise data centers, and managed services data centers. Colocation data centers dominate this market segment due to their cost-efficiency and flexibility for enterprises looking to minimize CAPEX while still leveraging robust IT infrastructure. The ability to share resources, alongside scalable leasing options, makes colocation an attractive choice for businesses of all sizes. Additionally, the growing trend of digitalization among local companies fuels the demand for colocation services.

By Operation Model

The market is also segmented by operation model into retail data centers and wholesale data centers. Retail data centers hold a substantial share in this segment, primarily due to their tailored solutions for individual clients and small-to-medium enterprises (SMEs). The increasing number of startups and growing awareness of IT outsourcing among businesses contribute to the retail model’s dominance. Retail data centers provide more personalized services and support, making them more appealing for companies that prefer not to engage with large-scale operations.

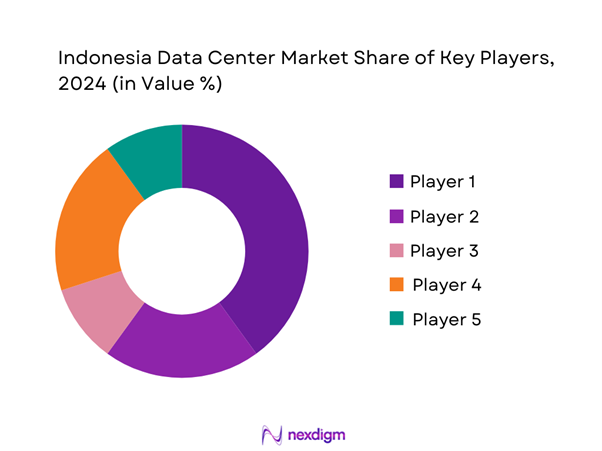

Competitive Landscape

The Indonesia Data Center market is dominated by several key players, reflecting a competitive landscape shaped by both local and international firms. Major players include DCI Indonesia, Telkomsigma, Alibaba Cloud, NTT Group, and Cyber1. These companies thrive due to their robust infrastructure, advanced technology, and strategic partnerships that enhance their service offerings in the rapidly evolving data center space.

| Company | Establishment Year | Headquarters | Market Reach | Data Center Types Offered | Client Base | Technological Innovations |

| DCI Indonesia | 2013 | Jakarta | – | – | – | – |

| Telkomsigma | 1996 | Jakarta | – | – | – | – |

| Alibaba Cloud | 2009 | Hangzhou, China | – | – | – | – |

| NTT Group | 2010 | Tokyo, Japan | – | – | – | – |

| Cyber1 | 2010 | Jakarta | – | – | – | – |

Indonesia Data Center Market Analysis

Growth Drivers

Increasing Digital Transformation

Indonesia is experiencing robust digital transformation, with the country’s internet penetration reaching 77.02% in 2022, equivalent to approximately 220 million users. This increasing connectivity is fueled by the rising smartphone adoption rate, which rose to 77% in 2023. As businesses digitalize operations, the demand for data processing and storage surges. According to the World Bank, Indonesia’s digital economy is projected to reach USD 124 billion by end of 2025, which emphasizes the urgency for businesses to strengthen their digital infrastructures, leading to greater demand for data centers.

Rising Demand for Cloud Services

The demand for cloud services in Indonesia is propelled by an increasing number of businesses migrating to digital platforms. An estimated 70% of Indonesian companies have started utilizing cloud services by 2023, showing sharp adoption rates driven by the need for data security, scalability, and remote access. New data centers are being established to cater to this influx, supported by Indonesia’s expanding digital economy, which was reported to generate USD 70 billion in revenue in 2022. As cloud usage becomes more integral to operations, the market demand for data centers continues to expand.

Market Challenges

Infrastructure Limitations

Despite the growth in digital technologies, infrastructure limitations pose challenges to the Indonesian Data Center market. Regional disparities in infrastructure quality impede the effective deployment of data centers, particularly in rural areas where connectivity and power supply remain inconsistent. Approximately 40% of the rural population still lacks stable internet access. This technological divide hinders expansion efforts for cloud providers and data center operators. The government recognizes the necessity for improved infrastructure, targeting investments in enhanced renewable energy solutions while transitioning the energy mix to 23% renewables by end of 2025, aiming to spur regional connectivity.

Competition Density

The Indonesian Data Center market is characterized by a high density of competition among local and international players, which presents both challenges and opportunities. With more than 10 major companies vying for market share, competition is intensifying, particularly in urban centers such as Jakarta and Surabaya. Consequently, margins may tighten, impacting smaller operators unable to compete at scale. The pressure to innovate and offer competitive pricing compromises profit margins, especially with established players investing heavily in marketing and customer acquisition strategies, impacting smaller firms’ survival.

Opportunities

Expansion into Tier II and III Cities

Significant market opportunities lie in the expansion of data centers into Tier II and III cities. Currently, only about 20% of Indonesia’s data centers are located outside major urban areas, despite the growing regional demand for cloud services. As internet penetration rises in these areas, projected to reach over 50% by end of 2025, more businesses are likely to seek localized data center services for efficiency and compliance with data residency regulations. Investments in tiered infrastructure in these regions can facilitate growth, capturing untapped market segments that remain underserved.

Adoption of Green Data Centers

The trend toward establishing green data centers is becoming increasingly significant in Indonesia, driven by corporate sustainability goals and governmental energy initiatives. With Indonesia committing to reducing greenhouse gas emissions by 29% by 2030, businesses are incentivized to adopt energy-efficient technologies. Currently, it is estimated that 30% of new data center facilities are being planned with sustainability in mind, leveraging renewable energy sources. This trend not only aligns with global environmental standards but also presents a competitive edge for firms adopting eco-friendly practices and technology.

Future Outlook

Over the next few years, the Indonesia Data Center market is poised for significant growth driven by continuous digital transformation across various sectors, a shift towards cloud-based services, and an increasing need for data storage solutions. The Government of Indonesia’s initiatives to promote technology investments and the expansion of telecommunication infrastructure will further boost the market. Additionally, the rise in e-commerce and online services will continue to drive demand, establishing Indonesia as a key player in the Southeast Asia data center landscape.

Major Players

- DCI Indonesia

- Telkomsigma

- Alibaba Cloud

- NTT Group

- Cyber1

- PT Indosat Ooredoo

- Global Switch

- Microsoft Azure

- Amazon Web Services (AWS)

- Rackspace

- DigitalOcean

- Equinix

- CBN Cloud

- Lintasarta

- IX Australia

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Communication and Information Technology)

- Telecom Operators

- E-Commerce Companies

- Financial Institutions

- IT Service Providers

- Cloud Service Providers

- Manufacturers and Enterprises with Data Needs

Research Methodology

Step 1: Identification of Key Variables

This phase includes mapping out the significant stakeholders in the Indonesia Data Center Market. Extensive desk research and extensive use of secondary and proprietary databases help to gather comprehensive industry-level information. The primary objective here is to identify the critical variables that influence market dynamics, including the types of data centers, operational models, and geographical distribution.

Step 2: Market Analysis and Construction

In this step, historical data is compiled and analyzed for the Indonesia Data Center Market. This analysis includes the evaluation of market penetration rates, the ratio of data centers to service providers, and revenue generation estimates. Additionally, service quality metrics are assessed to validate the reliability of these revenue estimates, ensuring a robust analysis.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses will be validated through computer-assisted telephone interviews (CATIs) conducted with industry experts across diverse companies. These consultations provide valuable insights into operational and financial performance from experienced professionals, which is crucial for refining the market data and supporting the hypotheses.

Step 4: Research Synthesis and Final Output

The final phase integrates insights from multiple data center manufacturers to gather detailed intelligence regarding product segments, sales performance, and consumer preferences. This interaction complements the bottom-up data collection efforts and provides validation of statistics, resulting in a well-rounded and accurate assessment of the Indonesia Data Center Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Landscape

- Historical Development

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Digital Transformation

Rising Demand for Cloud Services

Government Initiatives and Regulations - Market Challenges

Infrastructure Limitations

Competition Density - Opportunities

Expansion into Tier II and III Cities

Adoption of Green Data Centers - Trends

Shift Towards Edge Computing

Innovations in Cooling Systems - Regulatory Scenarios

Data Protection Regulations

Energy Efficiency Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Pricing, 2019-2024

- By Type (In Value %)

Colocation Data Centers

– Single-tenant

– Multi-tenant

Hyperscale Data Centers

– Cloud Providers (AWS, Azure, Google Cloud)

– Internet Giants (Meta, Alibaba Cloud, etc.)

Edge Data Centers

– Micro Edge Facilities

– Regional Edge Nodes

Enterprise Data Centers

– On-premise Corporate DCs

– Hybrid Cloud Integrated

Managed Services Data Centers

– Fully Managed

– Partially Managed - By Operation Model (In Value %)

Retail Data Centers

– Per rack/unit model

– Short-term contracts

Wholesale Data Centers

– High-capacity leasing (500kW+)

– Long-term contracts - By End-User Industry (In Value %)

IT & Telecom

– Cloud Service Providers

– Mobile Network Operators

Banking, Financial Services, and Insurance (BFSI)

– Core Banking Systems

– Digital Payment Infrastructure

Government

– E-Governance

– Public Sector Data Hosting

Retail

– E-commerce Platforms

– Point-of-Sale (POS) and CRM

Healthcare

– Electronic Medical Records (EMR)

– Telemedicine and IoT-based monitoring - By Region (In Value %)

Jakarta

West Java

Central Java

East Java

Sumatra - By Tier Level (In Value %)

Tier I

Tier II

Tier III

Tier IV

- Market Share of Major Players by Value, 2024

Market Share of Major Players by Type of Data Center Segments, 2024 - Cross Comparison Parameters (Company Overview, Strategic Initiatives, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Data Center Type, Partnerships, Market Reach, Innovative Technologies, Energy Efficiency Metrics, Security and Compliance Certifications, Client Portfolio, Uptime and Redundancy Standards, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

DCI Indonesia

Telkomsigma

Alibaba Cloud

NTT Group

Equinix

CBN Cloud

Cyber1

DCI Group

Lintasarta

Rackspace

Indosat Ooredoo

Microsoft Azure

Google Cloud

AWS

Connext

- Market Demand and Utilization Patterns

- Budget Allocations and Spending Trends

- Regulatory and Compliance Implications

- Needs and Pain Point Analysis

- Decision-Making Dynamics

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Pricing, 2025-2030