Market Overview

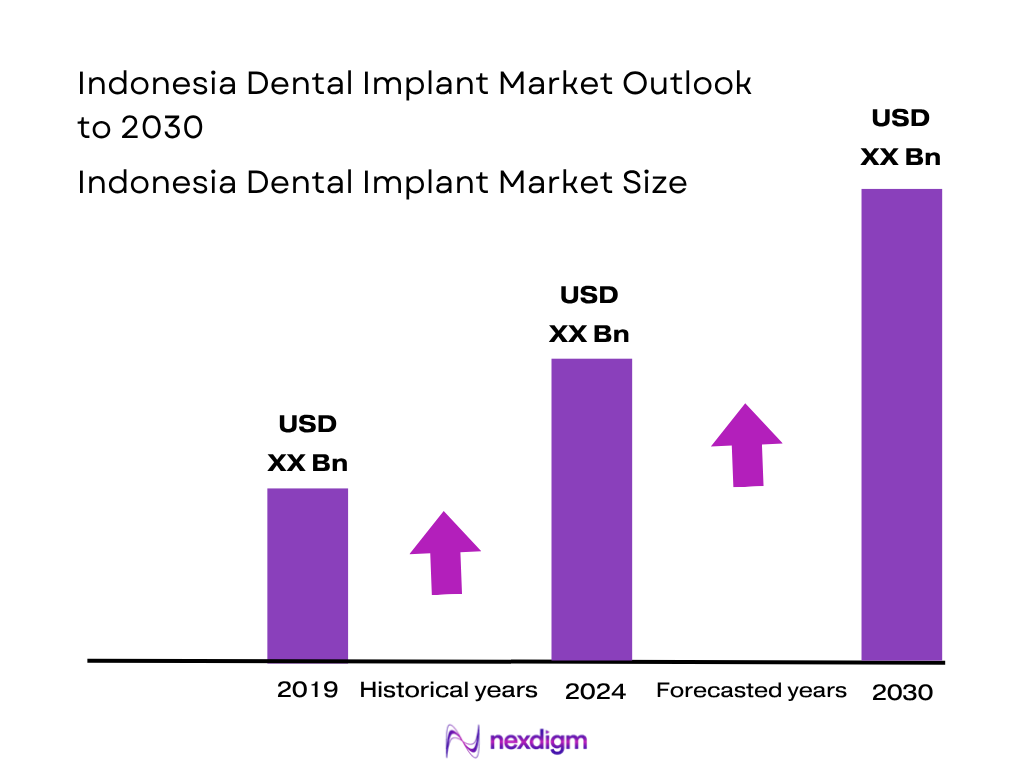

The Indonesia dental implant market is valued at USD 55.72 million as of 2025. This size has been driven by the convergence of rising tooth-loss incidence, increasing dental-aesthetic awareness, growth in urban middle-class disposable income and improvements in dental clinic infrastructure across major Indonesian metro zones. The implant segment benefits from patients favouring permanent solutions (implants vs dentures/bridges) as awareness and affordability improve.

Major Indonesian cities such as Jakarta and Surabaya dominate the dental-implant market owing to their dense population concentrations, superior dental-care infrastructure (including specialist clinics, trained implantologists and digital dentistry set-ups) and stronger private-healthcare spending. Urban residents in these cities have higher willingness-to-pay and better access to advanced dental procedures, which together elevate implant adoption ahead of more rural regions.

Market Segmentation

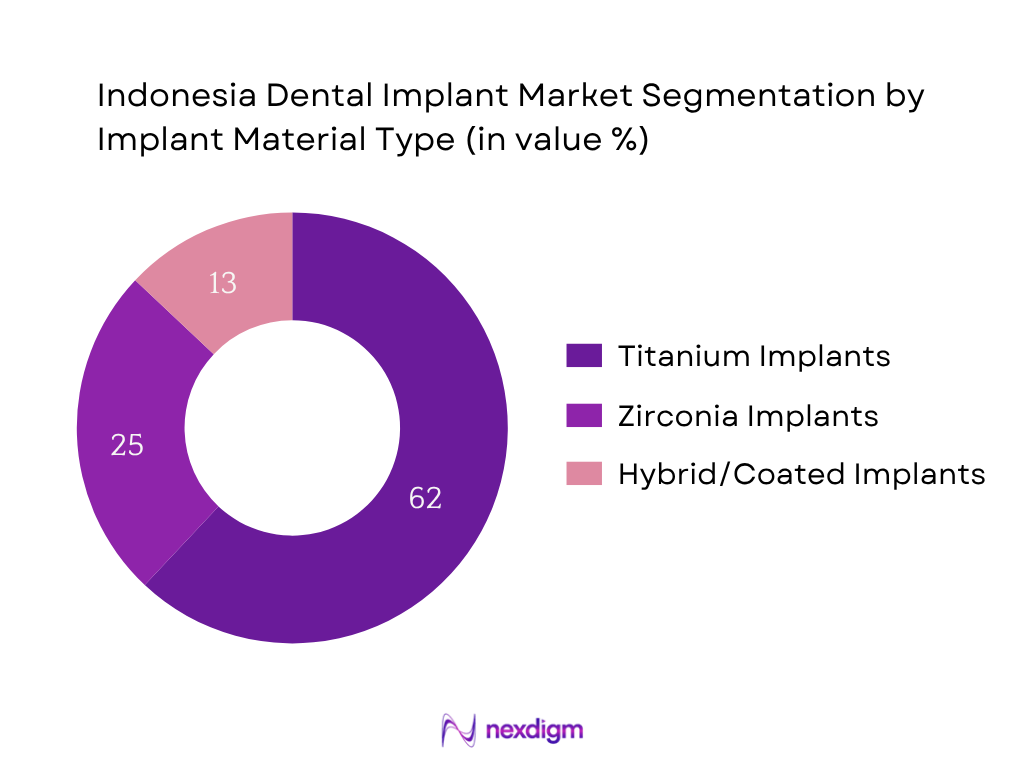

By Implant Material Type

Currently, the titanium implants sub-segment dominates the Indonesia dental implant market. This dominance is driven by titanium’s proven long-term osseointegration track-record, widespread clinician familiarity in Indonesia and cost-efficiency compared to newer materials such as zirconia. Many local clinics opt for titanium systems because of the consistency of outcome and the availability of multi-brand options. Moreover, importers and distributors are more comfortable sourcing titanium systems, which further reinforces the titanium-implant dominance in Indonesia.

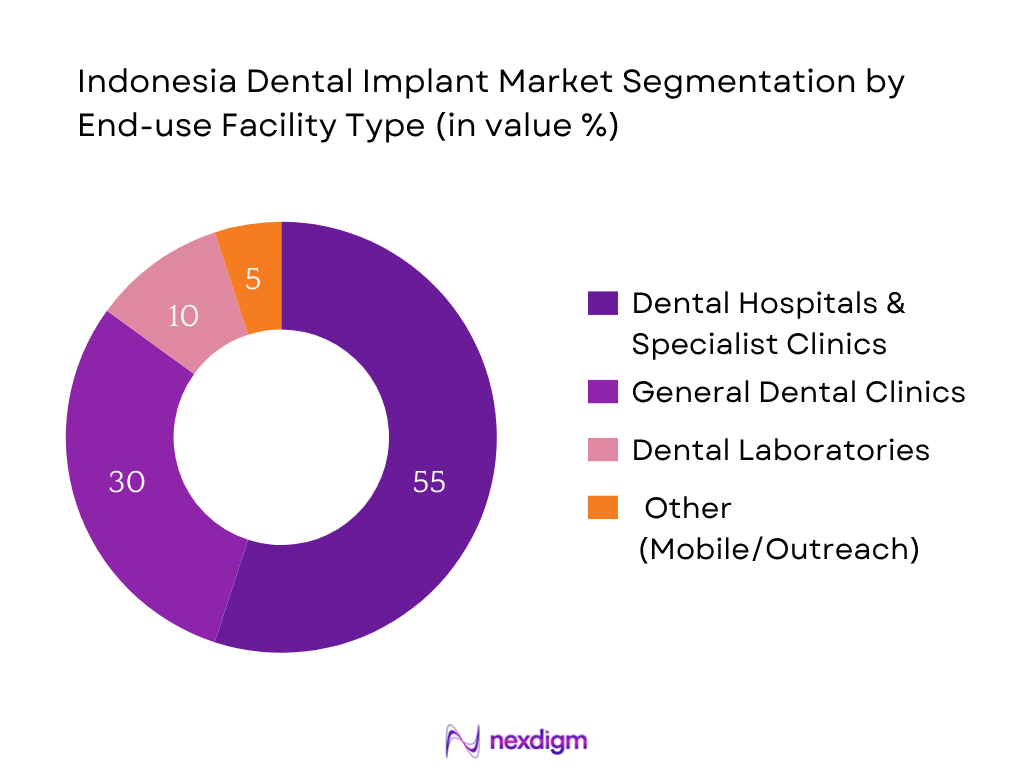

By End-Use Facility Type

Within Indonesia’s implant market the “Dental Hospitals & Specialist Clinics” sub-segment currently leads. These facilities have complex infrastructure required for advanced implant procedures (bone grafting, guided surgery, full-arch restorations), attract higher-spending patients (including dental tourism) and have established surgeon teams and treatment planning workflows. This capability enables clinics in major cities to place more implants and adopt premium systems, thereby giving the specialist-clinic sub-segment the largest share of revenue in the market.

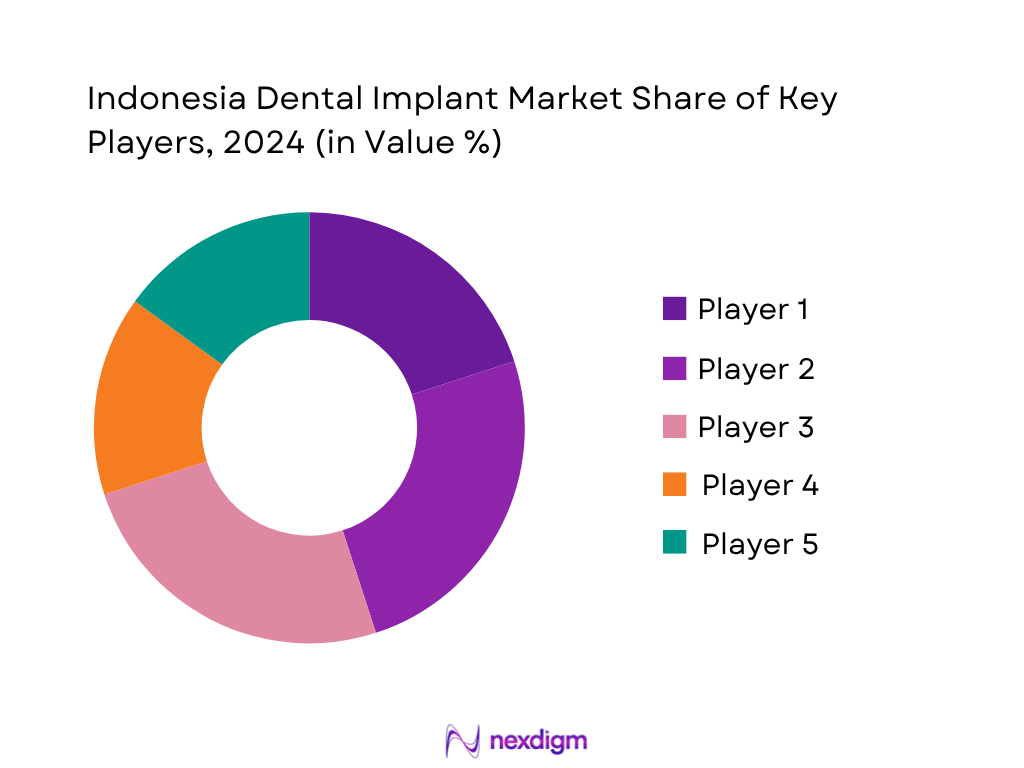

Competitive Landscape

The Indonesia dental implant market remains consolidated around a few major global OEMs and regional distributors, with additional local importers and smaller players. The dominance of global brands emphasises the importance of proven clinical outcomes, clinician training programmes and strong distribution networks in Indonesia’s urban centres.

| Company | Establishment Year | Headquarters | Indonesia Operation Start | Implant Portfolio Breadth | Local Training/Support Facility | Price Tier (Premium/Value) | Distribution Network Coverage |

| Straumann Group | 1954 | Basel, Switzerland | 2000s | – | – | – | – |

| DENTSPLY SIRONA Inc. | 1899 | York, USA | 1990s | – | – | – | – |

| Nobel Biocare (Danaher) | 1981 | Zürich, Switzerland | 1990s | – | – | – | – |

| Osstem Implant Co., Ltd. | 1997 | Seoul, S. Korea | 2010s | – | – | – | – |

| Zimmer Biomet Holdings, Inc. | 1927 | Warsaw, USA | 2010s | – | – | – | – |

Indonesia Dental Implant Market Analysis

Key Growth Drivers

Rising Tooth-Loss Prevalence & Edentulous Cases

In Indonesia, approximately one-fifth of middle-aged and pre-elderly individuals have at least one missing tooth, reflecting a high prevalence of partial tooth loss. The rate of complete tooth loss among adults aged above 20 remains notable, creating a large restorative care segment. These statistics reveal a substantial patient base seeking tooth-replacement options. Combined with the country’s growing awareness of oral health rehabilitation, this demographic trend fuels consistent demand for dental implant procedures, especially in urban areas where specialist services and advanced treatment facilities are more accessible.

Increasing Aesthetic & Restorative Dental Awareness

Only a small proportion of Indonesians practice correct tooth-brushing habits, indicating widespread poor oral hygiene. Alongside this, dental caries affects nearly nine out of ten citizens across various age groups. As oral disease burden continues to rise, there is a growing shift in preference toward permanent and aesthetic solutions, such as implants, rather than removable dentures. Consumers in metropolitan areas increasingly perceive dental implants as a lifestyle and health investment, enhancing both appearance and function, thus strengthening the market’s momentum.

Market Challenges

High Cost of Implant Procedures and Low Insurance Penetration

Out-of-pocket healthcare spending remains dominant in Indonesia, with limited coverage for advanced dental treatments under public insurance. The overall health workforce ratio falls below the threshold required for universal access, indicating gaps in service availability and affordability. Dental implant procedures are largely self-financed, posing a financial challenge for middle- and lower-income segments. This restricts adoption to urban, higher-income populations while limiting diffusion into secondary cities and rural regions, constraining broader market penetration despite increasing awareness.

Limited Local Manufacturing and Import Dependence

Indonesia’s dental implant supply chain remains heavily reliant on imports, with the majority of implant systems and accessories sourced from Europe and East Asia. The medical device market structure indicates that most of its total value is derived from imported products. This dependency exposes the market to foreign exchange fluctuations, customs delays, and tariff regulations. Any disruption in international logistics can directly affect implant availability and cost, which in turn impacts clinic pricing and limits the scalability of implant procedures nationwide.

Emerging Opportunities

Digital Dentistry Integration (3D Printing, Intraoral Scanning)

Indonesia’s dental ecosystem is witnessing rapid integration of digital technologies such as intraoral scanning, 3D printing, and computer-aided design systems. These advancements enable clinics to deliver precise implant placements and faster prosthetic manufacturing. Digital workflows reduce procedural times and increase patient satisfaction, enhancing clinical efficiency and profitability. As more clinics adopt digital tools, opportunities arise for suppliers to provide bundled implant systems integrated with scanning and design technologies, catering to the growing sophistication of Indonesia’s urban dental market.

Affordable Implant Models for Tier-2 Cities

With a national population exceeding 280 million and a steadily urbanizing demographic, Indonesia’s dental implant demand is expanding beyond Jakarta and Bali into emerging cities such as Medan, Makassar, and Surabaya. Middle-income consumers in these areas seek affordable yet durable implant options. Manufacturers introducing locally assembled or cost-effective implant models can unlock significant growth potential. Coupled with expanding dental insurance pilots and financing options, this shift toward value-tier implants promises to bridge affordability gaps and expand nationwide accessibility.

Future Outlook

Over the next six years the Indonesia dental implant market is expected to register healthy growth driven by multiple tailwinds. Rising urbanisation, increasing awareness of restorative and cosmetic dental procedures, the expansion of private-dental clinics in major Indonesian cities, and the growth of dental tourism will all support uptake. Advancements in implant technologies—such as guided surgery, 3D-printed abutments, zirconia systems—and expanding financing options for patients will further fuel growth. Companies that localise training, develop value-tier implant systems suited to Indonesia’s middle-income patient base, and build strong distribution across secondary cities are best positioned to capture growth.

Major Players

- Straumann Group

- DENTSPLY SIRONA Inc.

- Nobel Biocare (Danaher Corporation)

- Osstem Implant Co., Ltd.

- Zimmer Biomet Holdings, Inc.

- BioHorizons IPH, Inc.

- Hiossen Implant

- Megagen Implant Co., Ltd.

- Sweden & Martina S.p.A.

- Implant Direct Sybron International

- Dentium Co., Ltd.

- Cortex Dental Implants Industries Ltd.

- 3M Company (Dental Division)

- Lion Corporation (Healthcare Division)

- GC Corporation

Key Target Audience

- Dental implant manufacturers and OEMs

- Distributors and importers of dental-implant systems

- Hospitals and specialist dental clinics in Indonesia

- Private healthcare investment firms

- Insurance companies offering dental-care policies

- Investments & venture capitalist firms (investing in dental-tech start-ups)

- Government and regulatory bodies (e.g., Indonesian Ministry of Health, BPOM)

- Dental tourism development agencies and private equity funds

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the Indonesia dental-implant ecosystem encompassing implant OEMs, importers, specialist clinics, and end-users. Desk research collated secondary data from market-reports, government healthcare statistics and trade databases to define variables such as procedure volumes, average implant prices, clinic infrastructure and import volumes.

Step 2: Market Analysis and Construction

Historical data on implant placements, average unit price and import/trade flows were compiled to derive market size (value). Growth drivers—including aging population, tooth-loss prevalence, clinic infrastructure expansion—were assessed. Clinic and surgeon interviews supplemented data on adoption trends and patient willingness-to-pay.

Step 3: Hypothesis Validation and Expert Consultation

Market-hypotheses were validated through interviews with dental surgeons in Jakarta/Surabaya, import-distributors and clinic executives. Insights on local challenges (training availability, pricing pressures, competition) were incorporated to refine estimates and segmentation.

Step 4: Research Synthesis and Final Output

The final stage involved triangulating data from bottom-up (clinic/surgeon input) and top-down (market-reports, macro-healthcare trends) approaches to ensure accuracy. Forecasts were generated using the validated CAGR and scenario-analysis for mid-tier and premium segments.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary and Secondary Research, In-Depth Interviews with Dental Surgeons, Laboratory Owners, Importers, and Regulators, Limitations & Future Conclusions)

- Definition and Scope

- Evolution of Dental Implant Market in Indonesia

- Timeline of Technological Advancements and Regulatory Milestones

- Market Ecosystem and Value Chain Mapping (Implant Manufacturers, Importers, Distributors, Clinics, Labs, End Users)

- Supply Chain and Import Dependency Analysis (Import–Distribution–Clinic Flow, Pricing Layers, Mark-Up Analysis)

- Dental Healthcare Infrastructure Overview (Number of Registered Dentists, Clinics, and Implantology Centers)

- Role of Digital Dentistry and Dental Tourism in Market Growth

- Key Growth Drivers

Rising Tooth-Loss Prevalence & Edentulous Cases

Increasing Aesthetic & Restorative Dental Awareness

Growing Dental Tourism in Bali and Jakarta

Expanding Access to Specialized Dental Clinics

Advancements in Guided-Implantology and CAD/CAM - Market Challenges

High Cost of Implant Procedures and Low Insurance Penetration

Limited Local Manufacturing and Import Dependence

Lack of Skilled Implantologists and Standardized Training

Complex Regulatory Approvals for Imported Systems

Implant Failure & Maintenance Concerns - Emerging Opportunities

Digital Dentistry Integration (3D Printing, Intraoral Scanning)

Affordable Implant Models for Tier-2 Cities

Local OEM Manufacturing and ASEAN Export Opportunities

Insurance & FinTech Integration for Dental Care Credit

Growth in Hybrid Implants for Faster Osseointegration - Key Market Trends

AI-Driven Implant Treatment Planning

Short Implants and Flapless Surgery Techniques

Increasing Female Cosmetic Implant Patients

Digital Workflow Adoption among Urban Clinics - Government Regulation & Reimbursement Scenario

- SWOT Analysis

- Stakeholder Ecosystem (Manufacturers, Importers, Distributors, Clinics, Dental Labs, Training Institutes, Patients)

- Porter’s Five Forces Analysis (Supplier Power, Buyer Power, Competitive Rivalry, Substitution Risk, New Entrant Barriers)

- By Value (USD Million), 2019-2024

- By Volume (Number of Implants Placed), 2019-2024

- By Average Procedure Cost (USD Per Tooth Replacement), 2019-2024

- By Implant Type (In Value %)

Endosteal Implants

Subperiosteal Implants

Zygomatic Implants

Mini Implants

Transosteal Implants - By Material Type (In Value %)

Pure Titanium Implants

Zirconia Implants

Hybrid/Coated Implants

Titanium Alloy Implants - By Design & Connection Type (In Value %)

Tapered Implants

Parallel-Walled Implants

Internal Hex Connection

External Hex Connection

Conical Connection - By End-Use Facility (In Value %)

Dental Hospitals & Specialist Clinics

Independent Dental Clinics

Dental Laboratories

Academic & Research Institutes - By Price Tier (In Value %)

Premium Implant Systems

Value/Standard Implant Systems

Economy/Local Brands - By Region (In Value %)

Java Region (Jakarta, Surabaya, Bandung)

Sumatra & Western Indonesia

Sulawesi & Kalimantan

Bali & Tourist Dental Zones

Eastern Indonesia (Nusa Tenggara & Papua)

- Market Share of Major Players (Value / Volume)

- Cross-Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Breakdown by Implant Type, Distribution Touchpoints, Local Regulatory Presence (BPOM Approval), Training & Support Centers)

- SWOT Analysis of Major Players

- Pricing Analysis of SKUs by Brand and Material Type

- Detailed Company Profiles

Straumann Group

Dentsply Sirona Inc.

Nobel Biocare (Danaher Corp.)

Zimmer Biomet Holdings Inc.

Osstem Implant Co. Ltd.

Megagen Implant Co. Ltd.

BioHorizons Implant Systems

Hiossen Implant (US Subsidiary of Osstem)

Dentium Co. Ltd.

Sweden & Martina S.p.A.

Implant Direct Sybron International

Cortex Dental Implants Industries Ltd.

3M Company (Dental Division)

Lion Corporation (Healthcare Division)

GC Corporation (Japan)

- Demand and Utilization Patterns by Demographic

- Patient Budget Allocation & Financing Sources

- Regulatory and Licensing Compliance of Implant Centers

- Pain Points and Unmet Needs of Patients and Practitioners

- Clinical Purchase & Decision-Making Process

- By Value (USD Million), 2025-2030

- By Volume (Implant Units), 2025-2030

- By Average Procedure Cost (USD Per Tooth / Arch), 2025-2030