Market Overview

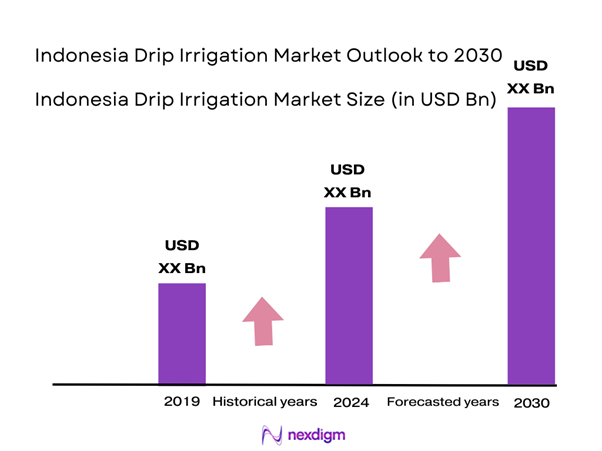

The Indonesia Drip Irrigation market is valued at USD 1.2 billion in 2024 with an approximated compound annual growth rate of 10.3% from 2024-2030, founded on significant demand stemming from agricultural advancements and effective water management techniques. The market is driven by increasing awareness among farmers regarding sustainable irrigation practices and the growing need for water conservation in agriculture. These factors promote investments in irrigation infrastructure, reflecting in the robust market size.

Dominant regions contributing to the market include Java, Sumatra, and Bali. Java’s extensive population and agricultural output make it a major hub for drip irrigation systems, while Sumatra and Bali are emerging as crucial players due to their agricultural diversification and government support for sustainable farming initiatives. These cities are recognized for fostering favorable conditions for the adoption of innovative irrigation technologies.

The Indonesian government is increasingly emphasizing quality standards and certifications for agricultural products and irrigation systems, ensuring product safety and efficacy. Regulatory frameworks stipulate that all irrigation equipment must comply with specific standards to promote reliability in agricultural practices. The introduction of new quality standards in 2023 aimed at improving water management technologies highlights the government’s dedication to enhancing agricultural productivity through certified drip irrigation methods.

Market Segmentation

By Product Type

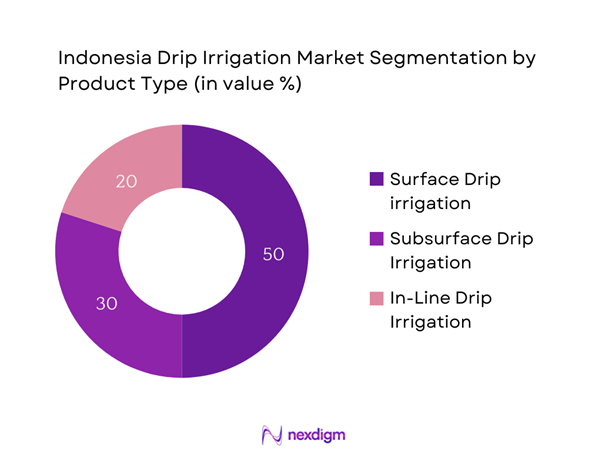

Indonesia’s drip irrigation market is segmented by product type into surface drip irrigation, subsurface drip irrigation, and in-line drip irrigation. Surface drip irrigation currently holds the dominant market share, attributed to its simplicity and efficiency in delivering water directly to the plant roots. Farmers favor this system due to its lower operational and maintenance costs compared to other segments. Moreover, the scalability and adaptability of surface drip irrigation make it particularly appealing for various crop types, enhancing its popularity among local farmers.

By Crop Type

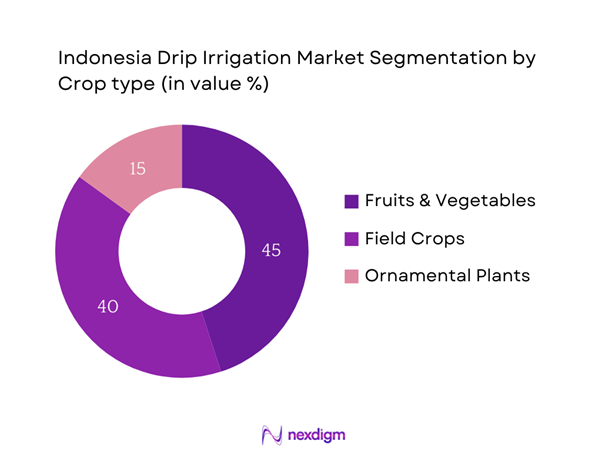

The market is further segmented by crop type, including field crops, fruits and vegetables, and ornamental plants. The fruits and vegetables segment dominates the market, driven by a growing consumer preference for fresh produce and the increasing demand for higher crop yields. Farmers are investing in drip irrigation systems to enhance productivity, ensure water efficiency, and meet the rising market demands. The ability of drip irrigation to optimize water usage while promoting healthier crop growth is a significant factor contributing to the dominance of this sub-segment.

Competitive Landscape

The Indonesia Drip Irrigation market is characterized by the presence of several key players, including local and international companies specializing in irrigation technologies. Major players such as Netafim and Jain Irrigation command significant attention in this market due to their innovative product offerings and established customer relationships. This consolidation of major players reflects their significant influence and capability to drive market advancements through technology and customer education.

| Company | Establishment Year | Headquarters | Product Offerings | Market Parameters | Innovations | Distribution Channels |

| Netafim | 1965 | Israel | – | – | – | – |

| Jain Irrigation | 1986 | India | – | – | – | – |

| Rain Bird | 1933 | USA | – | – | – | – |

| Toro Company | 1914 | USA | – | – | – | – |

| EPC (Irrigation Systems) Ltd. | 1992 | Turkey | – | – | – | – |

Indonesia Drip Irrigation Market Analysis

Growth Drivers

Increasing Water Scarcity

As Indonesia grapples with increasing water scarcity, the situation has necessitated the adoption of efficient water management practices, including drip irrigation systems. Reports indicate that around 60% of the country’s water resources are devoted to agricultural use, but due to climate change and overutilization, water availability is shrinking. The World Bank forecasts that by end of 2025, Indonesia’s total renewable water resources will drop to approximately 2,500 cubic meters per capita — a level that indicates severe water stress.

Technological Advancements

The advent of innovative technologies has significantly transformed Indonesia’s agricultural landscape, particularly in irrigation practices. The country has seen an increase in investment towards smart agriculture, with initiatives like precision farming gaining traction. Institutions report that the agricultural technology market in Indonesia is poised to reach an estimated USD 5 billion by end of 2025 as farmers adopt digital solutions such as GPS-based irrigation systems. These technologies enable producers to optimize water usage and improve crop yields, underscoring the importance of technological advancements in driving market growth.

Market Challenges

High Initial Investment Costs

One of the significant challenges in implementing drip irrigation systems is the high initial investment expenditure. Studies suggest that the average cost of installing a full drip irrigation system can reach up to IDR 20 million (approximately USD 1300) per hectare, which is prohibitive for many smallholder farmers. Additionally, in a country where 23.9 million people live below the poverty line, many farmers lack the necessary funds to invest in such systems. As a result, budget constraints remain a crucial barrier to widespread adoption of efficient irrigation practices.

Limited Technical Knowledge

The successful implementation of drip irrigation systems requires understanding and skills that many Indonesian farmers currently lack. Studies reveal that nearly 40% of smallholder farmers reported experiencing difficulties in understanding advanced irrigation technologies and their management. This lack of technical knowledge hinders the effective utilization of drip systems, resulting in inefficient water use and minimized benefits. Additionally, agricultural training programs in the remote areas of Indonesia have been reported to be insufficient, further complicating farmers’ ability to leverage these technologies effectively.

Opportunities

Rising Awareness of Efficient Water Use

As awareness of efficient water management practices rises among farmers, the demand for drip irrigation systems is expected to increase. The Indonesian government’s ongoing campaigns focus on educating farmers about sustainable irrigation practices, linking clean water access to economic stability. Current statistics show that 82% of farmers express interest in learning more about water-efficient technologies. This growing awareness is essential for generating substantial future market growth, as more producers look to adopt innovative agricultural solutions to maximize resource efficiency.

Government Initiatives for Sustainable Agriculture

The Indonesian government has launched various initiatives to promote sustainable agricultural practices, which increasingly include the adoption of advanced irrigation systems. With the government’s support and investments in irrigation infrastructure, combined with the growing agricultural sector projected to reach a value of USD 13.5 billion by 2025, there are considerable opportunities for further market expansion.

Future Outlook

Over the next several years, the Indonesia Drip Irrigation market is poised for considerable growth, driven by increasing agricultural needs, government policies favoring sustainable irrigation, and advancements in drip irrigation technology. The rise in water scarcity concerns and the demand for enhanced crop productivity are further propelling this market forward. Together, these factors are expected to create significant opportunities for growth, transforming the agricultural landscape in Indonesia.

Major Players

- Netafim

- Jain Irrigation

- Rain Bird

- Toro Company

- EPC (Irrigation Systems) Ltd.

- Irritec

- Altius Farms

- OASIS

- Plastro Irrigation

- Ceres Media

- CropX

- Hydro-Gardens

- RIVULIS

- GrowSpan

- M.A. Hellenic Energy S.A.

Key Target Audience

- Farmers and Agricultural Producers

- Agriculture Equipment Distributors

- Agricultural Cooperatives

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Agriculture, Ministry of Environment)

- Irrigation System Manufacturers

- Agricultural Consultants and Advisors

- Sustainable Farming Organizations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Drip Irrigation Market. This step is underpinned by comprehensive desk research, utilizing a combination of secondary and proprietary databases to collect extensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Indonesia Drip Irrigation Market. This includes assessing market penetration, the ratio of irrigation solutions, and the resultant revenue generation. Furthermore, an evaluation of product quality and market trends will be conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple drip irrigation manufacturers to acquire detailed insights into product segments, sales performance, customer preferences, and other pertinent factors. This interaction will help verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia Drip Irrigation Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Water Scarcity

Technological Advancements - Market Challenges

High Initial Investment Costs

Limited Technical Knowledge - Opportunities

Rising Awareness of Efficient Water Use

Government Initiatives for Sustainable Agriculture - Trends

Smart Irrigation Technologies

Eco-Friendly Practices - Government Regulation

Agricultural Policies

Quality Standards and Certifications - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024 (IDR Billion)

- By Volume, 2019-2024 (Million Hectares)

- By Average Price, 2019-2024 (IDR per Hectare)

- By Product Type (In Value %)

Surface Drip Irrigation

– Basic Surface Systems

– Pressure-Compensated Systems

– Non-Pressure Compensated Systems

Subsurface Drip Irrigation

– Permanent Subsurface Systems

– Temporary/Seasonal Subsurface Systems

In-Line Drip Irrigation

– Cylindrical Inline Drippers

– Flat Inline Drippers

– Pressure Compensated Inline Systems - By Crop Type (In Value %)

Field Crops

– Maize (corn)

– Soybeans

– Sugarcane

– Rice (where applicable)

Fruits and Vegetables

– Chili, Tomato, Onion

– Melon, Watermelon

– Papaya, Banana

– Pineapple, Mango

Ornamental Plants

– Floriculture (roses, orchids)

– Decorative shrubs (urban landscapes, resorts) - By Application (In Value %)

Agricultural Use

– Smallholder Farms

– Commercial Farms

– Government-Backed Irrigation Projects

Landscape Irrigation

– Public Gardens & Parks

– Residential Lawns & Golf Courses

– Resort Landscaping - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Farmer Programs

– Government Contracts and Tenders

– Institutional Procurement

Distributors and Dealers

– Agri-input dealers (physical stores)

– Local irrigation system installers

– Agro-cooperative networks

Online Sales

– E-commerce Platforms

– Manufacturer-owned platforms

– Agri-tech marketplaces - By Region (In Value %)

Java

Sumatra

Bali

Kalimantan

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Drip Irrigation Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Netafim

Jain Irrigation Systems Ltd

The Toro Company

Rain Bird Corporation

Hunter Industries

Chinadrip Irrigation Equipment Co. Ltd

Antelco Pty Ltd

T-L Irrigation

Sistema Azud

Metzer Group

Rivulis Irrigation Ltd

Shanghai Huawei Water Saving Irrigation Corp. Ltd

Mahindra EPC Ltd

Grupo Chamartin S.A.

Dripworks Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030 (IDR Billion)

- By Volume, 2025-2030 (Million Hectares)

- By Average Price, 2025-2030 (IDR per Hectare)