Market Overview

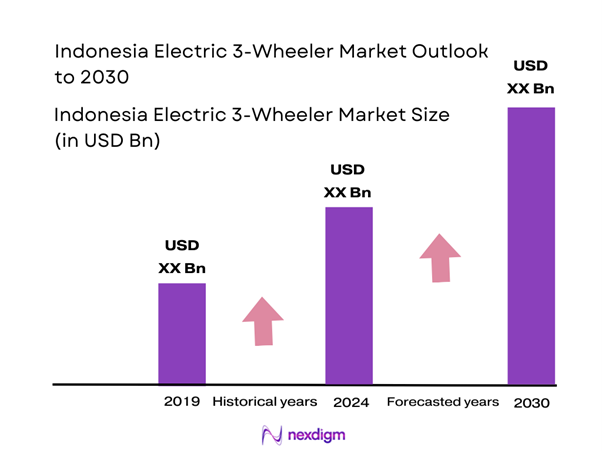

The Indonesia Electric 3-Wheeler Market is valued at U.S.D 1.42 billion in 2024 with an approximated compound annual growth rate (CAGR) of 13.5% from 2024-2030, based on a five-year historical analysis. The significant growth in the market is primarily driven by the increasing adoption of electric vehicles (EVs) in urban areas and supportive government initiatives promoting sustainable transportation. Furthermore, consumer awareness about environmental impacts and the push toward cleaner mobility solutions are fueling demand.

The dominant regions driving the electric 3-wheeler market include major urban centers such as Jakarta, Surabaya, and Bandung. Jakarta is a key city characterized by high population density and significant traffic congestion, necessitating the adoption of compact and efficient electric vehicles. Additionally, government policies supporting electric mobility, coupled with local manufacturers investing in charging infrastructure and vehicle production, further reinforce these cities’ status as market leaders.

The Indonesian government has introduced several incentives to promote the adoption of electric vehicles (EVs), recognizing their role in reducing greenhouse gas emissions and air pollution. In 2022, the government allocated around IDR 6 trillion (approximately USD 400 million) for subsidies to lower the purchase price of electric vehicles. These incentives include tax breaks and exemptions from import duties for electric vehicle manufacturers, aimed at encouraging local production that is projected to reach 20% of total vehicle sales by 2025.

Market Segmentation

By Vehicle Type

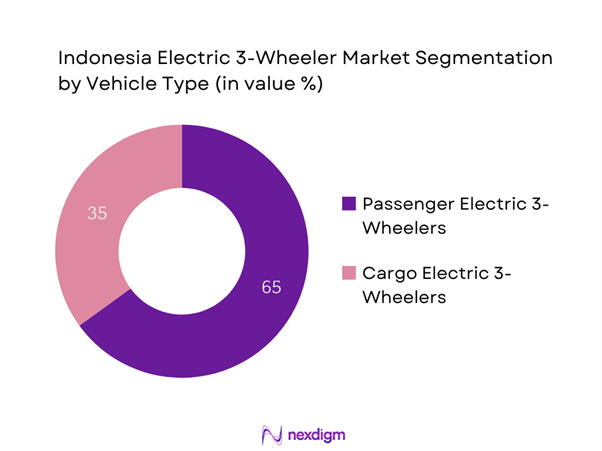

The Indonesia Electric 3-Wheeler Market is segmented by vehicle type into passenger electric 3-wheelers and cargo electric 3-wheelers. Passenger electric 3-wheelers dominate the market share, primarily due to their increasing acceptance as a viable means of daily transportation. The demand for passenger vehicles is significantly supported by ride-hailing services and local governmental initiatives aiming to reduce urban traffic and pollution levels. Moreover, electric passenger vehicles offer cost-efficient and environmentally friendly alternatives to traditional gasoline-powered three-wheelers, appealing to environmentally conscious consumers.

By Battery Type

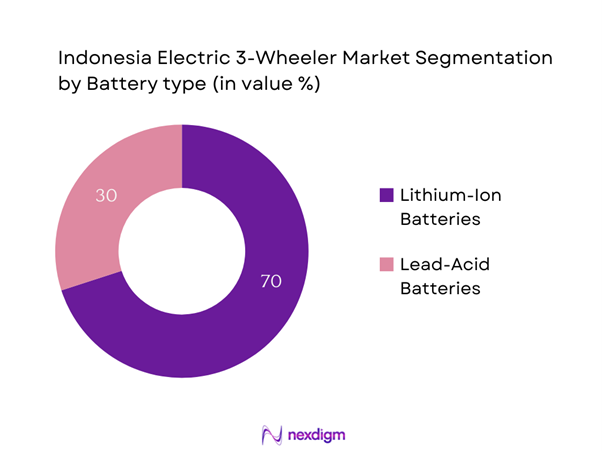

The market for electric 3-wheelers is further segmented by battery type into lithium-ion batteries and lead-acid batteries. Lithium-ion batteries account for the largest market share, driven by their superior energy density, longer lifespan, and reduced weight when compared to lead-acid alternatives. The growing preference for lithium-ion batteries is reflected in decreasing production costs and advancements in battery technology, which enhance performance and reliability. With automotive manufacturers increasingly investing in lithium-ion battery technology, this sub-segment is expected to maintain its lead in the electric 3-wheeler market.

Competitive Landscape

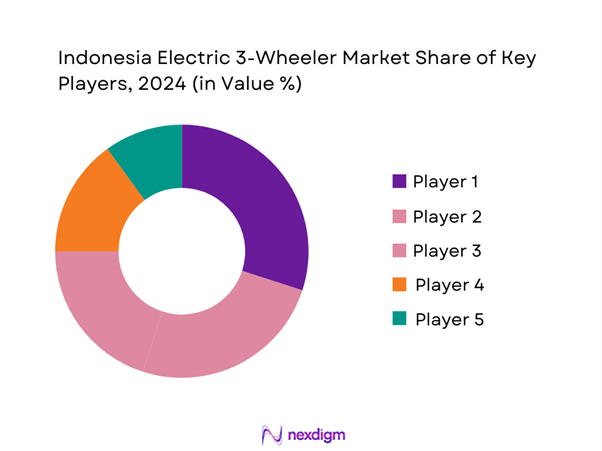

The Indonesia Electric 3-Wheeler Market is dominated by several key players, including both local and international manufacturers. These companies play a crucial role in shaping the market landscape by offering innovative products and robust service offerings. Prominent players include prominent local manufacturers that have leveraged these conditions effectively. Collaboration with government initiatives for building infrastructure has allowed for a competitive edge in this emerging market.

| Company Name | Established | Headquarters | Market Strategy | Product Range | Recent Innovations | Distribution Network |

| Toyota | 1937 | Jakarta, Indonesia | – | – | – | – |

| Bajaj Auto | 1945 | Jakarta, Indonesia | – | – | – | – |

| Mahindra Electric | 2010 | Bali, Indonesia | – | – | – | – |

| E-Tuk | 2018 | Jakarta, Indonesia | – | – | – | – |

| Green Gas Dispatch | 2016 | Surabaya, Indonesia | – | – | – | – |

Indonesia Electric 3-Wheeler Market Analysis

Growth Drivers

Rising Environmental Awareness

As urban populations grow, environmental concerns in Indonesia have intensified, with a reported 70% of residents in urban areas expressing concern over air quality and pollution caused by conventional vehicles. In Jakarta, air quality has consistently ranked among the worst in Southeast Asia, with PM2.5 levels exceeding World Health Organization (WHO) recommendations. This heightened awareness is driving demand for cleaner modes of transportation, including electric 3-wheelers. The government’s commitment to reducing carbon emissions by 29% and investments in electric vehicle infrastructure through the National Medium-Term Development Plan demonstrate a focused approach to addressing these environmental challenges.

Urbanization and Traffic Congestion

The rapid urbanization in Indonesia is a significant driver for the electric 3-wheeler market, with projections estimating that by end of 2025, about 68% of the population will live in urban areas, up from 56% in 2020. The urban centers, particularly Jakarta, face immense traffic congestion, which not only affects travel times but also exacerbates air pollution. The government has highlighted a need to transition to electric vehicles as part of its urban planning initiatives, particularly as the average travel time in Jakarta has increased to 60 minutes per trip due to congestion. Such factors underline the urgency for efficient, eco-friendly transportation solutions.

Market Challenges

Infrastructure Limitations

Infrastructure challenges remain a barrier to the widespread adoption of electric 3-wheelers in Indonesia. As of 2022, there were only around 1,000 charging stations across the country, which is insufficient for a burgeoning electric vehicle market. Additionally, the lack of a unified standards for charging systems hampers the development of a cohesive network. The Ministry of Energy and Mineral Resources has projected that Indonesia needs to increase its charging infrastructure to at least 2,200 stations to meet the growing demand by end of 2025. Such limitations are critical hindrances that must be addressed for market expansion.

High Initial Investment Costs

High initial investment costs present a significant challenge for both consumers and manufacturers in the Indonesian electric 3-wheeler market. The average price of an electric 3-wheeler can be about IDR 100 million (approximately USD 6,700), which is considerably higher than conventional models, approximately IDR 60 million (around USD 4,000). These financial barriers limit accessibility for many potential users, especially in a country where GDP per capita is approximately USD 4,200. To incentivize adoption, establishing more affordable financing solutions and reducing production costs will be crucial.

Opportunities

Technology Advancements in Batteries

The Indonesian electric 3-wheeler market stands to benefit significantly from ongoing advancements in battery technology. With lithium-ion battery costs declining by nearly 85% over the last decade, the potential for better performance and longer lifespan is increasing, while the average cost of battery packs in 2022 was approximately USD 137 per KWh. Additionally, local companies are increasingly investing in battery recycling technology and local production, which could also enhance supply chain resilience and reduce dependency on imports. Such advancements could lead to a more robust electric vehicle ecosystem, making electric 3-wheelers a more appealing option for consumers.

Expansion of E-commerce Logistics Sector

The expansion of the e-commerce logistics sector in Indonesia presents a significant opportunity for the electric 3-wheeler market. E-commerce sales in Indonesia surged to USD 40 billion in 2022, driven by a rapidly digitizing economy and an increase in online shopping habits. The logistics sector now seeks efficient, sustainable delivery methods, and electric 3-wheelers are emerging as a practical solution for urban deliveries due to their compact size and lower operational costs. Companies are exploring the use of electric 3-wheelers to navigate congested urban areas, and major delivery services are actively testing electric models for last-mile logistics. This trend is projected to encourage investment in electric vehicle fleets as logistics providers look to reduce their carbon footprint while maintaining competitiveness in the rapidly evolving e-commerce landscape. `

Future Outlook

Over the next five years, the Indonesia Electric 3-Wheeler Market is expected to demonstrate considerable growth potential driven by sustained government support for electric mobility, significant technological advancements in battery systems, and increasing consumer demand for clean and efficient transportation options. Initiatives implemented by Indonesian authorities to promote electric vehicles alongside the growing concern about air quality are likely to further bolster the market’s expansion. The integration of innovative designs and improved charging infrastructure will play an essential role in enhancing the consumer experience and encouraging widespread adoption.

Major Players in the Market

- Toyota

- Bajaj Auto

- Mahindra Electric

- E-Tuk

- Green Gas Dispatch

- Adgero Indonesia

- Tiga Roda Electric

- Vega Electric

- Jakarta Electric Vehicle

- Gojek

- Grab

- Yutong

- Piaggio

- Mitsubishi Motors

- Hyundai

Key Target Audience

- Government and Regulatory Bodies (Ministry of Transportation, Indonesian Electric Vehicle Association)

- Urban Planning Authorities

- Automotive Manufacturers

- Battery Suppliers and Manufacturers

- Investment and Venture Capitalist Firms

- Transportation and Logistics Companies

- Electric Vehicle Charging Infrastructure Developers

- Public Transportation Operators

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Indonesia Electric 3-Wheeler Market. This step includes extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including market size, growth drivers, and competitive positioning.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Indonesia Electric 3-Wheeler Market are compiled and analyzed. This includes assessing market penetration, the ratio of vehicle types, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates and market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies in the electric vehicle sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data collected throughout the research.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple electric 3-wheeler manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia Electric 3-Wheeler Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Government Incentives for Electric Vehicles

Rising Environmental Awareness

Urbanization and Traffic Congestion - Market Challenges

Infrastructure Limitations

High Initial Investment Costs - Opportunities

Technology Advancements in Batteries

Expansion of E-commerce Logistics Sector - Trends

Shift Towards Sustainable Transport Solutions

Increasing Adoption of Shared Mobility - Government Regulation

EV Policies and Subsidies

Emission Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Passenger Electric 3-Wheelers

– Low-Speed E-Rickshaws (≤25 km/h)

– High-Speed Passenger E3Ws (>25 km/h)

– Shared Mobility E3Ws (fleet-operated)

Cargo Electric 3-Wheelers

– Closed Cargo E3Ws

– Open Deck E3Ws

– Swappable Container Models - By End Use (In Value %)

Transportation Services

– First/Last Mile Connectivity

– App-based Shared Services

– Informal Public Transport (Bajaj-type models)

Goods Delivery

– E-commerce Delivery

– FMCG/Pharma Logistics

– Retail Supply Chain Delivery - By Battery Type (In Value %)

Lithium-ion Batteries

– Fixed Battery Models

– Swappable Battery Models

Lead-Acid Batteries

– Tubular Lead-Acid

– Flat Plate Lead-Acid - By Charging Infrastructure (In Value %)

Public Charging Stations

– AC Slow Chargers

– DC Fast Chargers

– Battery Swap Stations (Public)

Private Charging Units

– Home Charging Points

– Depot/Commercial Charging (Fleet Use)

– Solar-Powered Charging Units - By Region (In Value %)

Java

Bali

Sumatra

Kalimantan

Sulawesi

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Electric 3-Wheeler Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Vehicle Type, Battery Technology, Range and Payload Metrics, Fleet/B2B Partnerships, Government Scheme Participation, Dealers and Distributors, After-Sales Service Coverage, Production Capacity, Localization Rate, Charging Network Compatibility or Partnerships, Margins, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Toyota Astra Motor

Honda Prospect Motor

Nissan Motor Indonesia

Mitsubishi Motors Krama Yudha Indonesia

Daihatsu Indonesia

Suzuki Indomobil Sales

Hyundai Motor Manufacturing Indonesia

Isuzu Astra Motor Indonesia

Hino Motors Sales Indonesia

BMW Indonesia

Mercedes-Benz Indonesia

Kia Motors Indonesia

Ford Motor Indonesia

Great Wall Motors Indonesia

Wuling Motors

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030