Market Overview

The Indonesia geothermal energy market is valued at approximately USD 3.85 billion in 2024. This sizeable market is driven by the nation’s vast geothermal endowment, estimated at around 28.5 GW of potential, alongside escalating electricity demand and strong government support through regulatory incentives, risk‑sharing schemes, and financing mechanisms.

Within Indonesia, the geothermal market is concentrated in regions such as Java and Sumatra, owing to their intensive volcanic activity, high‑temperature reservoirs, and established infrastructure that facilitate exploration and grid integration. These islands dominate development because they offer favorable geological conditions and proximity to high-demand population centers, reducing costs and ensuring better project viability.

Market Segmentation

By Plant Technology

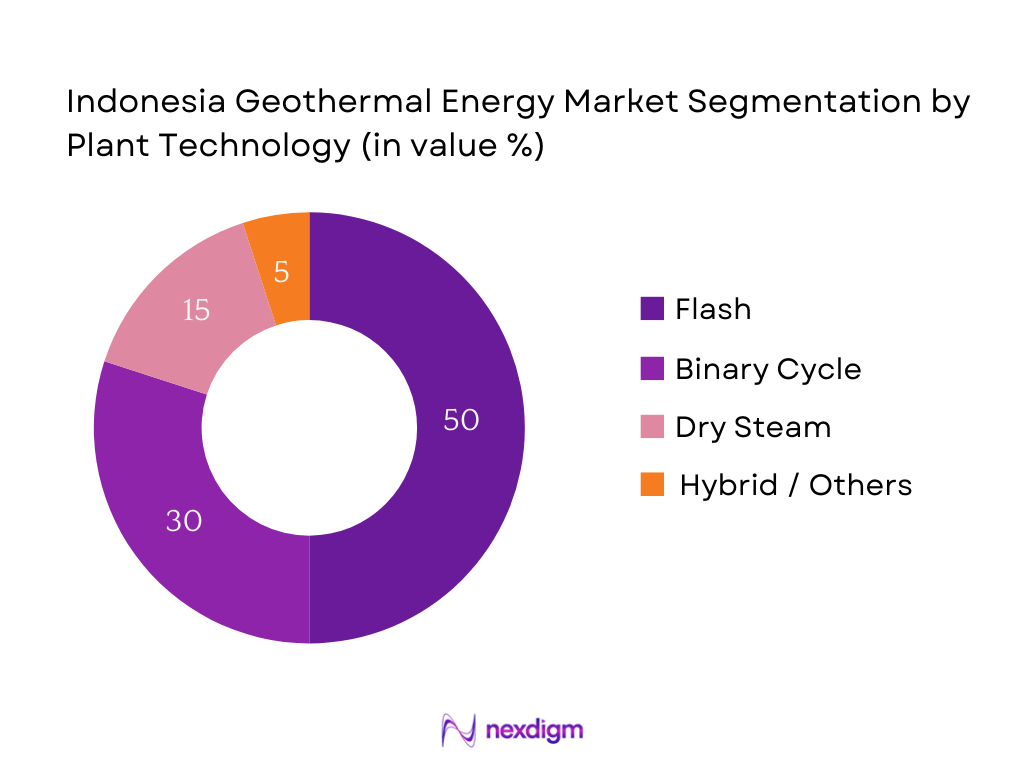

Indonesia’s geothermal market is segmented into flash (single and double), binary cycle, dry steam, and hybrid/other systems. Flash geothermal technology commands the leading market share due to its established reliability and higher power output from high‑enthalpy reservoirs, making it economically efficient for large-scale baseload power generation. The prevalence of high-temperature reservoirs in Java and Sumatra complements flash systems, enabling developers like PGE and Star Energy to capitalize on mature infrastructure and competitive tariffs.

By End‑Use Application

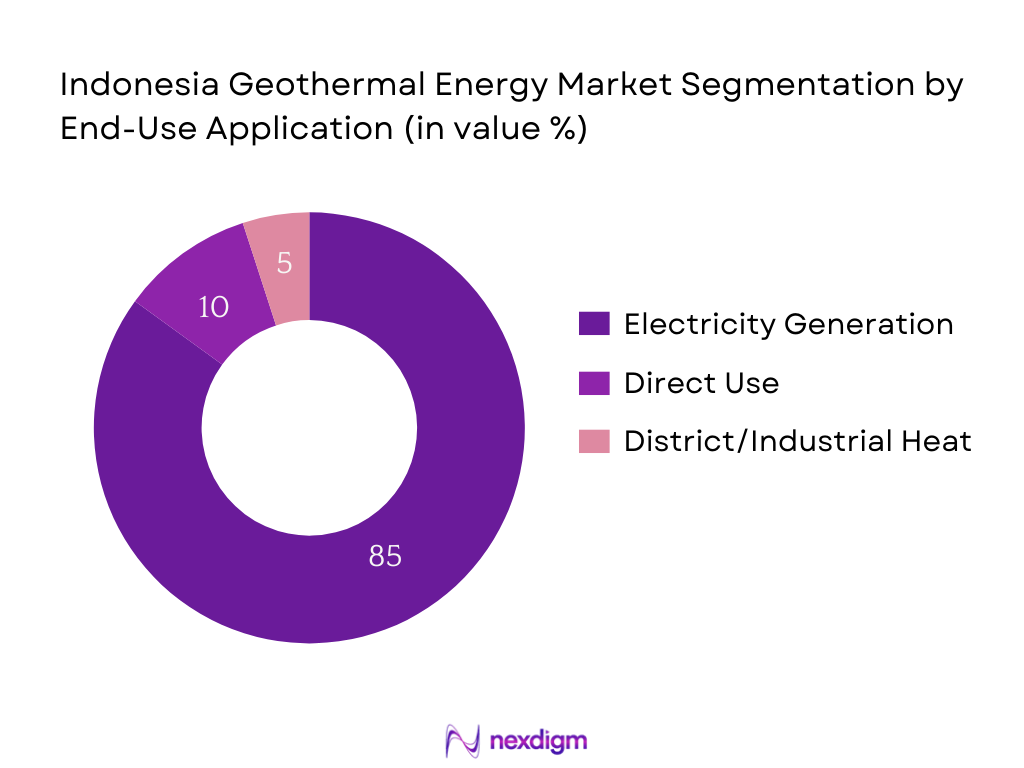

The Indonesia geothermal market is divided across electricity generation, direct-use applications (e.g., heating, agro-processing) and district or industrial heat. Electricity generation dominates, driven by state utility PLN’s prioritization of baseload renewable power to meet growing consumption. Projects are structured with long-term PPAs and tariff frameworks, enabling developers to scale operations economically. In contrast, direct-use and industrial heat applications remain niche due to limited infrastructure and the early stage of uptake in industrial zones and rural off-grid areas.

Competitive Landscape

The Indonesia geothermal energy market is shaped by a handful of major players—both state-owned and private—that lead capacity deployment, technology implementation, and project pipelines. The market is dominated by a few major players such as Pertamina Geothermal Energy (PGE), Star Energy Geothermal, Geo Dipa Energi, Supreme Energy, and Medco Power Indonesia. This concentration underscores their strategic access to high-enthalpy sites, financial backing, and key partnerships with EPC and drilling contractors.

| Company | Establishment Year | Headquarters | Installed Capacity (MW) | Reservoir Focus (°C) | # Operating Plants | PPA Tariff Band (USD/kWh) | Financing Structure | Technology Focus |

| Pertamina Geothermal Energy (PGE) | 1976 | Jakarta | – | – | – | – | – | – |

| Star Energy Geothermal | 2003 | Jakarta | – | – | – | – | – | – |

| Geo Dipa Energi | 2007 | Jakarta | – | – | – | – | – | – |

| Supreme Energy | 2013 | Jakarta | – | – | – | – | – | – |

| Medco Power Indonesia | 2006 | Jakarta | – | – | – | – | – | – |

Indonesia Geothermal Energy Market Analysis

Growth Drivers

Abundant High-Temperature Reservoirs in Java & Sumatra

Indonesia sits atop one of the world’s richest geothermal resource endowments, with geological estimates indicating approximately 23,965 megawatts (MW) of geothermal potential—roughly 40% of global reserves—concentrated across Java, Sumatra, Bali, and Sulawesi. Java and Sumatra, in particular, host the most prolific high‑enthalpy systems exceeding 200 °C, which are well suited for flash and multi‑flash geothermal technologies. As of year‑end 2022, Indonesia had realized 2,356 MW of installed geothermal capacity, making it second globally, behind the United States. This contrast—vast potential versus modest utilization—demonstrates the extent of untapped high‑temperature reservoirs driving ongoing market development.

National Renewable Energy Goals and RUPTL Allocation

Indonesia’s Rencana Usaha Penyediaan Tenaga Listrik (RUPTL) program outlines a robust renewable energy strategy up to 2030, with a focus on geothermal alongside other renewables. Between 2021 and 2030, the RUPTL estimates power sector investments at approximately USD 90 billion, of which USD 20 billion is allocated to generation by PLN and USD 40 billion to IPPs, covering renewables including geothermal. Simultaneously, the Just Energy Transition Partnership (JETP) under the World Bank projects overall power sector electrification—272 terawatt‑hours (TWh) in 2022 expected to quintuple by 2050—underscoring long‑term institutional commitment and planning toward geothermal contribution. These macro‑level allocations anchor geothermal firmly within national energy transition goals.

Market Challenges

High Exploration and Drilling Costs

Geothermal project development involves substantial initial capital outlay, heavily front-loaded in exploration and drilling. Indonesia has only deployed approximately 2,356 MW of installed geothermal capacity against a potential of over 23,965 MW. This wide gap signifies the financial and geological risk inherent in early-stage exploration, where multiple dry wells and deep drilling often exceed tens of millions of dollars before discovering commercially viable steam zones. As such, cost barriers remain a primary suppressant on acceleration of new capacity.

Limited Access to Transmission Infrastructure

Despite PLN’s grid growth strategy, transmission and distribution remain bottlenecks. The RUPTL estimates a need for USD 15 billion in transmission investments by 2030 to implement green RUPTL programs. Indonesia’s electricity network transformation agenda further highlights that network capacity must expand significantly two‑ to three‑fold to accommodate renewables integration. Geothermal resources often lie in remote or mountainous regions where grid access is minimal, delaying connection timelines and increasing project complexity.

Opportunities

Development of Binary Systems for Low-Enthalpy Reservoirs

Though Indonesia’s realized geothermal capacity remains at 2,356 MW, the nation holds nearly 23,965 MW of untapped potential—much of which comprises low‑enthalpy resources unsuitable for traditional flash systems. Binary cycle technology, capable of harnessing lower‑temperature geofluids (often 90–150 °C), provides a pathway to monetize these abundant resources. These systems can be modular, deployable in remote locations, and paired with smaller-scale feed‑in arrangements, creating new market segments beyond high‑temperature areas.

Hybridization with PV/BESS in Isolated Grids

Indonesia’s shift toward renewables integration is supported by PLN’s grid digitization and RE integration programs, including the I‑ENET initiative, which enhances distribution lines, SCADA systems, and AMI infrastructure. In this context, geothermal plants—especially binary or small flash sites—can be hybridized with solar PV and battery energy storage systems (BESS) to provide dispatchable, flexible power solutions suited to isolated or off‑grid regional systems. This hybrid model can stabilize supply during intermittent generation and unlock higher value from geothermal resources in leveling peak demand and enabling microgrid operation.

Future Outlook

Over the forecast horizon, the Indonesia geothermal energy market is well-positioned to experience strong growth, underpinned by policy drivers, infrastructure expansion, and evolving technology. Continued implementation of geothermal risk‑sharing schemes, streamlined permitting (e.g., IPPKH), and increased climate finance will accelerate exploration and capacity additions. Emerging trends like binary retrofits, geothermal‑PV/BESS hybrids, and direct-use applications present significant upside potential beyond traditional power generation.

Major Players

- Pertamina Geothermal Energy (PGE)

- Star Energy Geothermal

- Geo Dipa Energi

- Supreme Energy

- Medco Power Indonesia

- Sarulla Operations Ltd (SOL)

- KS Orka Renewables

- PT Sokoria Geothermal Indonesia (SGI)

- PT Sorik Marapi Geothermal Power (SMGP)

- Ormat Technologies

- Toshiba Energy Systems & Solutions

- Fuji Electric

- Mitsubishi Power

- Marubeni Corporation

- Itochu Corporation

Key Target Audience

- Independent Power Producers (IPPs) looking to enter or expand in geothermal generation

- State-Owned Enterprises (SOEs) such as PLN and Pertamina managing energy portfolios

- Investments and venture capitalist firms pursuing clean energy infrastructure

- International Development Finance Institutions (DFIs) providing blended finance or guarantees

- Industrial estate developers seeking captive or process heat applications

- Forest and environmental regulators (e.g., MEMR, Ministry of Environment and Forestry) overseeing geothermal licensing and IPPKH permits

- Climate finance and fund managers targeting green bonds, GCF, World Bank, and Clean Technology Fund investments

- Transmission and grid system operators coordinating renewable integration and POI development

Research Methodology

Step 1: Identification of Key Variables

The first phase entailed mapping all critical stakeholders—developers, regulators, OEMs, financiers—in Indonesia’s geothermal ecosystem. This involved desk research using secondary sources such as PEMDAS data, government regulatory publications, and proprietary databases to define variables like resource potential, tariff structures, and capacity.

Step 2: Market Analysis and Construction

A bottom-up estimation was conducted by aggregating installed capacities, announced projects, and pipeline data, validated against finance-backed PPA structures and PLN procurement targets. Cost‑based triangulation (USD per MW, drilling cost curves) and historical uptake analysis ensured robustness.

Step 3: Hypothesis Validation and Expert Consultation

Draft market estimates were validated through interviews (CATI) with industry stakeholders: developers, MEMR officials, PLN, and drilling/EPC contractors. Insights on permitting timelines, tariff negotiations, and technology preferences refined the quantitative model.

Step 4: Research Synthesis and Final Output

The final phase integrated supplier and OEM engagements to validate assumptions around technology deployment, capacity factors, and cost trends. A cross‑check against bottom‑up forecasts and expert insights ensured accuracy and industry relevance in our final market sizing and analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Geothermal Resource Classification and Belt Distribution

- Evolution of the Geothermal Policy Framework

- Geothermal Energy Development Lifecycle

- Steam-to-Wire Value Chain Mapping

- Stakeholder Analysis (EBTKE, PLN, SOEs, IPPs, EPCs, OEMs)

- Growth Drivers

Abundant High-Temperature Reservoirs in Java & Sumatra

National Renewable Energy Goals and RUPTL Allocation

Feed-in Tariff Regulations and Risk Sharing Facilities

Rising Demand from PLN and Industrial Clusters

Availability of International Climate Finance and DFIs - Market Challenges

High Exploration and Drilling Costs

Limited Access to Transmission Infrastructure

Land Permit and Forest Area Licensing Delays

Seismic Risk and Environmental Compliance Hurdles

Dependence on Imported Drilling Rigs and OEM Equipment - Opportunities

Development of Binary Systems for Low-Enthalpy Reservoirs

Hybridization with PV/BESS in Isolated Grids

Carbon Credit Revenue from Clean Development Mechanism

Enhanced Geothermal Systems (EGS) Pilots

International JV Models and Technology Transfer - Trends

Modular Binary Plant Deployments

Downhole Data Analytics and Digital Reservoir Monitoring

Local Content Mandates (TKDN) Integration in EPC

Co-location with Green Hydrogen and Ammonia Plants - Government Regulations

Presidential Decrees on Geothermal Tariffs

IPPKH and AMDAL Requirements for Forest Land Use

MEMR Guidelines on PPA Bankability

Fiscal Incentives: Tax Holiday, Duty Exemption

PLN Procurement and Grid Connection Framework - SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume (Installed Capacity, MW), 2019-2024

- By Average Feed-in Tariff (USD/kWh), 2019-2024

- By Plant Technology (In Value %)

Dry Steam

Single Flash

Double Flash

Binary Cycle

Hybrid Systems (Geothermal + Solar/BESS) - By Reservoir Temperature (In Value %)

Very Low (<90°C)

Low (90–150°C)

Medium (150–220°C)

High (>220°C) - By Development Stage (In Value %)

Operating Projects

Under Construction

Exploration and Drilling Phase

Tendered WKPs

Pre-feasibility/Identified Prospects - By Developer Ownership (In Value %)

State-Owned Enterprises

Domestic Independent Power Producers

Foreign Joint Ventures

Captive/Industrial Offtakers - By Region (In Value %)

Sumatra

Java

Bali-Nusa Tenggara

Sulawesi

Maluku-Papua

- Market Share of Major Players (Installed Capacity and Project Count)

- Market Share by Technology Type

- Cross Comparison Parameters (Installed Capacity (MW), Reservoir Temperature (°C), Capex per MW (USD), Average PPA Tariff (USD/kWh), Number of Operating Wells, Drilling Success Rate (%), Net Capacity Factor (%), Geographic Spread)

- Tariff Benchmarking and LCOE Bandwidth

- Detailed Profiles of Major Companies

Pertamina Geothermal Energy (PGE)

Star Energy Geothermal

Geo Dipa Energi

Supreme Energy

Medco Power Indonesia

KS Orka Renewables

Sarulla Operations Ltd (SOL)

Ormat Technologies

PT Sokoria Geothermal Indonesia

PT SMGP (Sorik Marapi)

Toshiba Energy Systems

Fuji Electric

Mitsubishi Power

Marubeni Corporation

Itochu Corporation

- PLN Capacity Procurement Plan (RUPTL Mapping)

- Industrial Steam and Power Demand Mapping

- Decision Journey for Project Offtake

- User Pain Points (Cost, Supply Stability, Land Conflicts)

- Energy Transition Commitments of Industrial Clusters

- By Value, 2025-2030

- By Volume (Projected Capacity in MW), 2025-2030

- By Average Feed-in Tariff, 2025-2030