Market Overview

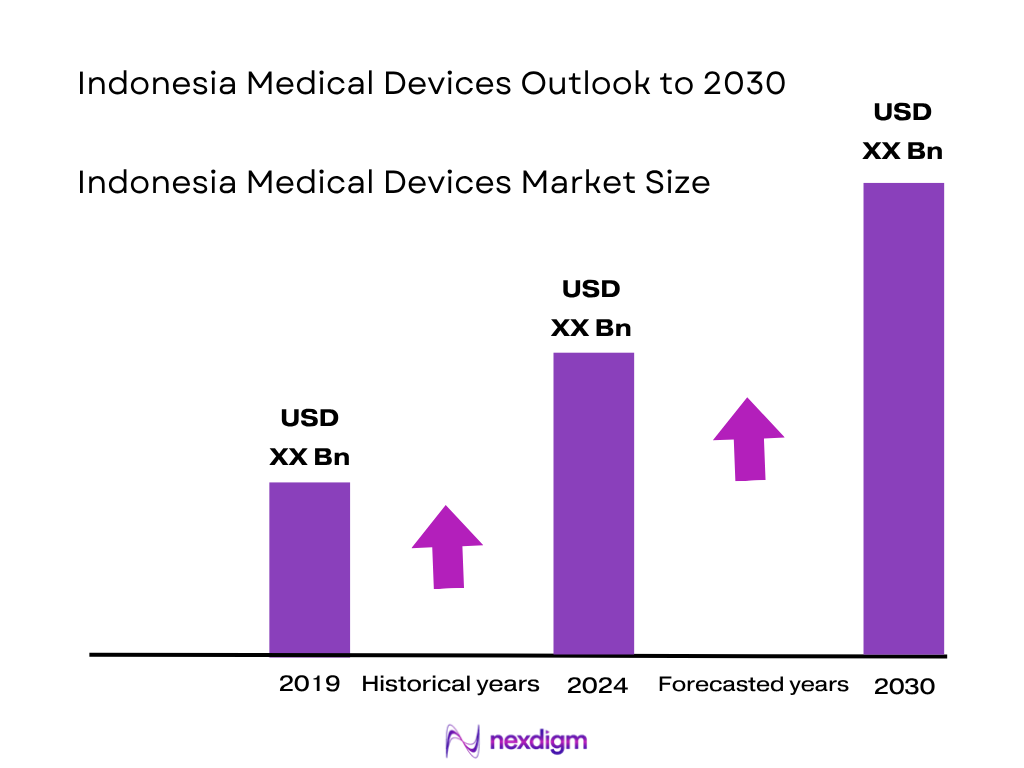

The Indonesia medical devices market is valued at USD 4.78 billion in 2024, up from USD 4.38 billion in 2023 (reflecting a strong growth driven by expansion in both public and private hospital capacity, and rapid adoption of devices under the BPJS‑Kesehatan national health insurance program which covers approximately 258.2 million people, around 90% of the population). Demand has surged for diagnostic imaging, patient monitoring, and consumables, propelled by rising healthcare infrastructure spending and universal coverage expansion.

Major urban centers such as Jakarta, Surabaya, and Bandung dominate the medical devices market due to concentration of advanced healthcare facilities, tertiary hospitals, and high-end diagnostic centers. These regions attract multinational manufacturers such as Siemens Healthineers, Philips, and GE Healthcare through robust infrastructure, better regulatory support, and higher per capita healthcare expenditure. Additionally, import hubs in major ports support rapid procurement and distribution of advanced imported devices.

Market Segmentation

By Device Category

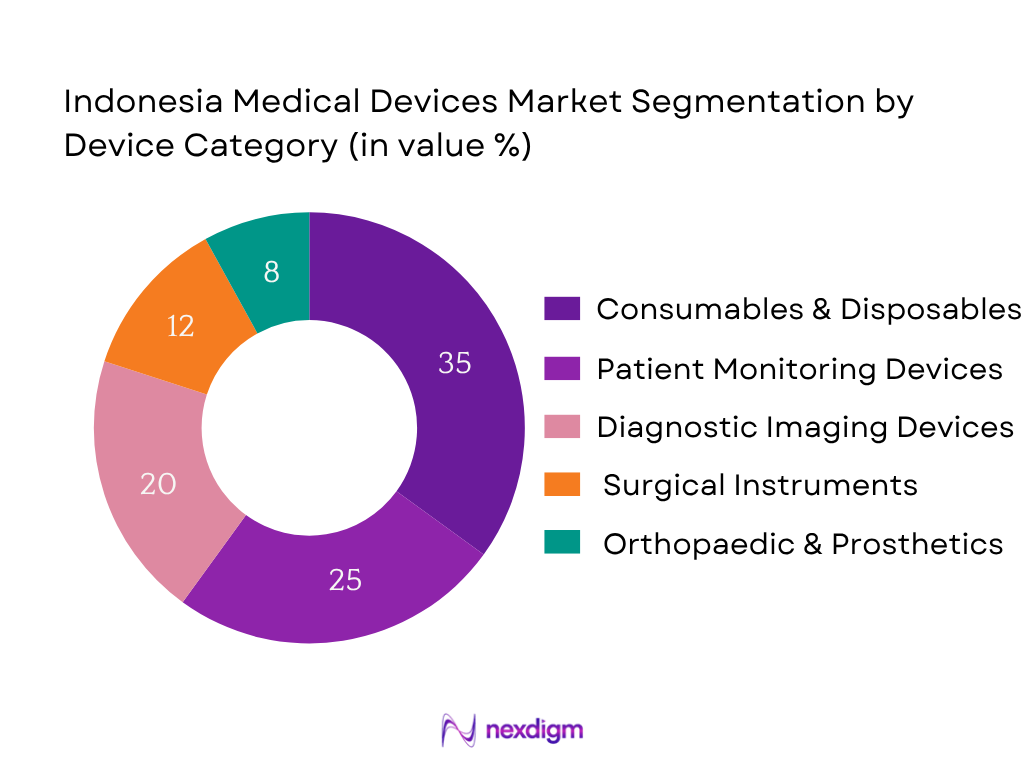

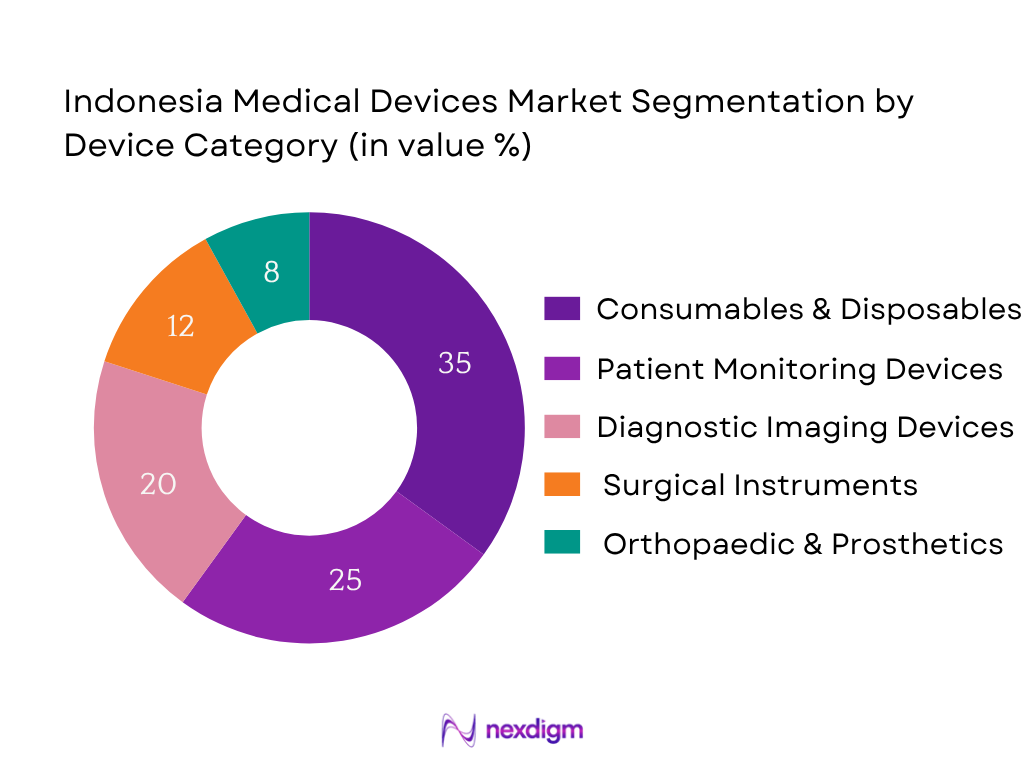

The Consumables & Disposables segment holds the largest market share in 2024 (approximately 35%) due to high recurring usage across hospitals, clinics, and home healthcare. Single-use syringes, surgical gloves, catheters, and dressing materials dominate volume consumption. In particular, local low-cost manufacturing supplies much of local consumables usage, and public procurement policies favour bulk disposable import or domestically-produced consumables, boosting this sub‑segment’s dominance. Patient Monitoring devices and Imaging follow, but consumables remain highest by value due to volume and replacement demand.

By End‑User

Public Hospitals (BPJS‑affiliated) command the largest share (~40%) of device revenues in 2024, driven by high volume procurement under national insurance reimbursement. BPJS-funded purchases focus on standard diagnostic, monitoring and consumables across thousands of public facilities. Private hospitals follow (~30%) responding to medical tourism and demand for premium solutions. Diagnostic imaging centers and home healthcare providers hold smaller share. The dominant public procurement channels and penetration of BPJS coverage give public hospitals lead position.

Competitive Landscape

The Indonesia medical devices market is dominated by major global and local players, including Siemens Healthineers Indonesia, Philips Indonesia, GE Healthcare Indonesia, Medtronic Indonesia, and Mindray Indonesia. This consolidation highlights the significant influence of these key companies across high‑end imaging, monitoring, and cardiac devices within the premium and public sectors.

| Company | Est. Year | Headquarters | Local Mfg or Assembly | Regulatory Approvals in ID | Distribution Network (Cities) | Service Centres Nationwide | Key Device Categories |

| Siemens Healthineers | 1847 | Germany | – | – | – | – | – |

| Philips Healthcare | 1891 | Netherlands | – | – | – | – | – |

| GE Healthcare | 1892 | USA | – | – | – | – | – |

| Medtronic | 1949 | USA | – | – | – | – | – |

| Mindray Indonesia | 1991 | China | – | – | – | – | – |

Indonesia Medical Devices Market Analysis

Growth Drivers

Expansion of Universal Health Coverage (BPJS)

Indonesia’s Jaminan Kesehatan Nasional (JKN) program now covers approximately 268.7 million people as of March 1, 2024 (96.28% of population) and reached 278.1 million (98.45%) by end‑2024 across 35 provinces and 473 districts/cities, with 23,682 primary healthcare centres and 3,162 referral hospitals in BPJS network. This massive patient enrolment translates to around 674 million healthcare visits in 2024—an average of 1.8 million per day. These utilization rates drive demand for medical devices across public and private facilities participating in BPJS reimbursement schemes.

Aging Population & NCD Prevalence

Indonesia’s elderly population (60 + years) reached 29 million, about 12% of the population in 2023, rising from roughly 9.78% in 2020. With life expectancy at around 73 years and demographic shift underway, this older cohort increasingly demands diagnostic imaging, cardiac monitors, orthopedic implants, and long‑term care devices. The rising prevalence of non‑communicable diseases (heart disease, diabetes) in seniors further fuels procurement of monitoring and surgical devices in hospitals, especially in urban centres.

Market Challenges

High Import Dependency for Advanced Devices

Indonesia remains heavily reliant on imports for advanced imaging and surgical equipment. Local medical device exports were only USD 200 million in 2023, compared to USD 3.5 billion in imports of diagnostic and surgical devices as per Ministry of Trade statistics. This results in long lead times for approvals and customs clearance, and exposes procurement to currency risk. The reliance limits price competitiveness and affects affordability in public tenders.

Regulatory & Licensing Delays (MoH & BPOM Approvals)

The MoH and BPOM approval process for new medical devices averages 6 to 12 months, based on Ministry of Health internal audit data. Delays are more pronounced for novel imported devices requiring technical dossier reviews and clinical evaluation. As of 2024, backlog data shows 1,200 pending device applications, slowing market entry for manufacturers and causing procurement segmentation disruptions.

Opportunities

Growth in Domestic Manufacturing under “Making Indonesia 4.0”

Under the “Making Indonesia 4.0” roadmap, investment incentives have led to establishment of 12 new medical device assembly plants accredited by MoH in 2024, focusing on consumables and patient monitoring equipment. Local manufacturing capacity for syringes and gloves rose from 20 million units monthly in 2022 to 28 million units monthly in 2024, according to Ministry of Industry. These initiatives reduce import dependency and support domestic device availability with faster distribution.

Expansion in Home Healthcare & Remote Patient Monitoring

BPJS mobile app usage for telehealth grew to 18 million users in 2024 with daily telemedicine consultations averaging 20,000 sessions per day in mid‑2024. Remote patient monitoring pilot programmes—using wearable ECG devices and glucometers—are underway across 15 provinces, involving 3,000 patients under community health centre supervision. This signals a rising opportunity for connected medical device vendors supplying home healthcare platforms and remote monitoring kits.

Future Outlook

The Indonesia medical devices market is projected to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030, reaching approximately USD 9.3 billion by 2030. Over the period ahead, the Indonesia medical devices market is expected to show strong growth, driven by public health insurance expansion (BPJS enhancing procurement reach), continued hospital infrastructure development, rising chronic disease burden, and localization policies encouraging domestic manufacturing. Increased government regulation emphasising local content, combined with foreign direct investment incentives, will further support device adoption and expansion. Technological advancements in AI-enabled diagnostics and remote monitoring, especially in Tier‑2 cities, will contribute to robust market expansion.

Major Players

- Siemens Healthineers Indonesia

- Philips Healthcare Indonesia

- GE Healthcare Indonesia

- Medtronic Indonesia

- Mindray Indonesia

- Johnson & Johnson Indonesia

- Becton Dickinson Indonesia

- Boston Scientific Indonesia

- Canon Medical Systems Indonesia

- Abbott Indonesia

- Stryker Indonesia

- Braun Indonesia

- PT Itama Ranoraya Tbk

- PT Jayamas Medica Industri (OneMed)

- PT Enseval Medika Prima

Key Target Audience

- Heads of Procurement, Public Hospitals (BPJS-affiliated)

- Heads of Procurement, Private Hospitals & Specialty Clinics

- Directors of Diagnostic Laboratories and Imaging Centre

- Heads of Medical Device Import/Distribution Companies

- Heads of Investment & Venture Capitalist Firms (healthcare & medtech)

- Ministry of Health Indonesia (MoH regulatory division)

- BPOM (National Agency of Drug and Food Control) Licensing Division

- Heads of Medical Device Manufacturing Firms in Indonesia

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping Indonesia’s medical device ecosystem including hospitals, distributors, manufacturers, regulators (MoH, BPOM), and BPJS procurement agencies. Extensive desk research and secondary database collection defined critical variables: device categories, procurement routes, import‑dependency, and regulatory environment.

Step 2: Market Analysis and Construction

Historical data for market size in 2023 and 2024 from secondary reports was compiled. Volume-to-value conversion, average device pricing, and procurement volumes were analysed. Device category segmentation and end-user revenue breakdowns were constructed to ensure accuracy of share estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses—such as dominance of consumables and public hospitals procurement—were validated through interviews with hospital procurement officers, distributor executives, and regulatory affairs specialists, using structured telephone-based interviews across Jakarta, Surabaya, and Bandung.

Step 4: Research Synthesis and Final Output

The final output was refined by engaging top-tier manufacturers (global and Indonesian), distributors, and government officials to verify data on regulatory approvals, local content requirements, service centre networks, and product portfolios. This ensured robust triangulation of bottom-up and top-down estimates.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In‑Depth Interviews with Distributors, Hospital Procurement Heads, and Regulatory Authorities, Primary Research Methodology, Limitations, and Concluding Notes)

- Definition and Scope

- Market Evolution & Historical Context

- Milestones in Domestic & Imported Device Approvals

- Lifecycle & Procurement Cycles in Hospitals & Clinics

- Supply Chain & Value Chain Analysis (Importers, Distributors, Local Manufacturers, Regulatory Bodies)

- Growth Drivers

Expansion of Universal Health Coverage (BPJS)

Aging Population & NCD Prevalence

Government Investment in Healthcare Infrastructure (Hospital Bed Additions, ICU Capacity)

Medical Tourism Growth (Jakarta, Bali)

Technological Upgrades & Digital Health Adoption - Market Challenges

High Import Dependency for Advanced Devices

Regulatory & Licensing Delays (MoH & BPOM Approvals)

Skilled Workforce Shortages in Device Handling

Price Sensitivity in Public Procurement

Uneven Healthcare Access in Rural & Remote Regions - Opportunities

Growth in Domestic Manufacturing under “Making Indonesia 4.0”

Expansion in Home Healthcare & Remote Patient Monitoring

Untapped Demand in Tier‑2/3 Cities - Trends

Integration of AI in Diagnostics

Tele‑ICU and Remote Surgery Trials

Wearable Medical Device Uptake - Government Regulations

Ministry of Health (MoH) Device Classification Rules

BPOM Import Licensing Norms

Halal Certification for Specific Devices - SWOT Analysis

- Stakeholder Ecosystem (Hospitals, Distributors, Regulators, Manufacturers)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Unit Price (by Device Category), 2019-2024

- By Device Type (In Value %)

Diagnostic Imaging Devices (MRI, CT, X‑ray, Ultrasound, Nuclear Imaging)

Patient Monitoring Devices (Multi‑parameter, Cardiac, Respiratory, Neurological)

Surgical Equipment (Electrosurgical, Endoscopic, Robotic Surgery)

Orthopedic & Prosthetic Devices (Joint Implants, Spinal Devices, Prosthetics)

Consumables & Disposables (Syringes, Gloves, Catheters, Dressings) - By End User (In Value %)

Public Hospitals (BPJS‑Affiliated)

Private Hospitals & Specialty Clinics

Diagnostic Laboratories

Home Healthcare Providers

Ambulatory Surgical Centers - By Distribution Channel (In Value %)

Direct Sales to Hospitals

Authorized Distributors & Agents

Retail Pharmacies & Medical Equipment Stores

E‑Commerce & Online Marketplaces

Government Tenders & Bulk Procurement - By Source of Manufacture (In Value %)

Imported Devices (USA, EU, Japan, China, South Korea)

Locally Manufactured Devices - By Region (In Value %)

Java (Jakarta, Bandung, Surabaya)

Sumatra (Medan, Palembang)

Kalimantan (Balikpapan, Banjarmasin)

Sulawesi (Makassar, Manado)

Bali & Nusa Tenggara

- Market Share of Major Players (Value & Volume)

Market Share by Device Category (Diagnostic, Surgical, Monitoring, etc.) - Cross Comparison Parameters (Company Overview, Product Portfolio Breadth (by Device Category), Indonesia‑Specific Regulatory Approvals, Distribution Network Size (Cities Covered), Local Manufacturing / Assembly Capabilities, After‑Sales Service Centers in Indonesia, Training & Education Programs for Healthcare Staff, Partnerships with Hospitals & Universities)

- SWOT Analysis of Major Players

- Pricing Analysis (Key SKUs by Device Category)

- Detailed Profiles of Major Companies

PT Itama Ranoraya Tbk

PT Jayamas Medica Industri Tbk (OneMed)

PT Phapros Tbk

PT Enseval Medika Prima

PT Mega Andalan Kalasan (MAK)

PT Sugih Instrumendo Abadi

Siemens Healthineers Indonesia

Philips Indonesia

GE Healthcare Indonesia

Medtronic Indonesia

Abbott Indonesia

Mindray Indonesia

Canon Medical Systems Indonesia

Olympus Indonesia

B. Braun Indonesia

- Hospital & Clinic Procurement Budgets

- BPJS Reimbursement Impact on Device Purchases

- Decision‑Making Hierarchy in Equipment Purchases

- Key Pain Points (Supply Delays, Training Gaps)

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price (by Device Category), 2025-2030