Market Overview

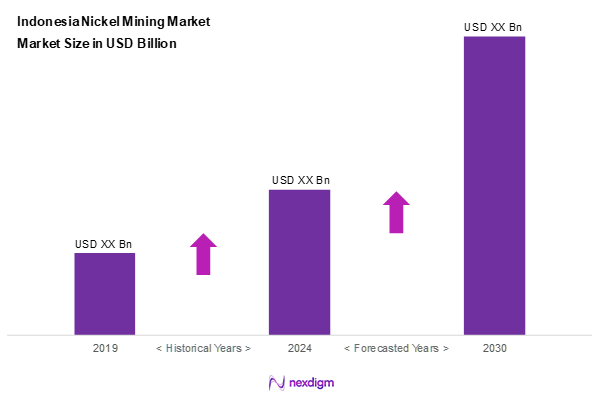

The Indonesia nickel mining market is valued at USD 30.4 billion in 2024, is expected to grow at a CAGR of 4.6% from 2024 to 2030, reflecting growth fuelled by the escalating global demand for electric vehicle batteries and stainless steel applications. This demand is primarily driven by the country’s rich nickel reserves, estimated at around 21 million metric tons, which propels both domestic production and export potential. Moreover, advancements in mining technologies and regulatory support have further facilitated market expansion and optimization of resource extraction.

Dominant regions in the Indonesia nickel mining market include Sulawesi and Sumatra, as these areas harbor significant nickel deposits and infrastructure conducive to mining activities. Sulawesi, in particular, has witnessed substantial investments leading to the establishment of industrial parks that streamline processing and logistics. Meanwhile, Sumatra supports nickel mining operations due to its established mining ecosystem and government incentives aimed at promoting local production capabilities.

Market Segmentation

By Product Type

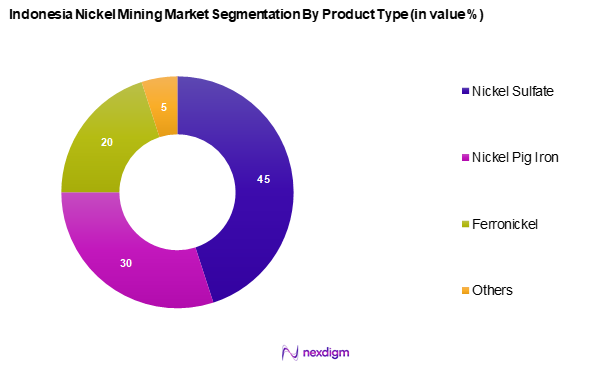

The Indonesia nickel mining market is segmented into nickel sulfate, nickel pig iron, ferronickel, and others. Nickel sulfate has emerged as a dominant sub-segment in the market, driven by its crucial role in battery production for electric vehicles. As the electric vehicle sector continues to grow globally, featuring brands like Tesla and BYD, the demand for nickel sulfate has surged, establishing it as a vital component in the battery supply chain. The ability of nickel sulfate to enhance battery efficiency also enhances its attractiveness among manufacturers, further solidifying its leading position in the market.

By Application

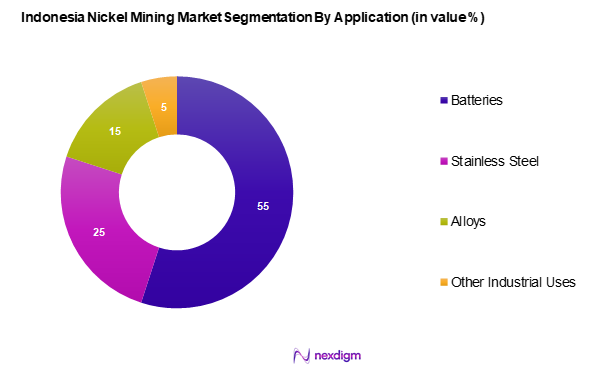

The Indonesia nickel mining market is segmented into batteries, stainless steel, alloys, and other industrial uses. The batteries segment has become the leading application area due to the exponential rise in electric vehicle adoption and the corresponding need for battery materials. This demand is further fueled by global trends toward renewable energy and environmentally friendly solutions. The growing investments in battery plants and research into advanced battery technologies underline the pivotal role this application holds in driving the nickel mining market’s future trajectory.

Competitive Landscape

The Indonesia nickel mining market is dominated by several key players, including local and international firms. Major players like PT Vale Indonesia and PT Aneka Tambang lead the market, showcasing a mix of operational efficiency, technological innovation, and significant investment in sustainable practices. This consolidation emphasizes the large influence these companies have in shaping market dynamics, which is critical for meeting global demand and navigating regulatory challenges.

| Major Players | Establishment Year | Headquarters | Annual Production (Metric Tons) | Product Types Offered | Market Strategy | Sustainability Initiatives |

| PT Vale Indonesia | 1968 | Jakarta, Indonesia | – | – | – | – |

| PT Aneka Tambang Tbk | 1968 | Jakarta, Indonesia | – | – | – | – |

| PT Indonesia Morowali IP | 2013 | Central Sulawesi, Indonesia | – | – | – | – |

| PT Bintang Selatan Mining | 1992 | Jakarta, Indonesia | – | – | – | – |

| PT Harita Group | 1994 | Jakarta, Indonesia | – | – | – | – |

Indonesia Nickel Mining Market Analysis

Growth Drivers

Rising Global Demand for Electric Vehicle Batteries

The accelerating transition towards electric mobility is significantly elevating the demand for nickel, a key material used in lithium-ion battery production. As electric vehicle (EV) adoption surges worldwide, the need for reliable sources of battery-grade nickel has become more urgent. Indonesia, possessing one of the world’s largest nickel reserves, plays a pivotal role in meeting this demand. Its strategic position and resource richness position it as a critical supplier in the global EV supply chain, thereby fueling expansion in its domestic mining sector.

Increasing Stainless Steel Production

Nickel’s widespread use in stainless steel manufacturing continues to drive its demand, especially amid robust growth in construction and infrastructure development. As industries increasingly adopt sustainable and durable materials, stainless steel remains a preferred choice—intensifying nickel consumption. Indonesia benefits from this trend, given its capacity to supply nickel to meet both domestic and international production needs. The continued momentum in stainless steel output further strengthens the relevance of Indonesia’s mining sector on the global stage.

Market Challenges

Environmental Concerns

Environmental sustainability remains a central challenge for nickel mining activities in Indonesia. The sector has faced scrutiny over deforestation, water contamination, and adverse effects on biodiversity, prompting strong reactions from both local communities and environmental advocacy groups. These concerns have led to tighter governmental oversight and stricter environmental regulations. Mining companies are increasingly required to implement eco-friendly practices and reclamation efforts, which can increase compliance costs but are essential for long-term operational viability.

Regulatory Compliance Issues

Indonesia’s regulatory landscape for mining operations has become more rigorous, with stricter laws introduced to safeguard environmental and social interests. Non-compliance can result in significant operational disruptions, reputational risks, and financial penalties. Companies operating in the sector must now prioritize transparency, sustainability, and community engagement. Adapting to evolving regulatory expectations has become a prerequisite for maintaining licenses and ensuring uninterrupted operations.

Opportunities

Technological Innovations in Mining

Emerging technologies are transforming Indonesia’s nickel mining landscape. Automation, artificial intelligence, and blockchain are being integrated into operations to enhance productivity, reduce environmental impact, and improve traceability. These innovations not only streamline mining processes but also open avenues for attracting sustainable investments. Companies embracing technology-driven practices are better positioned to meet environmental standards, improve margins, and gain competitive advantages in both domestic and international markets.

Expansion of Export Markets

Indonesia’s strategic efforts to expand its presence in international nickel markets offer strong growth potential. With rising global interest in clean energy and battery storage, several countries are actively sourcing nickel for their energy transition plans. Indonesia’s government is forging trade partnerships and enhancing export infrastructure to capitalize on this growing demand. Strengthening its role as a key exporter supports the sector’s profitability and contributes to the country’s broader economic development goals.

Future Outlook

Over the next several years, the Indonesia nickel mining market is anticipated to experience robust growth, bolstered by continued governmental support, technological advancements in mining methodologies, and increasing global demand for nickel-driven applications. The rise of electric vehicles and renewable energy technologies will further propel the need for nickel, presenting significant opportunities for expansion and investment within the sector. Accelerated infrastructure development and sustainability efforts will also play a crucial role in facilitating future growth.

Major Players

- PT Vale Indonesia

- PT Aneka Tambang Tbk

- PT Indonesia Morowali Industrial Park

- PT Bintang Selatan Mining

- PT Harita Group

- Nickel Asia Corp

- PT Nusantara Smelting

- PT Trimegah Bangun Persada

- PT Dharmapala Usaha Sukses

- PT Iriana Steels

- PT Sendang Sari

- PT Saptaindra Sejati

- PT Nusa Halmahera Minerals

- PT Merdeka Copper Gold Tbk

- PT Bumi Minerals Sukses

Key Target Audience

- Mining companies

- Electric vehicle manufacturers

- Battery manufacturers

- Metal traders

- Investors and venture capitalist firms

- Government and regulatory bodies (e.g., Ministry of Energy and Mineral Resources)

- Environmental organizations

- Industrial manufacturers using nickel-based materials

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering a comprehensive understanding of all key stakeholders in the Indonesia nickel mining market. This is achieved through extensive desk research, utilizing both secondary and proprietary databases to formulate an ecosystem map. The focus is on defining critical variables such as production capacity, demand drivers, market trends, and regulatory frameworks impacting the sector.

Step 2: Market Analysis and Construction

This stage centers on compiling and analyzing historical data relevant to the Indonesia nickel mining market. It encompasses evaluating production levels, understanding the interplay between local mining activities and global demand, and reviewing quality metrics contributing to overall sector performance. This detailed analysis aims to validate revenue generations and market trends through reliable statistical assessments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are established based on initial findings and then validated through consultations with industry experts. Computer-assisted telephone interviews (CATIs) with professionals directly involved in nickel mining and related sectors provide critical insights. These discussions are essential for refining existing data and ensuring the accuracy of the research findings by confirming operational and financial dynamics from an insider perspective.

Step 4: Research Synthesis and Final Output

The final phase involves interacting directly with leading nickel mining companies to gather in-depth insights into various facets, including their product lines, sales performance, and strategic initiatives. This engagement not only helps verify information derived from earlier data collection methods but also enriches the overall market analysis by incorporating practical insights into consumer preferences and operational challenges.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Global Demand for Electric Vehicle Batteries

Increasing Stainless Steel Production - Market Challenges

Environmental Concerns

Regulatory Compliance Issues

Price Volatility - Opportunities

Technological Innovations in Mining

Expansion of Export Markets - Trends

Shift Towards Sustainable Mining Practices

Increasing Involvement of Foreign Investments - Government Regulations

Mining Permits and Licensing

Export Taxation Policies

Environmental Protection Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type

Nickel Sulfate

– Battery-grade Nickel Sulfate

– Electroplating-grade Nickel Sulfate

Nickel Pig Iron (NPI)

– Low-grade NPI

– High-grade NPI (used in stainless steel production)

Ferronickel

– Low-carbon Ferronickel

– High-carbon Ferronickel

Others

– Nickel Matte

– Nickel Oxide

– Refined Nickel - By Application

Batteries

– Electric Vehicle (EV) Batteries

– Consumer Electronics Batteries

– Energy Storage Systems (ESS)

Stainless Steel

– Construction and Infrastructure

– Consumer Goods (e.g., kitchenware)

– Industrial Applications

Alloys

– Aerospace Alloys

– Marine Alloys

– Heat-Resistant Alloys

Other Industrial Uses

– Electroplating

– Chemical Catalysts

– Coinage - By Mining Method

Open-Pit Mining

– Laterite Ore Mining

– Strip Mining

Underground Mining

– Block Caving

– Cut and Fill

Others

– In-situ Leaching (experimental or pilot-stage)

– Combined Surface & Underground Extraction - By Region

Sulawesi

Sumatra

Kalimantan

Papua

Maluku - By Production Stage

Raw Ore

– Laterite Ore

– Saprolite Ore

– Limonite Ore

Intermediate Products

– Mixed Hydroxide Precipitate (MHP)

– Nickel Matte

– Nickel Intermediate Concentrates

Final Products

– Refined Nickel

– Battery-Grade Nickel

– Stainless Steel Inputs

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Product Type, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Production Capacity, Distribution Channels, Margins, Unique Value Offering, Innovation Capability, Environmental Stewardship)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

PT Vale Indonesia

PT Aneka Tambang Tbk

PT Indonesia Morowali Industrial Park

PT Bintang Selatan Mining

Nickel Asia Corp

PT Nusantara Smelting

PT Dharmapala Usaha Sukses

PT Harita Group

PT Inti Mining

PT Tanjung Berkat Abadi

PT Dolphin Energy

PT Iriana Steels

PT Sendang Sari

PT Saptaindra Sejati

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030