Market Overview

The Indonesia nitrogenous fertilizer market is valued at USD 8.98 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 6% from 2024-2030, reflecting significant growth trends supported by burgeoning agricultural activities and government initiatives aimed at enhancing crop yields. The increasing demand for food security as the population expands has acted as a catalyst for the adoption of nitrogenous fertilizers.

Indonesia’s market is primarily concentrated in key regions such as Java, Sumatra, and Kalimantan, where agricultural activities are prevalent. Java stands out due to its dense population, allowing for higher consumption levels owing to the concentration of farms and agricultural businesses. Sumatra and Kalimantan also contribute significantly due to their vast arable land and essential agricultural production. The synergy between local demand and government support in these areas solidifies their dominance in the nitrogenous fertilizer market landscape.

The Indonesian government has made considerable investments in subsidizing fertilizers, allocating around USD 3.4 billion in the 2023 budget specifically for fertilizer subsidies. This strategic support is designed to lower the cost of essential nitrogen fertilizers like urea and ammonium sulfate, which are pivotal for farmers, particularly smallholders who constitute over 60% of the agriculture sector. Such government backing not only facilitates access to fertilizers but also incentivizes higher usage among farmers, thus driving growth in the nitrogenous fertilizer market substantially.

Market Segmentation

By Product Type

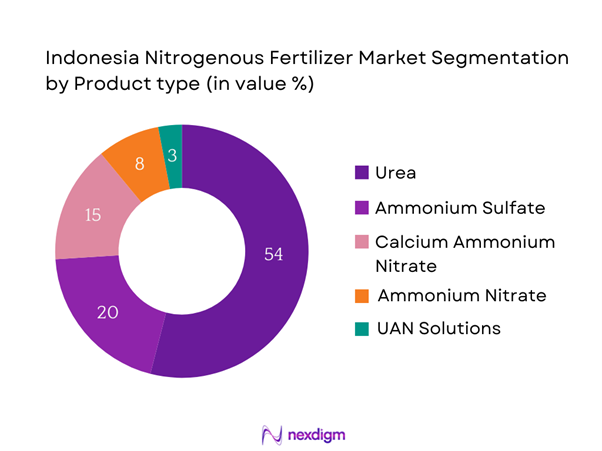

The Indonesia nitrogenous fertilizer market is segmented by product type into urea, ammonium sulfate, calcium ammonium nitrate, ammonium nitrate, and UAN solutions. Among these, urea has maintained a dominant market share, driven by its cost-effectiveness and broad applicability across various crops. Urea’s high nitrogen content makes it particularly attractive for increasing crop yield; thus, it is widely used by farmers, resulting in significant demand growth. Its established presence in the market, supported by substantial distribution networks and continuous consumer education on its benefits, reinforces its leading position.

By Application

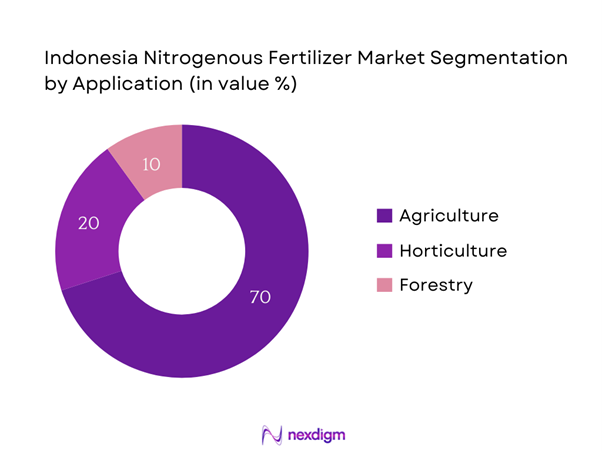

The market is further segmented by application into agriculture, horticulture, and forestry. The agriculture sector commands the largest share due to the growing emphasis on food production to meet the needs of an increasing population. Farmers are progressively utilizing nitrogenous fertilizers to enhance soil fertility and increase crop productivity. The adoption of modern farming techniques and government subsidies supporting fertilizer usage are pivotal in driving the agricultural sector’s immense demand for these fertilizers, leading to thriving market dynamics.

Competitive Landscape

The Indonesia nitrogenous fertilizer market is dominated by a few major players, including PT Pupuk Indonesia (Persero) and PT Petrokimia Gresik, alongside notable companies like Yara International and Nutrien. This consolidation highlights the significant influence of these key companies, characterized by their extensive product ranges and strong distribution networks, which enable them to meet diverse consumer requirements effectively.

| Major Players | Established | Headquarters | Market Share | Product Range | Distribution Network | Market Strategies |

| PT Pupuk Indonesia (Persero) | 1959 | Jakarta, Indonesia | – | – | – | – |

| PT Petrokimia Gresik | 1970 | Gresik, Indonesia | – | – | – | – |

| Yara International | 1905 | Oslo, Norway | – | – | – | – |

| Nutrien | 2018 | Saskatoon, Canada | – | – | – | – |

| PT Bina Sarana Sukses | 1996 | Jakarta, Indonesia | – | – | – | – |

Indonesia Nitrogenous Fertilizer Market Analysis

Growth Drivers

Increased Agricultural Output Demands

As the population of Indonesia is projected to reach approximately 275 million by the end of 2025, there is a substantial increase in the demand for agricultural output. According to the Food and Agriculture Organization (FAO), there is a requirement of 35 million metric tons of rice alone to ensure food security for the population. This surge in demand is pushing farmers to adopt nitrogenous fertilizers to boost productivity since it is critical for improving crop yields, ensuring that the agricultural sector remains competitive and capable of meeting domestic needs.

Rise in Fertilizer Adoption Rates

With the Indonesian government focusing on enhancing agricultural practices, the adoption rates of fertilizers have escalated. Recent studies indicate that fertilizer usage per hectare has increased to an average of 208 kg in 2024, compared to 180 kg in previous years. This increase correlates with the deployment of government programs aimed at educating farmers about the benefits of nitrogenous fertilizers. Consequently, as farmers recognize the critical impact of fertilizers on crop yields, adoption rates are expected to continue their upward trend, further stimulating market growth.

Market Challenges

Regulatory Constraints

The fertilizer industry in Indonesia faces various regulatory hurdles that challenge operations for manufacturers and distributors. The Ministry of Agriculture has imposed stringent regulations on fertilizer quality and distribution, which are aimed at ensuring food safety and environmental protection. These regulations often relegate small and medium enterprises to less favorable conditions, requiring them to meet standards that larger companies can afford to maintain. This regulatory landscape complicates market dynamics, impacting growth potential.

Environmental Concerns

Environmental sustainability is becoming an increasingly pressing issue within the fertilizer industry. Excessive nitrogen fertilizer usage has led to significant environmental degradation, including soil and water contamination. Reports indicate that in 2023, about 30% of Indonesia’s water bodies were affected by runoff containing nitrogen, prompting a government push towards more sustainable agricultural practices. This situation calls for rigorous measures to mitigate negative environmental impacts, which may translate into increased operational costs and requirements for nitrogenous fertilizer producers. Addressing these concerns remains essential for maintaining the industry’s long-term viability.

Opportunities

Expansion in Organic Fertilizer Market

The organic fertilizer market in Indonesia is on a growth trajectory, with production increasing to 800,000 metric tons in 2023, driven by binding regulations regarding fertilizer types and growing consumer preferences for sustainable agricultural practices. Currently, there is a notable shift among farmers towards mixed fertilizer strategies that include organic alternatives alongside nitrogenous fertilizers. This market transition is positioning organic fertilizers as viable complements to conventional nitrogenous fertilizers, contributing to soil health and environmental sustainability, thus reflecting an opportunity for future market development. As farmers embrace organic farming techniques, the integration of nitrogenous fertilizers geared towards organic crop development presents significant potential for execution in the market.

Technological Innovations in Fertilizers

Significant advancements in fertilizer technology, such as slow-release and coated fertilizers, are rapidly gaining traction in Indonesia. These innovations are designed to enhance nutrient availability while minimizing environmental impact. In 2023, about 40% of fertilizers used in major farming regions were slow-release formulations. This shift is encouraging farmers to adopt more efficient use of fertilizers while reducing over-application. Current technological innovations are not only benefitting crop yields but also aligning with sustainable agricultural practices. Companies that invest in research and development to implement these technologies are poised to capture a growing segment of the market.

Future Outlook

Over the next five years, the Indonesia nitrogenous fertilizer market is expected to experience substantial growth, propelled by increasing agricultural innovation, expanded distribution channels, and government initiatives aimed at reducing agricultural dependency on imported fertilizers. This growth is anticipated to be further supported by a rising population, which is boosting food demands, pushing for more effective fertilizer use. The market is also likely to see advancements in fertilizer technology that improve efficiency and align with environmental standards, creating new growth avenues.

Major Players

- PT Pupuk Indonesia (Persero)

- PT Petrokimia Gresik

- Yara International

- Nutrien

- PT Bina Sarana Sukses

- PT Fertilizer Sulfur

- PT Kaltim Fertil

- PT Kaltim Fertilizer

- DBN Fertilizers

- Mishra Fertilizers

- Adaro Group

- Aplikasi Pupuk

- PT Multi Agro Pupuk

- PT Samudera Dunia Pupuk

- PT Pupuk Kujang

- PT Hasil Sumber Rejeki

Key Target Audience

- Agricultural Product Manufacturers

- Fertilizer Distributors and Suppliers

- Investments and Venture Capitalist Firms

- Government Agencies (Ministry of Agriculture, Ministry of Industry)

- Environmental Regulatory Bodies

- Agricultural Cooperatives

- Large Scale Farmers

- Exporters of Agricultural Products

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia nitrogenous fertilizer market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including agricultural production rates, fertilizer consumption trends, and government policies.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia nitrogenous fertilizer market. This includes assessing market penetration, production capacities of key players, and revenue generation statistics. An evaluation of service quality metrics is also conducted to ensure the reliability and accuracy of the revenue estimates, allowing for a robust understanding of market performance and potential growth avenues.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through in-depth consultations with industry experts, including key players across different fertilizer segments. These consultations are conducted via computer-assisted telephone interviews (CATIs), providing valuable operational and financial insights directly from industry practitioners. This step is instrumental in refining and corroborating the collected market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with various nitrogenous fertilizer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia nitrogenous fertilizer market, ultimately culminating in a well-rounded report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Agricultural Output Demands

Government Subsidies

Rise in Fertilizer Adoption Rates - Market Challenges

Regulatory Constraints

Environmental Concerns - Opportunities

Expansion in Organic Fertilizer Market

Technological Innovations in Fertilizers - Trends

Smart Fertilizer Applications

Shift Towards Sustainable Practices - Government Regulation

Pricing Regulations

Quality Assurance Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Urea

– Prilled Urea

– Granular Urea

– Coated Urea (e.g., sulfur-coated for slow release)

– Government-subsidized vs. non-subsidized urea

Ammonium Sulfate

– Crystalline Ammonium Sulfate

– Granular Ammonium Sulfate

Calcium Ammonium Nitrate (CAN)

– Standard CAN

– Boron-enriched CAN (for micronutrient-deficient soils)

Ammonium Nitrate

– Agricultural-grade Ammonium Nitrate

– Stabilized Ammonium Nitrate (with inhibitors to reduce volatilization)

UAN Solutions (Urea Ammonium Nitrate)

– Low-concentration solutions (e.g., UAN 28%)

– High-concentration solutions (e.g., UAN 32%) - By Application (In Value %)

Agriculture

– Cereal Crops

– Oilseed Crops

– Pulses & Legumes

Horticulture

– Vegetables

– Fruits

– Floriculture

Forestry

– Timber plantations

– Reforestation and nursery programs

– Agroforestry combinations with intercropping - By Distribution Channel (In Value %)

Direct Sales

Distributors/Wholesalers

Online Retail - By Region (In Value %)

Java

Sumatra

Kalimantan

Sulawesi - By Packaging Type (In Value %)

Bags

Bulk

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Nitrogenous Fertilizer Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Fertilizer, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

PT Pupuk Indonesia (Persero)

Aplikasi Pupuk

MPM Group

PT Bina Sarana Sukses

PT Fertilizer Sulfur

PT Kaltim Fertilizer

Yara Indonesia

Nutrien

DBN Fertilizers

PT Petrokimia Gresik

PT Samudera Dunia Pupuk

PT Multi Agro Pupuk

Mishra Fertilizers

Adaro Group

PT Batera Agro

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- 9.2 By Volume, 2025-2030

- 9.3 By Average Price, 2025-2030