Market Overview

The Indonesia Packaged Water Market is valued at USD 3.92 billion with an approximated compound annual growth rate (CAGR) of 8.15 % from 2025-2030, driven by increasing health consciousness and a shift towards convenient consumption patterns. Rising urbanization has led to higher demand for packaged water due to the growing awareness of the importance of hydration and health benefits associated with bottled beverages. The shift towards premium bottled water products has further stimulated market growth, as consumers are willing to invest in quality options.

Jakarta and Surabaya are the dominant cities in the Indonesian packaged water market due to their significant population density and busy lifestyles, which create a reliable consumer base for convenient and accessible packaged water. Furthermore, these cities experience a high influx of tourists and expatriates, increasing the demand for bottled water as a preferred drinking option. Their developed retail structures, including supermarkets and convenience stores, enhance distribution channels, making packaged water easily available in these urban areas.

Government regulations surrounding quality assurance are critical to maintaining standards in the Indonesia packaged water market. The National Agency of Drug and Food Control mandates regular inspections and product testing to ensure compliance with health and safety standards. Currently, around 80% of bottled water producers are regularly checked for quality assurance, which contributes to consumer confidence in the industry.

Market Segmentation

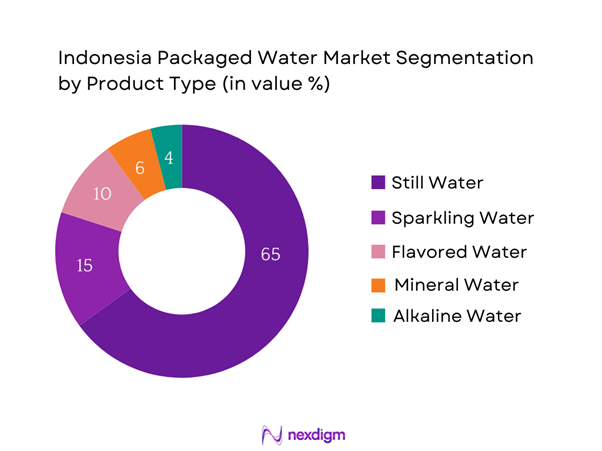

By Product Type

The Indonesia Packaged Water Market is segmented by product type into Still Water, Sparkling Water, Flavored Water, Mineral Water, and Alkaline Water. Among these, Still Water has a dominating market share, attributed to its widespread acceptance as a basic hydration solution for daily consumption. It appeals to a broad audience who prioritize affordable options for hydration over flavored or sparkling alternatives. Moreover, brands like Aqua have effectively marketed still water as ideal for everyday consumption, solidifying its preference among consumers.

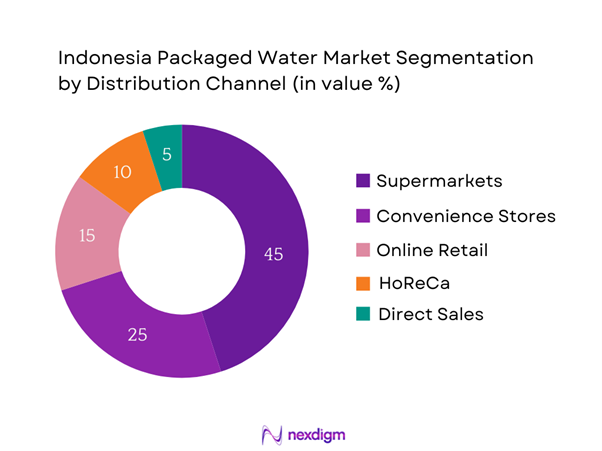

By Distribution Channel

The market is segmented further into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, HoReCa (Hotels, Restaurants, Cafés), and Direct Sales. The Supermarkets/Hypermarkets segment dominates due to the high foot traffic and consumer convenience associated with these retail formats. They offer a diverse range of packaged water brands and sizes, allowing consumers to choose based on their preferences and budget. Additionally, promotions and discounts prevalent in supermarkets further enhance consumer purchasing behavior, boosting the segment’s market share.

Competitive Landscape

The Indonesia Packaged Water Market is characterized by a consolidated structure dominated by a few key players. Major brands, such as Aqua and Nestlé Waters, influence market trends and consumer preferences through innovative marketing and extensive distribution networks. Their presence is indicative of both local and global players capitalizing on the growing health consciousness among Indonesian consumers.

| Company Name | Establishment Year | Headquarters | Market Position | Product Types | Distribution Channels | Unique Value Proposition |

| Aqua | 1973 | Jakarta, Indonesia | – | – | – | – |

| Nestlé Waters | 1992 | Jakarta, Indonesia | – | – | – | – |

| Ades | 2001 | Jakarta, Indonesia | – | – | – | – |

| Le Minerale | 2006 | Jakarta, Indonesia | – | – | – | – |

| Cleo | 1997 | Jakarta, Indonesia | – | – | – | – |

Indonesia Packaged Water Market Analysis

Growth Drivers

Increasing Health Awareness

Health awareness among Indonesian consumers continues to rise, leading to a 54% increase in bottled water consumption in recent years as people become more conscious of the importance of adequate hydration. This trend is supported by government campaigns promoting clean drinking water and health education. Additionally, the World Health Organization reports that only 65% of the population has access to safely managed drinking water, emphasizing the necessity of bottled water options as a safer alternative. As such, the demand for bottled water is expected to steadily increase as health awareness grows.

Urbanization and Population Growth

Urbanization in Indonesia is accelerating, with the urban population projected to reach approximately 60% of the total population by 2025. The World Bank indicates that urban areas are expected to see an influx of people seeking jobs and better living conditions, which in turn drives the demand for convenient hydration solutions like packaged water. Moreover, with Indonesia’s population nearing 270 million, the rising number of urban dwellers fuels the market for bottled water, aligning with consumers’ fast-paced lifestyles.

Market Challenges

Competition from Local Brands

The Indonesia packaged water market faces intense competition from numerous local brands. With over 150 registered bottled water brands, including popular names such as Le Minerale and Ades, the competition spasms price wars and saturates the market. Government regulations stipulate that only brands adhering to strict local standards can operate, intensifying competition among compliant brands. As local brands continue to innovate and capture market segments, international players may struggle to gain significant market share unless they differentiate their offerings or invest heavily in marketing efforts.

Regulatory Compliance and Quality Standards

Stringent regulatory compliance requirements exert pressure on packaged water manufacturers in Indonesia. The National Agency of Drug and Food Control mandates that all bottled water products meet specific quality and safety standards, according to Indonesian National Standards (SNI). Recent audits of the packaged water sector showed that only 70% of producers meet these standards, posing challenges for non-compliant companies and threatening their market presence. Such regulatory frameworks ensure product safety but also create barriers for new entrants, stifling potential innovation.

Opportunities

Rising Demand for Eco-Friendly Packaging

The shift towards eco-friendly packaging is presenting significant growth opportunities in the Indonesia packaged water market. Approximately 58% of consumers are willing to pay more for products that utilize sustainable packaging options. The government’s initiative to reduce single-use plastics is creating a favorable environment for companies that innovate in biodegradable and recyclable packaging solutions. As consumers increasingly prioritize sustainability, brands that adapt can capture a loyal demographic and position themselves as leaders in eco-friendly practices.

Growth of Health and Wellness Trends

The health and wellness trend is rapidly gaining momentum in Indonesia, evidenced by an increase in consumer expenditure on health-oriented products. The health food and beverage sector is projected to witness a growth of USD 4.35 billion by 2025, indicating a strong preference for healthier alternatives. This shift is creating opportunities for bottled water brands to market enhanced hydration options, such as electrolyte-infused waters or vitamin-enriched products, aligning with consumers’ proactive health management strategies. Companies that effectively capitalize on this trend will likely experience greater demand for their products.

Future Outlook

Over the next five years, the Indonesia Packaged Water Market is projected to experience substantial growth, propelled by rising health awareness, urban population escalation, and the trend towards on-the-go consumption. Continued innovations in product offerings and packaging, along with government initiatives promoting clean drinking water, are expected to enhance market attractiveness. With the increasing entry of new brands into the market, consumer choices will expand, encouraging overall market growth and competition.

Major Players

- Aqua

- Nestlé Waters

- Ades

- Le Minerale

- Cleo

- Pristine

- Sumber Air Minum (SAM)

- Blue Drop

- Amidis

- Bali Water

- Dasani (Coca-Cola)

- VIT (Danone)

- Sansevieria

- Sido Muncul

Key Target Audience

- Retail and Wholesale Distributors

- Beverage Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Indonesian Ministry of Health)

- Health and Wellness Organizations

- Food and Beverage Retail Chains

- Supermarket and Hypermarket Chains

- Event Management Companies

Research Methodology

Step 1: Identification of Key Variables

The initial stage of the research encompasses constructing a detailed ecosystem map of all primary stakeholders within the Indonesia Packaged Water Market. This phase relies on extensive desk research, leveraging a combination of secondary sources such as industry reports and proprietary databases to compile comprehensive data. The primary goal is to identify and define essential variables influencing market dynamics and behavior.

Step 2: Market Analysis and Construction

In this phase, we will aggregate and analyze historical data related to the Indonesia Packaged Water Market. This includes evaluating various factors such as demand patterns, distribution channels, consumer preferences, and revenue generation metrics. A thorough examination of quality metrics will be performed to ensure the credibility and accuracy of the financial estimates derived from the collected data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently validated through structured interviews with industry experts representing diverse entities within the packaged water sector. These consultations will yield valuable operational and strategic insights directly from experienced practitioners, ensuring a robust foundation for validation and refinement of the overall market data.

Step 4: Research Synthesis and Final Output

The final stage involves engaging with multiple packaged water manufacturers to capture detailed insights related to product offerings, sales performance, consumer behaviors, and other relevant elements. This interaction will serve to substantiate and enhance the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia Packaged Water Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Overview Genesis

- Historical Timeline of Key Players

- Business Cycle Phases

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Health Awareness

Urbanization and Population Growth

Environmental Sustainability Concerns - Market Challenges

Competition from Local Brands

Regulatory Compliance and Quality Standards - Opportunities

Rising Demand for Eco-Friendly Packaging

Growth of Health and Wellness Trends - Trends

Packaged Water Sponsorship in Events

Innovative Marketing Strategies - Government Regulation

Quality Assurance Policies

Import Tariffs and Trade Agreements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Still Water

– Regular Purified Water

– Natural Spring Water

– Distilled Water (niche segment)

Sparkling Water

– Carbonated Mineral Water

– Flavored Sparkling Water

– Zero-Calorie Sparkling Variants

Flavored Water

– Fruit-Infused Water (lemon, berry, apple)

– Vitamin-Enriched Water

– Herbal or Botanicals-Infused Water

Mineral Water

– Naturally Sourced Mineral Water

– Fortified Mineral Water

– Sulfate or Calcium-Rich Waters

Alkaline Water

– pH 8.5–9.5 Bottled Alkaline Water

– Electrolyzed Reduced Water (ERW)

– Ionized Alkaline Water in PET or glass bottles - By Distribution Channel (In Value %)

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

HoReCa (Hotels, Restaurants, Cafés)

Direct Sales - By Packaging Type (In Value %)

Bottles

Pouches

Cans

Tetra Paks

Jugs - By Region (In Value %)

Sumatra

Riau

Aceh

Papua

Maluku

Sulawesi

Kalimantan

Bali and Nusa Tenggara

Java Island - By Consumer Segment (In Value %)

Household

Corporate

Institutional

Fitness Centers

Events and Catering

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Packed Water Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Revenues, Distribution Channels, Number of Dealers and Distributors, Gross and Operating Margins, Production Plant, Capacity, Unique Value offering, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Aqua (Danone)

Nestle Waters

Indocement Tunggal Prakarsa Tbk

Ades (Coca-Cola)

VIT (Danone)

Cleo (Aqua Golden Mississippi)

Amidis

Pristine

DASANI (Coca-Cola)

Le Minerale

Sumber Air Minum (SAM)

Aqua Pure

Sansevieria

Blue Drop

Sido Muncul

- Market Demand and Usage Patterns

- Consumer Preferences and Budget Allocations

- Regulatory and Compliance Insights

- Needs and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030