Market Overview

The Indonesia Pharmacy Retail Market is valued at USD 10,797.7 million, based on five-year historical analysis. This remarkable scale is driven by rising prevalence of chronic diseases, increasing healthcare expenditure among the aging population, and higher female labor force participation that boosts demand for wellness and personal care products; over 151,000 cardiovascular-related deaths in the country reinforce the surge in prescription and OTC demand.

Pharmacy retail activity is highly concentrated in Jakarta, Surabaya, and Bandung, owing to their dense populations, advanced healthcare infrastructure, and strong economic activity. These urban centers offer lucrative markets for both brick‑and‑mortar pharmacy chains and e‑pharmacies that thrive on superior logistics connectivity and tech adoption.

Market Segmentation

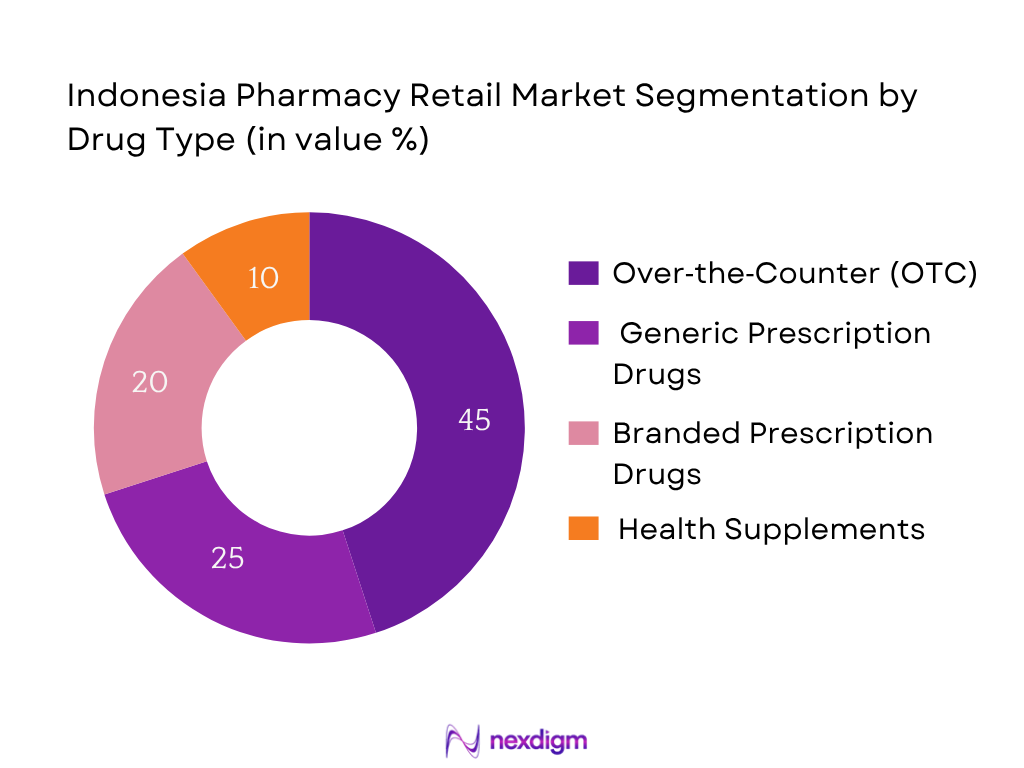

By Drug Type

The market is segmented into: Over‑the‑Counter (OTC) Drugs, Generic Prescription Drugs, Branded Prescription Drugs, and Health Supplements. OTC drugs command around 45% of market share in 2024. Their dominance stems from ease of access across both offline and online channels, affordability, and consumer preference for self‑medication of common ailments. Retail chains aggressively promote OTC SKUs, and convenience stores also stock essential OTC items, reinforcing the segment’s leadership.

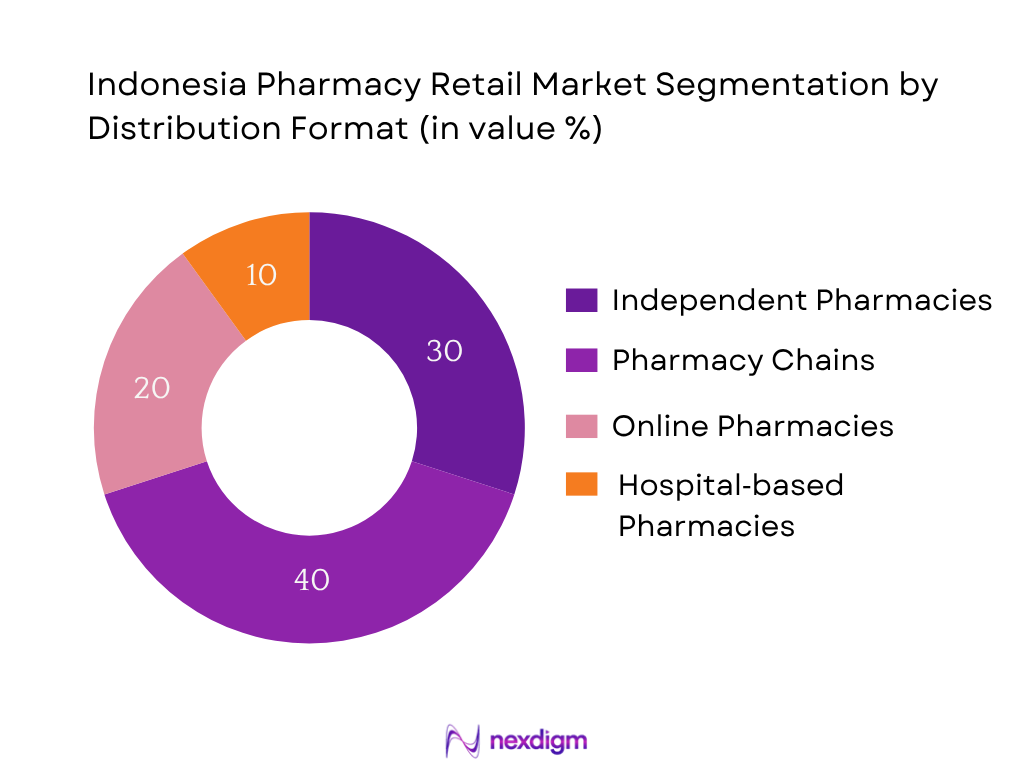

By Distribution Format

The market is also segmented into Independent Pharmacies, Pharmacy Chains, Online Pharmacies (E‑Pharmacy), and Hospital‑based Pharmacies. Pharmacy Chains dominate with an estimated 40% market share in 2024. Their prominence arises from widespread store networks, integration of e‑prescription platforms, and loyalty programs, enabling them to capture a wide customer base. Chains such as Kimia Farma and Guardian leverage their scale, urban presence, and digital tools to outperform independent chemists.

Competitive Landscape

The Indonesia pharmacy retail sector is characterized by a mix of government-backed insit‐controlled chains and private operators, with increasing competition from digital disruptors. Major players such as Kimia Farma, Guardian, and Watsons have established omnichannel models featuring integrated e-prescriptions, health consultations, and loyalty programs.

| Company | Year Established | Headquarters | Store Count | Digital Integration | BPOM Compliance | E‑Prescription Capability | Loyalty Program | Private Label SKUs |

| Kimia Farma | 1817 | Bandung | – | – | – | – | – | – |

| Guardian Indonesia | 1998 | Jakarta | – | – | – | – | – | – |

| Century Healthcare | 1971 | Jakarta | – | – | – | – | – | – |

| K24 Pharmacy | 2000 | Jakarta | – | – | – | – | – | – |

| Apotek Roxy | 1985 | Bandung | – | – | – | – | – | – |

Indonesia Pharmacy Retail Market Analysis

Growth Drivers

Rising Healthcare Spend

Indonesia’s current health expenditure reached IDR 1,050 trillion in 2022 (approx. USD 65 billion), with government spending accounting for IDR 400 trillion, mainly for hospital services and pharmaceuticals. The Ministry of Health reported that 72% of non-COVID public health spending covers pharmaceutical claims, totaling around IDR 320 trillion in 2021–2022. Additionally, the World Bank reported a US$4 billion investment in health-system strengthening approved in late 2023, focused on procurement of medical and pharmaceutical equipment. These numbers reflect a sustained increase in funding that directly increases pharmacy demand for both prescription and OTC medications.

BPJS Expansion

The national health insurance program JKN (BPJS Kesehatan) covers approximately 268.7 million Indonesians as of March 1, 2024, equating to 96.3% of the population. By end-2023, active paying participants numbered 214 million. Expansion from 220 million in 2020 to nearly 269 million in 2024 illustrates rapid uptake. As BPJS covers pharmaceuticals prescribed at pharmacies, this wide coverage contributes directly to pharmacy revenue growth and drives utilization across both urban and rural outlets.

Market Challenges

Regulatory Licensing

Indonesia’s healthcare overhaul under Government Regulation No. 49/2023 mandates stricter compliance: distribution of treatment for occupational illnesses now requires determination within 30 days by BPJS Ketenagakerjaan or BPJS Kesehatan. Additionally, pharmacies must secure BPOM, Ministry of Health, and Halal certifications under GR 28/2024, which require systematic data protection and digital health standards. These layered compliance burdens slow store openings and increase administrative costs for expansion, particularly for smaller chains.

Cold Chain Infrastructure

As of 2024, Indonesia’s cold chain market—critical for storing temperature-sensitive pharmaceuticals—is valued at around USD 3 billion, with about 12.5 million m³ of cold storage capacity. With 40+ cold chain companies centralized in Greater Jakarta, peripheral regions remain underserved. The lack of efficient cold logistics outside urban centers exposes pharmacy outlets in Tier‑2/3 cities to supply disruptions for injectables and biologics—a key operational hurdle.

Opportunities

E‑Pharmacy

Indonesia’s e‑health market is currently valued at USD 3.5 billion. Telemedicine and e-prescribing services on platforms like Halodoc and SehatQ are rapidly expanding; in 2024 the Ministry of Health reports that 80% of healthcare facilities still lack digital tools, revealing substantial room for pharmacy digitalization. E‑pharmacy can leverage this digital gap—especially in urban zones—by offering integrated drug delivery and online health consultations to millions of BPJS‑insured patients.

Franchising

The Government’s health financing reforms, including JKN modernization and social security improvements, open new avenues for franchised pharmacy models. BPJS Kesehatan revenue reached IDR 79.25 trillion in 2021, indicating strong institutional support for universal pharmacy access. Modern retail formats aligned with BPJS service points (Puskesmas) offer scalable franchising opportunities, especially by partnering with hospital networks and provincial health offices supported through the SATUSEHAT Logistics integration system from 2024

Future Outlook

Over the next six years, the Indonesia Pharmacy Retail Market is expected to maintain strong growth, underpinned by public‑private healthcare partnerships, integration of online prescription technologies, and rising consumer health awareness. E‑pharmacy platforms will increasingly reshape access, while chain pharmacies will enhance store experience through telehealth services, wellness screening, and loyalty programs. Expansion into Tier‑2/3 cities ensures untapped rural penetration, supporting sustained momentum in both urban and semi–urban regions.

Major Players

- Kimia Farma

- Guardian Indonesia

- Century Healthcare

- K24 Pharmacy

- Apotek Roxy

- Watsons Indonesia

- Apotek Generik

- SehatQ (E‑Pharmacy)

- GoApotik

- Halodoc

- KlikDokter

- Apotek Medika Farma

- Apotek Karunia

- Apotek Melawai

- Viva Health

Key Target Audience

- Pharmaceutical retailers (chain & independent)

- HealthTech & E‑pharmacy platforms

- Investments and venture capitalist firms

- C-suite executives in pharmacy and OTC sectors

- BPOM (National Agency of Drug and Food Control)

- Ministry of Health, Indonesia

- Healthcare infrastructure investors

- Private equity firms in healthcare retail

Research Methodology

Step 1: Identification of Key Variables

We built an ecosystem map of stakeholders—retailers, distributors, digital platforms, regulators—and used secondary and proprietary databases, along with BPOM and Ministry data, to outline critical market drivers.

Step 2: Market Analysis and Construction

Historical revenue and volume data (2019‑2023) were compiled from industry databases and government health expenditure reports to model market structure by segment and channel, ensuring accuracy in revenue attribution.

Step 3: Hypothesis Validation and Expert Consultation

We tested projections with CATI interviews involving pharmacy chain executives, e‑pharmacy leaders, and distributors to gather firsthand information on technology adoption, pricing strategies, and supply‑chain challenges.

Step 4: Research Synthesis and Final Output

Engaged directly with five of the top chains—including Kimia Farma—to obtain SKU‑level sales data, digital strategy insights, and consumer buying behavior. These insights validated bottom‑up estimates and underpinned strategic recommendations.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Evolution and Market Genesis

- Timeline of Key Regulatory and Industry Events

- Business and Distribution Cycle (OTC, Prescription, E-Pharmacy)

- Supply Chain and Value Chain Mapping (Distributors, Manufacturers, Retailers, Digital Platforms)

- Growth Drivers

Rising Healthcare Spend

BPJS Expansion

Urbanization - Market Challenges

Regulatory Licensing

Cold Chain Infrastructure

Grey Market Drugs - Opportunities

E-Pharmacy

Franchising

Health-Tech Partnerships - Market Trends

Telemedicine Linkages

AI-Powered Supply Chain

Preventive Health Focus - Regulatory & Compliance Landscape

BPOM

Ministry of Health

Halal Certifications - SWOT Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Transaction Value, 2019-2024

- By Product Category (In Value %)

Prescription Medicines

– Chronic Disease Drugs

– Acute Disease Medications

– Specialty/High-Value Drugs

Over-the-Counter (OTC) Drugs

– Pain Relievers & Fever Reducers

– Cold & Cough Remedies

– Digestive Aids & Antacids

– Allergy & Skin Treatments

Vitamins & Dietary Supplements

– Multivitamins

– Immunity Boosters

– Sports Nutrition & Protein Powders

– Women’s Health Supplements

Skincare and Personal Care Products

– Dermatological Solutions

– General Skincare

– Oral Care, Hair Care, Feminine Hygiene

Diagnostic & Medical Devices

– Thermometers, Blood Pressure Monitors

– Glucometers, Nebulizers, Pulse Oximeters

– Home Test Kits

Herbal/Traditional Medicine

– Jamu Products

– Herbal Remedies

– TCM/Imported Herbal Lines

Baby and Child Care

– Infant Nutrition

– Baby Skincare & Hygiene

– Pediatric OTC Medications & Vitamins - By Distribution Format (In Value %)

Independent Pharmacies

– Family-Owned Single Pharmacies

– Local Community Chemists

Pharmacy Chains

– National Chains

– Regional Chains & Franchises

Online Pharmacies

– App-Based Ordering

– E-commerce Pharmacy Sections

Drugstores at Hospitals & Clinics

– In-Hospital Pharmacies

– Clinic-Based Dispensaries and Mini Pharmacies - By Location Type (In Value %)

Tier 1 Cities

Tier 2 Cities

Rural and Semi-Urban - By Customer Type (In Value %)

General Public (B2C)

– Walk-in Customers

– Online Individual Orders

– Preventive Healthcare Purchases

Institutional Buyers (Hospitals, Clinics)

– Bulk Prescription Fulfillment

– Replenishment Orders for Clinic Chains

– Specialized Drug Procurement (injectables, cold chain)

Government Procurement

– BPJS Kesehatan (Indonesia’s Universal Health Coverage)

– E-Catalogue Supply & Tender-Based Supplies

– Public Health Center (Puskesmas) Demand - By Store Size and Layout (In Value %)

Small Format (<500 sq. ft.)

Medium Format (500–1,500 sq. ft.)

Large Format (>1,500 sq. ft.)

- Market Share by Revenue and Store Count

- Cross Comparison Parameters (Company Overview, Ownership Structure, Revenue Channels, Expansion Plans, Price Strategies, Tech Integration, Loyalty Programs, Product Assortment, Compliance Record)

- SWOT Analysis of Key Players

- Price Benchmarking (SKU-level analysis for major product categories)

- Detailed Profile of Major Companies

Kimia Farma

Guardian Indonesia

Century Healthcare

K24 Pharmacy

Apotek Roxy

Viva Health

Watsons Indonesia

Apotek Generik

SehatQ (E-Pharmacy)

GoApotik

Halodoc

KlikDokter

Apotek Medika Farma

Apotek Karunia

Apotek Melawai

- Consumer Behavior by Age Group and Income Bracket

- Preferences for Store Format and Product Categories

- Online vs Offline Buying Trends

- Healthcare Insurance (BPJS) Coverage Influence

- Spending Power and Repeat Purchase Behavior

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Transaction Value, 2025-2030