Market Overview

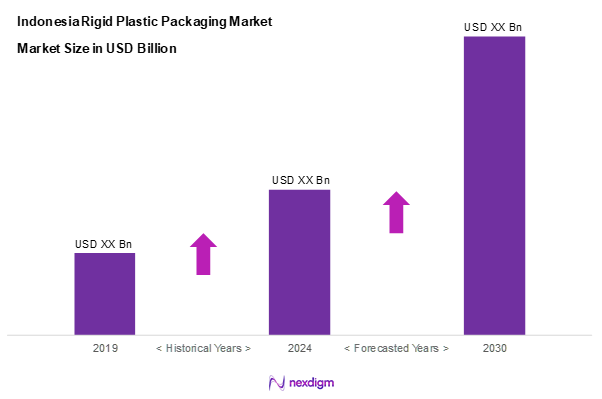

As of 2024, the Indonesia rigid plastic packaging market is valued at USD 3.4 billion, with a growing CAGR of 7.4% from 2024 to 2030, reflecting growth driven by various factors including urbanization, increased disposable income, and an expanding consumer base. This growth has been supported by a surge in demand for food and beverage packaging, primarily conditioning consumers towards convenience and product safety. Additionally, advancements in manufacturing technology have enhanced production efficiency and product variety, making rigid plastic packaging a preferred choice.

Dominant regions within the market include Java and Sumatra, where urbanization rates are particularly high, leading to increased demands for packaged goods. Java, being the economic hub of Indonesia, has the highest concentration of food and beverage industries, while Sumatra’s rich agricultural output drives demand for packaging solutions that maintain product freshness. These regions substantially contribute to the overall growth and revitalization of the rigid plastic packaging market.

Market Segmentation

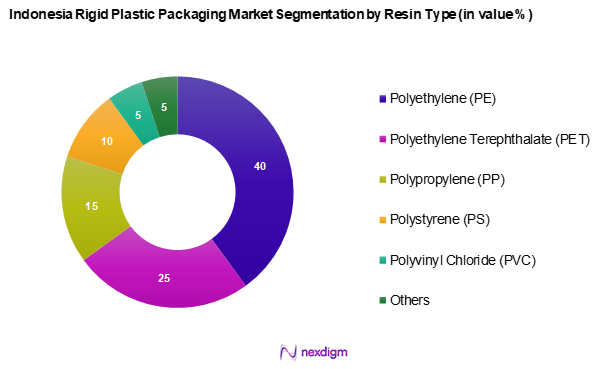

By Resin Type

The Indonesia rigid plastic packaging market is segmented into Polyethylene (PE), Polyethylene terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Polyvinyl Chloride (PVC), and others. Among these, Polyethylene (PE) holds a dominant market share due to its versatility, high resistance to moisture, and affordability, making it suitable for a variety of applications from food packaging to household goods. PE packaging products are widely utilized in everyday consumer goods, resulting in widespread acceptance and usage.

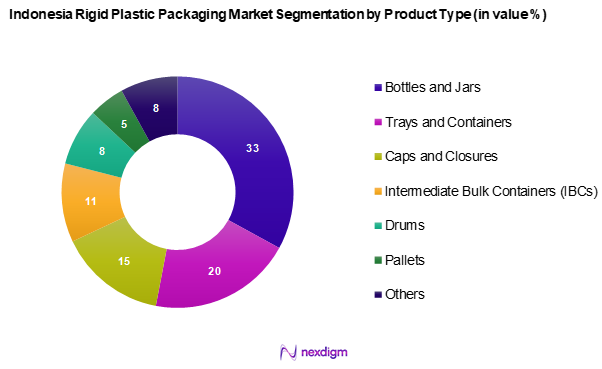

By Product Type

The Indonesia rigid plastic packaging market is segmented into bottles and jars, trays and containers, caps and closures, Intermediate Bulk Containers (IBCs), Drums, Pallets and others. The Bottles and Jars segment leads the market owing to its essential role in the beverage and health supplement industries. Consumer preferences for bottled products due to their portability and convenience have significantly supported continuous growth in this segment, driving manufacturers to innovate and diversify their offerings to meet changing consumer needs.

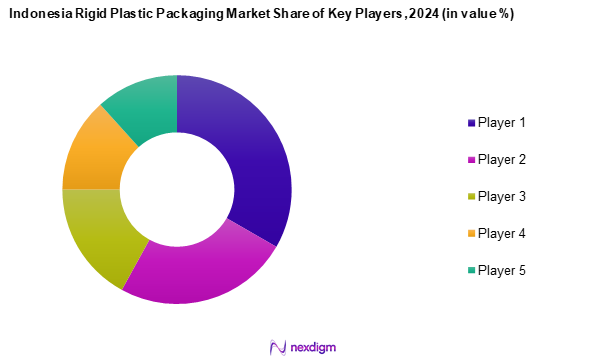

Competitive Landscape

The Indonesia rigid plastic packaging market is dominated by several major players, including both local and international companies. Notable companies like PT. Berlina Tbk and PT. Indorama Ventures Indonesia have established themselves as key contributors to the market’s supply, bolstered by strong innovation capabilities and extensive distribution networks. This consolidation illustrates the influential position of these firms, facilitating market stability and growth.

| Company | Establishment Year | Headquarters | Markets Share | Revenue (USD Mn) | Product Range | Competitive Edge |

| Berlina | 1969 | Bekasi, Indonesia | – | – | – | – |

| PT Indo Tirta Abadi. | 2001 | Banten, Indonesia | – | – | – | – |

| PT. Solusi Prima Packaging | 2008 | Banten, Indonesia | – | – | – | – |

| Indorama Ventures Public Company Limited | 2011 | Banten, Indonesia | – | – | – | – |

| PT. Neilsen | 2001 | Tangerang, Indonesia | – | – | – | – |

Indonesia Rigid Plastic Packaging Market Analysis

Growth Drivers

Urbanization Trends

The increasing urban population in Indonesia is a major factor driving the rigid plastic packaging market. As more people migrate to cities, there is a growing demand for packaged goods, particularly in rapidly expanding urban centres. This shift toward urban living encourages greater consumption of convenience products and packaged foods, significantly boosting the need for rigid plastic packaging in the food and beverage sector. The market continues to be influenced by these evolving consumer habits, which prioritize convenience and longer shelf life.

E-commerce Expansion

The rise of e-commerce in Indonesia has significantly increased the demand for effective packaging solutions. As online shopping becomes more prevalent, there is a growing need for durable and protective packaging that ensures product safety during transit. The increasing preference for door-to-door delivery services further supports the expansion of rigid plastic packaging. This trend is expected to continue as digital shopping habits strengthen, reinforcing the need for secure and reliable packaging materials.

Market Challenges

Environmental Regulations

Growing concerns over plastic waste have led to stricter environmental regulations in Indonesia, encouraging a shift toward more sustainable packaging solutions. Government initiatives aimed at reducing plastic consumption present challenges for manufacturers, who must adapt to regulatory requirements while managing production costs. Companies in the rigid plastic packaging sector are under increasing pressure to incorporate eco-friendly alternatives to meet sustainability targets and avoid potential regulatory penalties.

Recycling and Waste Management Issues

Limited recycling infrastructure in Indonesia poses a significant challenge for the rigid plastic packaging market. A relatively low plastic recycling rate contributes to environmental concerns, affecting both the industry and public health. The lack of an efficient waste management system further complicates efforts to promote sustainable packaging solutions. As consumer awareness about eco-friendly products increases, companies must find ways to enhance recycling initiatives and develop sustainable packaging options to remain competitive.

Opportunities

Innovations in Bioplastics

The growing adoption of bioplastics presents new opportunities for the rigid plastic packaging market. With increasing consumer demand for environmentally friendly packaging, companies are exploring biodegradable and renewable material alternatives. These innovations align with sustainability goals and offer a viable solution to reduce reliance on traditional plastic. As more businesses shift toward eco-conscious practices, the development and integration of bioplastics in packaging solutions are expected to gain momentum.

Technological Advancements in Manufacturing

Advancements in manufacturing technologies are transforming the rigid plastic packaging industry, improving efficiency and sustainability. The adoption of automation, artificial intelligence, and smart production techniques allows manufacturers to reduce waste, lower production costs, and enhance product quality. These innovations enable the creation of high-performance packaging with reduced environmental impact. As industries embrace modern manufacturing methods, companies that invest in advanced technologies will gain a competitive edge in the evolving market landscape.

Future Outlook

Over the next five years, the Indonesia rigid plastic packaging market is expected to experience robust growth driven by urbanization, the booming e-commerce sector, and rising consumer awareness of sustainable packaging solutions. Additionally, advancements in production technology and increasing regulation surrounding environmental concerns are anticipated to reshape market dynamics, presenting both challenges and opportunities for manufacturers. As the market evolves, companies that focus on sustainability and innovation will likely emerge as leaders in this space.

Major Players

- Berlina

- PT Indo Tirta Abadi.

- Solusi Prima Packaging

- Indorama Ventures Public Company Limited

- Indo Cap Closures

- Hasil Raya Industries

- Hokkan Deltapack Industri

- PT Rheem Indonesia

- Neilsen

- Namasindo Plus

Key Target Audience

- Manufacturers and Producers in Rigid Plastic Packaging

- Food and Beverage Companies

- Healthcare Product Manufacturers

- Retail and E-commerce Businesses

- Government and Regulatory Bodies (Ministry of Industry, Ministry of Trade)

- Investments and Venture Capitalist Firms

- Environmental Organizations

- Logistics and Supply Chain Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map comprising all major stakeholders within the Indonesia rigid plastic packaging market. This step was underpinned by extensive desk research using a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective was to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Indonesia rigid plastic packaging market was compiled and analysed. This included assessing market penetration, the ratio of manufacturers to end-users, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics was conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through Computer-Assisted Telephone Interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provided valuable insights directly from practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple rigid plastic packaging manufacturers to acquire insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction verified and complemented the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia rigid plastic packaging market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Urbanization Trends

E-commerce Expansion - Market Challenges

Environmental Regulations

Recycling and Waste Management Issues - Opportunities

Innovations in Bioplastics

Technological Advancements in Manufacturing - Trends

Increasing Consumer Awareness on Sustainability

Rise of Smart Packaging Technologies - Government Regulation

Compliance with Safety Standards

Incentives for Sustainable Practices - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Resin Type (In Value %)

Polyethylene (PE)

– Low-Density Polyethylene (LDPE) & Linear Low-Density Polyethylene (LLDPE)

– High Density Polyethylene (HDPE)

Polyethylene terephthalate (PET)

Polypropylene (PP)

Polystyrene (PS) and Expanded polystyrene (EPS)

Polyvinyl Chloride (PVC)

Others - By Application (In Value %)

Food and Beverage

Healthcare

Personal Care

Household

Industrial - By Product Type (In Value %)

Bottles and Jars

Trays and Containers

Caps and Closures

Intermediate Bulk Containers (IBCs)

Drums

Pallets

Others - By Region (In Value %)

Java

Sumatra

Bali

Sulawesi

Others - By End-User (In Value %)

Food

– Candy & Confectionery

– Frozen Foods

– Fresh Produce

– Dairy Products

– Dry Foods

– Meat, Poultry, And Seafood

– Pet Food

– Other Food Products

Foodservice

Beverage

Healthcare

Cosmetics and Personal Care

Industrial

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Material Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Business Segment Revenue, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Berlina

PT Indo Tirta Abadi.

PT. Solusi Prima Packaging

Indorama Ventures Public Company Limited

Indo Cap Closures

Hasil Raya Industries

PT. Hokkan Deltapack Industri

PT Rheem Indonesia

PT. Neilsen

PT. Namasindo Plus

- Market Demand and Utilization Trends

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Points Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030