Market Overview

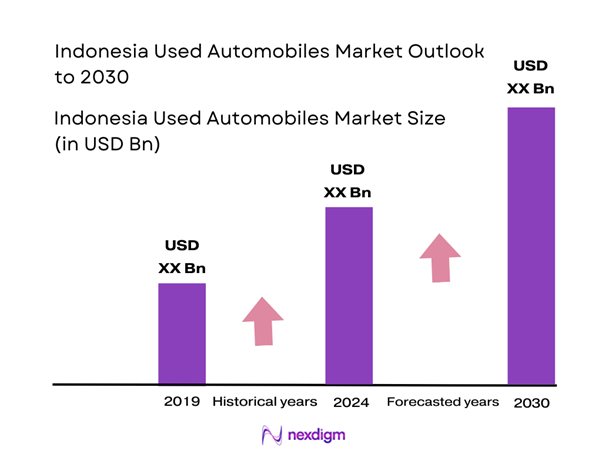

The Indonesia Used Automobiles Market is valued at USD 57 billion with an approximated compound annual growth rate (CAGR) of 6.04% from 2024-2030, reflecting significant growth in recent years driven by rising consumer demand for affordable transport and a growing middle-class population. The vehicle fleet in Indonesia has expanded due to urban growth and changing preferences toward personal car ownership.

Dominant cities such as Jakarta, Surabaya, and Bandung significantly influence the Indonesia Used Automobiles Market. Their populations contribute to a higher demand for used vehicles as residents seek cost-effective transportation solutions amid urban congestion and rising new car prices. Additionally, Jakarta’s status as the capital city and its fast-paced development enhances the market’s growth by attracting both local and international car dealerships catering to the increasing number of consumers looking for affordable used vehicles.

The rising middle-class population in Indonesia is a significant growth driver for the used automobiles market. Indonesia’s middle class is expected to reach approximately 80 million by end of 2025, representing a substantial increase from 56 million in 2020. This demographic shift is fueled by higher disposable incomes and urban job opportunities. The World Bank reports that a growing middle-class boosts demand for personal vehicles as more individuals and families seek affordable transport options, greatly contributing to the used vehicle market’s expansion.

Market Segmentation

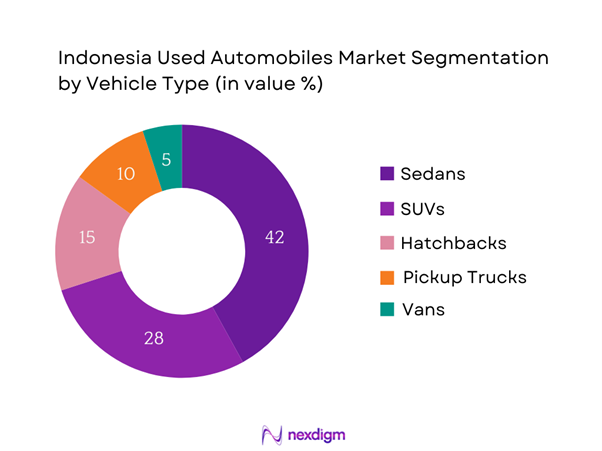

By Vehicle Type

The Indonesia Used Automobiles Market is segmented by vehicle type into sedans, SUVs, hatchbacks, pickup trucks, and vans. Currently, sedans hold the dominant market share due to their affordability, fuel efficiency, and practicality for urban commuting. Many consumers prefer sedans for their manageable sizes, making them suitable for navigating Indonesia’s crowded streets. Furthermore, manufacturers like Toyota and Honda have established strong reputations in this category, further solidifying the sedan segment’s status in the used vehicle market.

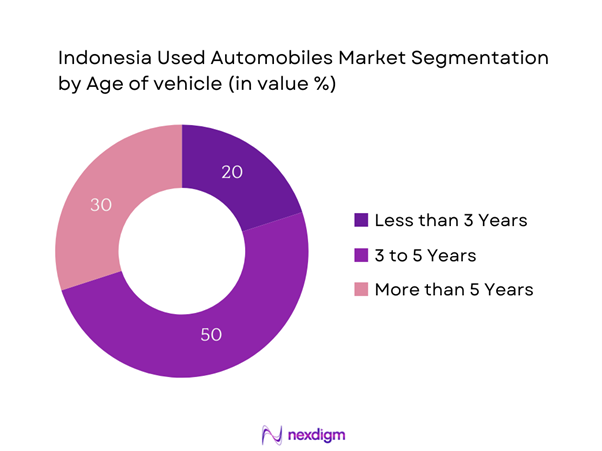

By Age of Vehicle

The market is also segmented by the age of vehicle, including segments for vehicles less than 3 years old, 3 to 5 years old, and more than 5 years old. Vehicles aged 3 to 5 years lead this segment due to high demand among cost-conscious consumers seeking relatively new vehicles with lower depreciation rates. This age group remains appealing because these vehicles typically have modern features without the hefty price tag of new models, making them an attractive option in a price-sensitive market.

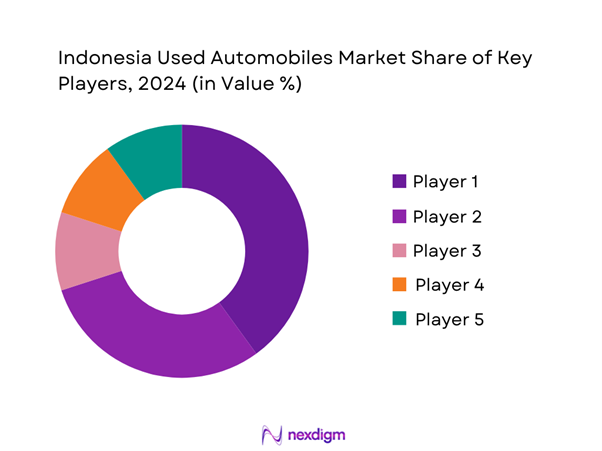

Competitive Landscape

The Indonesia Used Automobiles Market is dominated by a few major players, including well-established local manufacturers and international brands. Key companies like Toyota, Honda, and Suzuki exert significant influence through their extensive dealer networks and strong brand loyalty among consumers. This consolidation reinforces the competitive positioning of these companies and highlights their market dominance, particularly for popular vehicles like sedans and SUVs.

| Company Name | Establishment Year | Headquarters | Market Focus | Market Share (%) | Key Models | Distribution Channels |

| Toyota Astra Motor | 1971 | Jakarta, Indonesia | – | – | – | – |

| Honda Prospect Motor | 1999 | Jakarta, Indonesia | – | – | – | – |

| Mitsubishi Motors | 1970 | Jakarta, Indonesia | – | – | – | – |

| Suzuki Indomobil Motor | 1970 | Jakarta, Indonesia | – | – | – | – |

| Nissan Motor Indonesia | 2001 | Jakarta, Indonesia | – | – | – | – |

Indonesia Used Automobiles Market Analysis

Growth Drivers

Urbanization and Infrastructure Development

Urbanization in Indonesia is accelerating, with the urban population projected to grow to over 200 million by end of 2025. The rapid influx of individuals into urban areas increases the demand for convenient transportation solutions, thereby propelling the used vehicles market. Alongside urban population growth, the Indonesian government is investing heavily in infrastructure development, with an allocation of approximately USD 430 billion over five years for road expansion, public transit systems, and smart city initiatives. Investments in infrastructure are crucial for enhancing mobility and accessibility, thereby motivating more residents to consider used automobiles for their daily commutes.

Increased Demand for Affordable Transport

In light of rising economic pressures and the increasing cost of new vehicles, there is a notable shift toward used automobiles, which are seen as a more affordable transportation option. The Indonesian automotive industry has recorded an approximate increase of 7 million used vehicles sold annually, as consumers gravitate towards the second-hand market to optimize their transportation budgets. With urban transport costs rising by about 6% annually, more individuals are turning to used vehicles that can be acquired for significantly lower prices than new models, thus expanding the market for cost-effective mobility solutions.

Market Challenges

Regulatory Compliance and Standards

The regulatory environment surrounding used automobiles in Indonesia poses significant challenges for market participants. The government has been tightening vehicle emission standards to comply with regional and global environmental regulations, leading to additional costs for dealerships and potential roadblocks for older vehicle sales. Specifically, the Ministry of Environment and Forestry has laid out regulations affecting the registration of vehicles older than 10 years, which impacts approximately 30% of the existing used vehicle inventory. This regulatory compliance needs increased investments in vehicle upgrades or adjustments to existing fleets, creating hurdles in the used automobiles market.

Fluctuation in Demand due to Economic Factors

Economic instability can heavily impact the demand for used automobiles in Indonesia. With GDP growth estimated at 5.2% in the coming years, fluctuations in income levels directly influence purchasing decisions among potential vehicle buyers. For instance, inflation rates have averaged around 3.0%, affecting consumer spending habits. Additionally, factors such as fuel price volatility and currency fluctuations can alter the affordability of owning a vehicle, making it a challenge for consumers who may delay purchases during uncertain economic times. These economic dynamics present ongoing challenges for the growth of the used automobiles market.

Opportunities

Growing Preference for Electric Used Vehicles

The transition towards electric vehicles (EVs) presents a substantial growth opportunity for Indonesia’s used automobiles market. As of 2023, there are approximately 25,000 electric vehicles on Indonesian roads, and this number is expected to grow significantly as the government promotes EV adoption through incentives and charging infrastructure development. Currently, the sale of used electric vehicles is becoming more attractive, particularly in urban regions, where consumers are increasingly seeking sustainable options. The government aims to have a 20% share of new vehicle sales being EVs by end of 2025, paving the way for an expanding secondary market involving pre-owned electric vehicles.

Rise in Online Vehicle Sales

The growing trend of online vehicle sales offers a robust opportunity for the Indonesian used automobiles market. Initiatives by e-commerce platforms such as OLX and TaniGroup have led to a notable rise in buyers opting for online marketplaces to purchase used cars, reflecting a shift in consumer behavior due to convenience and accessibility. Between 2022 and 2024, the online vehicle buying segment has observed a surge with the number of transactions increasing by around 40%. Additionally, this shift allows sellers to reach a broader audience and potential buyers to compare prices more effectively. The effect of digitalization in the automotive sector is encouraged by over 60 million people using the internet in Indonesia as of 2023, illustrating a growing market for digital vehicle sales platforms. The increasing efficiency of these platforms will further enhance the penetration of the used vehicle market in the country.

Future Outlook

Over the next five years, the Indonesia Used Automobiles Market is projected to experience robust growth, driven by rising consumer confidence, continuous urbanization, and a burgeoning interest in affordable and reliable used vehicles. Increasing availability of financing options, coupled with greater emphasis on car ownership among younger demographics, will likely contribute to expanding market dynamics. Moreover, the development of digital platforms for buying and selling used cars enhances accessibility and convenience for consumers, positioning the market for further expansion.

Major Players in the Market

- Toyota Astra Motor

- Honda Prospect Motor

- Mitsubishi Motors

- Suzuki Indomobil Motor

- Nissan Motor Indonesia

- BMW Indonesia

- Hyundai Mobil Indonesia

- Mercedes-Benz Indonesia

- Wuling Motors

- Chery

- MG Motor Indonesia

- DFSK Motor Indonesia

- Tata Motors Indonesia

- Isuzu Astra Motor Indonesia

- Great Wall Motors Indonesia

Key Target Audience

- Automobile Dealerships

- Private Vehicle Buyers

- Fleet Management Companies

- Online Vehicle Sales Platforms

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Transportation, Indonesian Investment Coordinating Board)

- Automotive Aftermarket Service Providers

- Logistics and Supply Chain Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of stakeholders within the Indonesia Used Automobiles Market. This step is informed through extensive desk research, which utilizes both secondary data and proprietary databases to gather in-depth information relevant to the industry. The primary goal is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Indonesia Used Automobiles Market will be compiled and analyzed. This includes examining factors such as vehicle possession trends, market penetration rates, and the ratio of used vehicles available to those in demand. Additionally, evaluations of service provider metrics will be conducted to enhance the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through expert consultations, which include structured interviews with industry leaders from various manufacturing companies. These interactions will yield valuable operational and financial insights, which are crucial for refining and confirming the collected market data.

Step 4: Research Synthesis and Final Output

The final stage encompasses direct engagement with various stakeholders in the used automobile sector to acquire comprehensive insights into product segments, sales performance, and consumer preferences. This engagement will help ensure the verification and validation of the data gathered, allowing for a robust analysis of the Indonesia Used Automobiles Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Middle-Class Population

Urbanization and Infrastructure Development

Increased Demand for Affordable Transport - Market Challenges

Regulatory Compliance and Standards

Fluctuation in Demand due to Economic Factors - Opportunities

Growing Preference for Electric Used Vehicles

Rise in Online Vehicle Sales - Trends

Digitalization in Vehicle Sales

Customized Financing Options - Government Regulation

Import Regulations

Emission Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Vehicle Type (In Value %)

Sedans

– Compact Sedans

– Mid-size Sedans

– Full-size Sedans

SUVs

– Compact SUVs

– Mid-size SUVs

– Full-size SUVs

Hatchbacks

– Entry-level Hatchbacks

– Premium Hatchbacks

Pickup Trucks

– Single Cab

– Double Cab

Vans

– Passenger Vans

– Cargo Vans - By Age of Vehicle (In Value %)

Less than 3 Years

– Company Lease Returns

– Demo Vehicles

3 to 5 Years

– Privately Owned

– Fleet Turnovers

More than 5 Years

– High-mileage Units

– Budget Segment Vehicles - By Fuel Type (In Value %)

Petrol

– Conventional Petrol Engines

– Turbocharged Petrol Engines

Diesel

– Light-duty Diesel

– Commercial-grade Diesel

Electric

– Battery Electric Vehicles (BEVs)

– Hybrid Electric Vehicles (HEVs) - By Region (In Value %)

Java

Sumatra

Kalimantan

Sulawesi

Bali and Nusa Tenggara - By Distribution Channel (In Value %)

Online Platforms

– OLX Indonesia

– Mobil123

– Carmudi

Dealerships

– Certified Pre-Owned Showrooms

– Multi-brand Used Car Lots

Auctions

– Government Vehicle Auctions

– Private and Fleet Auctions

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Used Automobiles Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Edible Oil, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Toyota Astra Motor

Honda Prospect Motor

Mitsubishi Motors Krama Yudha Indonesia

All-new Astra Daihatsu Motor

Nissan Motor Indonesia

Suzuki Indomobil Motor

Isuzu Astra Motor Indonesia

BMW Indonesia

Hyundai Mobil Indonesia

Mercedes-Benz Indonesia

Wuling Motors

Chery Automotive Indonesia

MG Motor Indonesia

DFSK Motor Indonesia

Astra International

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Buyer Behavior Analysis

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030