Market Overview

The Israel aerial smart weapons market is valued at approximately USD ~ billion. This market has been significantly driven by Israel’s strategic emphasis on enhancing its defense capabilities, especially in precision-guided munitions. The country’s technological prowess in unmanned aerial vehicles (UAVs) and smart weaponry has been a major factor in the growth of this sector. The defense industry in Israel continues to prioritize investment in advanced air-to-ground and air-to-air smart weapon systems, which has led to a sustained demand for these solutions both domestically and internationally. In addition, Israel’s focus on modernizing its military arsenal with cutting-edge technologies such as laser-guided missiles and autonomous strike systems has further propelled market growth.

Israel is the leading country in the aerial smart weapons market due to its robust defense ecosystem and technological advancements in military-grade UAVs and smart munitions. The country’s extensive defense R&D infrastructure, supported by companies like Rafael Advanced Defense Systems and Israel Aerospace Industries (IAI), places it at the forefront of innovation in this market. The U.S., as a key ally and importer of Israeli defense technologies, significantly contributes to global demand for Israel’s aerial smart weapons. Additionally, countries in the Middle East such as Saudi Arabia and the UAE, along with NATO members, continue to drive demand for precision-guided weapons, bolstering Israel’s dominance in the global defense market.

Market Segmentation

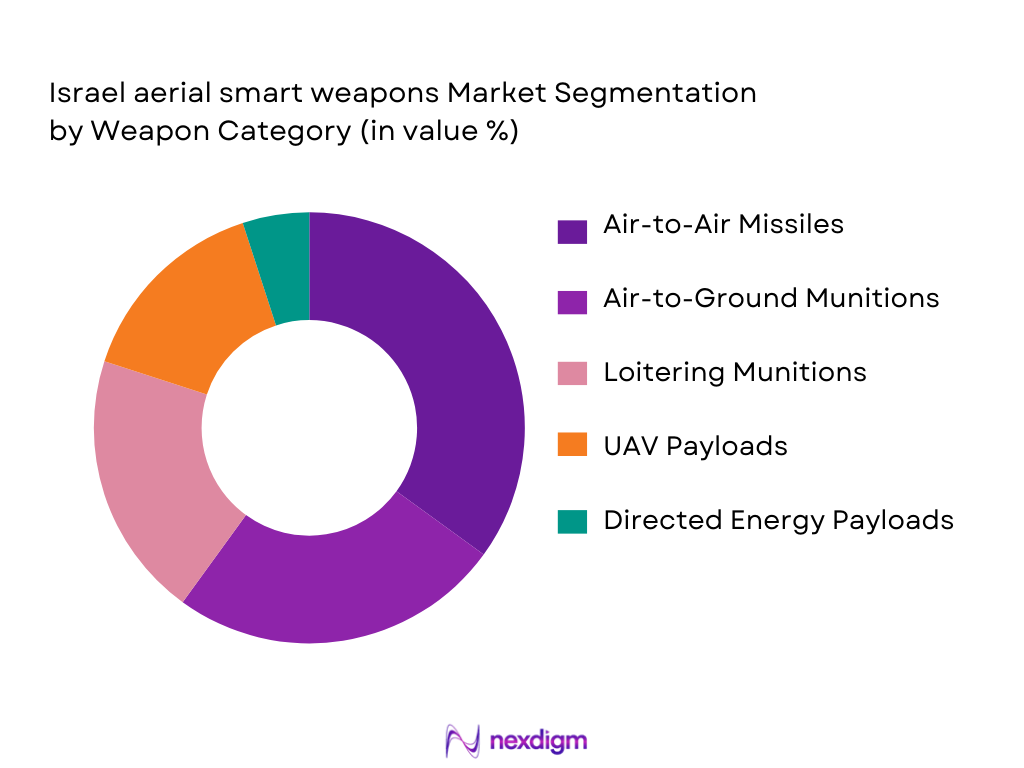

By Weapon Category

The Israel aerial smart weapons market is segmented into air-to-air missiles, air-to-ground munitions, loitering munitions, UAV payloads, and directed energy payloads. Among these, air-to-air missiles have a dominant market share, largely due to Israel’s long-standing expertise in developing advanced missile systems such as the Python and Derby missiles. These systems are renowned for their agility and effectiveness in close and beyond visual range combat, thus commanding a significant portion of both domestic and international demand.

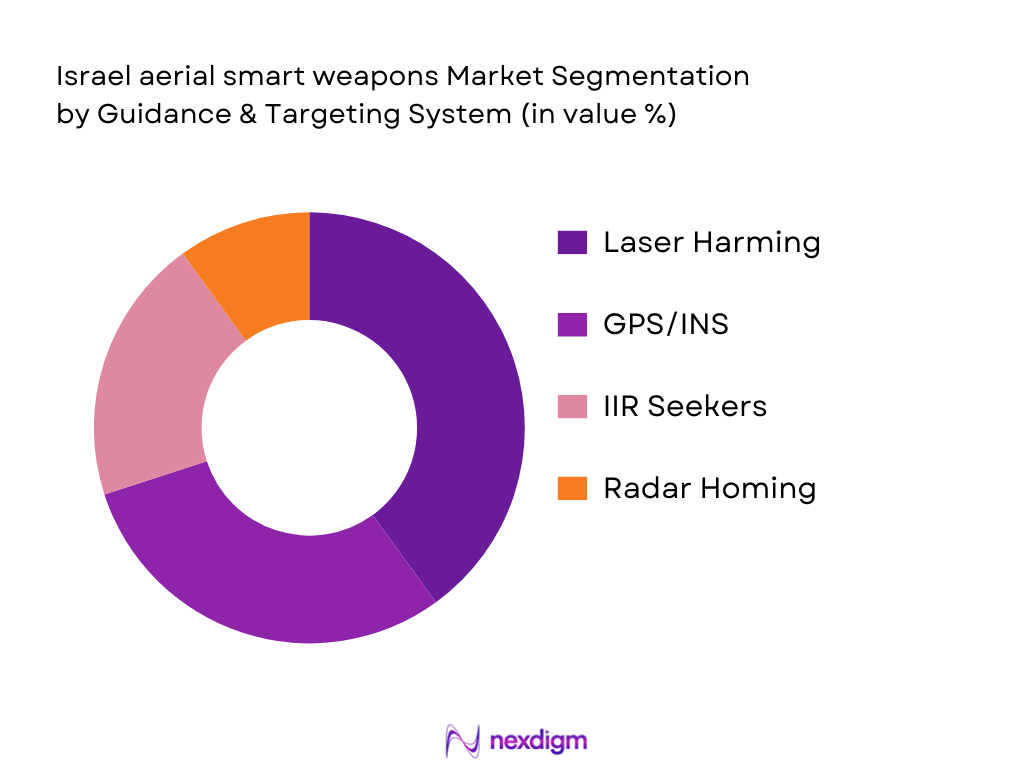

By Guidance & Targeting System

This segment includes GPS/INS, laser homing, infrared (IIR) seekers, and radar homing systems. The laser homing segment is currently the most dominant due to its application in a wide range of missile and bomb systems, particularly in air-to-ground munitions. Israel’s use of laser guidance in precision bombs such as the Delilah missile system offers a higher degree of accuracy, making it a preferred choice for military forces worldwide, especially in counter-terrorism and anti-insurgency operations.

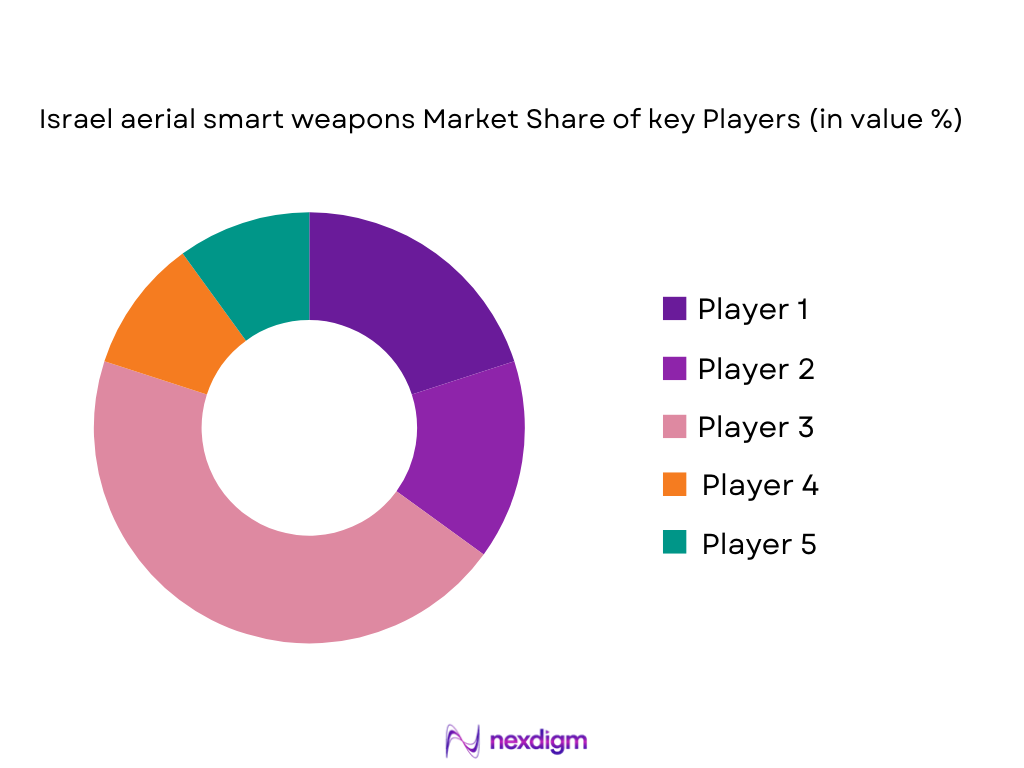

Competitive Landscape

The Israel aerial smart weapons market is dominated by several key players who have established a stronghold due to their technological expertise, innovation, and strategic defense alliances. The major players include Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), Elbit Systems, and IMI Systems. These companies have a competitive advantage in developing next-generation aerial smart weapons and are often involved in government and defense contracts, providing solutions for Israel’s armed forces as well as international customers. The market also features several international defense players who collaborate with Israeli firms for advanced weaponry development.

| Company Name | Establishment Year | Headquarters | Technology Strength | Defense Contracts | Export Reach | R&D Investment |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| IMI Systems | 1933 | Ramat HaSharon, Israel | ~ | ~ | ~ | ~~ |

| Aeronautics Defense Systems | 1997 | Yavne, Israel | ~ | ~ | ~ | ~ |

Israel Aerial Smart Weapons Market Analysis

Growth Drivers

Urbanization

Urbanization has been a significant driver of defense and military market growth, particularly in the aerial smart weapons sector. As global urbanization trends continue, particularly in the Middle East and Asia, countries are investing more in advanced defense technologies to protect urban and strategic locations. In 2024, the urban population in Israel was around ~ % of the total population, contributing to the increased focus on urban defense solutions and precision-guided weaponry. Israel’s focus on smart weapons, including UAVs and precision munitions, aligns with this growth, providing enhanced capabilities for urban warfare and counter-terrorism operations in densely populated areas. The trend towards increased urbanization creates a greater need for smart weapons that offer precision, minimizing collateral damage in urban warfare scenarios. This increase in urban growth has necessitated higher investments in advanced weapon systems to secure urban territories and strategic facilities.

Industrialization

The industrialization of defense technologies is another critical growth driver in the aerial smart weapons market. Israel’s aerospace and defense sector, which contributes over ~n% to the country’s GDP, continues to see significant industrial development. In 2024, Israel’s defense spending was estimated to be USD ~ billion, representing ~ % of its GDP. This substantial investment supports both the growth of advanced manufacturing for smart weapons and the scaling of production capabilities for UAVs, air-to-ground munitions, and loitering munitions. As industrialization of defense manufacturing systems progresses, Israel is well-positioned to enhance production capacity, leading to the innovation and cost-efficiency of smart weapons. The increasing integration of AI and automation in defense manufacturing systems will also further boost the sector, reducing production costs while improving performance.

Restraints

High Initial Costs

High initial costs associated with the development and deployment of aerial smart weapons continue to be a significant restraint in the market. In 2024, Israel’s defense budget was allocated a substantial portion for advanced technology development, with the Israeli Air Force spending a reported USD ~ billion on precision-guided munitions, UAVs, and other smart weapons. These high initial costs include research, development, and integration of new technologies, which can strain the financial resources of both the Israeli government and international buyers. The procurement of high-tech defense systems, while crucial for military superiority, is often hindered by these significant financial barriers. As a result, countries with limited defense budgets may delay procurement or opt for less expensive alternatives, affecting overall market growth.

Technical Challenges

Technical challenges in the development and maintenance of aerial smart weapons are another restraint in the market. These weapons rely on cutting-edge technologies, such as precision guidance systems, AI, and high-performance sensors, all of which require ongoing advancements and adaptations. In 2024, Israel’s military technology sector faced difficulties with adapting new guidance systems to rapidly changing combat scenarios. Additionally, the complexity of integrating UAVs with multiple sensor technologies for real-time targeting poses substantial challenges. Maintenance and repair of these high-tech systems also add operational costs. The reliance on advanced, often highly customized, technologies create vulnerabilities related to system malfunctions or incompatibility with other platforms. This technical complexity can also hinder the rate of adoption in countries with less-developed defense industries.

Opportunities

Technological Advancements

The rapid pace of technological advancements in artificial intelligence, robotics, and sensor systems presents significant opportunities for the aerial smart weapons market. Israel, a leader in AI integration in defense, is continuously pushing boundaries in autonomous systems and AI-driven targeting technologies. As of 2024, Israel’s government allocated approximately USD ~ billion for AI and cybersecurity investments in the defense sector. These technologies enable enhanced precision, real-time data processing, and autonomous decision-making capabilities in aerial smart weapons. The ongoing advancements in AI-driven weapons systems allow for faster, more accurate strikes while reducing human error and minimizing collateral damage. With technological improvements, Israel’s smart weapons can be deployed in a broader range of operational scenarios, creating new market opportunities for both local and international buyers.

International Collaborations

International collaborations represent a significant opportunity for the aerial smart weapons market to expand. Israel’s extensive network of defense partnerships, particularly with NATO and the United States, provides numerous opportunities for exporting its advanced weapon systems. In 2024, Israel’s defense exports were valued at USD ~ billion, with significant contracts signed with countries such as India, the U.S., and Germany. These international partnerships open avenues for further technological development, co-production agreements, and joint ventures that enable Israel’s defense sector to access broader markets. As military collaborations grow between countries, there is an increasing demand for advanced smart weapon systems, including UAVs and precision-guided munitions, presenting a significant growth opportunity for Israeli defense contractors.

Future Outlook

Over the next five years, the Israel aerial smart weapons market is expected to grow at a steady pace, driven by continuous advancements in missile technology, increasing demand for UAVs, and the integration of smart systems like artificial intelligence (AI) for targeting and autonomy. The rise of geopolitical tensions in the Middle East and beyond will likely accelerate the demand for advanced defense systems, including precision-guided munitions and smart weapons. Furthermore, Israel’s ongoing defense modernization programs, including the expansion of loitering munition capabilities, will continue to contribute to the market’s growth. Innovations in directed energy and laser-guided payloads will also influence the future development of aerial smart weapons.

Major Players in the Israel Aerial Smart Weapons Market

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- IMI Systems

- Aeronautics Defense Systems

- Lockheed Martin

- Boeing

- Raytheon Technologies

- Northrop Grumman

- MBDA

- Saab AB

- Thales Group

- Leonardo S.p.A.

- BAE Systems

- General Dynamics

Key Target Audience

- Defense and Military Procurement Agencies (Israel Ministry of Defense)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (US Department of Defense, NATO)

- Air Force and Army Aviation Departments

- Aerospace & Defense Manufacturers

- Weaponry and Military Technology Contractors

- Regional Security Forces (Middle East, Africa)

- International Defense Suppliers and Contractors

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify the critical variables that influence the market, including defense procurement cycles, technological advancements, and geopolitical considerations. This will involve gathering secondary data from industry reports and databases, along with expert consultations.

Step 2: Market Analysis and Construction

A historical analysis will be conducted to assess the market size, product penetration, and export patterns. The analysis will also account for the production capabilities of Israel’s key players and their impact on global demand.

Step 3: Hypothesis Validation and Expert Consultation

We will validate our market hypotheses through consultations with industry leaders, defense contractors, and procurement officers. These insights will refine and confirm our understanding of market trends and drivers.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing all data and expert inputs, combining both qualitative and quantitative approaches. This will ensure that the final report offers a comprehensive, accurate view of the aerial smart weapons market.

- Executive Summary

- Research Methodology (Market Definitions & Aerial Smart Weapons Taxonomy, Assumptions & Defense Sector Benchmarks, Intelligence Sources and Data Validation Checkpoints, Guidance on Defense Procurement Forecasting, Primary & Secondary Research Framework, Estimation of Black‑Box Spend & Classified Procurement Adjustments, Limitations, Sensitivity Scenarios & Future Outlook Boundaries)

- Israel Defense Industrial Base Structural Overview

- Aerial Smart Weapons Definition, Scope & Capabilities

- Evolution of Smart Guided Systems (GPS/INS, IIR, Radar, Laser)

- Force Modernization Drivers

- Israel’s Operational Deployments & Lessons Learned

- Supply Chain & Value Chain Mapping (Domestic to Global Tier‑1/2/3)

- Export Control Regimes & Foreign Military Sales Protocols

- Growth Drivers

Precision Strike Emphasis

UAV Adoption - Market Challenges

Export Controls

Geopolitical Volatility

Strategic Opportunities

AI Targeting

Directed Energy Integration - Threat Landscape

Cyber & EW Vulnerability

Regulatory Environment

Defense Procurement

ITAR/EAR Analogues - Competitive Forces

Supply Power

Buyer Power

Substitution Dynamic

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Weapon Category (In Value %)

Air‑to‑Air Missiles (inc. Medium & Beyond Visual Range)

Air‑to‑Ground Precision Guided Munitions

Loitering Munitions / Cruise Missiles (e.g., Delilah)

High‑Precision UAV Payloads & Smart Bombs

Directed Energy Payloads Integrated on Air Platforms - By Guidance & Targeting System (In Value %)

GPS/INS‑Guided Systems

Laser Homing & Semi‑Active Laser Guidance

Imaging Infrared (IIR) Seekers

Active & Passive Radar Homing - By Platform Type (In Value %)

Manned Fixed‑Wing Combat Aircraft

Rotary‑Wing Attack Platforms

Unmanned Aerial Systems (UAS / UCAV)

Autonomous Strike Platforms - By Range Classification (In Value %)

Short‑Range Precision Weapons

Medium + Extended Range Smart Munitions

Long‑Range Cruise & Loitering Munitions

- Market Share by Value & Unit Deployment

- Cross‑Comparison Parameters (Product Portfolio Coverage (Missile Types + Guidance Suite), Guidance & Targeting Technology Differentiators, Platform Integration Footprint (UAVs, Aircraft, Rotary), Export Footprint & Foreign Military Contracts, R&D Intensity & Innovation Pipeline, Classified Program Participation & IP Strength, After‑Sales Support & Field Sustainment Capability, Cost Per Engagement Metrics)

- Detailed Company Profiles

Rafael Advanced Defense Systems Ltd. (Missile & Guided Munitions R&D)

Israel Aerospace Industries (IAI) (Aerial Platforms & Guided Systems)

Elbit Systems Ltd. (UAS & Precision Payload Suites)

Aeronautics Defense Systems Ltd. (UAV Platforms)

ELTA Systems Ltd. (Sensors, EW & Guidance Support)

Lockheed Martin Corporation (Partner & Export Collaborator)

RTX Corporation (Guided Weapons & Sensors)

The Boeing Company (Platform Integration)

Northrop Grumman Corporation (UAV & Precision Payloads)

BAE Systems plc (Advanced Munitions)

MBDA S.A.S. (Collaborative Programs)

Safran S.A. (Avionics & Guidance Tech)

Thales Group (Targeting & Navigation Suite)

AeroVironment, Inc. (Small UAV Payloads)

Hanwha Systems (EW & Smart Capabilities)

- Defense Capability Modernization Drivers

- Decision Criteria (Cost‑Effectiveness, Interoperability)

- Mission Profiles & Weapon Use Cases

- Budget Allocation Trends (CapEx and OpEx)

- Program Acquisition Timelines & Procurement Cycles

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035