Market Overview

The Israel aerospace and defense biometrics market is witnessing significant growth, with an estimated market size of USD ~ million in 2025. The market has been driven by increasing national security concerns, government-backed defense initiatives, and the ongoing development of advanced biometric recognition systems, such as facial, fingerprint, and iris recognition. The rising need for enhanced border security, military access control, and intelligence operations has propelled the demand for biometric solutions in Israel. Further advancements in biometric technology, such as the integration of AI-driven algorithms, are also playing a critical role in expanding the market, providing accurate, scalable, and real-time identification.

Israel, being a global leader in defense technology and innovation, is home to some of the world’s leading defense contractors and agencies, including the Israel Defense Forces (IDF) and Israel Aerospace Industries (IAI). The market dominance of Israel stems from the country’s investment in cutting-edge technology for military applications, as well as its geopolitical location, which necessitates high security. Tel Aviv and Herzliya are the key hubs for aerospace and defense technology, with a heavy concentration of R&D facilities, military bases, and defense tech companies. These cities foster the development of advanced biometric systems for government and defense applications.

Market Segmentation

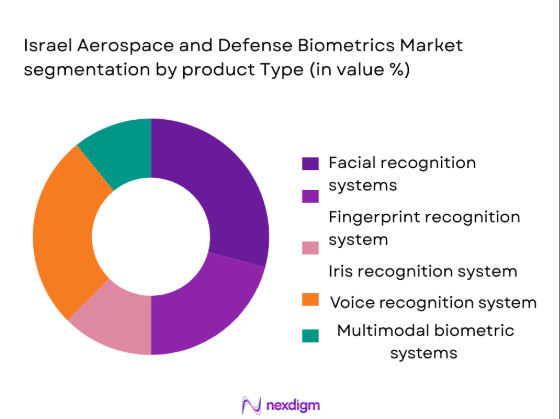

By Product Type

The Israel aerospace and defense biometrics market is primarily segmented by product type into facial recognition systems, fingerprint recognition systems, iris recognition systems, voice recognition systems, and multimodal biometric systems. Among these, facial recognition systems have emerged as the dominant segment due to their ability to provide non-intrusive, rapid, and accurate identification in security-sensitive environments such as airports, military installations, and border control stations. Facial recognition’s ability to identify individuals without physical contact makes it highly suitable for high-security areas where safety protocols must be stringent. Additionally, facial recognition has gained substantial traction due to advancements in AI and machine learning, enhancing its accuracy, speed, and scalability in real-time monitoring systems.

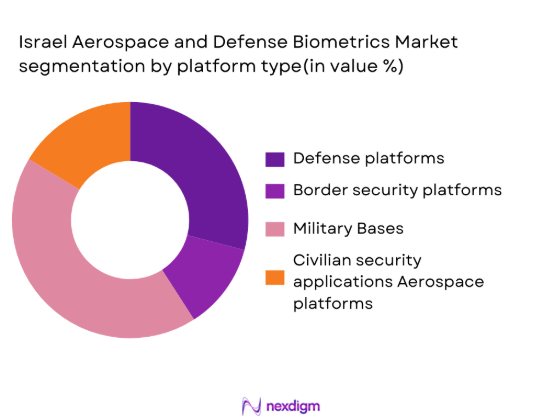

By Platform Type

The market is also segmented by platform type, with key categories including aerospace platforms, defense platforms, border security platforms, military bases, and civilian security applications. Defense platforms hold the highest market share within this segmentation. The demand for biometric systems in defense platforms is primarily driven by Israel’s ongoing military operations and security needs. Military bases and defense contractors require advanced biometric systems to monitor personnel, track movements, and ensure access control in sensitive areas. The Israel Defense Forces (IDF) have been major adopters of biometric solutions, leveraging them for secure identification and surveillance, further strengthening the dominance of defense platforms in this market.

Competitive Landscape

The Israel aerospace and defense biometrics market is competitive, dominated by both local defense tech companies and global players. Local manufacturers, such as Israel Aerospace Industries (IAI) and Elbit Systems, have a substantial influence due to their close relationship with government agencies and their long-standing experience in defense and aerospace technologies. Meanwhile, global players like Thales Group and NEC Corporation contribute through their established reputations in the biometric technology sector. This consolidation underlines the importance of strong, trusted relationships with government entities and defense agencies.

| Company | Establishment Year | Headquarters | Market Share | Technology Focus | Primary Client | Partnerships | R&D Investment |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| NEC Corporation | 1899 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| HID Global | 1991 | Austin, USA | ~ | ~ | ~ | ~ | ~ |

Israel Aerospace and Defense Biometrics Market Dynamics

Growth Drivers

Rising Security Concerns in the Defense Sector

The defense sector in Israel is undergoing significant modernization, driven by rising security concerns related to regional instability. The Israel Defense Forces (IDF) have seen increasing investments in high-tech defense solutions, including biometric systems, to improve border security, personnel tracking, and military operations. For instance, Israel allocated an estimated 5.6% of its GDP towards defense in 2025, reflecting the continued focus on security and defense technology, including biometrics. As of 2023, the IDF is heavily investing in advanced biometric surveillance systems to enhance national security, particularly in high-risk areas like borders and military installations. The growing emphasis on securing sensitive military sites has also led to the adoption of biometric identification systems as part of the country’s security infrastructure

Government Investments in Biometric Solutions for National Security

The Israeli government has consistently supported the integration of biometric solutions for national security purposes. In 2025, Israel’s Ministry of Defense allocated substantial funding towards the adoption of biometric systems to secure military bases, airports, and border areas. With growing concerns over terrorism and illicit activities, national defense initiatives prioritize the development and implementation of biometric solutions such as fingerprint and facial recognition systems. Additionally, Israel’s government has launched several strategic initiatives, such as the National Cyber Directorate, which supports integrating cybersecurity measures, including biometric identification technologies, into the broader national defense framework. These government-led investments have laid the foundation for robust biometric adoption in defense and security applications.

Market Challenges

Privacy Concerns Surrounding Biometric Data Collection

Despite the growing adoption of biometric systems, privacy concerns remain a significant challenge in Israel. In 2025, privacy regulations regarding biometric data are becoming stricter globally, with Israel’s government under pressure to comply with international data protection standards such as the European Union’s General Data Protection Regulation (GDPR). These regulations require stringent controls on the collection, storage, and use of biometric data, posing challenges for the defense sector in Israel as it seeks to implement large-scale biometric solutions without infringing on individuals’ privacy rights. Concerns about data breaches, unauthorized surveillance, and misuse of biometric information are increasingly leading to calls for more transparency and security around biometric systems

High Implementation Costs for Biometric Systems

The cost of implementing biometric solutions in the defense sector remains a significant barrier to widespread adoption in Israel. In 2025, the upfront costs associated with the development, deployment, and maintenance of biometric systems are high. This includes the cost of procuring advanced hardware such as fingerprint scanners, facial recognition cameras, and iris scanners, as well as the integration of these systems into existing security infrastructures. The Israeli government has committed funding, but the financial burden remains a challenge for smaller defense contractors and local companies trying to adopt these technologies. Additionally, the complexity of integrating these systems with older security infrastructure increases the overall cost, further limiting their adoption in some defense applications.

Market Opportunities

Increasing Adoption of Biometric Systems in Defense Logistics

Israel’s defense logistics sector is beginning to see the increased adoption of biometric systems as a means to enhance security and operational efficiency. The integration of biometric solutions in logistics operations ensures that only authorized personnel can access sensitive military equipment, weapons, and critical infrastructure. Biometric authentication provides a higher level of security compared to traditional methods, minimizing human error and fraud in defense logistics. With the rise in defense spending, the Israeli government is pushing for modernization across its logistics sector, including the integration of biometric identification technologies for military assets and personnel tracking. This trend is expected to continue as Israel strengthens its logistics infrastructure to support defense readiness.

Expansion of Biometric Systems in Border Control and Airport Security

Israel’s strategic location has made it a leader in implementing cutting-edge security measures for border control and airport security. Biometric systems, particularly facial recognition and fingerprint scanning, are becoming increasingly prevalent at Israeli airports and border checkpoints. In 2025, Israel’s Ben Gurion Airport and other border entry points are adopting advanced biometric solutions for traveler identification and border control processes. This adoption is supported by the Israeli government’s ongoing efforts to improve border security through technology. The increasing global emphasis on secure borders, combined with Israel’s expertise in biometric identification systems, positions the country as a key player in the expansion of biometric systems in border and airport security.

Future Outlook

Over the next decade, the Israel aerospace and defense biometrics market is poised for robust growth. The market is expected to expand significantly, driven by the continued development of advanced biometric systems, integration with artificial intelligence (AI), and heightened security concerns. Key drivers will include ongoing government investments in defense technology, the proliferation of smart surveillance systems, and an increased focus on border security and military access control. The future of biometric technologies in Israel will also be shaped by innovations in contactless biometric systems and AI-powered identification solutions, making the systems more efficient, scalable, and secure.

Major Players in the Market

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Thales Group

- NEC Corporation

- HID Global

- Motorola Solutions

- Gemalto

- Crossmatch

- Suprema

- IDEMIA

- Gemalto

- Fujitsu

- Vision-Box

- Crossmatch

- 3M

Key Target Audience

- Aerospace and Defense Manufacturers

- Government Agencies

- Military Contractors

- Investments and Venture Capitalist Firms

- Security and Surveillance Equipment Distributors

- Airports and Border Control Authorities

- Regulatory Bodies

- Private Defense & Security Solution Providers

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out key players in Israel’s aerospace and defense biometric landscape. Extensive secondary research and industry databases are utilized to identify all relevant factors such as government defense initiatives, biometric technology adoption trends, and current market players. The aim is to build a foundation for the study based on critical data points, including product types, platforms, and geographic demand.

Step 2: Market Analysis and Construction

Historical market data, especially from government and defense spending reports, will be analyzed to determine penetration levels of biometric systems in defense and aerospace sectors. A combination of financial metrics, operational data, and market share estimates will be examined to build a complete understanding of the market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are carried out with key industry professionals from defense organizations, biometric technology providers, and government agencies. Telephone interviews and online surveys will be used to validate and refine hypotheses about biometric system adoption, challenges, and opportunities. These discussions provide a deeper understanding of future trends and market readiness.

Step 4: Research Synthesis and Final Output

In the final phase, detailed engagements with Israeli defense contractors and biometric solution providers will be conducted. Information will be gathered about their product offerings, R&D initiatives, and military procurement strategies. This will ensure that the findings are accurate and reflective of the evolving market conditions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising security concerns in the defense sector

Government investments in biometric solutions for national security

Technological advancements in biometric recognition technologies - Market Challenges

Privacy concerns surrounding biometric data collection

High implementation costs for biometric systems

Integration challenges with existing security infrastructure - Market Opportunities

Increasing adoption of biometric systems in defense logistics

Expansion of biometric systems in border control and airport security

Rising demand for mobile biometric solutions in defense applications - Trends

Growth of AI-driven biometric systems

Integration of biometrics with other security technologies

Shift towards contactless biometric solutions

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fingerprint Recognition Systems

Facial Recognition Systems

Iris Recognition Systems

Voice Recognition Systems

Multimodal Biometric Systems - By Platform Type (In Value%)

Aerospace Platforms

Defense Platforms

Border Security Platforms

Military Bases and Installations

Civilian Security Applications - By Fitment Type (In Value%)

OEM Fitment

Retrofit Systems

Mobile/Portable Solutions

Cloud-based Biometric Solutions

Integrated Biometric Systems - By End User Segment (In Value%)

Government Agencies

Military and Defense Contractors

Aerospace OEMs

Private Security Firms

Airport Security Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Government Procurement

OEM Distribution Channels

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters (Market share by technology, Government contracts, Regional presence, System integration capabilities, Product innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed company profiles

Elbit Systems

Israel Aerospace Industries

Rafael Advanced Defense Systems

Motorola Solutions

Thales Group

Gemalto

NEC Corporation

HID Global

Biometric Group

Zebra Technologies

Precise Biometrics

Crossmatch

Suprema

IDEX Biometrics

Clearview AI

- Growing government and defense spending in Israel

- Increasing adoption of biometric systems for access control

- Adoption of biometric systems by military and defense contractors

- Private sector embracing biometric security solutions for high-risk areas

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035