Israel aerospace and defense carbon brake Market Overview

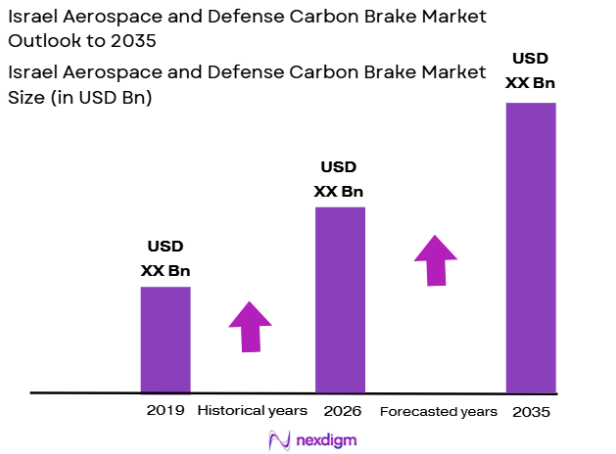

The Israel Aerospace and Defense Carbon Brake market is witnessing significant growth due to the increasing adoption of advanced materials and lightweight technologies in the aerospace industry. As of 2025, the market is valued at approximately USD ~million, driven by the growing demand for enhanced braking systems in both military and commercial aircraft. Technological advancements in carbon-carbon composites and carbon fiber braking systems, coupled with rising defense budgets and aircraft fleet expansion, are key factors driving this market’s growth.

Dominant regions in this market include the United States, Israel, and several European countries. Israel, being a strategic hub for aerospace and defense innovations, plays a significant role due to its strong aerospace manufacturing capabilities and government initiatives to upgrade defense infrastructure. Moreover, countries like the U.S. and the U.K. maintain leadership due to their substantial investments in military aircraft and advanced aerospace technologies, which further drive the demand for specialized carbon brake systems

Market Segmentation

By Product Type

The Israel Aerospace and Defense Carbon Brake market is segmented by product type into carbon fiber brakes, carbon-carbon composite brakes, and hybrid carbon brakes. In recent years, carbon-carbon composite brakes have seen the most significant growth in the aerospace and defense sectors due to their lightweight, high-performance characteristics. These brakes are particularly preferred in military and high-end commercial aircraft because of their superior thermal resistance and durability under extreme conditions. Their ability to withstand high temperatures without compromising on performance makes them highly suitable for modern, high-speed aircraft that require efficient and reliable braking systems. As the aerospace sector continues to prioritize reducing weight while improving performance, carbon-carbon composites are expected to dominate the product segment.

By Aerospace Application:

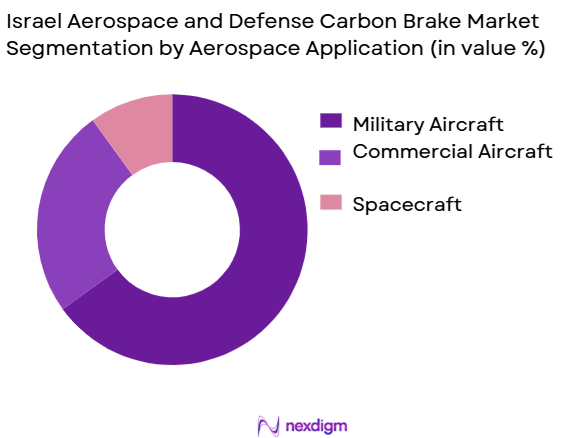

The market is also segmented by aerospace application into military aircraft, commercial aircraft, and spacecraft. Military aircraft are the dominant segment due to the increased demand for high-performance and durable brake systems for defense applications. Israel, with its robust defense industry, heavily invests in advanced military aircraft, contributing to the high demand for carbon brakes in this segment. These brakes offer critical advantages in defense operations where rapid deceleration is essential for maneuverability and safety. Furthermore, military aircraft are typically subjected to more intense operational conditions, necessitating braking systems that can withstand these extremes, further boosting the carbon brake demand.

Competitive Landscape

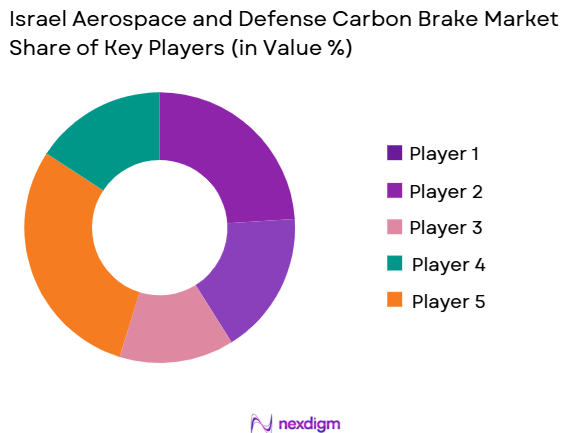

The Israel Aerospace and Defense Carbon Brake market is dominated by a few major players who provide innovative and highly efficient carbon braking solutions. These include global leaders such as Safran Landing Systems, Collins Aerospace, and Meggitt PLC, which offer cutting-edge technologies and have a strong presence in both the military and commercial aircraft sectors. The consolidation of a few dominant players in the market indicates the significant influence of these companies in shaping the future of aerospace braking technologies.

| Company | Establishment Year | Headquarters | Technology Focus | Market Segment | R&D Investment | Global Reach |

| Safran Landing Systems | 2005 | France | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1931 | United States | ~ | ~ | ~ | ~ |

| Meggitt PLC | 1947 | United Kingdom | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ |

| Parker Hannifin Corporation | 1917 | United States | ~ | ~ | ~ | ~ |

Israel aerospace and defense carbon brake Market Analysis

Israel aerospace and defense carbon brake Market Analysis

Growth Drivers

Urbanization

Urbanization in Israel and its neighboring regions is driving significant growth in the aerospace and defense sector, which in turn fuels the demand for advanced carbon brake systems. Israel’s urban population reached ~% in 2025, highlighting the trend toward urbanization that stimulates increased investments in infrastructure, transportation, and aerospace technologies. The demand for improved air travel and advanced defense systems has surged in these urban centers. This trend, supported by the government’s emphasis on infrastructure modernization, has led to greater investments in the development and implementation of cutting-edge carbon braking systems in both military and commercial aircraft.

Industrialization

Israel’s rapid industrialization has boosted its aerospace and defense sectors, increasing the demand for high-performance components like carbon brake systems. The country’s manufacturing output in 2025 amounted to approximately USD ~billion, with the aerospace sector contributing significantly. Israel has become a leader in the development of military aircraft, space technologies, and defense systems. As industrialization continues, particularly in aerospace and defense manufacturing, the need for efficient, lightweight braking systems is growing. Carbon brakes, offering superior performance under high-stress conditions, are becoming a key component in Israel’s expanding defense capabilities and aircraft fleet.

Restraints

High Initial Costs

The high initial cost of developing and implementing carbon brake systems remains a significant restraint for the aerospace and defense market in Israel. Manufacturing these advanced braking systems requires substantial investments in R&D and infrastructure. For example, in 2025, Israel’s defense budget allocated over USD ~billion, but only a fraction of this is directed toward technological advancements like carbon brake systems. The cost of sourcing raw materials, particularly carbon fiber, and the specialized equipment for testing and manufacturing brakes further complicates cost-effectiveness. This financial burden limits the widespread adoption of carbon brakes in both military and civilian aircraft.

Technical Challenges

Technical challenges, such as the complexity of integrating carbon brakes into existing aerospace platforms, pose a barrier to market growth. In Israel, the integration of carbon-carbon composite materials into new aircraft designs is slowed by the need for extensive testing and customization. In 2025, several Israeli aerospace companies faced challenges in adapting their existing platforms to accommodate advanced carbon braking systems due to the unique structural requirements of these materials. The advanced nature of carbon-carbon composites also requires highly specialized manufacturing techniques, which are not always compatible with existing production lines, resulting in delays and increased costs.

Opportunities

Technological Advancements

Technological advancements are a significant opportunity for the growth of Israel’s aerospace and defense carbon brake market. Israel is known for its innovations in aerospace technologies, and in 2025, over ~% of the country’s aerospace exports were centered around advanced materials, including carbon composites used in braking systems. The development of new composite materials that offer lighter weight, higher strength, and better thermal resistance is poised to enhance the performance of carbon brakes. The Israeli government’s ongoing investment in advanced aerospace technologies, including a USD ~billion initiative for R&D in the aerospace sector, supports these advancements, creating opportunities for new braking solutions.

International Collaborations

International collaborations present substantial opportunities for Israel’s aerospace and defense carbon brake market. Israel has been strengthening its aerospace partnerships with countries such as the United States, Germany, and the United Kingdom. These collaborations foster the exchange of technology and expertise in carbon brake systems. In 2025, Israel signed multiple agreements with international aerospace companies to jointly develop advanced braking technologies for military and commercial aircraft. Such collaborations not only enhance Israel’s technological capabilities but also open up new markets for Israeli-made carbon brake systems, ensuring continued demand for innovative solutions in both military and civilian sectors.

Future Outlook

Over the next ~years, the Israel Aerospace and Defense Carbon Brake market is expected to experience robust growth, driven by the increasing demand for advanced and lightweight braking systems in military and commercial aircraft. With continuous advancements in materials science, particularly in carbon-carbon composite technologies, the market is poised for substantial innovation. Additionally, rising investments in the aerospace sector and a focus on improving fuel efficiency and reducing maintenance costs are expected to propel the market forward. As aircraft manufacturers continue to prioritize performance, the need for efficient, high-performance brakes will drive continued demand for carbon brakes in both the military and commercial sectors.

Major Players in the Market

- Safran Landing Systems

- Collins Aerospace

- Meggitt PLC

- Honeywell Aerospace

- Parker Hannifin Corporation

- SGL Carbon

- GKN Aerospace

- Rolls-Royce

- GE Aviation

- Airbus Group

- Boeing

- Liebherr-Aerospace

- UTC Aerospace Systems

- Calspan Corporation

- Brembo

Key Target Audience

- Aerospace and Defense Manufacturers

- Military and Defense Ministries

- Aviation Authorities

- Aircraft Maintenance and Repair Organizations

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Private Equity Firms in Aerospace and Defense Sector

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on constructing a detailed ecosystem map of the Israel Aerospace and Defense Carbon Brake market. This is based on comprehensive secondary research, including industry reports, trade publications, and proprietary databases, to identify key drivers and influencers of the market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed, including the market’s penetration rate and demand for carbon brake systems in various aerospace applications. A detailed review of service providers, their market share, and overall revenue generation is included.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, in-depth consultations are conducted through computer-assisted telephone interviews (CATIs) with industry experts, including aerospace engineers, defense contractors, and senior executives from key players in the market.

Step 4: Research Synthesis and Final Output

The final research phase engages directly with aerospace manufacturers to verify insights gathered from secondary research. This ensures the accuracy and reliability of the collected data and provides a comprehensive analysis of the Israel Aerospace and Defense Carbon Brake market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Israel-Specific Terminologies, Abbreviations, Market Sizing Logic, Bottom-Up & Top-Down Validation, Triangulation Framework, Primary Interviews Across Aerospace and Defense Carbon Brake Providers, OEMs, and Industry Experts, Demand-Side & Supply-Side Weightage, Data Reliability Index, Limitations & Forward-Looking Assumptions)

- Definition and Scope of Aerospace and Defense Carbon Brakes

- Market Genesis and Evolution Pathway

- Israel Aerospace and Defense Carbon Brakes Industry Timeline

- Aerospace and Defense Carbon Brakes Business Cycle

- Key Growth Drivers

Technological Advancements in Aerospace Braking Systems

Increase in Aerospace Fleet Sizes and New Aircraft Programs

Rising Focus on Fuel Efficiency and Lightweight Material

Adoption of Sustainable Practices in Aerospace Manufacturing

- Market Challenges

High Initial Cost of Carbon Brakes

Regulatory Constraints on Material Usage and Manufacturing - Key Trends

Shift Towards Hybrid and Carbon-Carbon Brake Technologies

Integration of Carbon Brakes in Spacecraft and Autonomous Aircraft

Focus on Reducing Maintenance Costs and Enhancing Performance

- Market Opportunities

Increasing Demand for Advanced Braking Systems in Military Aircraft

Growing Need for Carbon Brakes in Next-Gen Commercial Aircraft

Strategic Investments in Israeli Aerospace Industry - Government Regulations

National Aerospace Safety Regulations and Standards

International Certification Bodies and Compliance

Environmental Regulations for Sustainable Aerospace Manufacturing - SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type Adoption, 2020-2025

- By Aerospace Platform, 2020-2025

- By Region, 2020-2025

- By Product Type (In Value %)

Carbon Fiber Brakes

Carbon-Carbon Composite Brakes

Advanced Hybrid Carbon Brakes - By Aerospace Application (In Value %)

Military Aircraft

Commercial Aircraft

Spacecraft - By Brake System Type (In Value %)

Wheel Brakes

Emergency Brakes

Anti-Skid Brakes - By Distribution Channel (In Value %)

OEMs (Original Equipment Manufacturers)

Aftermarket

Third-Party Distributors

- By Region (In Value %)

Central Region

Northern Region

Southern Region

Eastern Region

- Market Share Analysis

- Cross Comparison Parameters(Product Portfolio Breadth, Brake System Efficiency and Security Features, Regulatory Approvals and Certifications, Distribution Footprint and Global Reach, Manufacturing & Localization Capabilities, R&D Investment and Technological Advancements, Strategic Partnerships and Collaborations)

- SWOT Analysis of Key Players

- Pricing Analysis

Pricing Trends for Different Carbon Brake Technologies

Comparison of Prices Across Leading Carbon Brake Providers

- Detailed Company Profiles

Safran Landing Systems

Collins Aerospace

Meggitt PLC

Honeywell Aerospace

Parker Hannifin Corporation

Brembo

SGL Carbon

GKN Aerospace

Rolls-Royce

GE Aviation

Airbus Group

Boeing

Liebherr-Aerospace

UTC Aerospace Systems

Calspan Corporation

- Demand Pattern & Utilization Metrics

- Procurement Models & Purchasing Cycles for Carbon Brake Systems

- Compliance & Certification Expectations

- Consumer Needs, Desires & Pain-Point Mapping

- Decision-Making Framework for Aerospace and Defense Buyers

- Cost vs. Performance Prioritization in Aerospace Carbon Brakes

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Selling Price, 2026-2035

- By Technology and Deployment Type, 2026-2035