Market Overview

The Israel aerospace and defense connectors market is valued at approximately USD ~million in 2024. The growth of this market is driven by the increasing demand for high-performance, reliable connectors in military, aerospace, and defense applications. As Israel continues to modernize its defense systems, there is a rising need for connectors that can operate under extreme environmental conditions in advanced platforms such as fighter jets, UAVs, and radar systems. The ongoing investments in military infrastructure, along with technological innovations, further drive this market’s expansion. The growth is also supported by Israel’s strategic position in the global aerospace industry and its focus on defense technology.

Israel stands as a dominant player in the aerospace and defense connectors market, largely due to its robust defense sector and technological innovation. The country’s major cities, including Tel Aviv and Herzliya, are home to prominent defense and aerospace companies like Israel Aerospace Industries (IAI) and Elbit Systems, which focus on advanced electronic systems and aerospace technologies. These cities serve as hubs for connector manufacturing and research, benefiting from Israel’s strong military ties and high-tech infrastructure, which continue to drive the demand for specialized connectors in the aerospace and defense sector.

Market Segmentation

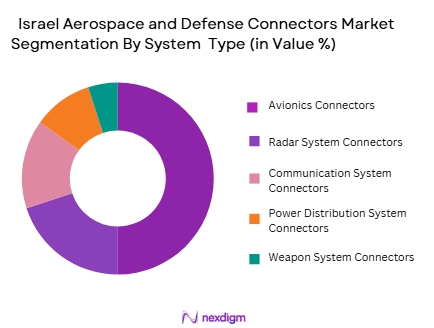

By System Type

The Israel aerospace and defense connectors market is segmented by system type into connectors for avionics, radar systems, communication systems, power distribution systems, and weapon systems. Avionics connectors dominate this segment. This dominance can be attributed to the critical role of avionics in modern military and commercial aircraft, where connectors need to meet high standards of reliability and performance. As military aircraft and UAVs become more sophisticated, the demand for advanced avionics connectors increases, making them the largest subsegment in the market. The technological advancements in avionics systems and the increasing modernization of Israel’s fleet of aircraft contribute to the growing need for these connectors.

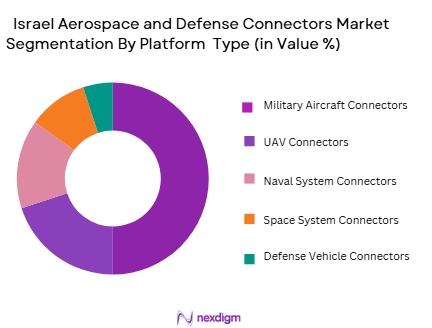

By Platform Type

The market is also segmented by platform type, including military aircraft, UAVs (unmanned aerial vehicles), naval systems, space systems, and defense vehicles. Military aircraft connectors lead this segment. Israel’s investment in upgrading its fleet of fighter jets and surveillance aircraft, such as the F-35, has driven the demand for high-performance connectors in these platforms. These connectors must meet rigorous standards to ensure system reliability and resilience in combat scenarios. UAVs also contribute to market growth as Israel continues to develop and deploy advanced drone technology, which requires specialized connectors for communication and power systems.

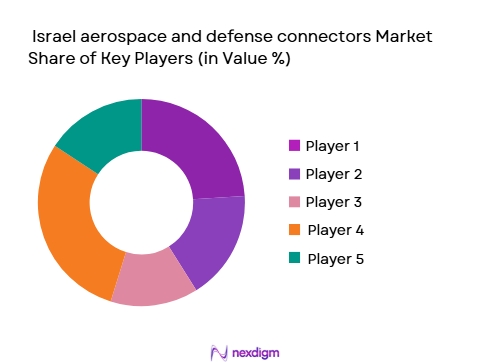

Competitive Landscape

The Israel aerospace and defense connectors market is highly competitive, with several major players dominating the market. Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems are key players in this sector, providing connectors for a wide range of defense applications. These companies have established themselves as leaders in the aerospace and defense industry through their continuous innovation, deep expertise in advanced electronics, and partnerships with military and aerospace manufacturers worldwide. Global aerospace companies like Lockheed Martin and Boeing also influence the market due to their collaboration with Israeli firms in defense and aerospace technology.

| Company Name | Establishment Year | Headquarters | Product Focus | Market Reach | Technological Advancements | Strategic Initiatives |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

Israel Aerospace and Defense Connectors Market Analysis

Growth Drivers

Rising Defense & Aerospace Electronics Demand

Connectors are critical components in aerospace and defense systems, enabling reliable power and signal transmission across avionics, communication systems, UAVs, and radar platforms. With Israel’s defence sector known for high innovation in avionics, autonomous systems, and electronics, the demand for ruggedized, high‑performance connectors is on the rise. Global trends in high‑bandwidth avionics, electrification of military platforms, and secure data networks also expand needs for advanced connectors that support faster data transfer, lower interference, and higher reliability under extreme conditions. Expansion of space systems and secure C4ISR architecture will further drive connector volume and value through 2035.

Innovation‑Driven Technology Upgrades

Israel’s defence tech landscape emphasizes rapid innovation—many technologies are tested in real time and iterated quickly—leading to advanced electronic subsystems adoption. This ecosystem supports the integration of next‑generation connectors that accommodate miniaturization, fiber‑optic data transmission, and hybrid high‑speed designs. As defense OEMs and Tier‑1 suppliers across Israel modernize aircraft, UAVs, and land systems, they increasingly specify connectors with enhanced durability, electromagnetic compatibility, and environmental resistance. Sustained R&D and integration of dual‑use electronics further bolster connector demand both domestically and for exports, aligning with global aerospace and defense connector market growth trajectories.

Market Challenges

Complex Regulatory & Export Controls

Israel’s defense tech companies operate under strict export control and regulatory frameworks—such as mandates enforced by the Defense Exports Control Agency (DECA). These regulations govern how advanced connectors and electronic subsystems can be sold overseas, particularly when components have potential military end‑use or dual‑use classifications. Navigating this regulatory landscape adds time, cost, and compliance burdens for suppliers aiming to enter foreign markets. Delays or restrictions can limit connector product rollout cycles, slow certification, and constrain rapid scaling, especially for smaller suppliers seeking international contracts amid evolving geopolitical conditions.

Supply Chain and Certification Barriers

Advanced aerospace and defense connectors require rigorous qualification standards due to mission safety and performance demands. Qualifying new connector designs—especially fiber‑optic or high‑speed hybrid types—requires extensive testing and certification, which can be resource‑intensive. Coupled with global supply chain pressures and reliance on imported specialty materials or precision manufacturing tools, this raises production complexity. Additionally, the small scale of the Israeli market relative to global hubs means local firms must compete on efficiency and integration speed, while securing reliable sources of high‑grade materials and maintaining certifications across multiple international defence standards.

Opportunities

Tech‑Driven Export Growth & Global Integration

Israel’s aerospace and defense industry is export‑oriented and recognized for cutting‑edge technologies. Advanced connector solutions tailored for high‑speed data, secure avionics, and sensor fusion systems present an export opportunity to global defense OEMs. As air, land, and space defense platforms increasingly embed sophisticated electronics, Israel’s reputation for innovation and mission‑proven systems positions local connector suppliers to partner in international programs. Export growth can be supported through joint ventures, licensed manufacturing, and integration into multinational OEM supply chains, helping Israeli companies scale production and diversify revenue beyond domestic defense spend.

Dual‑Use & Commercial Aerospace Expansion

Beyond defense, connectors enabling robust, secure communications and power management will be in demand in commercial aerospace, space tech, and dual‑use applications. The expansion of UAVs, satellite constellations, and avionics upgrades in civil aircraft creates new segments for advanced connector products. Investment in dual‑use technologies accelerates innovation and broadens market reach, allowing Israeli firms to leverage defense‑grade connector expertise into commercial aviation electronics and space systems. Cross‑sector demand also opens doors for connector manufacturers to develop modular, upgradable platforms that serve both defense contracts and high‑growth civil aerospace markets.

Future Outlook

Over the next decade, the Israel aerospace and defense connectors market is poised for steady growth, driven by the country’s increasing investments in defense modernization, the expansion of UAV and space exploration technologies, and the growing demand for high-performance connectors in military aircraft. The evolving requirements for enhanced connectivity, durability, and reduced weight in defense systems will further fuel this market. Technological advancements in miniaturization, along with greater reliance on UAVs, will continue to play a major role in shaping the market dynamics for aerospace and defense connectors in Israel.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Boeing

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- Saab

- L3 Technologies

- Honeywell Aerospace

- Rolls-Royce

- General Electric Aviation

- Airbus

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Military agencies and contractors

- Aircraft manufacturers

- Aerospace component suppliers

- UAV manufacturers

- Aerospace research and development organizations

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify and define key market variables affecting the Israel aerospace and defense connectors market. This includes analyzing technological advancements, regulatory frameworks, and industry-specific trends, utilizing a combination of secondary research and expert consultations to build a comprehensive market model.

Step 2: Market Analysis and Construction

We compile historical data to assess trends in market penetration, pricing, and demand across various system types and platforms. This step allows us to create a robust model for understanding market dynamics and growth potential for connectors in the aerospace and defense sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with key industry experts, including aerospace and defense engineers and product developers. This feedback ensures the accuracy of our projections and market assumptions.

Step 4: Research Synthesis and Final Output

Data collected through the previous steps is synthesized into a comprehensive market report. In this final phase, direct engagements with stakeholders in aerospace and defense ensure that our findings reflect real-world conditions, providing actionable insights for businesses operating in the aerospace and defense connectors market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for advanced military and defense systems

Increased focus on lightweight and durable components for aircraft

Technological advancements in connectors for electronic warfare systems - Market Challenges

High cost of specialized connectors for aerospace applications

Complexity in meeting stringent military standards and certifications

Limited number of suppliers for high-performance aerospace connectors - Market Opportunities

Growing adoption of UAVs and drones in defense applications

Technological innovations in connector miniaturization and reliability

Strategic collaborations with international aerospace and defense companies - Trends

Miniaturization of connectors for next-generation avionics and communications systems

Increased use of hybrid and electric propulsion systems in military and aerospace platforms

Integration of advanced materials in connectors to improve performance in extreme conditions - Government regulations

Military standards and certifications for aerospace connectors

Environmental regulations on the use of specific materials in aerospace connectors

Export control regulations for defense-related components - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Connectors for Avionics

Connectors for Radar Systems

Connectors for Power Distribution

Connectors for Military Communication Systems

Connectors for Weapon Systems - By Platform Type (In Value%)

Military Aircraft

Drones and UAVs

Naval Systems

Ground Defense Systems

Space Systems - By Fitment Type (In Value%)

OEM

Aftermarket

Upgrades & Refurbishments

Maintenance

Repair & Overhaul (MRO)

- By EndUser Segment (In Value%)

Military

Commercial Aerospace

Defense Contractors

Government and Law Enforcement

Space Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Distributors

E-commerce Platforms

Government Tenders

OEM Partnerships

- Cross Comparison Parameters(Material innovation, Production capabilities, Compliance with regulations, Price competitiveness, Distribution network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

General Electric Aviation

Boeing

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

Saab

L3 Technologies

Honeywell Aerospace

Rolls-Royce

Airbus

Leonardo

- Rising demand for secure and reliable connectors in military communication systems

- Increasing use of aerospace connectors in unmanned systems and drones

- Need for high-performance connectors in advanced avionics and radar systems

- Growing importance of space exploration and satellite systems in connector demand

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035