Market Overview

The Israel aerospace and defense connectors market is valued at approximately USD ~million in 2024, driven by the expanding defense sector and the rising demand for high-performance connectors for military, aerospace, and communication systems. The market’s growth is fueled by technological advancements in electronics and an increase in defense spending. As Israel continues to innovate in defense technologies, the demand for connectors that can withstand extreme environments in systems such as radar, communication devices, and avionics is growing rapidly.

Israel is a dominant player in the aerospace and defense connectors market due to its strong defense industry and technological expertise. Major cities like Tel Aviv and Herzliya, which are home to Israel Aerospace Industries (IAI) and Elbit Systems, lead the market. Israel’s strategic location, advanced R&D in defense technologies, and collaborations with international aerospace companies ensure its prominence in the global aerospace and defense sectors. Israel’s military innovation and infrastructure further solidify its leadership in the aerospace connector market.

Market Segmentation

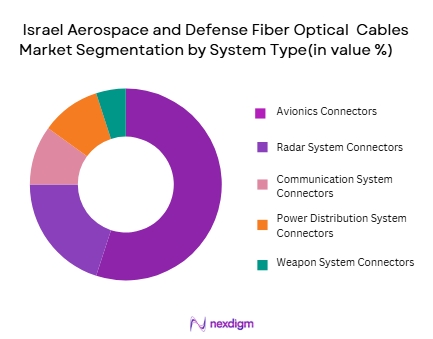

By System Type

The Israel aerospace and defense connectors market is segmented by system type, including avionics connectors, radar system connectors, communication system connectors, power distribution system connectors, and weapon system connectors. Avionics connectors dominate this segment. The primary reason for this dominance is the critical role avionics systems play in military and commercial aviation. These systems require highly reliable and durable connectors capable of operating under extreme conditions. As Israel continues to modernize its fleet of fighter jets and UAVs, the demand for avionics connectors is expected to remain strong. With advancements in avionics technologies, the need for specialized connectors that ensure secure and uninterrupted operations is increasing, driving the growth of this subsegment.

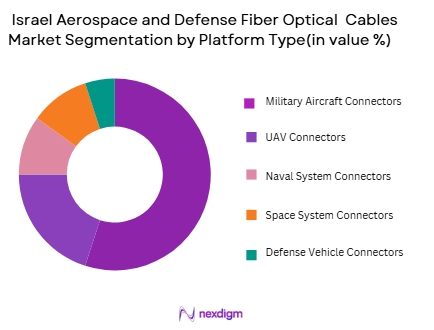

By Platform Type

The market is segmented by platform type, which includes military aircraft, UAVs (unmanned aerial vehicles), naval systems, space systems, and defense vehicles. Military aircraft connectors represent the largest subsegment, driven by Israel’s continuous investments in upgrading its fleet of fighter jets and surveillance platforms like the F-35 and the Heron UAV. These aircraft require advanced connectors that can meet the high standards for durability and reliability required in combat situations. UAVs, which are increasingly used in military applications, also contribute significantly to market growth, with connectors supporting power, data, and communication systems for these platforms.

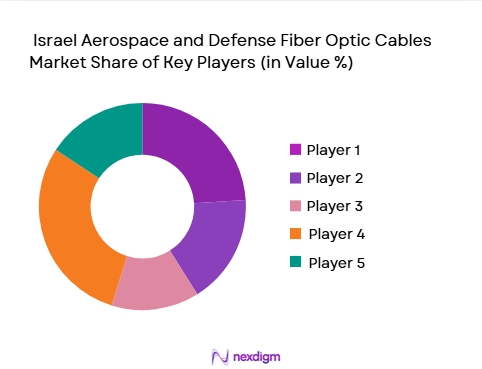

Competitive Landscape

The Israel aerospace and defense connectors market is led by a few key players, including Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems, alongside international aerospace giants such as Boeing, Lockheed Martin, and Northrop Grumman. The market’s dominance is driven by Israel’s strong defense sector, which continues to innovate and develop cutting-edge technologies. Companies such as IAI and Elbit Systems are deeply involved in the design, manufacturing, and integration of high-performance connectors for military aircraft, UAVs, and communications systems, ensuring their continued leadership in the aerospace and defense connector market.

| Company Name | Establishment Year | Headquarters | Product Focus | Market Reach | Technological Advancements | Strategic Initiatives |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

Israel Aerospace and Defense Connectors Market Analysis

Growth Drivers

Technological Advancements in Connector Systems

The demand for more reliable, durable, and high-performance connectors is increasing due to advancements in connector technology, such as miniaturization and enhanced electrical performance. Innovations in aerospace materials and the need for connectors that can withstand extreme conditions in military and aerospace applications are driving the growth of the market. Additionally, the integration of optical and fiber optic connectors is expanding the range and capabilities of systems, further stimulating the market.

Increased Military and Defense Spending

Governments worldwide, especially in defense-focused nations like Israel, are increasing their military budgets to enhance their defense capabilities. As military technology becomes more sophisticated, the demand for high-performance connectors that can integrate with advanced avionics, radar, communication, and weapon systems is increasing. This investment in military technology ensures a steady demand for specialized connectors designed for military and aerospace applications.

Market Challenges

High Production Costs

Manufacturing high-quality aerospace and defense connectors involves advanced materials and strict standards, making production costs significantly higher than standard connectors. The complexity of meeting the stringent durability and reliability requirements for military-grade connectors, along with the need for specialized manufacturing processes, creates a financial barrier to broader adoption, especially for smaller defense contractors or markets in developing nations.

Complex Regulatory and Certification Processes

Aerospace and defense connectors are subject to a variety of industry regulations and standards, including military certifications and environmental compliance. Navigating these complex certification processes can be time-consuming and costly for manufacturers. Additionally, any failure to meet these regulatory requirements could result in delays, costly rework, or penalties, further challenging companies in this sector.

Opportunities

Expansion of UAV and Drone Applications

The rapid adoption of unmanned aerial vehicles (UAVs) in defense and commercial sectors presents a significant opportunity for the connectors market. UAVs require specialized connectors for communication, power distribution, and data transfer systems. As Israel and other countries expand their use of UAVs in military operations and surveillance, the demand for reliable connectors will continue to grow, creating new market opportunities.

Collaborations and Partnerships with Aerospace Giants

Strategic collaborations between defense contractors and global aerospace companies offer substantial growth potential. As defense and aerospace companies continue to integrate advanced technologies, including new types of connectors, partnerships can provide access to new technologies, resources, and markets. For instance, partnerships between Israeli aerospace companies and international players like Boeing and Lockheed Martin can lead to joint ventures for developing next-generation connector systems.

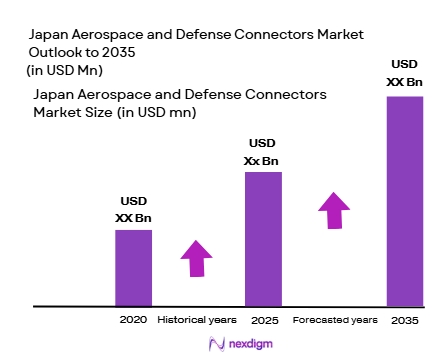

Future Outlook

Over the next decade, the Israel aerospace and defense connectors market is expected to experience steady growth, driven by Israel’s continuous investment in military and aerospace technologies. The rising adoption of UAVs, space exploration systems, and next-generation avionics will create substantial demand for specialized connectors. Technological advancements in miniaturization, improved durability, and enhanced functionality of connectors will further contribute to the growth of the market. As Israel strengthens its defense capabilities and further integrates cutting-edge technologies, the need for advanced aerospace and defense connectors will continue to rise, ensuring a positive outlook for the market.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Lockheed Martin

- Boeing

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- Saab

- L3 Technologies

- Honeywell Aerospace

- Rolls-Royce

- General Electric Aviation

- Airbus

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Military agencies and contractors

- Aircraft manufacturers

- Aerospace component suppliers

- UAV manufacturers

- Aerospace research and development organizations

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the key market variables impacting the Israel aerospace and defense connectors market. These variables include technological innovations, market demand from defense contractors, and geopolitical factors that influence defense procurement decisions. Extensive secondary research is conducted to gather initial insights into these variables.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance is collected and analyzed, including key trends in defense spending, technological adoption, and connector requirements for various aerospace platforms. The analysis also includes customer segmentation and market penetration.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accuracy, market hypotheses are validated through consultations with industry experts from the aerospace and defense sectors. These experts provide insights into the evolving demands for connectors and technological advancements, validating our findings and assumptions.

Step 4: Research Synthesis and Final Output

After synthesizing data and expert opinions, a comprehensive market report is produced, presenting detailed insights into the Israel aerospace and defense connectors market. This report includes actionable recommendations for stakeholders based on the collected data and market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for high-speed communication systems in defense

Growing space exploration initiatives

Technological advancements in fiber optic cable materials and design - Market Challenges

High cost of advanced fiber optic cables

Rigorous certification and regulatory standards

Complex installation and maintenance requirements - Market Opportunities

Rising demand for fiber optic cables in satellite communication systems

Integration of fiber optics into military UAVs

Growing commercial demand for advanced aviation systems - Trends

Increasing adoption of fiber optics in space communication systems

Miniaturization of fiber optic cables for compact aerospace systems

Integration of fiber optic cables with IoT and smart defense technologies - Government regulations

Strict certification standards for fiber optic cables in defense and aerospace sectors

Regulatory push for enhanced cybersecurity in fiber optic communications

Environmental regulations promoting sustainable materials in cable production - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

High-performance fiber optic cables

Single-mode fiber optic cables

Multimode fiber optic cables

Aerospace-grade fiber optic cables

Military-grade fiber optic cables - By Platform Type (In Value%)

Military aviation

Space systems

Commercial aviation

Unmanned aerial vehicles (UAVs)

Marine platforms - By Fitment Type (In Value%)

Board-to-board fiber optic connections

Cable-to-board fiber optic connections

Wire-to-wire fiber optic connections

Rectangular fiber optic connectors

Circular fiber optic connectors - By EndUser Segment (In Value%)

Defense contractors

Aerospace manufacturers

Commercial aircraft operators

Space agencies

Government defense departments - By Procurement Channel (In Value%)

Direct sales

Distributors and resellers

OEM partnerships

Online platforms

Government contracts

- Cross Comparison Parameters (Price, Technology, Performance, Reliability, Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Molex

TE Connectivity

Amphenol Aerospace

Hirose Electric

Smiths Interconnect

Lemo

ITT Interconnect Solutions

Harwin

Samtec

Souriau-Sunbank

Kyocera Connector Products

Vero Technologies

OFS Fitel

Oxygen Networks

Viasat

- Increasing need for secure, high-speed communication in defense

- Aerospace manufacturers adopting fiber optics for lightweight, efficient systems

- Commercial aircraft operators using fiber optics for in-flight data systems

- Government defense departments investing in advanced communication infrastructure

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035