Market Overview

The Israel Aerospace and Defense Multi-Functional Display (MFD) market is valued at approximately USD ~billion in 2024, with strong growth projected for the coming years. This growth is largely driven by technological advancements in display technologies, especially the integration of digital cockpit displays and sensor technologies. The increasing demand for multi-functional displays in military and aerospace sectors, where complex systems require high levels of integration, also plays a critical role. Furthermore, the rising defense budgets globally and the growth of defense modernization programs are expected to continue fueling the demand for these advanced systems.

Israel, as a leading defense technology hub, dominates the multi-functional display market due to its strong presence in aerospace and defense technologies. The nation’s defense contractors, including Israel Aerospace Industries and Elbit Systems, contribute significantly to market leadership. Additionally, major global players, such as the U.S. and European nations, also play a key role in driving the market due to their large-scale defense budgets and ongoing military innovations. The strategic collaborations and partnerships within these regions further solidify their dominance in the global market for aerospace and defense MFDs.

Market Segmentation

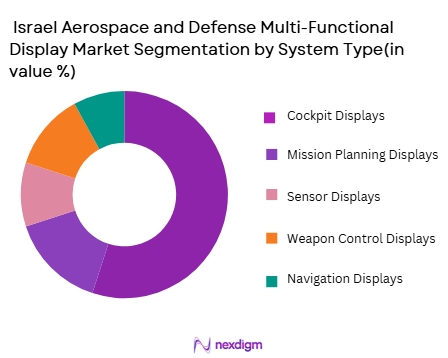

By System Type

The Israel Aerospace and Defense Multi-Functional Display market is segmented by system type, which includes cockpit displays, mission planning displays, sensor displays, weapon control displays, and navigation displays. Among these, cockpit displays dominate the market, accounting for the largest share. This is due to the growing demand for advanced, integrated cockpit systems that offer real-time data for pilots to make strategic decisions in combat situations. Modern cockpits now require multifunctional systems to improve operational efficiency and safety, making these displays essential. Furthermore, advancements in head-up display (HUD) technologies and the increasing trend of glass cockpits in both military and commercial aviation sectors contribute to the dominance of this segment.

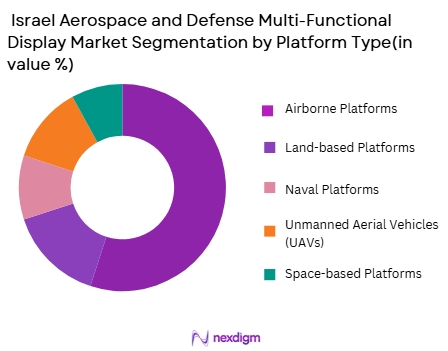

By Platform Type

The market is also segmented by platform type, including airborne platforms, land-based platforms, naval platforms, unmanned aerial vehicles (UAVs), and space-based platforms. Among these, airborne platforms hold a dominant share in the market, largely due to the increasing demand for advanced avionics and integrated display systems in fighter jets, military transport aircraft, and surveillance planes. The increasing need for next-generation fighter jets and the integration of MFDs for real-time data display in combat aircraft make airborne platforms a significant segment in the market. The widespread use of MFDs in commercial aviation further strengthens this segment’s position.

Competitive Landscape

The Israel Aerospace and Defense Multi-Functional Display market is highly competitive, with a few major players dominating the landscape. These companies are heavily involved in advancing the technology and capabilities of MFD systems. The market is dominated by both local Israeli companies and global defense contractors, who offer high-performance solutions for both military and commercial sectors.

The competition among these players is intensifying due to the constant need for innovation in the defense and aerospace sectors. Israel Aerospace Industries (IAI) and Elbit Systems are among the key players in the Israeli market, leveraging their strong expertise in avionics, defense, and aerospace systems. On the global front, companies like L3Harris Technologies, Rockwell Collins, and Thales Group continue to maintain a significant presence due to their vast product portfolios and established relationships with defense contractors worldwide.

| Company Name | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Market Focus | Technology Strength |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ |

| Rockwell Collins (Collins Aerospace) | 1933 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

Israel Aerospace and Defense Multi-Functional Display Market Analysis

Growth Drivers

Modernization of Cockpit and Mission Systems

The shift from analog to fully digital cockpits, especially in fighter jets, transport aircraft, UAVs and ground command vehicles, is propelling demand for multi‑functional displays. These displays consolidate flight, navigation, mission and sensor data into unified interfaces, reducing pilot workload and improving situational awareness. Defense forces globally are upgrading legacy platforms with glass cockpits and networked avionics to enhance real‑time data fusion and decision effectiveness. Israel, with its high tech defense industry and export‑oriented aviation programs, stands to benefit from such modernization trends.

Demand for High‑Performance, Ruggedized Displays

Aerospace and defense applications demand displays that withstand extreme environments—wide temperature ranges, vibration, shock, and electromagnetic interference. Multi‑functional displays with advanced technologies (e.g., LED/TFT, OLED, ruggedized LCD) meet these requirements while offering improved brightness, resolution and reliability. Increasing adoption of such displays in both military and commercial aircraft, as well as in space and naval platforms, drives market growth. Continuous R&D in display miniaturization, touchscreen capability, and sensor integration further enhances operational efficiency and safety.

Market Challenges

High Development and Certification Costs

Designing aerospace‑grade multi‑functional displays involves significant R&D expense, especially for systems that must integrate complex avionics, sensor data, and mission software. Certification requirements for safety‑critical aerospace and defense systems are stringent, adding time and cost to bring new display technologies to market. These barriers can limit innovation speed and market entry for smaller firms. Additionally, defense procurement cycles are long and highly regulated, which may slow adoption of next‑generation MFDs despite technological readiness.

Integration Complexity and Interoperability Issues

MFDs must seamlessly interface with a wide range of avionics, sensors, and communication systems. Achieving reliable integration across legacy and new systems can be complex, requiring significant customization and rigorous testing to ensure interoperability and cybersecurity. This complexity increases development effort and may introduce delays or cost overruns. Ensuring seamless data exchange between the displays and mission‑critical systems—especially in multi‑domain operations and networked defense environments—remains a persistent challenge for aerospace integrators.

Opportunities

Export of Advanced Avionics Solutions

Israel’s defense sector is a major global exporter of avionics and electronic systems; advanced multi‑functional displays are a natural extension. As global air forces and militaries modernize fleets with glass cockpits and digital mission systems, Israeli firms can compete to supply ruggedized MFDs that meet demanding performance standards. Exporting these systems into allied programs expands market reach beyond domestic demand and leverages Israel’s reputation for high‑technology defense electronics.

Growth in Unmanned and Autonomous Platforms

Unmanned aerial vehicles (UAVs), autonomous ground vehicles, and space systems increasingly rely on sophisticated displays for ground control stations and human‑machine interfaces. The proliferation of these platforms in defense and dual‑use applications creates opportunities for MFD suppliers to diversify product offerings and enter adjacent markets. Enhanced situational awareness solutions, augmented reality interfaces, and multi‑sensor fusion displays tailored to autonomous mission profiles represent emerging segments that can drive growth through 2035.

Future Outlook

The Israel Aerospace and Defense Multi-Functional Display market is expected to continue growing steadily over the next decade, driven by significant advancements in avionics and military systems integration. Over the coming years, the demand for cutting-edge MFD systems in both manned and unmanned aerial platforms will rise due to growing defense modernization efforts and increasing investments in aerospace technology. The market is also expected to benefit from the shift toward more integrated, versatile, and compact display systems capable of supporting complex operations in military and defense applications. This progress will be driven by collaborations between defense contractors and advancements in related technologies such as sensors, artificial intelligence, and augmented reality.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- L3Harris Technologies

- Rockwell Collins (Collins Aerospace)

- Thales Group

- Northrop Grumman

- Honeywell Aerospace

- Boeing Defense

- General Dynamics

- Saab Group

- Raytheon Technologies

- BAE Systems

- Curtiss-Wright

- Sagem (Safran)

- MBDA

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace OEMs

- Defense Contractors

- Military Research Institutions

- Aerospace and Defense Consulting Firms

- Private Aerospace Companies

- Manufacturers of Display Technologies for Defense

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical market dynamics influencing the Israel Aerospace and Defense Multi-Functional Display market. We utilize extensive desk research, secondary databases, and proprietary data sources to identify trends, drivers, and challenges. The aim is to recognize all key variables impacting the industry, such as technological advancements, regulatory frameworks, and defense procurement systems.

Step 2: Market Analysis and Construction

In this phase, we compile and assess historical data on the Israel Aerospace and Defense Multi-Functional Display market. This includes reviewing past sales trends, market penetration, and growth rates. We also evaluate market performance and consumer adoption rates to derive meaningful conclusions and predict future market growth.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations play a pivotal role in validating hypotheses derived from historical data. Industry experts and practitioners are interviewed using computer-assisted telephone interviews (CATIs) to collect insights regarding operational practices, technological innovations, and market dynamics. These consultations help refine the research and enhance the reliability of the final report.

Step 4: Research Synthesis and Final Output

In the final step, the research is synthesized, and the data is cross verified by consulting with key players in the industry, including system manufacturers and defense contractors. The insights from this step are integrated with the data gathered from secondary research to ensure that the final report is comprehensive and accurate.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for integrated defense systems

Technological advancements in display technologies

Rising defense budgets across global markets - Market Challenges

High initial costs of multi-functional display systems

Complexity of integration into existing defense systems

Regulatory challenges in defense procurement - Market Opportunities

Growth in military modernization programs

Expansion of UAV and autonomous systems

Increasing collaboration between private and public defense sectors - Trends

Shift towards digital cockpit displays

Advancements in touch-screen and multi-touch interface technology

Growing reliance on virtual and augmented reality systems in defense - Government regulations

ISO 9001 Certification for Aerospace Systems

Defense Acquisition Regulations (DAR)

Aerospace Safety Standards (FAA)

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Cockpit Displays

Mission Planning Displays

Sensor Displays

Weapon Control Displays

Navigation Displays - By Platform Type (In Value%)

Airborne Platforms

Land-based Platforms

Naval Platforms

Unmanned Aerial Vehicles (UAVs)

Space-based Platforms - By Fitment Type (In Value%)

OEM Fitments

Retrofit Fitments

Hybrid Fitments

Modular Fitments

Custom Fitments - By EndUser Segment (In Value%)

Defense Contractors

Government Agencies

Aerospace OEMs

Private Aerospace Companies

Military Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Third-party Distributors

Government Procurements

Online Procurement Platforms

Auction & Bidding Systems

- Cross Comparison Parameters (Market share, Pricing strategy, Technological innovation, Customer service, Distribution channels, Display Type, Resolution & Graphics Performance, Human‑Machine Interface Features, Integration & Connectivity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

L3Harris Technologies

Thales Group

Rockwell Collins

Northrop Grumman

Honeywell Aerospace

Boeing Defense

General Dynamics

Saab Group

Curtiss-Wright

Sagem (Safran)

Harris Corporation

MBDA

- Increased adoption by military forces globally

- Growing interest from defense contractors in Israel and abroad

- Rising use of multi-functional displays in UAVs and drones

- Demand for rugged and durable systems in extreme environments

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035