Market Overview

The Israel aerospace and defense telemetry market is valued at approximately USD ~ million. This market has experienced consistent growth, largely driven by the country’s prominent position in the global defense sector and its advanced aerospace capabilities. Telemetry systems in Israel are utilized in missile defense testing, satellite tracking, unmanned aerial vehicle (UAV) operations, and space exploration missions. The expanding defense budget and continuous government spending on defense R&D, especially in cutting-edge technologies like artificial intelligence (AI) and machine learning for telemetry analytics, are key drivers of this growth. Additionally, Israel’s focus on enhancing missile defense systems and expanding aerospace and defense exports to global markets is expected to sustain growth in the coming years.

Israel’s dominance in the aerospace and defense telemetry market is centred in Tel Aviv, Herzliya, and Haifa. Tel Aviv serves as the hub for many defense contractors and technology startups, with key players like Elbit Systems and Rafael Advanced Defense Systems. The country’s defense industry benefits from its highly skilled workforce, robust R&D infrastructure, and government-led initiatives such as the Israel Innovation Authority, which fosters technology development in defense and aerospace sectors. Furthermore, Israel’s strategic partnerships with major global defense markets, such as the United States and Europe, and its export agreements with countries like India and Turkey, further cement its position as a leader in telemetry innovation.

Market Segmentation

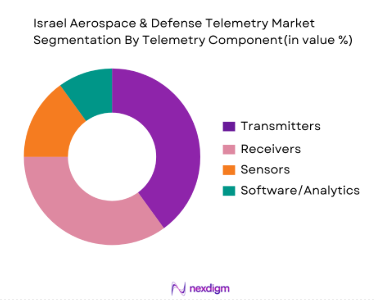

By Telemetry Component

Israel’s aerospace and defense telemetry market is segmented by key components, which include transmitters, receivers, sensors, and software. Among these, telemetry transmitters and receivers play the dominant role due to their fundamental necessity in communication systems during missile and satellite tests, as well as UAV operations. Telemetry transmitters are in high demand due to their ability to relay critical test data in real time over vast distances, crucial for Israel’s missile defense systems and UAVs. The increasing development of miniaturized, secure, and high-bandwidth transmitters that can support sophisticated systems like Iron Dome and David’s Sling drives the dominance of this sub-segment.

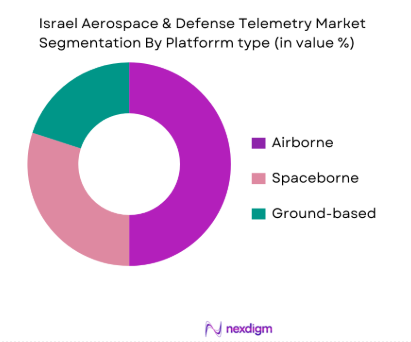

By Platform Type

The Israel aerospace and defense telemetry market is also segmented by platform type, including airborne, spaceborne, and ground-based platforms. The airborne segment dominates, driven by Israel’s extensive use of UAVs for defense and intelligence purposes. Israel has developed several cutting-edge UAVs such as Heron and Skylark, which rely on advanced telemetry systems for real-time data transmission. These systems are essential for communication, control, and surveillance operations during flight, making them critical for defense strategies. The rapid advancement in drone technology and Israel’s role as a leader in unmanned aerial vehicle development further strengthens the market share of airborne telemetry systems.

Competitive Landscape

The Israel aerospace and defense telemetry market is highly competitive, with several major players that dominate the landscape. Israel’s local defense contractors, such as Elbit Systems and Rafael Advanced Defense Systems, maintain a strong foothold in the telemetry segment due to their comprehensive product portfolios, ranging from missile defense systems to UAV telemetry solutions. International companies, including L3Harris and Northrop Grumman, also contribute significantly to the market by providing specialized telemetry equipment and services.

| Company | Establishment Year | Headquarters | Key Parameter 1 | Key Parameter 2 | Key Parameter 3 | Key Parameter 4 | Key Parameter 5 | Key Parameter 6 |

| Elbit Systems | 1966 | Haifa, Israel | Telemetry Solutions | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1958 | Haifa, Israel | Missile Systems | ~ | ~ | ~ | ~ | ~ |

| IAI (Israel Aerospace) | 1953 | Tel Aviv, Israel | Satellite Telemetry | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | Telemetry Hardware | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | UAV Telemetry Systems | ~ | ~ | ~ | ~ | ~ |

Israel Telemetry Market Analysis

Market Drivers

Defense Modernization & Secure C2 Contracts

The Israeli defense sector has seen substantial investments in modernization, driven by both domestic needs and international export demand. The Israeli government allocated approximately USD ~ billion in defense spending for 2024, a 6.4% increase from the previous year. This funding supports the integration of advanced technologies, including secure Command and Control (C2) systems, which are critical for real-time data transmission in missile defense systems, UAVs, and satellite communication. Additionally, Israel’s defense contracts with global allies such as the U.S. and European nations have heightened demand for secure C2 telemetry systems. Israel’s role as a global leader in defense exports further accelerates this demand, positioning the market for significant growth.

UAV and UCAV Telemetry Growth

Israel continues to be a leading innovator in unmanned aerial vehicles (UAVs) and unmanned combat aerial vehicles (UCAVs), where telemetry systems are integral. The Israeli Air Force operates hundreds of UAVs such as the Heron and Skylark, which rely on advanced telemetry for communication and surveillance. With Israel’s aerospace and defense exports reaching USD 11 billion in 2023, UAVs, which account for a large portion of this figure, are playing a central role in the country’s defense strategy. Furthermore, the global UAV market, heavily influenced by Israeli exports, reached USD ~billion in 2023 and is expected to see continued growth, directly benefiting telemetry system demand.

Restraints and Challenges

Spectrum Congestion & Regulatory Restrictions

With the growing demand for telemetry systems in the defense sector, the issue of spectrum congestion has become a major concern. Telemetry systems rely on specific frequency bands for communication, and Israel has seen increased competition for bandwidth allocation, particularly in the 1 GHz to 10 GHz range, which is crucial for both defense and commercial uses. The Israeli government has been working closely with international bodies such as the International Telecommunication Union (ITU) to ensure proper spectrum management. However, as of 2024, approximately 80% of Israel’s frequency bands are already allocated, which could limit the availability of bandwidth for new telemetry systems. This spectrum congestion poses challenges for future telemetry development and expansion

High Integration and Cybersecurity Costs

The integration of advanced telemetry systems in military platforms requires significant investments in cybersecurity and system security infrastructure, as these systems are highly vulnerable to cyberattacks. The cost of securing telemetry systems, particularly in missile defense systems and UAVs, can exceed 25% of the total system cost, according to estimates from the Israeli Cyber Directorate. Given the increasing sophistication of cyber threats, Israel’s defense sector allocates more than USD 50 million annually to cybersecurity measures for its telemetry systems. This high integration and cybersecurity cost is a significant challenge for both local and international defense contractors involved in telemetry solutions. Source: Israeli Cyber Directorate

Emerging Opportunities

AI/ML for Predictive Telemetry Analysis

Artificial intelligence (AI) and machine learning (ML) are transforming the capabilities of telemetry systems in defense applications. The Israeli government’s 2024 budget includes an allocation of USD 100 million for AI-driven defense technologies, with a significant portion dedicated to enhancing telemetry systems. AI-powered predictive analytics can significantly improve system reliability and reduce the risks associated with mission-critical operations by analysing large datasets in real-time to predict failure patterns or optimize mission planning. Israel’s defense sector has been particularly focused on applying these technologies in UAV telemetry systems and satellite operations, which are expected to see significant improvements in operational efficiency and accuracy. Source: Israel Innovation Authority

Software‑Defined Telemetry Radios

The increasing adoption of software-defined radios (SDRs) in the defense sector presents a major opportunity for the telemetry market in Israel. SDRs allow for more flexible and adaptable telemetry communication, making it easier to switch between different frequency bands and communication protocols. As of 2024, Israel has invested USD 150 million in SDR technologies, particularly for its missile defense systems, where quick adaptability is crucial. The shift to SDRs allows for seamless integration of telemetry across various defense platforms, making it a crucial technology for the future of Israel’s telemetry systems.

Future Outlook

Over the next five years, Israel’s aerospace and defense telemetry market is expected to witness robust growth, primarily driven by advancements in UAV technology, satellite communication systems, and missile defense initiatives. The demand for real-time data transmission systems will continue to grow with the increasing deployment of unmanned aerial vehicles, satellite tracking systems, and high-stakes military defense systems. Technological innovations, including enhanced AI-powered telemetry systems, miniaturization of telemetry devices, and advancements in satellite communications, will further propel market expansion.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- L3Harris Technologies

- Northrop Grumman

- Thales Group

- Honeywell Aerospace

- Raytheon Technologies

- General Dynamics

- Lockheed Martin

- Boeing Defense, Space & Security

- BAE Systems

- Leonardo S.p.A.

- Orbital ATK

- Cobham Limited

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military Procurement Departments

- Defense OEMs and System Integrators

- Telecommunications Companies

- Aerospace and Satellite Communications Providers

- Telecom Equipment Manufacturers

- Space Agencies

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key components, players, and technologies that drive the telemetry market in Israel. This involves a thorough review of secondary data sources such as industry reports, market databases, and government publications.

Step 2: Market Analysis and Construction

We then analyse historical data to understand market penetration, demand for telemetry products, and adoption by defense sectors. This step focuses on evaluating the volume and value of installed telemetry systems and the contribution of major defense contracts.

Step 3: Hypothesis Validation and Expert Consultation

To validate findings, we conduct expert consultations through interviews with key industry players, such as defense manufacturers, satellite providers, and telemetry system developers. Insights are gathered from both local and international experts to refine our understanding.

Step 4: Research Synthesis and Final Output

Finally, the research is synthesized into actionable insights, using a bottom-up approach to ensure accuracy in revenue projections and market forecasts. Data is cross verified with industry stakeholders to provide a holistic and validated market report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations and Industry Nomenclature, Instrumentation & Test Data Standardization Approach, Market Sizing Methodology, Forecasting Techniques and Confidence Intervals, Primary Research Protocol (Interviews with Defense OEMs, Program Managers, Range Test Labs)

- Israel Defense Export & Local Demand Dynamics

- Government Procurement & Budget Allocation Framework

- Lifecycle of Telemetry Programs

- Value Chain & Supply Network

- Market Drivers

Defense Modernization & Secure C2 Contracts

UAV and UCAV Telemetry Growth

Space Launch & Satellite TT&C Demand

Sensor Fusion & Big‑Data Telemetry Analytics

- Restraints and Challenges

Spectrum Congestion & Regulatory Restrictions

High Integration and Cybersecurity Costs

Interoperability Demands - Emerging Opportunities

AI/ML for Predictive Telemetry Analysis

Software‑Defined Telemetry Radios

Telemetry as a Service - Technology Trends

Miniaturized Telemetry Payloads

Encrypted & Quantum‑Resilient Links

Full‑Duplex SATCOM Telemetry

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average System Price, 2020-2025

- Telemetry Service Revenue vs Product Revenue Split, 2020-2025

- By Telemetry Component

Transmitters & RF Front Ends

Receivers & Demodulation Units

Antennas

Sensors & Data Acquisition Units

Telemetry Processing & Software Suites - By Platform

Airborne Telemetry

Space Telemetry & TT&C

Missile & Guided Weapons Test Telemetry

Ground‑Based Defense Telemetry Nodes

Maritime / Shipborne Systems - By Transmission Medium

Wireless RF

Satellite Telemetry

Optical & Free‑Space Optical Links

Wired/Borne Test Data Links - By Application

Flight Test Instrumentation & Evaluation

Command & Control Telemetry in Live Ops

Health & Usage Monitoring Systems

ISR Telemetry Fusion

Mission‑Critical Secure Data Links - By End‑User

Israel Defence Forces

Space Agencies

Defense OEMs (System Integrators)

Export Customers

Government Labs & Test Ranges

- Market Share of Major Players — Value & Volumn

- Cross‑Comparison Parameters (Telemetry Product Portfolio Breadth, Secure RF & SATCOM Capability, Defense Certification & Compliance Levels, R&D Intensity in Telemetry DSP/AI, Installed Base, Export Contracts & Interoperability Standards, Spectrum & Frequency Band Expertise, Value‑Added Services (Maintenance, Analytics)

- Strategic SWOT Profiles of Key Players

Pricing & SKU Analysis

Porter’s Five Forces - Detailed Profiles

Israel Aerospace Industries

Elbit Systems Ltd.

Rafael Advanced Defense Systems

RT Aerostats Systems

Gilat Satellite Networks Ltd.

L3Harris Technologies

Honeywell International Inc.

BAE Systems

Lockheed Martin Corporation

Northrop Grumman Corporation

General Dynamics Corporation

Thales Group

Cobham Limited

Safran Data Systems

Orbit Communication Systems

- Operational Demand Patterns

- Budget Allocations & Spend Cycles

- Procurement Decision Processes

- Requirements, Pain Points, Compliance Needs

- Israel Telemetry Market Value Projection, 2026-2025

- By Component, Platform, Transmission Medium, Application, 2026-2025

- Price / ASP Trends, 2026-2025

- Scenario Analysis, 2026-2025