Market Overview

The Israel Aerospace Carbon Fiber Market is experiencing steady growth, driven by the increasing demand for lightweight, high-strength materials used in commercial, military, and space applications. Carbon fiber reinforced plastics (CFRP) are crucial in reducing weight while maintaining structural integrity, which is vital for Israel’s advanced aerospace sector. The market is expected to continue expanding due to Israel’s robust defense sector, extensive aerospace research, and strategic partnerships with global aerospace giants. Furthermore, Israel’s aerospace market is supported by government initiatives focused on innovation and technological advancements in materials science.

The market dominance is heavily concentrated in a few regions, particularly Tel Aviv and Haifa, which host the leading aerospace manufacturers and research institutes. Tel Aviv’s prominence is attributed to its proximity to major defense contractors, such as Israel Aerospace Industries (IAI), and its established aerospace ecosystem. Haifa benefits from the presence of key academic and industrial players specializing in aerospace composites and cutting-edge manufacturing techniques. These cities have become hubs for carbon fiber technology development due to strong investments in aerospace and defense sectors, government research support, and a growing talent pool in material science.

Market Segmentation

By Carbon Fiber Type

The Israel Aerospace Carbon Fiber Market is segmented by carbon fiber type into PAN-based, pitch-based, and high-modulus carbon fibers. PAN-based carbon fiber dominates the market, driven by its superior strength and lightweight properties, making it ideal for aerospace applications. This type of fiber is widely used in commercial aircraft components, military structures, and space technologies. PAN-based fibers offer high tensile strength, which is essential for the rigorous demands of aerospace applications, ensuring durability and performance under extreme conditions. Additionally, the extensive production infrastructure for PAN fibers in Israel and its cost-effectiveness contribute to its dominant position.

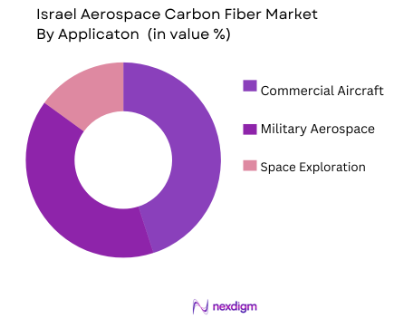

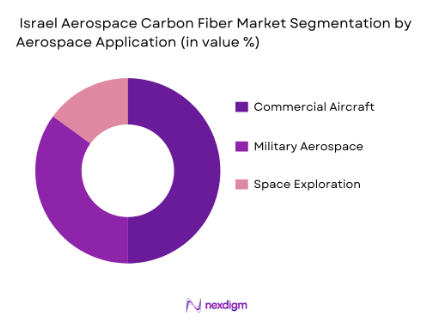

By Aerospace Application

The market is also segmented by aerospace application, with significant demand arising from commercial aircraft, military aerospace platforms, and space exploration applications. The commercial aircraft segment holds the largest market share due to the growing need for fuel-efficient, lightweight aircraft. Carbon fiber’s application in the production of wings, fuselage, and tail sections of aircraft significantly reduces weight and improves fuel efficiency. Israel’s aerospace industry, with players like IAI, has extensively adopted carbon fiber in commercial aircraft manufacturing. The military and space sectors are also witnessing growing carbon fiber adoption, though at a comparatively smaller scale due to specific requirements for stealth and thermal resistance.

Competitive Landscape

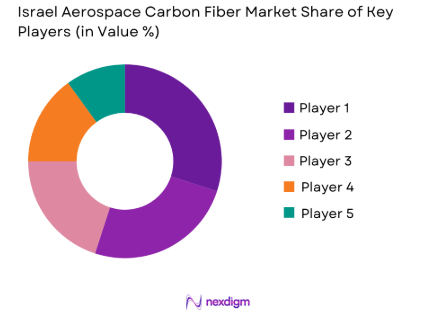

The Israel Aerospace Carbon Fiber Market is characterized by a high level of competition, with both domestic and international players contributing significantly to its growth. The market is driven by established aerospace giants, such as Israel Aerospace Industries (IAI), and global suppliers of carbon fiber materials like Toray and Hexcel, which have established strong relationships with Israeli aerospace manufacturers.

| Company Name | Establishment Year | Headquarters | Production Capacity | R&D Investment | Strategic Partnerships | Certifications |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Toray Industries | 1926 | Tokyo, Japan | ~ | ~ | ~ | ~ |

| Hexcel Corporation | 1948 | Stamford, USA | ~ | ~ | ~ | ~ |

| SGL Carbon | 1991 | Wiesbaden, Germany | ~ | ~ | ~ | ~ |

| DowAksa | 2004 | Istanbul, Turkey | ~ | ~ | ~ | ~ |

Future Outlook

Over the next several years, the Israel Aerospace Carbon Fiber Market is expected to witness significant growth, driven by advancements in aerospace technologies, increased demand for lightweight materials, and Israel’s continued leadership in defense and space technologies. As the aerospace sector increasingly adopts carbon fiber composites for fuel-efficient, durable, and high-performance applications, Israel’s position as a key player in aerospace manufacturing will continue to strengthen. With ongoing investments in R&D and technological innovation, the market is poised for steady growth, particularly in the military and commercial aircraft sectors.

Major Players

- Israel Aerospace Industries (IAI)

- Hexcel Corporation

- Toray Industries

- SGL Carbon

- DowAksa

- Mitsubishi Chemical Carbon Fiber & Composites

- Teijin Limited

- Solvay S.A.

- BASF SE

- Zoltek (Liberty Carbon)

- Hyosung Advanced Materials

- Formosa Plastics Corporation

- Anshan Sinocarb Carbon Fibers Co.

- Cytec Solvay Group

- Specialty Materials

Key Target Audience

- Aerospace Manufacturers & OEMs

- Defense Contractors and Government Defense Agencies

- Military and Commercial Aircraft Operators

- Government and Regulatory Bodies

- Carbon Fiber Precursor Suppliers

- Composite Material Suppliers and Distributors

- Advanced Material R&D Laboratories and Institutes

- Investment and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying and defining key variables that impact the Israel Aerospace Carbon Fiber Market, including factors such as carbon fiber types, aerospace segment demand, and production capabilities. This involves comprehensive secondary research to establish an ecosystem map.

Step 2: Market Analysis and Construction

This phase compiles historical data to analyze carbon fiber penetration in aerospace structures, focusing on key applications like wings, fuselage, and military components. The analysis also includes insights into production trends and pricing dynamics.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, industry expert interviews and consultations are conducted. These insights from key players in the aerospace sector help refine the analysis of market dynamics and consumer behavior within the carbon fiber industry.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from expert interviews, market analysis, and competitive intelligence, providing a comprehensive view of the market. This information is validated by direct engagement with aerospace manufacturers and carbon fiber suppliers.

- Executive Summary

- Research Methodology (Carbon Fiber Precursor Analysis, Aerospace Composite Demand Modeling, Primary Interview Framework, Data Adjustments)

- Market Definition & Boundaries

- Material Science & Carbon Fiber Properties in Aerospace

- Historical Genesis of Aerospace Carbon Fiber Adoption in Israeli Aerospace OEMs

- National Strategic Context

- Supply Chain – From Precursor Sourcing to CFRP Part Integration

- Global vs. Israel Positioning

- Growth Drivers

Increasing Aircraft Production & Fleet Modernization

Government Support for Advanced Materials R&D

Demand for Lightweight, High‑Strength Materials in UAV & Space Programs Export‑Oriented Défense Aerospace Contracts - Market Challenges & Barriers

High Production Costs & Capital Intensity

Skilled Workforce & Technical Manufacturing Constraints

Raw Material Precursor Import Dependency

Certification & Regulatory Barriers for Aerospace CFRP - Market Opportunities

Development of next-generation high strength and high modulus fibers

Growth in space launch and satellite structure manufacturing

Increasing adoption of carbon fiber in aerospace interiors and secondary structures - Market Trends

Automated Composite Fabrication Adoption

Nanostructured & Hybrid Carbon Fibers

Sustainability, Recycling & Lifecycle Engineering

Digital Twin & Advanced Simulation for CFRP Design

- By Value, 2020-2025

- By Volume, 2020-2025

- By CFRP Penetration in Aircraft Structures, 2020-2025

- By Carbon Fiber Type (In Value %)

PAN‑Based, Pitch‑Based

High‑Modulus

Ultra‑High Modulus

Precursor Fiber Characteristics - By Application Segment (In Value %)

Commercial Aircraft Structures

Military Fixed‑Wing Platforms

Rotary Wing & UAVs

Space & Satellite Components

Engine & Composite Drive Components - By Component Type In Value %)

Primary Structure

Secondary Structure

Interiors, Engine - By End‑Market Customer (In Value %)

OEM Tier

Tier‑1 Composites Supplier

Defense Prime, MRO

- By Tow Size & Modulus Classification (In Value %)

Small Tow <24K

Intermediate Tow

High Modulus

- Market Share Analysis

- Cross‑Comparison Parameters (Product Portfolio Breadth, Aerospace Certifications Held, Composite Manufacturing Footprint, Strategic Partnerships & Defense Contracts, R&D Investment & Pipeline Innovation, Localization of Precursor Sourcing, End‑Use Penetration by Aircraft Type, Price Positioning & Cost per kg CFRP)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Profiles

Hexcel Corporation

Toray Industries Inc.

SGL Carbon SE

Teijin Limited

Mitsubishi Chemical Carbon Fiber & Composites

BASF SE

Zoltek

Dow Aksa / Aksa Advanced Materials

Hyosung Advanced Materials

Formosa Plastics Corporation

Anshan Sinocarb Carbon Fibers Co.

Specialty Materials

- CFRP Adoption Rates by Aircraft Segment

- Buyer Procurement Priorities

- Replacement, Retrofit & MRO Carbon Fiber Utilization

- By Value, 2026-2035

- By Volume, 2026-2035

- Aerospace CFRP Price Forecasts, 2026-2035