Market Overview

The Israel aerospace composites market is valued at approximately USD ~ billion, driven by the country’s strong aerospace and defense industry. Israel’s aerospace sector has been a leader in defense technology and military UAV development, which significantly impacts the demand for high-performance composite materials. The market growth is supported by advancements in composite technologies, increasing use of lightweight and durable materials, and government incentives for defense contractors. The demand for aerospace composites in Israel is particularly strong due to a growing focus on enhancing the capabilities of defense systems and UAVs.

The dominant players in Israel’s aerospace composites market are centered in key cities such as Tel Aviv, Herzliya, and Haifa. Tel Aviv and Herzliya are known for their proximity to Israel Aerospace Industries (IAI) and Elbit Systems, two of the largest players in the aerospace and defense sectors. These cities benefit from a robust ecosystem of innovation, supported by government-backed initiatives and military contracts. Haifa, on the other hand, is an industrial hub, housing multiple aerospace companies focusing on composite materials for both civil and defense aerospace applications.

Market Segmentation

By Composite Material Type

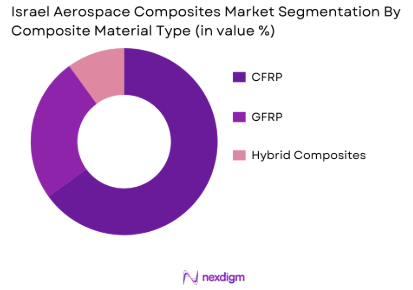

The aerospace composites market is segmented by material type into Carbon Fiber Reinforced Polymer (CFRP), Glass Fiber Reinforced Polymer (GFRP), and Hybrid Composites. CFRP is the leading segment in Israel’s aerospace composites market due to its high strength-to-weight ratio and exceptional durability. These properties make CFRP an ideal material for aircraft structural components, such as fuselages and wings, especially in military and UAV applications. Israel’s aerospace industry has prioritized CFRP for its use in advanced fighter jets, UAVs, and commercial aircraft, making it the dominant segment in the composites market.

By Application

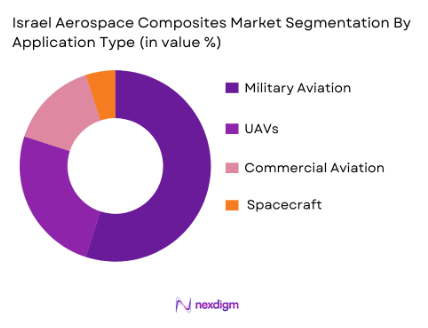

The market is further segmented by application into Military Aviation, Commercial Aviation, UAVs (Unmanned Aerial Vehicles), and Spacecraft. The military aviation segment holds a significant share due to Israel’s focus on enhancing the defense capabilities of its air force and defense systems. Composites are extensively used in military aviation for stealth applications, advanced fighter jets, and drones. Israel’s technological expertise in composite materials, coupled with defense contracts, contributes to the prominence of military aviation in the country’s aerospace composites market.

Competitive Landscape

The Israel aerospace composites market is dominated by key players like Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems. These companies are leaders in the defense and aerospace sectors, and they maintain a strong focus on integrating advanced composite materials into their aircraft and UAV platforms. International players such as Boeing and Lockheed Martin also play a role in Israel, though they are not as prominent as the local manufacturers.

| Company Name | Establishment Year | Headquarters | Composite Product Portfolio | Manufacturing Technology | Key Aircraft Programs | Certifications |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

Future outlook

Over the next decade, the Israel aerospace composites market is expected to experience steady growth, with a compound annual growth rate (CAGR) of 6% from 2026 to 2035. This growth will be driven by increasing demand for advanced lightweight materials in defense, aerospace, and UAV applications. The technological advancements in composite materials, such as improved thermoplastic composites and the expansion of space exploration initiatives, will further fuel the market’s growth. The local aerospace ecosystem, supported by strong government defense spending and strategic partnerships, will continue to create opportunities for further advancements in aerospace composites.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- Boeing

- Lockheed Martin

- Airbus

- General Electric

- Raytheon Technologies

- Northrop Grumman

- Raytheon

- Sika AG

- Hexcel Corporation

- Owens Corning

- Spirit AeroSystems

- Collins Aerospace

Key Target Audience

- Aerospace OEMs and Tier-1 suppliers

- UAV manufacturers and developers

- Defense contractors and military agencies

- Government and regulatory bodies

- Composite material suppliers and manufacturers

- Research and development firms in aerospace composites

- Investment and venture capital firms

- Aerospace and defense industry analysts

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Israel aerospace composites market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including material trends, technological advancements, and defense requirements.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Israel aerospace composites market is compiled and analyzed. This includes evaluating market penetration, the ratio of local suppliers to global suppliers, and resultant revenue generation. A critical component is to examine the cost structure and pricing strategies of key players in the market. This stage helps to understand how various market forces such as supply chain challenges, material innovation, and defense budgets shape the overall market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through expert consultations. These will include structured interviews with key industry stakeholders such as composites manufacturers, aerospace OEMs, and R&D firms. These consultations provide essential insights directly from industry practitioners, which will be instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all the gathered information into a comprehensive market report. This includes acquiring detailed insights into aerospace composite segments, technological advancements, and consumer preferences. This direct engagement with manufacturers and suppliers helps to verify and complement the statistics derived from the initial research phases, ensuring an accurate and validated analysis.

- Executive Summary

- Research Methodology (Market Definitions and Composites Scope, Israel Aerospace Composites Value Chain Mapping, Data Collection, Satellite & Defense A&D Data Integration, Primary Research Framework, Assumptions and Forecast Logic, Limitations and Data Validation Checks, Composite Market Modelling Approach)

- Industry Genesis and Israel Aerospace Composites Evolution

- Strategic Importance of Composites in Israeli A&D

- Aerospace Composites Value Chain

- Regional & Sectoral Demand-Pull

- Government & Policy Support for Composites

- Growth Drivers

High Strength‑to‑Weight Requirements

Local Defense Industry Growth

UAV Proliferation

Export Demand to NATO & Asia - Market Challenges

Raw Material Import Dependencies

Certification Barriers

Skilled Workforce Constraints - Opportunities

Advanced Carbon Nanocomposite Adoption

Electric/Hybrid Aircraft Composites

Space Composites - Market Trends

Automation in Layup & AFP

Digital Twin Quality Assurance

Local Supply Chain Localization

Value, 2020-2025

Volume, 2020-2025

Pricing Trends by Composite Type, 2020-2025

- By Composite Material Type (In Value%)

Carbon Fiber Reinforced Polymer

Glass Fiber Reinforced Polymer

Thermoplastic Composites

Ceramic Matrix Composites

Hybrid Composites - By End‑Use Application (In Value%)

Structural Aerostructures

Non‑structural Aerostructures

UAV & Drone Frames

Radomes & Antenna Covers

Interiors & Fairings - By Manufacturing Technology (In Value%)

Automated Fiber Placement

Resin Transfer Molding

Autoclave Cure; Out‑of‑Autoclave (OOA)) - By Aircraft Type (In Value%)

Defense Fighter & ISR

Commercial Passenger Jets

Business Jets

UAV/Multi‑Rotor

Space Launch & Satellite Structures - By Customer Tier (In Value%)

OEMs

Tier‑1 Composite Assemblers

Tier‑2 Sub‑Assemblers

Contract Manufacturing Organizations

- Market Share – Israel Aerospace Composite Supply (Value & Output)

- Cross‑Comparison Parameters for Israel Aerospace Composites Companies (Company Overview, Composite Product Portfolio Breadth, Manufacturing Technology & Certifications, Key Aircraft Programs Served, Revenue by Aerospace Composites Segment, Capacity, Export Footprint & Strategic Alliances, R&D Intensity & Composite Innovation Pipeline)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Israel Aerospace Industries

Elbit Systems / Cyclone

Comparts Composite Manufacturing

Aerospace Composite Materials & Parts

Carbon Fiber Composite Airframe Components

Hybrid & Sustainable Composites

Composite Machining Tool Specialist

Advanced Composite OEM/Integrator

Space & Satellite Composite Developer

Composite UAV Frame Supplier

Composite Layup & Production Services

Aerospace MRO Composites Provider

Advanced Thermoplastic Composites Firm

Composite Inspection & NDT Services

Defense Composite Systems Specialist

- Raw Materials and Prepreg Sourcing Footprint

- Composite Part Fabrication Hubs

- MRO (Maintenance, Repair & Overhaul) Composites Segment

- Trade Channels and Export Routes

- Collaboration Networks OEMs – Tier‑1s – Universities

- Composite Demand by Value, 2026-2035

- By Volume, 2026-2035

- By Application, 2026-2035

- Technology Adoption Rate Scenarios, 2026-2035