Market Overview

The Israel aerospace fasteners market is primarily driven by the increasing demand for precision components in the aerospace sector. The market is valued at approximately USD ~ million in 2025, supported by the growth in both the commercial and defence aerospace segments. Israel’s position as a global leader in aerospace manufacturing, particularly through entities like Israel Aerospace Industries (IAI), contributes significantly to the demand for advanced fasteners. This demand is further driven by the ongoing development of next-generation aircraft, increasing military aerospace investments, and strong infrastructure for MRO services in Israel. The robust technological advancements in materials and aerospace systems are enhancing the need for high-performance fasteners in airframe and engine assemblies.

The market for aerospace fasteners in Israel is primarily dominated by cities such as Tel Aviv and Haifa. Tel Aviv serves as the hub for Israel’s high-tech industry, including aerospace manufacturing, with companies like Israel Aerospace Industries (IAI) and Elbit Systems operating from this region. Haifa, home to several defense contractors, also plays a pivotal role in the production of fasteners required for both commercial and military aircraft. Israel’s strategic position in the Middle East, along with its robust defense sector, bolsters the dominance of these cities in the aerospace fasteners market, making it a critical player in global aerospace supply chains.

Market Segmentation

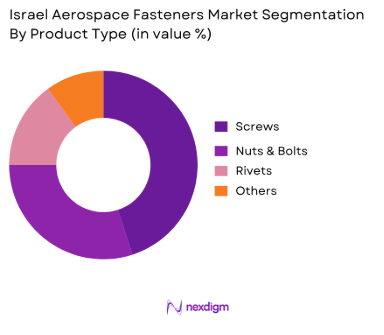

By Product Type

The Israel aerospace fasteners market is segmented by product type into screws, nuts & bolts, rivets, and others, such as pins, washers, and retaining rings. Among these, screws dominate the market share in 2025, driven by their extensive use in securing key components in aircraft structures and engines. The preference for screws is also due to their high torque resistance, ease of application, and the growing emphasis on lightweight materials in aerospace manufacturing. Companies like IAI and Elbit Systems continue to favor screws for their robustness and versatility in various aerospace applications, especially in commercial and defense aircraft.

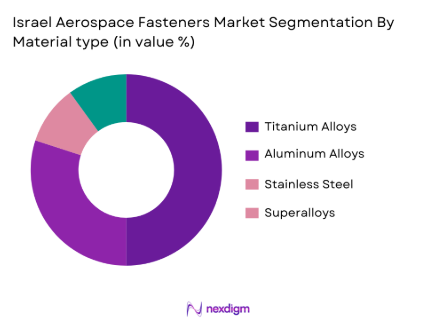

By Material Type

In the Israel aerospace fasteners market, the segment is divided into titanium, aluminum alloys, stainless steel, and superalloys. Titanium alloys hold the dominant market share due to their exceptional strength-to-weight ratio and high resistance to corrosion, making them ideal for the aerospace sector, especially in engine and airframe applications. This material’s dominance is backed by its superior performance under extreme temperatures and mechanical stresses, particularly in military aerospace and high-performance aircraft. The preference for titanium alloys is growing due to the increasing emphasis on reducing aircraft weight while maintaining structural integrity.

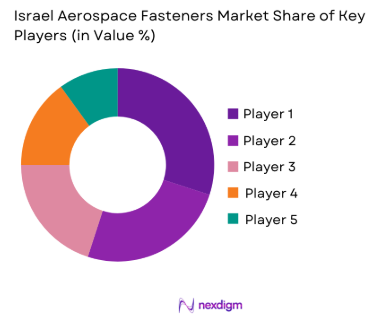

Competitive Landscape

The Israel aerospace fasteners market is characterized by the dominance of both local players and global suppliers. Israel Aerospace Industries (IAI), as one of the largest aerospace manufacturers in the country, significantly influences the fastener supply chain. The market also features strong competition from international manufacturers, with players like Howmet Aerospace and LISI Aerospace holding significant shares in the global aerospace fasteners market. These companies cater to Israel’s fastener demand due to their advanced manufacturing capabilities, compliance with stringent aerospace standards, and established relationships with OEMs (Original Equipment Manufacturers).

| Company Name | Establishment Year | Headquarters | Production Capacity | Material Types | OEM Relationships | Certifications | Revenue |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | High | ~ | ~ | ~ | ~ |

| Howmet Aerospace | 1883 | Pittsburgh, USA | High | ~ | ~ | ~ | ~ |

| LISI Aerospace | 1973 | Paris, France | Medium | ~ | ~ | ~ | ~ |

| Precision Castparts | 1953 | Portland, USA | High | ~ | ~ | ~ | ~ |

| Ashot Ashkelon Industries | 1975 | Ashkelon, Israel | Medium | ~ | ~ | ~ | ~ |

Israel Aerospace Fasteners Market Dynamics

Growth Drivers

Increase in Aircraft Production & Fleet Orders

Israel’s aerospace manufacturing industry, including both commercial and defense aircraft, is experiencing significant growth, driven by increased fleet orders. The global aerospace manufacturing sector, particularly in military and defense, is projected to see significant expansion, with defense expenditure rising worldwide. Israel’s defense budget alone has reached USD ~ billion in 2025, reflecting a continued focus on upgrading defense capabilities, which directly impacts the demand for fasteners. The Israeli Air Force, one of the most technologically advanced globally, also continues to upgrade its fleet, creating a steady need for high-quality aerospace fasteners in aircraft production. Source: Israel Ministry of Defense.

Rising MRO Service Cycles

The maintenance, repair, and overhaul (MRO) market in Israel has grown significantly, with major aerospace maintenance hubs in Tel Aviv and Haifa supporting both domestic and international aircraft. The global MRO market is valued at over USD~ billion in 2025, with Israel accounting for a notable share due to its advanced infrastructure and strategic geographic location. The Israeli Air Force alone spends millions annually on MRO services for its fleet. This demand for repairs drives the need for precision fasteners in frequent aircraft servicing, supporting a continuous market for aerospace fasteners. Source: Israel Civil Aviation Authority.

Market Challenges

High Barriers for Certification & Traceability

Aerospace fasteners require certifications that ensure safety, reliability, and compliance with international standards, such as AS9100 and NADCAP. The cost and time required for obtaining these certifications pose a significant challenge to fastener manufacturers in Israel. The certification process can take several months and involves stringent quality checks that are expensive to meet. Moreover, traceability is crucial in aerospace manufacturing, where failures can result in catastrophic outcomes. The cost of meeting certification standards for fasteners is high, especially for smaller players in Israel’s aerospace supply chain. Source: Israel Civil Aviation Authority.

Supply-Chain Disruptions in Geopolitical Context

Israel’s aerospace fasteners market faces significant risks from global supply chain disruptions due to geopolitical tensions in the Middle East. This affects the timely availability of materials and components, especially those sourced from countries with political instability. In 2025, the ongoing geopolitical issues in Eastern Europe and the Middle East have led to logistical delays and increased transportation costs, exacerbating the challenges faced by Israeli manufacturers. The reliance on global suppliers for materials like titanium and superalloys further magnifies the impact of these geopolitical factors on the aerospace fasteners market in Israel. Source: World Bank.

Opportunities

Localizing Tier-2 Fastener Production in Israel

An emerging opportunity in the Israeli aerospace fasteners market is the localization of Tier-2 fastener production. Currently, many fasteners used in Israeli aerospace manufacturing are sourced internationally, leading to higher costs and longer lead times. By establishing more local manufacturing capabilities, Israel can reduce dependency on foreign suppliers, lower costs, and improve supply chain efficiency. The Israeli government’s initiatives to boost local manufacturing, alongside the growing aerospace industry, provide an ideal environment for Tier-2 fastener manufacturers to expand their operations. In 2025, the Israeli government has allocated USD~ million for local defense manufacturing projects, directly supporting this initiative. Source: Israel Ministry of Economy and Industry.

Advanced Materials & Smart Fasteners

The development and adoption of advanced materials and smart fasteners present a significant opportunity for growth in Israel’s aerospace fasteners market. Smart fasteners, which integrate sensors to monitor structural integrity, are gaining traction in aerospace applications due to their ability to enhance aircraft safety and reduce maintenance costs. Israel is already a leader in advanced technology, and its aerospace sector is investing in R&D to develop these high-tech solutions. In 2025, Israel Aerospace Industries (IAI) is collaborating with global companies to develop smart fasteners for next-generation aircraft, further propelling the demand for advanced fasteners.

Future Outlook

The Israel aerospace fasteners market is set for steady growth in the coming years, fueled by advancements in aerospace technology and the increasing demand for lightweight materials. Over the next decade, the market will see a rise in military and commercial aircraft production, driving the demand for high-performance fasteners. This trend is expected to be further supported by Israel’s strategic partnerships with global aerospace giants and its increasing investments in defense technologies. As Israel continues to be a critical player in both aerospace manufacturing and defense systems, the demand for sophisticated fasteners, particularly those made from titanium and aluminum, is expected to expand.

Major Players

- Israel Aerospace Industries (IAI)

- Ashot Ashkelon Industries Ltd.

- Howmet Aerospace

- LISI Aerospace

- Precision Castparts

- Alcoa

- GE Aviation

- Trimas Aerospace

- Rexnord Corporation

- MS Aerospace

- Boeing Distribution Services

- Fastenal

- Stanley Engineered Fastening

- B&B Specialties

- Saturn Fasteners

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace OEMs

- Aerospace Component Manufacturers

- Aerospace Maintenance and Repair Organizations (MROs)

- Aerospace Engineering and Design Firms

- Defense Contractors

- Airline Operators and Fleet Managers

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the key players, materials, and manufacturing processes in the Israel aerospace fasteners market. A comprehensive mapping of stakeholders will be conducted using secondary research and proprietary data from aerospace industry reports and government publications.

Step 2: Market Analysis and Construction

Historical data from aerospace manufacturers and MRO service providers will be compiled and analyzed to understand market penetration and demand for specific fastener types. This will help in estimating market size, revenue forecasts, and identifying growth trends.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses generated through market research will be validated through expert interviews with aerospace engineers, procurement heads from OEMs, and key decision-makers within the Israeli aerospace industry. These consultations will ensure the accuracy and relevance of market assumptions.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating all collected data into a comprehensive report. Insights gathered from interviews, combined with quantitative market data, will allow for a reliable and validated analysis of the Israel aerospace fasteners market.

- Executive Summary

- Research Scope & Methodology (Market Definitions, Assumptions & Inclusions, Data Sources & Validation, Market Sizing Approaches, Limitations and Confidence Intervals)

- Macro Aerospace Ecosystem

- Role of IAI & Defense Prime Integrators

- Fastener Importance in Aircraft Structures & MRO Cycles

- Value Chain & Supply Chain Dynamics

- Certification & Compliance Requirements

- Growth Drivers

Increase in Aircraft Production & Fleet Orders

Rising MRO Service Cycles

Defense Modernization & Special Mission Platforms - Challenges

Raw Material Price Volatility

High Barriers for Certification & Traceability

Supply‑Chain Disruptions in Geopolitical Context

- Opportunities

Localizing Tier‑2 Fastener Production in Israel

Advanced Materials & Smart Fasteners

Export Adjacent Aerospace Subcontracting - Market Trends

Shift Toward Lightweight, Composite‑Compatible Fasteners

Digital Procurement & Supplier Scorecards

Additive Manufacturing for Custom Fasteners

- Market Value, 2020-2035

- Volume, 2020-2035

- Average Selling Price by Fastener Type, 2020-2035

- By Fastener Product Type (In Value%)

Screws

Nuts & Bolts

Rivets

Pins, Washers, Others - By Material Type (In Value%)

Titanium Alloys

Aluminum Alloys

Stainless Steel

Superalloys

Composite‑Compatible Fasteners

- By Application (In Value%)

Airframe Assembly

Engine & Powerplant

Aerospace Interiors & Cabin Fixtures

Landing Gear & Actuation Systems

Avionics Mounting & Control Surfaces

By End‑Use Sector (In Value%)

Commercial Aviation

Defense & Military Aerospace

Space & Satellites Launch Systems

Aftermarket MRO & Retrofit

- By Procurement Source (In Value%)

OEM Direct Procurement

Tier‑1/2 Subcontracted Production

Aftermarket Distribution - By Quality & Certification Tier (In Value%)

AS9100 Certified Components

NADCAP Accredited Production

Non‑Accredited Hardware

- Competitive Market Structure

- Cross‑Comparison Parameters, Product Certification, Fastener Mechanical Specifications Material Capabilities, Quality/Traceability Systems, Supply‑Chain Footprint, Production Capacity & Scalability, R&D/Innovation in Fastening Tech, On‑Time Delivery & Warranty Performance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Israel Aerospace Industries

Ashot Ashkelon Industries Ltd.

Mivrag Cold Forming Technology

Delta Fitt Inc.

Ananka Group

Precision Castparts Corp.

LISI Aerospace SAS

Trimas Aerospace

National Aerospace Fasteners Corp.

Howmet Aerospace Inc.

Stanley Black & Decker

Saturn Fasteners, Inc.

B&B Specialties, Inc.

MS Aerospace

Boeing Distribution Services

- OEM Procurement Practices

- Supplier Qualification & Quality Assurance

- Tier‑2/3 Supplier Landscape

- Logistics, Lead Times & Inventory Practices

- Risk Management (Certification, Compliance, Dual‑Use Controls)

- Future Market Size, 2026-2035

- Growth Drivers, 2026-2035

- Segment Growth Trajectories, 2026-2035