Market Overview

The Israel aerospace fluoropolymers market has seen consistent growth, driven by rising demand for advanced materials in aerospace applications. The market is valued at approximately USD ~ million in 2025, with growth attributed to the aerospace sector’s need for high-performance materials capable of withstanding extreme temperatures, pressure, and chemical exposure. Increasing investments in both military and commercial aerospace technologies have fueled the demand for fluoropolymer solutions. Additionally, advancements in additive manufacturing, along with the rising use of lightweight, corrosion-resistant materials, have contributed to this market’s expansion.

Israel, with its strategic location and established defense and aerospace industry, is the dominant player in the market. Key cities like Tel Aviv and Haifa, known for their aerospace infrastructure, house several defense contractors and innovation centres that support the demand for high-performance materials. The country’s robust relationship with international defense agencies and its focus on technological innovation, especially in unmanned aerial vehicles (UAVs) and space exploration, make it a leader in the aerospace fluoropolymer market. Furthermore, global players like the U.S. and the EU often collaborate with Israeli manufacturers, expanding Israel’s market presence in aerospace materials.

Market Segmentation

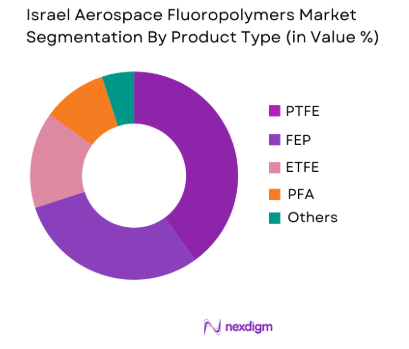

By Product Type

The Israel aerospace fluoropolymers market is segmented by product type into PTFE, FEP, ETFE, PFA, and others. PTFE is the dominant product type in this segment. This is primarily due to its exceptional resistance to high temperatures and chemicals, making it ideal for critical aerospace components like insulation materials for wiring and coatings for electronic systems. PTFE’s adaptability to extreme environments and its broad application range have established it as the go-to fluoropolymer in aerospace. Furthermore, the growing need for durable materials in defense and commercial aerospace systems continues to drive the dominance of PTFE.

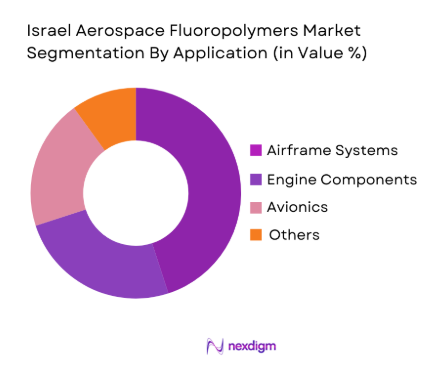

By Application

The Israel aerospace fluoropolymers market is further segmented by application into airframe systems, engine components, avionics, and others. Airframe systems dominate this segment due to the growing demand for lightweight and durable materials that can withstand extreme temperatures and pressures encountered in aerospace environments. Fluoropolymers are commonly used in the construction of seals, gaskets, and electrical insulation for airframes. As Israel’s aerospace industry grows, airframe manufacturers continue to rely heavily on these materials for their corrosion resistance, thermal stability, and electrical insulating properties.

Competitive Landscape

The Israel aerospace fluoropolymers market is dominated by a few key players, with both local and international companies making their mark. Companies like Teva Fluoropolymers and Solvay have established significant footprints in Israel, capitalizing on the country’s growing aerospace sector. The presence of multinational companies further strengthens the competitive dynamics, fostering innovation and ensuring a broad product portfolio. This consolidation within the market highlights the crucial role of these players in meeting the high demands for fluoropolymer materials in defense, space exploration, and commercial aerospace applications.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Reach | Manufacturing Capacity | R&D Investment |

| Teva Fluoropolymers | 1969 | Tel Aviv | ~ | ~ | ~ | ~ |

| Solvay | 1863 | Brussels | ~ | ~ | ~ | ~ |

| Arkema | 2004 | Paris | ~ | ~ | ~ | ~ |

| Chemours | 2015 | Delaware | ~ | ~ | ~ | ~ |

| Dow Chemical | 1897 | Michigan | ~ | ~ | ~ | ~ |

Israel Aerospace Fluoropolymers Market Analysis

Growth Drivers

Expansion of Israeli UAV and Defense Production

Israel is known for its leadership in unmanned aerial vehicles (UAVs) and defense systems, and this growth is propelling the demand for aerospace fluoropolymers. The Israeli UAV market, valued at approximately USD ~billion in 2024, continues to expand, with the Ministry of Defense prioritizing further investments in drone technology and defense infrastructure. In line with this, the IDF’s increased investment in technological innovations, especially within defense production, is expected to drive the demand for specialized aerospace materials. UAVs, which are becoming more advanced, require high-performance materials like fluoropolymers for their insulation, seals, and wiring due to their thermal stability, chemical resistance, and lightweight properties.

Electrification Trends

The trend towards electrification in the aerospace industry is increasingly driving the need for advanced materials, particularly in areas such as electric propulsion systems, avionics, and electrical wiring. In 2024, Israel has increased its investment in electrification technologies within the aerospace sector. The Israeli government’s National Energy Innovation Fund announced an investment of USD ~ million in 2024 for developing sustainable aviation technologies, including electrification of aircraft. As the industry transitions towards electric aircraft, the demand for fluoropolymers, which offer high electrical resistance and insulation properties, is expected to rise significantly. These materials play a crucial role in enhancing the performance of electrical systems in aviation, which is crucial for meeting future sustainability goals.

Restraints

High Production & Certification Costs

The production and certification costs for aerospace fluoropolymers remain a significant restraint in the market. Aerospace materials must undergo rigorous testing and certification processes to meet international standards, which raises the cost of production. In Israel, regulatory bodies such as the Civil Aviation Authority (CAA) impose strict compliance requirements, contributing to high certification costs. Additionally, fluoropolymers require expensive manufacturing processes, especially those tailored for aerospace, which increases the overall cost structure. In 2024, Israel’s national regulatory body reports that certification fees for aerospace materials have increased by 12% compared to previous years, adding financial pressure on manufacturers, limiting their ability to scale production.

Feedstock Price Volatility

Fluoropolymers are derived from fluorine-based raw materials, which are subject to price fluctuations due to global supply chain challenges and geopolitical tensions. In 2024, the price of key feedstocks for fluoropolymer production, such as tetrafluoroethylene (TFE), has risen by 8% in Israel, influenced by supply shortages and the increasing demand for industrial-grade fluorine. This price volatility poses a significant challenge for aerospace manufacturers in Israel who rely on these materials for the production of high-performance components. Given the global reliance on key fluorine suppliers, such as those in China and the U.S., fluctuations in the supply chain can hinder the production of fluoropolymers, cause production delays and raising material costs.

Opportunities

Indigenous Resin Development Initiatives

Israel’s growing focus on self-reliance in the defense and aerospace sectors presents a significant opportunity for the development of indigenous fluoropolymer resins. In 2024, the Israeli government’s Ministry of Economy and Industry announced a new initiative to support the development of homegrown resin production capabilities. The initiative is part of a broader strategy to reduce reliance on international suppliers and boost the competitiveness of the domestic aerospace industry. Given Israel’s advanced chemical engineering capabilities and its focus on technological innovation, there is a strong potential for local companies to develop proprietary fluoropolymer resins tailored to aerospace needs, which could lead to cost reductions and supply chain security.

Additive Manufacturing Integration

Additive manufacturing is emerging as a key opportunity for the aerospace fluoropolymers market. In 2025, Israel has seen a 15% increase in investment towards advanced manufacturing techniques, including 3D printing technologies for aerospace applications. Fluoropolymer materials are ideal candidates for additive manufacturing due to their high performance in extreme conditions. As the aerospace sector in Israel adopts 3D printing for producing complex parts such as seals, gaskets, and electrical insulation, the demand for specialized fluoropolymers is expected to grow. Additive manufacturing offers the potential for reduced waste, lower production costs, and the ability to manufacture highly customized components for the aerospace industry.

Future Outlook

Over the next decade, the Israel aerospace fluoropolymers market is expected to see steady growth. The increasing investment in defense technologies, including UAVs and satellite systems, coupled with advancements in aerospace manufacturing, will fuel demand for specialized fluoropolymer solutions. The market will benefit from technological innovations, particularly in additive manufacturing, which will make it easier to produce complex fluoropolymer components with better performance and reduced production costs.

Major Players

- Teva Fluoropolymers

- Solvay

- Arkema

- Chemours

- Dow Chemical

- Honeywell International

- 3M

- BASF

- Asahi Glass

- Gujarat Fluorochemicals Ltd.

- Daikin Industries

- Mitsubishi Chemical Corporation

- Saint-Gobain Performance Plastics

- SABIC

- DuPont

Key Target Audience

- Aerospace OEMs

- Defense Contractors

- Space Agencies

- Additive Manufacturing Firms

- Investments and Venture Capitalist Firms

- Aerospace MRO Providers

- Government and Regulatory Bodies

- Raw Material Suppliers

Research Methodology

Step 1: Identification of Key Variables

The research begins with an ecosystem map construction, identifying the key stakeholders in the Israel aerospace fluoropolymers market. Secondary research is performed to gather data on key variables, including product types, market size, applications, and competitive landscape. The primary goal is to define all critical factors affecting market dynamics.

Step 2: Market Analysis and Construction

Historical data is compiled and analysed to assess market penetration. Data on the volume and value of fluoropolymers used in aerospace applications are analysed, particularly focusing on growth trajectories for product segments. Additionally, market share analysis based on sub-segments like airframe systems and engine components is included.

Step 3: Hypothesis Validation and Expert Consultation

We validate our initial hypotheses through consultations with industry experts, including manufacturers, suppliers, and aerospace engineers. Interviews with key decision-makers in the aerospace sector provide insights into future trends, consumer preferences, and market growth drivers.

Step 4: Research Synthesis and Final Output

We synthesize data from interviews, secondary sources, and market analysis. This final phase ensures that our report provides accurate, reliable insights into the current state and future projections of the Israel aerospace fluoropolymers market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Israel Aerospace Fluoropolymer Supply Chain Mapping, Top‑Down & Bottom‑Up Sizing Techniques, Primary Research Protocols, Secondary Data Sourcing, Data Triangulation and Validation, Market Bias & Limitations)

- Market Definition and Scope

- Market Genesis & Development History

- Regulatory and Standards Landscape

- Industry Value Chain & Supply Network

- Macro Drivers & Risk Triggers

- Growth Drivers

Rising Demand for High Thermal & Chemical Resistance Materials

Expansion of Israeli UAV and Defense Production

Electrification Trends - Restraints

High Production & Certification Costs

Feedstock Price Volatility - Opportunities

Indigenous Resin Development Initiatives

Additive Manufacturing Integration - Market Trends

Light weighting & Green Materials

Localization of Supply Chains

Partnership Between Resin Makers & Tier OEMs

- Market Value, 2020-2025

- Volumetric Consumption, 2020-2025

- Price Realization Trends, 2020-2025

- Demand Analysis by End‑Use, 2020-2025

- Israel Export & Import Balance, 2020-2025

- By Resin Type (In Value%)

PTFE (Thermal/Chemical Resistance)

ETFE (Lightweight Insulation)

FEP (Melt Processable Applications)

FKM/Perfluoro elastomers (Seals/Gaskets)

Others (ECTFE, PVDF Variants)

- By Component Type (In Value%)

Electrical Insulation & EWIS Jacketing

Hoses & Tubing

Seals, Gaskets & O‑rings

Coatings & Films

Composite Integration Interfaces

- By Application Segment (In Value%)

Airframe Systems

Engine & Powertrain Components

Avionics & Electrical Distribution

Defense & Weaponized Platforms

Space Launch & Satellite Systems - By Form of Supply (In Value%)

Powder

Pellets

Dispersion/Solutions

Custom Preforms & Films

- By End Customer Demand Profile (In Value%)

Commercial OEMs

Military/Defense Prime Contractors

MRO & Aftermarket Providers

National Space Agencies

- Market Share Analysis (Value & Volume by Player)

- Cross Comparison Parameters (Company Overview, Resin Technology Portfolio, Israel & Global Footprint, Strategic Alliances, Revenues by Aerospace Segment, R&D Intensity, Certification Credentials, Supply Chain Depth, Integration Capability, Production Capacity, Manufacturing Locations, Pricing Strategy, Aftermarket Support, Environmental/Compliance Practices, Patent Positioning)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force

- Detailed Profiles

AGC Inc.

Daikin Industries, Ltd.

The Chemours Company

3M Company

Arkema S.A.

Solvay S.A.

Dongyue Group

DuPont

Dow Inc.

Gujarat Fluorochemicals Ltd.

Hubei Everflon Polymer Co.

Fluoroseals SpA

Halopolymer OJSE

Honeywell International

Mitsubishi Chemical Corporation

- Purchasing Behaviour

- Utilization Intensity in Defense vs Commercial Platforms

- Israel Supply Assurance & Strategic Stockholdings

- Cost Sensitivity & Total Cost of Ownership

- End‑User Innovation Requirements

- Market Value Forecast, 2026-2035

- Consumption Volume Projections, 2026-2035

- Price Forecast Index, 2026-2035