Market Overview

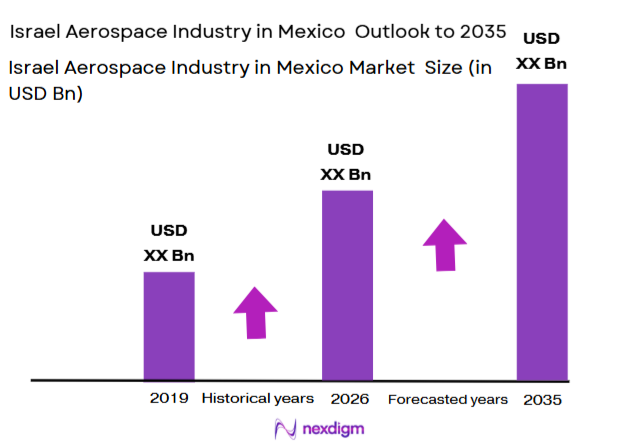

The Israel Aerospace Industry market is valued at USD ~billion in 2024. It has seen significant growth in recent years, with an expanding market driven by both government and private investments. In 2024, the market was valued at approximately USD ~billion, with substantial growth expected due to increasing demand for advanced defense systems, unmanned aerial vehicles (UAVs), and aerospace testing systems. The continuous innovation and support for defense and space technologies, particularly by Israel’s aerospace companies, have accelerated the market’s expansion in Mexico. The rise of commercial aerospace ventures and government partnerships have further driven the market forward.

Key cities in Mexico that dominate the aerospace sector include Mexico City, Querétaro, and Baja California. These cities serve as aerospace hubs due to their proximity to key suppliers and manufacturing plants. Querétaro, in particular, is known for its aerospace park, which houses many aerospace and defense manufacturing companies, making it a central location for international collaborations. Baja California, with its strategic location, offers easy access to the U.S. market, enhancing its role in the aerospace supply chain.

Market Segmentation

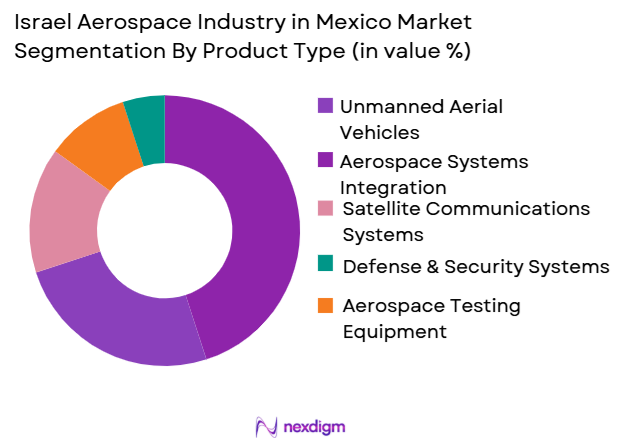

By Product Type

The Israel Aerospace Industry in Mexico is segmented by product type into defense and security systems, unmanned aerial vehicles (UAVs), aerospace systems integration, satellite communications, and aerospace testing equipment. UAVs have seen dominant market growth in Mexico, largely driven by their applications in both military and civilian sectors. UAVs are used extensively for surveillance, reconnaissance, and mapping purposes. The increasing demand from government agencies for advanced defense systems has significantly contributed to the growth of UAVs in Mexico. Additionally, UAVs are gaining popularity in agricultural, border surveillance, and infrastructure inspection sectors.

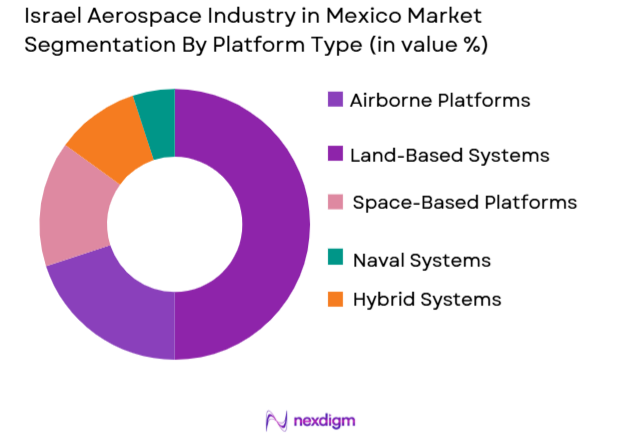

By Platform Type

The market is further segmented by platform type into land-based systems, airborne platforms, space-based platforms, naval systems, and hybrid systems. Airborne platforms are leading in market share due to their broad use in both defense and commercial aerospace applications. Airborne platforms, such as drones and fighter jets, have become integral to the Mexican defense strategy, supported by strong ties with Israeli aerospace companies. The demand for airborne systems has been especially high in sectors such as surveillance and border protection. Furthermore, the integration of advanced technologies in airborne platforms has made them indispensable for modern military and commercial applications.

Competitive Landscape

Competitive Landscape

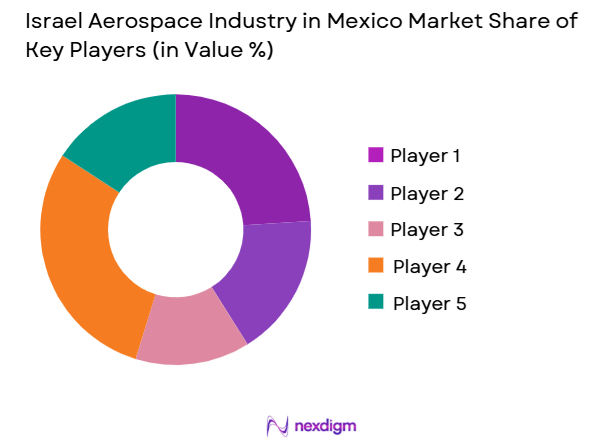

The Israel Aerospace Industry in Mexico is characterized by a concentrated competitive landscape, with a few dominant players. The leading players in the market include Israeli defense and aerospace companies such as Israel Aerospace Industries (IAI) and Elbit Systems. These companies are at the forefront of providing high-tech defense and aerospace solutions. The presence of local suppliers and collaboration with government and private aerospace firms in Mexico ensures a competitive edge. Companies like Rafael Advanced Defense Systems and AeroVironment also play a crucial role in supplying UAVs and defense systems to Mexico.

| Company | Establishment Year | Headquarters | Market Share | Product Portfolio | Technological Advancements | Global Presence |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ |

| AeroVironment | 1970 | USA | ~ | ~ | ~ | ~ |

| Aeronautics Defense Systems | 1997 | Israel | ~ | ~ | ~ | ~ |

Israel Aerospace Industry in Mexico Market Analysis

Israel Aerospace Industry in Mexico Market Analysis

Growth Drivers

Urbanization

Urbanization has played a critical role in the growth of the aerospace industry in Mexico, especially in cities like Mexico City, Querétaro, and Tijuana. In 2024, over ~% of Mexico’s population resides in urban areas, contributing to the demand for advanced infrastructure and security systems, which includes aerospace technologies like UAVs and satellite communication systems. The development of urban centers requires significant investment in advanced surveillance and transportation systems, including air mobility solutions, making urbanization a key driver. As the country’s population grows, so does the need for technology-driven solutions, including aerospace innovations.

Industrialization

Mexico’s industrial sector continues to evolve, with aerospace manufacturing playing a significant role in its development. As of 2024, Mexico is the second-largest exporter of aerospace products in Latin America, driven by growing industrialization in regions like Querétaro. The Mexican government’s investment in industrial parks and infrastructure, combined with rising demand for aerospace systems from both military and commercial sectors, has propelled this trend. Industrialization efforts in Mexico continue to support the manufacturing of advanced aerospace technologies such as drones, satellite systems, and air defense equipment, with significant foreign investment from global aerospace giants.

Restraints

High Initial Costs

The high initial costs of aerospace technology, especially in the defense and satellite sectors, represent a major restraint for the industry in Mexico. As of 2024, the average cost for advanced aerospace systems, such as defense drones or satellite communication equipment, remains a barrier to entry for many smaller companies. While large enterprises and government contracts can afford such high costs, smaller firms and local entities struggle to justify these expenditures. The high cost of R&D and technology integration remains an obstacle to the widespread adoption of advanced aerospace systems in the country.

Technical Challenges

The Israeli aerospace industry in Mexico faces several technical challenges, particularly in the areas of integration and maintenance of aerospace technologies. Despite advancements, the lack of infrastructure and skilled workforce for advanced manufacturing and servicing of aerospace systems in Mexico has hindered growth. In 2024, only ~% of aerospace components were manufactured locally, with the remainder imported from Israel or other countries. The complexity of integrating these systems and maintaining their efficiency requires highly specialized technical skills, which are in short supply in the region.

Opportunities

Technological Advancements

Technological advancements are a major opportunity for the aerospace industry in Mexico, particularly in unmanned aerial vehicles (UAVs) and satellite systems. The demand for more advanced UAVs for surveillance, agriculture, and logistics is growing rapidly. In 2024, the Mexican government launched a new initiative to integrate AI-driven technologies into aerospace systems to improve data analysis, flight control, and predictive maintenance. With advancements in AI and machine learning, aerospace systems are becoming more autonomous, efficient, and cost-effective, which presents a major opportunity for local manufacturers to capitalize on cutting-edge technologies.

International Collaborations

International collaborations present a significant opportunity for Mexico’s aerospace industry. Mexico has seen an influx of foreign direct investment from countries like the U.S. and Israel in the aerospace sector. As of 2024, aerospace companies from Israel and the U.S. have established joint ventures and partnerships with local firms, fostering technology transfer and enhancing the country’s aerospace capabilities. These collaborations provide Mexico with access to advanced aerospace technologies and expertise, which can help local manufacturers improve product quality, expand their offerings, and increase their share in the global aerospace market.

Future Outlook

Over the next decade, the Israel Aerospace Industry in Mexico is expected to experience robust growth. This is attributed to increased government spending on defense and technological advancements in aerospace and UAV systems. The industry’s growth is also supported by expanding collaborations between Israeli companies and Mexican firms. As military needs evolve, Mexico will continue to increase its demand for cutting-edge aerospace technologies, ensuring a positive outlook for the sector.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Rafael Advanced Defense Systems

- AeroVironment

- Aeronautics Defense Systems

- Israel Military Industries

- Elta Systems

- Rada Electronic Industries

- Skylock

- Bluebird Aero Systems

- Magal Security Systems

- Israel Shipyards

- Intra Defense Technologies

- Orbit Technologies

- Aeronautics Ltd.

Key Target Audience

- Aerospace Manufacturers

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Defense Technology Research Organizations

- Military and Airforce Departments

- Aerospace Testing and Certification Bodies

- Defense Contractors and System Integrators

- Private Aerospace Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying all key variables that affect the Israel Aerospace Industry in Mexico. This includes gathering data from secondary sources such as industry reports, government publications, and financial reports of key players in the market. The objective is to map out the main drivers and challenges that influence the market.

Step 2: Market Analysis and Constructio

This step involves a thorough analysis of the historical market data to determine trends, growth rates, and patterns in the industry. The analysis also covers the various sectors within the aerospace industry, such as UAVs, defense systems, and aerospace testing equipment, to build a comprehensive understanding of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated by consulting industry experts through interviews and surveys. These consultations are designed to gather insights into technological trends, government spending, and defense priorities, which will help refine the data and improve the accuracy of market forecasts.

Step 4: Research Synthesis and Final Output

The final phase integrates the data collected from both secondary research and expert consultations. This includes synthesizing market forecasts, validating assumptions, and preparing a detailed report that captures all the dynamics affecting the Israel Aerospace Industry in Mexico, including competitive landscape and future growth predictions.

- Executive Summary

- Israel Aerospace Industry in Mexico Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing government defense budgets

Expansion of commercial space programs

Technological advancements in aerospace systems - Market Challenges

Regulatory hurdles and compliance issues

High initial investment costs

Intense competition from global aerospace manufacturers - Market Opportunities

Growing demand for UAVs in both military and civilian sectors

Strategic partnerships with local aerospace companies

Export opportunities to Latin American countries - Trends

Shift towards autonomous aerospace systems

Increasing focus on satellite-based communications

Adoption of green technologies in aerospace production

- Government Regulation

National and International Defense and Security Regulations

Export and Import Restrictions for Airborne Systems

- SWOT Analysis

- Porter’s Five Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Unmanned Aerial Vehicles (UAVs)

Aerospace Systems Integration

Satellite Communication Systems

Defense & Security Systems

Aerospace Testing Equipment - By Platform Type (In Value%)

Land-Based Systems

Airborne Platforms

Space-Based Platforms

Naval Systems

Hybrid Systems - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket

Upgraded Systems

Retrofit Systems

Modular Systems - By EndUser Segment (In Value%)

Government & Military

Commercial Airlines

Private Sector Aerospace

Space Exploration Organizations

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Government Procurement

Private Sector Procurement

OEM Partnerships

Third-Party Distributors

International Trade Agreements

- Market Share Analysis by Value/Volume

- CrossComparison Parameters(Market Share, Technological Innovation, Pricing Strategy, Production Capacity, R&D Investments)

- Pricing & Procurement Analysis

- SWOT Analysis of Key Competitors

- Key Players

Elbit Systems

IAI

Rafael Advanced Defense Systems

AeroVironment

Israel Shipyards

Orbital Systems

Elta Systems

Aeronautics Defense Systems

Israel Military Industries

Rada Electronic Industries

Magen David Adom

Intra Defense Technologies

Magal Security Systems

Skylock

Bluebird Aero Systems

- Government agencies investing in defense capabilities

- Private aerospace companies focusing on satellite technology

- Increased demand for air defense systems

- Emerging aerospace research programs in Mexico

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035