Market Overview

The Israel Aerospace Parts Manufacturing market is valued at ~. This growth is driven by the country’s strong defense and aerospace sector, including extensive government support and exports. Israel has long been a leader in technological innovation, with its defense industry playing a pivotal role in both military and commercial aerospace. The growing demand for military aircraft and UAVs, coupled with increasing civilian aerospace operations, fuels the market. Israel Aerospace Industries (IAI) and Elbit Systems have significantly contributed to maintaining the market’s strength, bolstered by global export initiatives. This dynamic growth is also supported by Israel’s integration into global aerospace supply chains and its partnerships with prominent OEMs worldwide.

Israel’s aerospace parts manufacturing sector is concentrated in key cities such as Tel Aviv and Herzliya. These locations are home to Israel’s top aerospace companies, including Israel Aerospace Industries and Elbit Systems. The country’s dominance in the sector is attributed to its robust government support, significant defense budget, and a history of military and commercial aerospace expertise. Furthermore, Israel’s strategic geographical location allows it to serve key global markets, including Europe, North America, and Asia. The collaborative relationships between Israel’s government and aerospace companies have ensured that the country remains at the forefront of innovation and manufacturing in the aerospace industry.

Market Segmentation

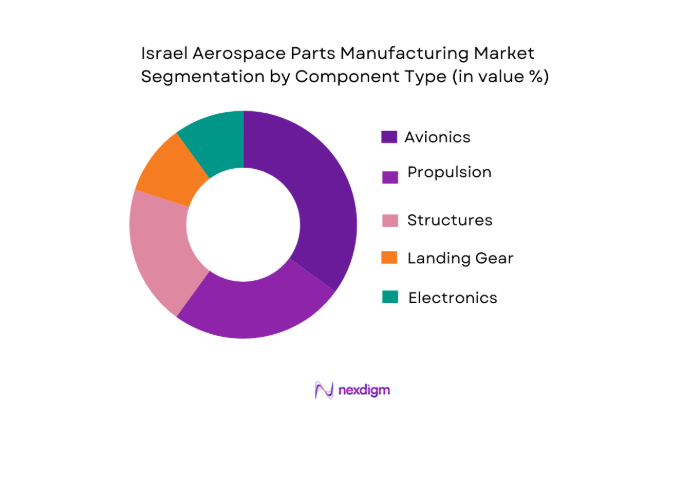

By Component Type

The Israel Aerospace Parts Manufacturing market is segmented by component type, which includes structures, propulsion, avionics, landing gear, and electronics. Among these, avionics has the dominant share in the market. This segment benefits from Israel’s advanced capabilities in radar systems, electronic warfare, and avionics equipment. Companies like Elbit Systems have led innovations in this space, particularly in the integration of avionics for military platforms such as UAVs and fighter jets. The country’s emphasis on high-tech defense systems and the increasing demand for smart, advanced electronics in both military and commercial aircraft make avionics a high-demand segment.

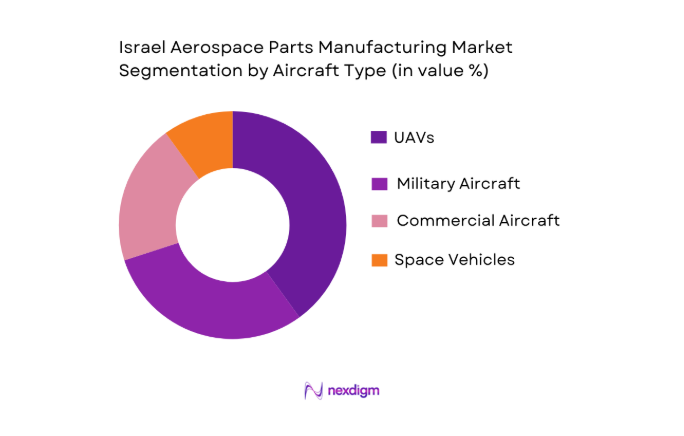

By Aircraft Type

The market is also segmented by aircraft type, including military aircraft, UAVs (unmanned aerial vehicles), commercial aircraft, and space vehicles. UAVs have the largest market share in Israel’s aerospace parts manufacturing sector, driven by both domestic and global demand. Israel’s military and defense strategy relies heavily on UAVs for surveillance, reconnaissance, and strike missions. Additionally, Israel’s aerospace companies, such as Elbit Systems, provide a significant number of UAV components for both local and international markets. The growth of global drone usage, including in commercial sectors, further boosts the demand for UAV-related aerospace parts.

Competitive Landscape

The Israel Aerospace Parts Manufacturing market is dominated by a few major players, including Israel Aerospace Industries (IAI), Elbit Systems, Ashot Ashkelon Industries, and RADA Electronic Industries. These companies have maintained dominance through their expertise in developing military-grade aerospace parts and components, extensive defense contracts, and partnerships with global OEMs like Boeing and Airbus. Additionally, the local industry’s strength is underpinned by the government’s substantial investment in defense technology and aerospace innovation. This consolidation highlights the significant influence of these key companies, which continue to lead technological advancements in military and commercial aerospace segments.

| Company Name | Establishment Year | Headquarters | Product Type | Export Reach | R&D Investment | Strategic Partnerships |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa | ~ | ~ | ~ | ~ |

| Ashot Ashkelon Industries | 1975 | Ashkelon | ~ | ~ | ~ | ~ |

| RADA Electronic Industries | 1989 | Netanya | ~ | ~ | ~ | ~ |

| RT Aerostats Systems | 2003 | Herzliya | ~ | ~ | ~ | ~ |

Israel Aerospace Parts Manufacturing Market Analysis

Israel Aerospace Parts Manufacturing Market Analysis

Growth Drivers

Rising Defense Spending

Rising defense spending is a key growth driver for the Israel Aerospace Parts Manufacturing market. Israel’s defense budget has seen consistent growth in recent years, reaching USD ~ in 2022. This increase in defense expenditure supports the country’s advanced aerospace and defense sectors, especially in the production of UAVs and military aircraft. The Israeli government has emphasized the modernization of military technologies, which directly impacts the demand for aerospace parts. The global increase in military spending, which saw a rise of ~ in 2023, further strengthens the domestic aerospace market in Israel.

Commercial Aerospace Expansion

Commercial aerospace in Israel is expanding steadily due to the growing demand for air travel and global fleet modernization. As of 2024, Israel’s aviation sector has been buoyed by the global recovery of the airline industry, which saw an increase in passenger numbers by over ~ compared to 2023. Israel’s commercial aerospace manufacturers, including Elbit Systems and Israel Aerospace Industries (IAI), are capitalizing on the growth of commercial aircraft orders. Moreover, the Israeli economy is expected to grow at ~ in 2024, contributing to higher demand for air travel and commercial aircraft parts.

Market Challenges

Export Control Regulations

Export control regulations pose a significant challenge to Israel’s aerospace parts manufacturing market. Israel enforces stringent export controls on military and dual-use technologies, which are governed by the Ministry of Defense. In 2024, Israel’s defense export control mechanisms were tightened, with over USD ~ in defense and aerospace exports undergoing scrutiny for compliance with international regulations, including ITAR (International Traffic in Arms Regulations). This regulatory framework limits market access, particularly in high-tech aerospace parts, and requires adherence to compliance procedures, which can delay manufacturing and international sales.

Supply Chain Disruptions

Supply chain disruptions have posed challenges to Israel’s aerospace parts manufacturing sector, particularly in the wake of global logistics bottlenecks. In 2024, Israel’s aerospace sector faced delays due to shortages in raw materials, such as advanced composites and titanium alloys, critical for aircraft and defense components. The global supply chain crisis, exacerbated by geopolitical tensions and the ongoing COVID-19 pandemic, caused extended lead times for critical aerospace parts. This had a cascading effect on Israel’s production timelines and export deliveries.

Opportunities

Growth of Israel’s Space Sector

Israel’s space sector is a growing opportunity for the aerospace parts manufacturing market. In 2022, the country’s space industry saw an investment of over USD ~ in various projects, including satellite systems and space exploration technologies. With increasing global interest in satellite communications, Earth observation, and space exploration, Israel’s space technology capabilities offer a new avenue for aerospace parts manufacturers. The government’s strategic focus on space exploration, particularly the establishment of the Israel Space Agency, further underscores the potential growth opportunities in this segment.

Civil Aviation Fleet Modernization

Israel’s civil aviation fleet is undergoing significant modernization, which presents growth opportunities for aerospace parts manufacturers. In 2024, Israel’s national airlines, such as El Al, began introducing newer, more fuel-efficient aircraft models, including Boeing 787 and Airbus A350. This modernization, driven by the airline industry’s recovery from the pandemic and the rise in passenger traffic, is expected to drive demand for advanced aerospace components. With the growth of the global aviation market, Israel’s position as a hub for aerospace manufacturing strengthens its opportunities in this segment.

Future Outlook

Over the next five years, the Israel Aerospace Parts Manufacturing market is expected to witness significant growth, driven by continuous government support, advancements in aerospace technology, and increasing demand for both military and commercial aerospace components. Israel’s aerospace companies are poised to expand their market share globally, especially in the UAV sector, where international demand continues to grow. Technological advancements in materials, such as lightweight composites and advanced avionics, are expected to further propel growth in the aerospace parts sector. Moreover, Israel’s strong defense ties with global powers and its emphasis on expanding its civilian aerospace capabilities will contribute to the market’s future growth.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Ashot Ashkelon Industries

- RADA Electronic Industries

- RT Aerostats Systems

- Elta Systems Ltd

- Israel Military Industries

- Comtech Telecommunications

- Oshkosh Defense

- Boeing

- Airbus

- General Electric Aerospace

- Safran Group

- Honeywell Aerospace

- Collins Aerospace

Key Target Audience

- Aerospace OEMs

- Investments and Venture Capitalist Firms

- Defense Contractors

- Aviation Regulatory Bodies

- Military & Defense Government Agencies

- Aerospace Component Suppliers

- Government and Regulatory Bodies

- Private Equity Firms Specializing in Aerospace and Defense Investments

Research Methodology

Step 1: Identification of Key Variables

The first phase involves defining the ecosystem, identifying key players and stakeholders in the Israel Aerospace Parts Manufacturing market. Extensive desk research will be conducted to collect historical data, and relevant variables such as the growth of UAVs, defense budgets, and aerospace innovation will be identified.

Step 2: Market Analysis and Construction

In this phase, historical data from various sources such as industry reports, government publications, and financial reports from key aerospace companies will be compiled. This will include analyzing key metrics like market value, production volume, and aircraft production rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested and validated by conducting interviews with industry experts and executives from key aerospace companies. These consultations will provide insights into market trends, key growth drivers, and challenges faced by industry players.

Step 4: Research Synthesis and Final Output

The final output will synthesize all data gathered from secondary and primary research to provide actionable insights. A comprehensive market model will be created that reflects the dynamic nature of the aerospace industry, especially focusing on the shifting demand patterns in military and commercial aircraft components.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Data Sources, Assumptions & Normalization Metrics, Supply Chain Validation & Certification Standards)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Rising Defense Spending

Commercial Aerospace Expansion

Technological Advancements

Strength of Local Suppliers and OEMs - Market Challenges

Export Control Regulations

Supply Chain Disruptions

High Cost of Materials and Manufacturing

Geopolitical Tensions Impacting Trade - Market Trends

Shift to Sustainable Aerospace Manufacturing

Increased Demand for UAV and Drone Parts

Advancements in Composite Materials for Aircraft

Integration of Smart Technologies in Aerospace Components - Opportunities

Growth of Israel’s Space Sector

Civil Aviation Fleet Modernization

Expansion in Commercial Aerospace Exports

Emerging Market Demand - Government Regulations

Impact of Export Controls on Manufacturing

Regulatory Bodies and Certifications

Local Content Regulations and Compliance - SWOT Analysis

- Porter’s 5 Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type , 2020-2025

- By Component Type (In Value %)

Fuselage Structures

Engine Components

Avionics & Electronics

Landing Gear & Actuation Systems - By Aircraft Type (In Value %)

Commercial Aircraft

Military Aircraft

UAVs

Spacecraft Components - By Material Type (In Value %)

Titanium Alloys

Composite Materials

Aluminum Alloys

Specialty Materials - By End‑User (In Value %)

Original Equipment Manufacturers

Maintenance, Repair, and Overhaul Services

Aftermarket Parts Suppliers

Defense & Aerospace Contractors

- Market Share of Major Players

- Cross Comparison Parameters (Supplier Relationships, R&D Investment and Technological Edge, Production Capacity and Output, Compliance with International Standards, Product Portfolio and Innovation, Financial Strength and Revenue Breakdown, Export vs Domestic Market Focus, Strategic Alliances and Partnerships)

- SWOT Analysis of Key Players

Israel Aerospace Industries (IAI)

Elbit Systems

Ashot Ashkelon Industries

RADA Electronic Industries

Other Major Players - Pricing Analysis of Major Players

Unit Pricing for Key Components

Pricing Strategies for OEMs vs Aftermarket Suppliers

Competitor Price Benchmarking - Detailed Profiles of Major Players

Israel Aerospace Industries (IAI)

Elbit Systems

Ashot Ashkelon Industries

RADA Electronic Industries

RT Aerostats Systems

Elta Systems Ltd

Israel Military Industries

Comtech Telecommunications

Oshkosh Defense

Boeing

Airbus

General Electric Aerospace

Safran Group

Honeywell Aerospace

Collins Aerospace

- Cost vs Quality Trade-Offs

- Certification and Compliance Requirements

- Technological Innovation

- UpgradesSupply Chain and Delivery Lead Times

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035

- By Component and Product Type, 2026-2035

- By Region, 2026-2035