Market Overview

The Israel Aerospace Plastics Market is valued at USD ~ in 2025, with continued growth attributed to advancements in material technology and an increasing focus on lightweight components in the aerospace industry. Israel’s aerospace sector has seen a surge in demand for high-performance polymers, driven by both commercial and defense sectors, which seek to improve fuel efficiency and reduce overall weight. The adoption of composite materials like PEEK and PPS in various applications, such as fuselage and cabin interiors, also plays a key role in market expansion. The demand for high-strength plastics continues to grow due to their exceptional durability and heat resistance in critical aerospace applications.

The dominance of Israel in the aerospace plastics market is primarily driven by its robust aerospace manufacturing and defense industry, with major hubs in cities like Tel Aviv and Haifa. The country is home to industry leaders like Israel Aerospace Industries (IAI), which specializes in both commercial and military aircraft manufacturing. Israel’s strong emphasis on defense contracts, innovation in aerospace materials, and government-backed initiatives for advanced material research contribute to its position as a leader. Furthermore, strategic alliances with global aerospace companies bolster its market influence, cementing its standing in the industry.

Market Segmentation

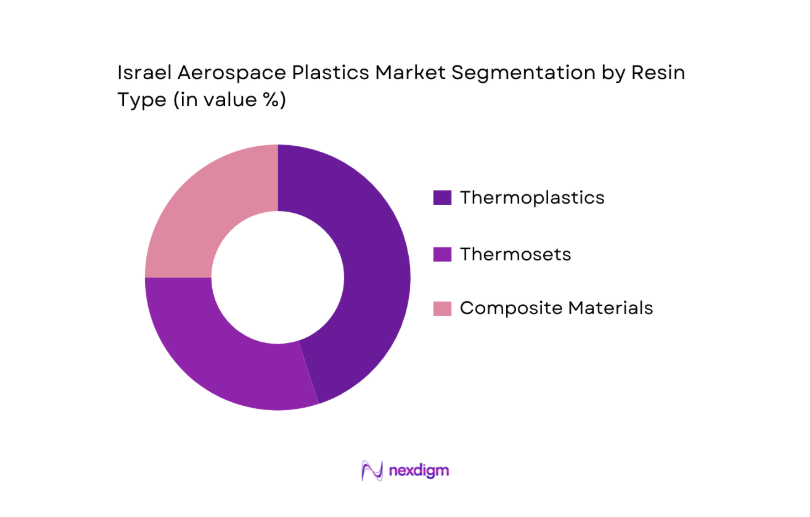

By Resin Type

The Israel Aerospace Plastics Market is segmented by resin type into thermoplastics, thermosets, and composite materials. Thermoplastics, particularly high-performance polymers like PEEK and polycarbonate, have a dominant market share. These materials are favored for their ease of processing, high thermal stability, and resistance to corrosion, making them ideal for critical aerospace components like electrical housings and fluid systems. The increasing demand for lightweight, fuel-efficient solutions in the aerospace industry fuels the preference for these resins. With the advent of 3D printing technologies, the demand for thermoplastics is expected to increase further due to the flexibility and precision they offer in creating complex parts.

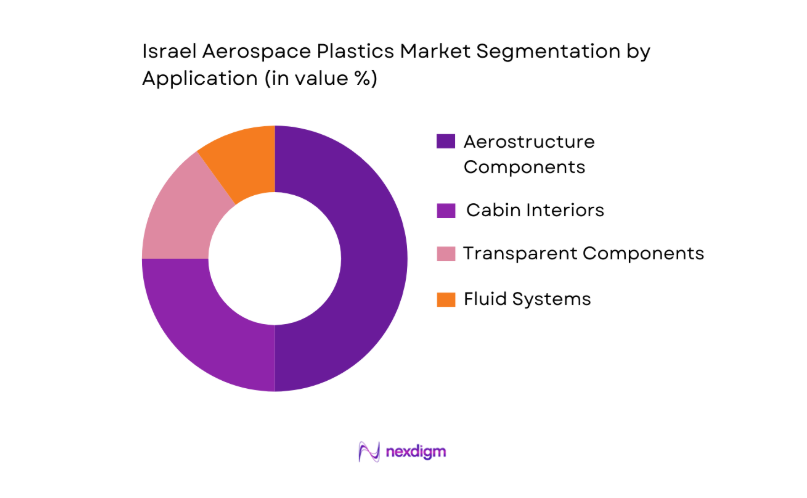

By Application

The market is also segmented by application into aerostructure components, cabin interiors, transparent components, and fluid systems. Aerostructure components hold the dominant share in the market due to the increasing use of advanced plastic composites in wings, fuselage, and landing gears, which require materials that offer high strength-to-weight ratios and excellent performance in extreme conditions. These materials, such as carbon fiber-reinforced polymers, play a crucial role in reducing aircraft weight and improving fuel efficiency, which is a major driving factor for this segment’s dominance in the aerospace plastics market.

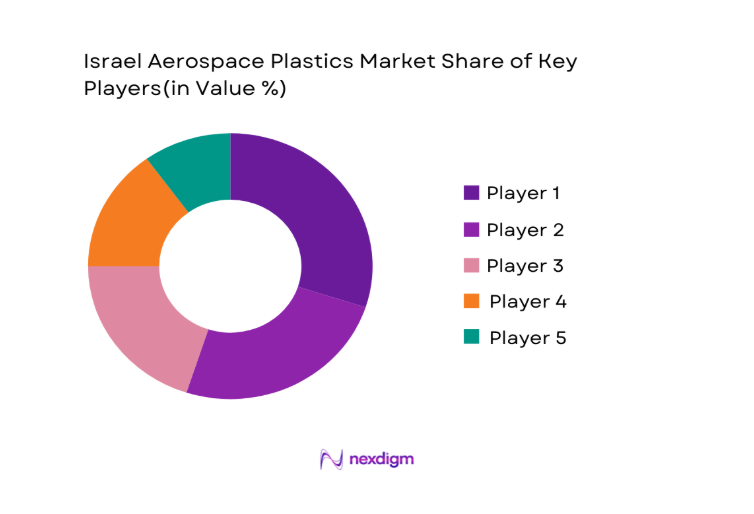

Competitive Landscape

The Israel Aerospace Plastics Market is dominated by a handful of key players, including local companies like Israel Aerospace Industries and international giants such as Solvay and Victrex. These players drive innovation, with a strong emphasis on developing advanced materials that meet the stringent requirements of aerospace applications. The consolidation of market players is visible, as leading companies continue to expand their market presence through strategic partnerships and innovations.

| Company | Establishment Year | Headquarters | Technology Focus | Market Position | R&D Investment | Global Partnerships |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Solvay | 1853 | Brussels, Belgium | ~ | ~ | ~ | ~ |

| Victrex | 1993 | Lancashire, UK | ~ | ~ | ~ | ~ |

| SABIC | 1976 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| Toray Industries | 1926 | Tokyo, Japan | ~ | ~ | ~ | ~ |

Israel Aerospace Plastics Market Analysis

Growth Drivers

Aerospace Industry Demand Growth

The aerospace industry continues to experience substantial demand growth, largely driven by the global recovery in air travel and increased government defense spending. In 2025, global passenger traffic is expected to reach approximately ~, surpassing pre-pandemic levels, thus driving up the demand for commercial aircraft. The increased defense budgets across regions, such as the U.S. and European Union, will also contribute to the continued growth of aerospace manufacturing. According to the World Bank, global defense expenditure was around USD ~ in 2025, marking a consistent increase in defense-related aerospace activity.

Technological Advancements in Polymer Manufacturing

Technological advancements in polymer manufacturing are playing a crucial role in the evolution of aerospace plastics, particularly through innovations in 3D printing and advanced composite materials. In 2024, the adoption of 3D printing in aerospace is expected to grow significantly, driven by improvements in material strength and the cost-efficiency of production. Additionally, high-performance polymers like PEEK are increasingly utilized for parts requiring thermal and chemical resistance. The World Economic Forum estimates that additive manufacturing in aerospace will exceed USD ~ by 2024, reflecting the ongoing investment in these advanced technologies.

Market Challenges

Volatility in Raw Material Prices

The volatility in raw material prices is a key challenge for the aerospace plastics market. In 2024, the price of key raw materials such as carbon fiber and PEEK resins is subject to fluctuations due to supply chain disruptions and raw material shortages. The price of carbon fiber, for instance, has risen by ~ since 2025 due to disruptions in its global supply. As a result, aerospace manufacturers face increased costs in producing key components. According to the IMF, global commodity prices in 2024 are expected to fluctuate by ~ based on geopolitical tensions and supply shortages.

Regulatory & Certification Barriers

Aerospace plastics are subject to stringent regulatory and certification standards to ensure safety and reliability in high-performance environments. In 2025, the European Union and the U.S. FAA continue to impose rigorous testing and approval processes for new materials used in aerospace applications. For example, the approval process for new thermoplastic composites can take up to 18 months due to the complex testing requirements for heat resistance, impact performance, and durability. The length of this certification cycle delays the time-to-market for new materials, impacting manufacturers’ ability to quickly adopt and integrate cutting-edge polymers.

Market Opportunities

Local Supply Chain Expansion

Israel’s domestic aerospace plastics market stands to benefit from expanding local supply chains, which can reduce reliance on international suppliers and mitigate risks posed by geopolitical tensions. In 2025, Israel’s government has prioritized increasing local production of key aerospace materials. The Israel Innovation Authority has allocated USD ~ in grants to local manufacturers for the development of new materials, further accelerating the growth of Israel’s aerospace supply chain. Additionally, Israel Aerospace Industries (IAI) continues to invest in local manufacturing capabilities, supporting the expansion of the country’s aerospace plastics market.

Development of Bio-based Plastics

The aerospace plastics industry is moving toward the development of bio-based plastics as a response to the growing demand for sustainable solutions. As of 2026, the global shift toward eco-friendly materials is creating new opportunities for the adoption of bio-based plastics. For instance, bio-derived thermoplastics such as polyamide and polylactic acid (PLA) are increasingly being tested in aerospace applications for parts like cabin interiors and seats. Bio-based plastic consumption in aerospace is expected to grow as manufacturers look to meet sustainability targets while reducing their carbon footprints.

Future Outlook

Over the next decade, the Israel Aerospace Plastics Market is expected to show significant growth, driven by technological advancements in material science and increasing demand for lightweight components in the aerospace sector. The adoption of advanced polymers like PEEK and carbon-fiber composites, along with the growing need for fuel-efficient solutions in both commercial and military aviation, will likely propel market expansion. Additionally, the rise of additive manufacturing (3D printing) in aerospace manufacturing offers a promising opportunity for further market development. As global demand for advanced aerospace plastics continues to surge, Israel’s strategic position in the industry, supported by a robust defense sector and continuous innovation, ensures its continued market dominance.

Major Players

- Israel Aerospace Industries

- Solvay

- Victrex

- SABIC

- Toray Industries

- Evonik Industries

- Hexcel Corporation

- Plasto-Vack Ltd.

- Polycart Technology

- Aero Sol

- Elbit Systems

- Boeing Advanced Materials

- Airbus Materials Division

- DuPont Engineering Polymers

- Arkema

Key Target Audience

- Aerospace Manufacturers

- Defense Contractors

- Raw Material Suppliers

- Polymer Producers

- Tier-1 Aerospace Component Suppliers

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Aerospace Consulting Firms and Industry Analysts

Research Methodology

Step 1: Identification of Key Variables

The first step involves conducting an ecosystem analysis to identify key drivers, challenges, and technological advancements in the Israel Aerospace Plastics Market. This process utilizes secondary research and market reports to construct an accurate framework of the market variables, focusing on materials, end-users, and growth drivers.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to understand market penetration, technology adoption rates, and material usage trends. The aim is to generate accurate data points regarding market size, value, and segmentations, supported by real-time industry insights from key stakeholders.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on preliminary research and are then validated by conducting in-depth interviews with industry experts. These interviews provide invaluable insights from major aerospace manufacturers, polymer suppliers, and defense contractors to confirm or refine assumptions and predictions.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into actionable insights. Interaction with multiple aerospace players helps verify product usage trends, material preferences, and future market directions. This phase ensures that the data reflects real-time industry demands and challenges, delivering an accurate and reliable market forecast.

- Executive Summary

- Research Methodology (Market Definitions & Scope, Data Collection Approach, Market Sizing Methodology, Key Assumptions & Limitations)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Aerospace Industry Demand Growth

Technological Advancements in Polymer Manufacturing

Shift Toward Lightweight Materials

Domestic Market Developments - Market Challenges

Volatility in Raw Material Prices

Regulatory & Certification Barriers

Supply Chain and Geopolitical Risks - Trends

Rise in Additive Manufacturing Adoption

Sustainability & Green Materials Focus

Smart Materials Integration - Opportunities

Local Supply Chain Expansion

Development of Bio-based Plastics

Export Opportunities to Global OEMs - Government Regulations

Local and International Certification Standards

Trade & Import/Export Regulations

Compliance with Environmental Standards - SWOT Analysis

- Porter’s 5 Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Resin Type (In value %)

Thermoplastics

Thermosets

Composite Materials - By Application (In value %)

Aerostructure Components

Cabin Interiors & Electrical Systems

Transparent Components

Fluid Systems & Ducting - By End-User Segment (In value %)

Commercial Aircraft OEMs

Military & Defense Platforms

Space & Launch Systems

UAVs & Autonomous Systems - By Process Technology (In value %)

Injection Molding

Extrusion/Forming

Additive Manufacturing

- Market Share of Major Players

Share by Value and Volume

Segmentation by Resin Type & Process Technology - Cross Comparison Parameters (Company Overview & Strategic Position, Business Models and Key Product Focus, Financial Metrics & Revenue Breakdown by Product Type, R&D Capabilities & Innovation Focus, Certification & Compliance Performance, Production Capacity and Operational Footprint)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Comparative Pricing Strategies

- Detailed Profiles of Major Players

Israel Aerospace Industries

Solvay

Victrex

SABIC

Evonik

Arkema

Toray Industries

Hexcel Corporation

Plasto-Vack Ltd.

Polycart Technology

Aero Sol

Elbit Systems

Boeing Materials

Airbus Materials Division

DuPont Engineering Polymers

- Market Demand and Utilization

- Cost-Performance Evaluation

- Procurement Strategies & Sourcing Behavior

- Regulatory Compliance Impact on Decision Making

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035