Market Overview

The Israel Aerospace Pressure Gauge Market, valued at USD ~ in 2025, is primarily driven by advancements in aerospace technologies, the expansion of Israel’s defense sector, and a growing demand for precision instrumentation in civil aviation. The demand for aerospace pressure gauges is influenced by the increase in military procurements, commercial aircraft build-ups, and the rising trend of retrofitting older aircraft with new sensor technologies. As the aerospace sector in Israel continues to modernize, the market for aerospace pressure gauges has also expanded due to the integration of smart gauges, which offer better accuracy and reliability.

Israel’s aerospace pressure gauge market is dominated by key cities such as Tel Aviv and Haifa. The country’s defense and aerospace sectors, which contribute significantly to the market, are concentrated around these cities, with major defense contractors and research facilities located in Haifa, and Tel Aviv serving as a hub for international aerospace collaborations. Israel’s defense ministries, coupled with the technological advancements in both military and commercial aviation, make these cities the focal points for aerospace innovation, driving the pressure gauge market’s growth.

Market Segmentation

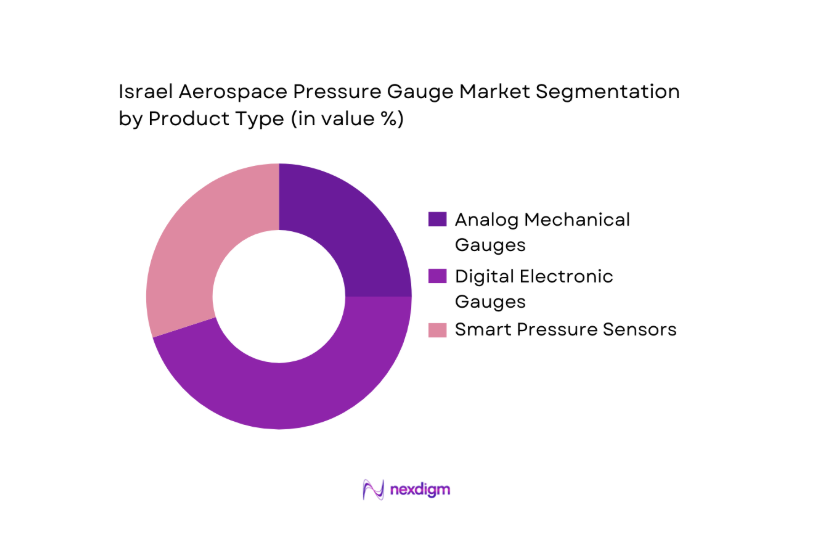

By Product Type

The Israel Aerospace Pressure Gauge Market is segmented into analog mechanical gauges, digital electronic gauges, and smart pressure sensors. Among these, digital electronic gauges dominate the market share in 2024 due to their high accuracy and integration with modern avionics systems. Digital gauges offer enhanced precision in pressure measurements, crucial for the increasing automation in aerospace systems. With the rise of smart technologies in aviation, these electronic gauges are also seeing increased adoption in both commercial and military aircraft for critical applications such as fuel systems and hydraulic controls.

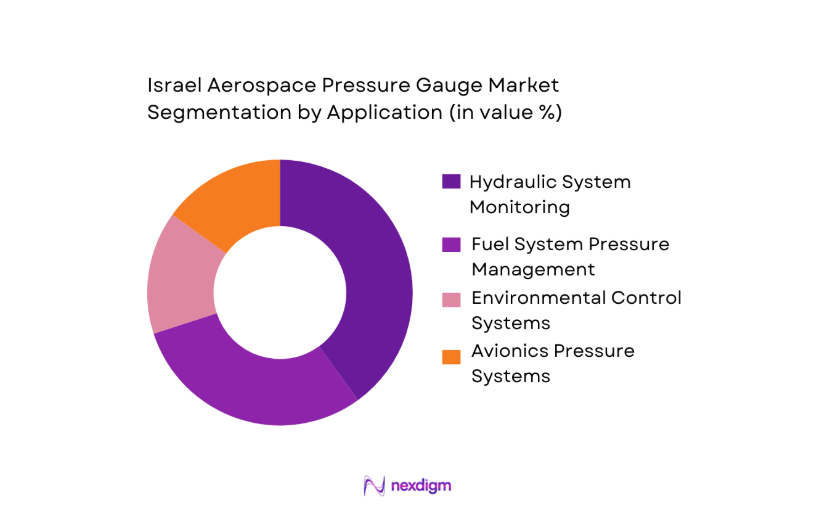

By Application

The Israel Aerospace Pressure Gauge Market is also segmented by application into hydraulic system monitoring, fuel system pressure management, environmental control systems, and avionics pressure systems. Hydraulic system monitoring holds the largest market share in 2024, as these systems are integral to both commercial and military aircraft operations. Pressure gauges are essential in maintaining hydraulic pressure within safe operational limits, ensuring the effective functioning of aircraft systems such as landing gear and flight control actuators. The constant demand for high-performance hydraulic systems in military aircraft and commercial airliners contributes to the dominance of this application segment.

Competitive Landscape

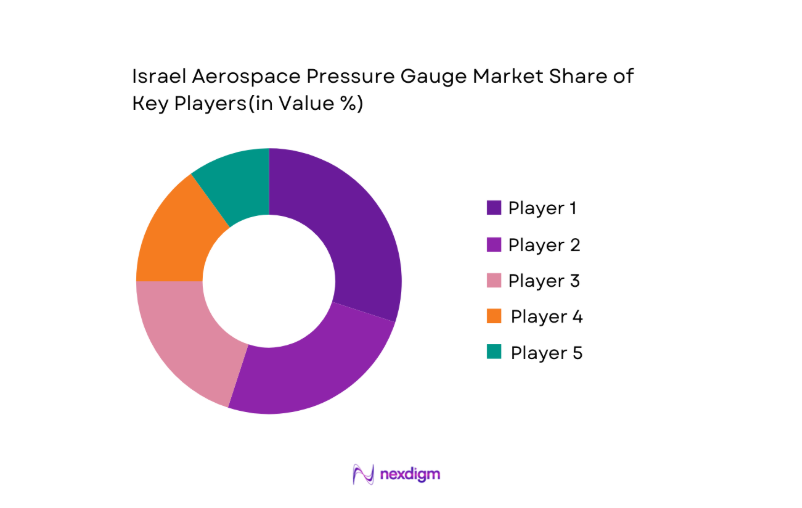

The Israel Aerospace Pressure Gauge Market is dominated by a few major players, including Honeywell, Emerson Electric, and Meggitt. These companies control a significant portion of the market, thanks to their well-established brand reputation, advanced technologies, and strong partnerships with defense and aerospace contractors. The competition is also influenced by regional players who have a deep understanding of the local market, particularly in defense procurement. As the demand for high-precision pressure gauges continues to rise, global and local players alike are pushing for technological innovation and certification advancements.

| Company Name | Establishment Year | Headquarters | Product Focus | Certification Compliance | R&D Investment | Market Penetration | Sales Channels | Technology Focus |

| Honeywell | 1906 | Morris Plains, US | ~ | ~ | ~ | ~ | ~ | ~ |

| Emerson Electric | 1890 | St. Louis, US | ~ | ~ | ~ | ~ | ~ | ~ |

| Meggitt | 1943 | England, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | Cleveland, US | ~ | ~ | ~ | ~ | ~ | ~ |

| WIKA Instrument | 1946 | Klingenberg, DE | ~ | ~ | ~ | ~ | ~ | ~ |

Israel Aerospace Pressure Gauge Market Analysis

Growth Drivers

Aviation Growth

Aviation growth is a key driver for the aerospace pressure gauge market, especially in Israel, as the country’s aviation sector continues to experience robust expansion. Israel’s commercial aviation is projected to grow with an increase in international travel, bolstered by the recovery of global airlines. In 2024, the global air traffic is expected to reach 90% of pre-pandemic levels, according to the International Air Transport Association (IATA). The demand for advanced aircraft and components, such as pressure gauges, continues to rise. Furthermore, Israel is one of the leading countries in the development of unmanned aerial systems (UAS), which requires pressure gauges for accurate and reliable performance. Increased government investments in civil aviation infrastructure further stimulate market growth.

Defense Expansion

Defense expansion is a crucial growth driver for the Israeli aerospace pressure gauge market. Israel’s defense spending is increasing, with an estimated USD 24.8 billion budget for 2024, marking a 3% increase from the previous year, according to the Israeli Ministry of Defense. The country is focusing on modernizing its military capabilities, which includes upgrading air defense systems, fighter jets, and UAVs, all of which require highly reliable pressure gauges. With Israel’s position as a global defense powerhouse, the market for pressure gauges used in military aircraft, helicopters, and drones is expected to benefit from this expansion. The growth of defense expenditure is complemented by Israel’s ongoing efforts to export defense technology to other nations, further driving the demand for high-performance aerospace components.

Market Challenges

Stringent Certification

Stringent certification requirements for aerospace components, including pressure gauges, present a major challenge to market growth. The aviation industry is governed by international standards set by agencies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). In Israel, the Civil Aviation Authority (CAA) enforces these stringent regulations. As of 2024, all new pressure gauges used in civilian and military aircraft must meet the EASA DO-160G and MIL-STD certification standards, which involve rigorous testing and approval processes. Meeting these standards requires significant investments in research and development, increasing the time and cost to market for manufacturers. Additionally, the complexity of certification delays the entry of new technology into the market, creating hurdles for manufacturers aiming to introduce innovative solutions.

Supply Chain Beta Constraints

Supply chain constraints are a significant challenge faced by the aerospace pressure gauge market. Israel’s aerospace sector relies on complex global supply chains for the procurement of materials, components, and finished goods. In recent years, disruptions due to geopolitical tensions and the COVID-19 pandemic have caused delays and shortages in the supply of key raw materials such as high-grade alloys and semiconductor components, which are vital for manufacturing precision gauges. With global supply chains still recovering, manufacturers in Israel face difficulties in maintaining production schedules. Additionally, raw material price fluctuations, driven by global market instability, further complicate the supply chain. As of 2024, lead times for certain aerospace components have increased by 20%, impacting overall production timelines for aerospace systems, including pressure gauges.

Opportunities

MRO Expansions

The growing demand for maintenance, repair, and overhaul (MRO) services is a significant opportunity for the Israel aerospace pressure gauge market. As Israel’s defense and commercial aviation sectors continue to expand, the need for MRO services is increasing. According to the Israel Ministry of Transportation, the number of aircraft undergoing MRO in Israel is expected to grow by 15% by 2026. Pressure gauges play a critical role in the ongoing maintenance of aircraft hydraulic, fuel, and environmental systems. The expansion of MRO capabilities in Israel provides significant growth opportunities for suppliers of aerospace pressure gauges. This growth is supported by Israel’s strategic location as a hub for Middle Eastern airlines, further driving demand for MRO services and aerospace parts.

Space Program

Israel’s expanding space program presents substantial opportunities for the aerospace pressure gauge market. With initiatives like the SpaceIL mission and plans for more advanced satellite launches, Israel is making significant strides in space exploration. As of 2024, Israel’s government is increasing investments in its space infrastructure, with the Israel Space Agency (ISA) receiving a projected USD 60 million boost in funding. This growing focus on space exploration requires advanced aerospace components, including pressure gauges, to monitor the performance of spacecraft in various environmental conditions. The growing demand for reliable and high-performance gauges in space missions opens up new market opportunities for manufacturers. The advancements in Israel’s space program are expected to require specialized pressure sensors for applications such as fuel systems and environmental monitoring, further propelling demand for these components.

Future Outlook

The Israel Aerospace Pressure Gauge Market is poised for robust growth in the coming decade. Over the next few years, the market is expected to show steady growth driven by advancements in aerospace technologies, increasing defense contracts, and the ongoing modernization of Israel’s commercial aviation fleet. Furthermore, with global aerospace companies adopting more advanced sensor technologies, including IoT-based smart pressure gauges, there is potential for market expansion into new aerospace segments, including space exploration and unmanned aerial vehicles (UAVs).

The adoption of digital and smart pressure gauges is expected to surge, driven by the need for improved accuracy and reliability in monitoring critical aerospace systems. Additionally, the aerospace sector’s push for sustainability and energy efficiency will foster demand for more advanced, energy-efficient pressure gauges in environmental control and fuel systems.

Major Players

- Honeywell International Inc.

- Emerson Electric Co.

- Meggitt PLC

- Parker Hannifin Corp.

- WIKA Instrumentation

- AMETEK, Inc.

- Keller AG für Druckmesstechnik

- Ashcroft Inc.

- Gems Sensors & Controls

- Sensata Technologies

- TE Connectivity

- Bourdon Haenni

- QED, Inc.

- Circor Aerospace

- Aerospace System Integrators

- Newbow Aerospace Ltd.

Key Target Audience

- Aerospace OEMs

- Military Defense Agencies

- Aerospace MRO Providers

- Airline Operators

- Pressure Sensor Manufacturers

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying key market variables such as product type (analog, digital, smart gauges), application types (hydraulic, fuel, avionics systems), and geographic factors influencing the Israeli aerospace pressure gauge market. Extensive desk research is conducted, gathering data from secondary sources, databases, and industry reports.

Step 2: Market Analysis and Construction

Historical data is analyzed to construct a robust market model. This includes market size, growth trends, and segmentation, coupled with an assessment of the Israeli aerospace sector’s dynamics, such as defense spending, commercial aviation growth, and technological advancements in pressure gauge technologies.

Step 3: Hypothesis Validation and Expert Consultation

Expert opinions are gathered through interviews with industry leaders, including OEMs, suppliers, MRO providers, and regulatory bodies. These consultations help validate market assumptions and provide detailed insights into market trends, customer needs, and competitive dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings to develop a comprehensive report. This includes in-depth market insights derived from primary research, expert consultations, and verified data points. This step ensures that the final output is accurate, actionable, and reflective of current and future market conditions.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview of aerospace nautical & aircraft pressure gauges

- Timeline

- Growth drivers

aviation growth

defense expansion

avionics modernization - Market challenges

stringent certification

supply chain beta constraints - Market trends

digital retrofit

predictive maintenance sensors - Opportunities

MRO expansions

space programs

exports - Government regulations

- SWOT analysis

- Porter’s Five Forces

- By market value, 2020-2025

- By unit shipments, 2020-2025

- Average price per gauge type, 2020-2025

- By Pressure Gauge Type (In Value %)

Analog mechanical gauges

Digital electronic gauges

Smart IoT‑enabled pressure sensors

Wireless aviation pressure monitoring units - By Technology (In Value %)

Piezoresistive sensors

Capacitive sensors

MEMS pressure technologies

Hybrid sensor systems - By End‑Use Aircraft Platform (In Value %)

Commercial aircraft

Military aircraft

Helicopter/rotorcraft

Space & launch vehicles - By Application (In Value %)

Hydraulic system monitoring

Environmental control & cabin pressure

Fuel system & avionics pressurization

Engine & bleed air systems

- Market Share of Major Players

Share by revenue contributions

Installed base percentages in Israeli aerospace systems - Cross Comparison Parameters (Gauge Accuracy Performance, Certification Compliance Depth, Temperature Range Capability, Vibration & Shock Tolerance, Weight per Unit)

- SWOT Analysis of Key Players

Strategic capability in aerospace pressure gauge

Technology differentiation

Supply chain robustness - Pricing Analysis of Major Players

OEM vs aftermarket unit pricing

Certification premium pricing differences - Detail Profile of Major Players

Honeywell International Inc.

AMETEK, Inc.

Emerson Electric Co.

Parker Hannifin Corp.

Meggitt PLC

Keller AG für Druckmesstechnik

Ashcroft Inc.

WIKA Instrumentation

Gems Sensors & Controls

Sensata Technologies

TE Connectivity

Bourdon Haenni

QED, Inc.

Circor Aerospace

Newbow Aerospace Ltd.

- OEM avionics procurement criteria

- MRO & aftermarket adoption cycles

- Defense procurement pressures

- Certification & compliance cost impacts

- By market value, 2026-2035

- By volume of units sold/installed, 2026-2035

- Average price per gauge type, 2026-2035