Market Overview

The Israel aerospace propulsion systems market is valued at approximately USD ~ in 2024, supported by a robust defense sector, advancements in propulsion technologies, and increasing demand for UAVs and space launch systems. Israel’s aerospace industry is one of the most developed globally, with a strong focus on defense and commercial aerospace propulsion technologies. The market size is primarily driven by the government’s defense spending, investments in space exploration, and the demand for high-performance propulsion systems across various aerospace platforms.

Israel, particularly cities such as Tel Aviv and Herzliya, stands as a leading hub for aerospace propulsion technology. The dominance of Israel in the global aerospace propulsion market is largely attributed to its strategic government initiatives, technological expertise, and strong military demand. The country’s investment in defense, specifically in advanced UAV systems and missile technology, significantly fuels market growth. Additionally, Israel’s collaboration with international aerospace firms further strengthens its position in the market, allowing the integration of cutting-edge propulsion systems in both commercial and defense sectors.

Market Segmentation

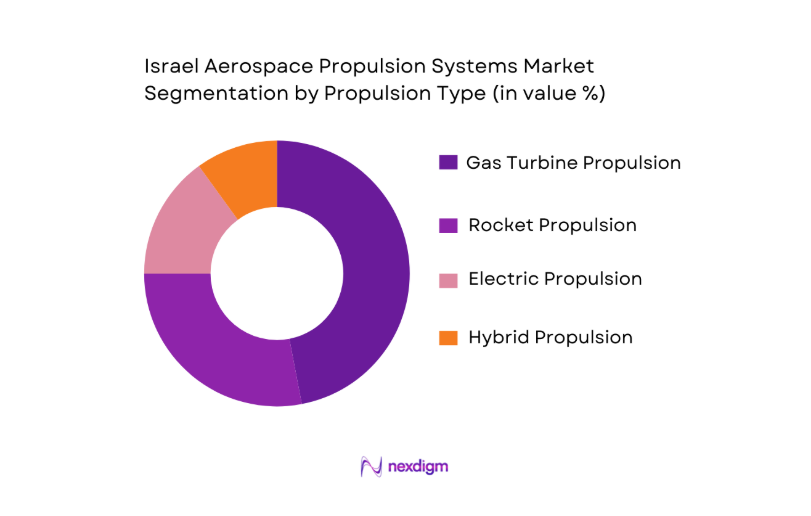

By Propulsion Type

The Israel aerospace propulsion systems market is segmented by propulsion type into Gas Turbine, Rocket Propulsion, Electric Propulsion, and Hybrid Propulsion. Among these, gas turbine propulsion systems are the dominant segment in the market due to their reliability and performance in various military and commercial applications. These systems, often used in aircraft and UAVs, continue to lead the market because of their proven efficiency and high thrust-to-weight ratio, making them essential for both fixed-wing military and commercial aircraft. The increasing reliance on UAVs for both military and surveillance purposes has contributed to the growth of the gas turbine propulsion systems segment in Israel.

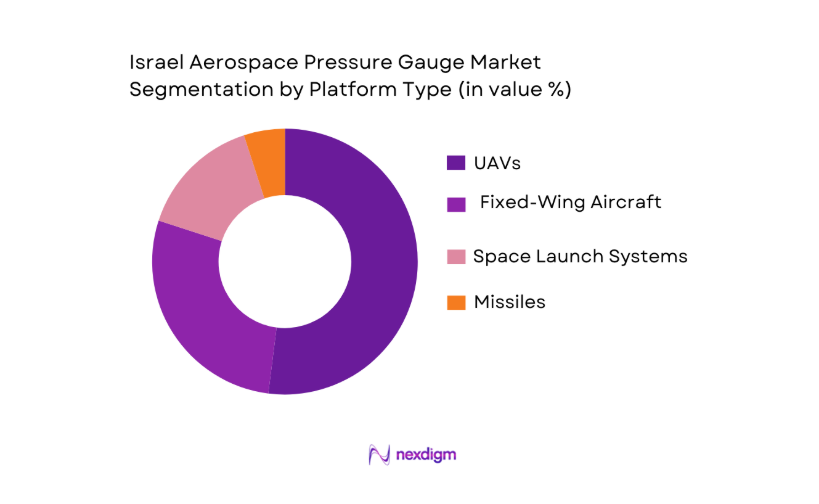

By Platform Type

The market is also segmented by platform type into Fixed-Wing Aircraft, UAVs, Space Launch Systems, and Missiles. UAVs hold the largest market share in Israel, primarily due to the country’s significant investment in unmanned aerial systems for both defense and commercial applications. These UAVs, which rely heavily on advanced propulsion technologies, continue to dominate because of Israel’s leadership in the global UAV market. Additionally, the Israeli military’s increasing demand for surveillance drones, loitering munitions, and reconnaissance platforms plays a pivotal role in the dominance of this sub-segment.

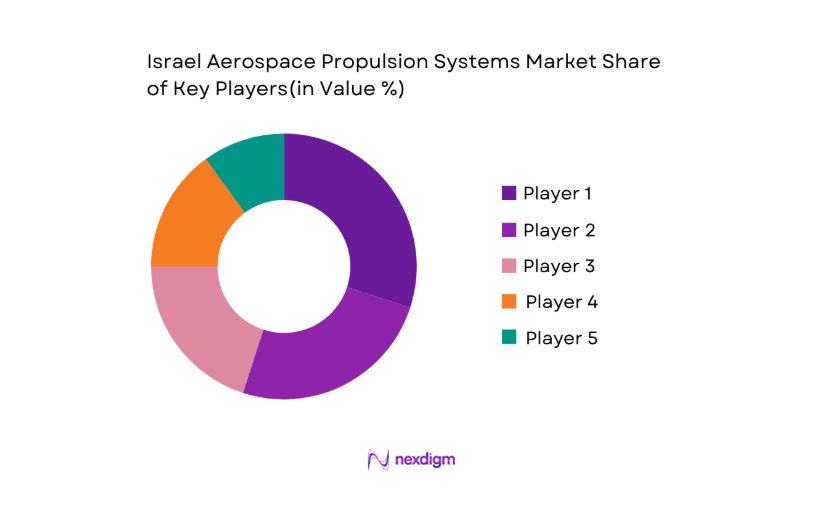

Competitive Landscape

The Israel aerospace propulsion systems market is characterized by strong competition, with key players that dominate both the domestic and international markets. These companies are leaders in developing cutting-edge propulsion technologies used in aerospace defense systems, UAVs, and space applications. The major companies benefit from long-standing government contracts, significant R&D investments, and collaborations with international aerospace firms.

| Company | Establishment Year | Headquarters | Technologies | R&D Investment | Key Products | Market Focus |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Tomer Propulsion Systems | 1983 | Beer Sheva, Israel | ~ | ~ | ~ | ~ |

| Bet Shemesh Engines Ltd | 1985 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

Israel Aerospace Propulsion Systems Market Analysis

Growth Drivers

Defense Budgets

Global defense spending has seen substantial increases in recent years, especially in Israel, driven by the country’s strategic priorities in maintaining national security. The Israeli defense budget is projected to remain robust in the coming years, with approximately USD ~ allocated for defense in 2024. This growth in defense expenditure is expected to continue with a steady rise in demand for advanced propulsion systems in defense applications. Israel’s commitment to technological advancement in missile defense and aerospace systems will further fuel the need for cutting-edge propulsion technologies. According to the World Bank, the defense expenditure as a percentage of GDP for Israel stands at ~, one of the highest globally. This level of investment is key to sustaining the market for aerospace propulsion systems.

Space Commercialization

The growing focus on space commercialization is another key growth driver for the Israel aerospace propulsion systems market. Israel’s active participation in the space sector, with significant government-backed initiatives, is contributing to the growth of space exploration and satellite technology. In 2024, Israel’s space industry is expected to receive USD ~ in government funding, with further plans to enhance satellite and launch vehicle production. The rapid expansion of private sector players in Israel, such as the launch services and satellite manufacturers, is driving demand for propulsion systems. According to the Israeli Ministry of Science and Technology, the country’s investment in space technologies has grown by ~ from 2020 to 2024. This reflects the nation’s growing commitment to commercial space ventures, increasing the demand for advanced propulsion systems that support satellite launches and space exploration.

Market Challenges

Export Controls

Export controls have become a significant challenge for the Israeli aerospace propulsion systems market, particularly with regard to defense and dual-use technologies. Israel’s strict defense export regulations restrict the flow of aerospace propulsion systems to certain regions, limiting international trade opportunities. In 2025, the Israeli government is tightening its export regulations in line with global non-proliferation agreements. These regulations are intended to control sensitive military technologies, including propulsion systems, which impacts the ability of companies to expand in foreign markets. The Israeli Ministry of Defense’s Directorate of Defense Export Controls (DECA) reports that export licenses for certain propulsion systems are only granted following strict vetting and compliance with international arms agreements, making market access more complex.

Supply Chain Constraints

The Israel aerospace propulsion systems market faces considerable supply chain constraints, exacerbated by the global semiconductor shortage and disruptions in global logistics networks. In 2025, a significant challenge arises from the dependence on global suppliers for high-tech materials, components, and specialized manufacturing equipment needed for advanced propulsion systems. These constraints are expected to lead to delays in production timelines for new propulsion technologies. The Israeli aerospace industry is taking measures to mitigate these issues by increasing domestic manufacturing capacity and seeking alternate suppliers, but ongoing global supply chain disruptions continue to present hurdles. The Israeli government, through initiatives like the National Cyber and Innovation Authority, is investing in strengthening the local aerospace supply chain to reduce reliance on global imports.

Market Opportunities

Advanced Electric Propulsion

The ongoing development of advanced electric propulsion systems presents a significant opportunity for the Israel aerospace propulsion market. Israel’s investment in electric propulsion technologies has been increasing, driven by a strong interest in reducing the carbon footprint of aerospace systems. Currently, Israel has several startups and aerospace manufacturers exploring electric and hybrid-electric propulsion systems for both UAVs and commercial aircraft. For example, the Israeli company MagniX is focusing on the development of electric propulsion solutions for small aircraft, which are expected to play a crucial role in reducing operating costs for regional flights. The Israeli government, through its support for clean technology innovations, is accelerating the development of electric propulsion technologies as part of its broader environmental policy goals. Israel’s aerospace sector is particularly well-positioned to lead in the global transition to electric propulsion, supported by the country’s strong R&D base and government incentives.

Space Logistics

With the ongoing commercialization of space, space logistics is becoming a key growth area in the aerospace propulsion market. Israel is one of the key players in the global space logistics sector, especially in satellite deployment and space exploration missions. Companies like SpaceIL, which successfully landed an unmanned spacecraft on the Moon, are driving the demand for reliable propulsion systems in the space logistics sector. Israel’s space capabilities, combined with its expertise in propulsion technologies, place the country in a prime position to capitalize on the growing space logistics market. In 2024, Israel is expected to launch multiple commercial satellite missions, further boosting the demand for propulsion systems. As the market for space transportation grows, Israel’s established aerospace and defense industry will provide the foundation for continued success in space logistics.

Future Outlook

Over the next decade, the Israel aerospace propulsion systems market is expected to show considerable growth. This growth is driven by technological advancements in propulsion systems, the expanding demand for UAVs in military and civilian sectors, and Israel’s increasing involvement in space exploration initiatives. The country’s defense budget will likely continue to support the development of next-generation propulsion systems for advanced aircraft and missiles. Furthermore, Israel’s growing collaboration with global aerospace players will help to bring innovative propulsion solutions to the forefront, ensuring a promising market trajectory.

Major Players

- Israel Aerospace Industries

- Tomer Propulsion Systems

- Bet Shemesh Engines Ltd

- Elbit Systems

- Rafael Advanced Defense Systems

- General Electric Aerospace

- Rolls-Royce Holdings plc

- Pratt & Whitney

- Honeywell Aerospace

- Safran S.A.

- MagniX

- Aerojet Rocketdyne

- Heron Systems

- Aviation Engines Ltd

- Innovative Propulsion Technologies

Key Target Audience

- Defense Contractors and OEMs

- Aerospace Propulsion System Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Commercial Aircraft Manufacturers

- Space Exploration Agencies

- UAV Manufacturers and Integrators

- Aerospace Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we will identify and define key variables that affect the Israel aerospace propulsion systems market. This includes analyzing propulsion types, platform demand, R&D investments, and defense industry trends. We will utilize both primary and secondary research to gather a comprehensive understanding of the market dynamics.

Step 2: Market Analysis and Construction

We will collect and analyze historical data from defense contracts, space programs, and UAV deployments. This step also involves understanding revenue generation across aerospace platforms and propulsion systems. This phase helps in estimating current and future market penetration.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with experts, including aerospace engineers, system integrators, and military officials. Their insights will help refine market assumptions, providing a more accurate reflection of current trends and future projections.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with aerospace manufacturers and defense agencies to validate assumptions regarding propulsion technologies. This ensures that the market data is comprehensive, accurate, and aligned with real-world conditions, resulting in a well-rounded report on the Israel aerospace propulsion systems market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Defense budgets

space commercialization

UAV proliferation - Market Challenges

Export controls

supply chain constraints

certification barriers - Opportunities

Advanced electric propulsion

space logistics

dual‑use tech exports - Market Trends

Shift to electric/hybrid

additive manufacturing adoption - Government Regulations & Export Regimes

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2025-2025

- By volume, 2025-2025

- By average price, 2025-2025

- Propulsion Type Segmentation (In Value %)

Gas Turbine / Turbofan / Turbojet

Rocket Chemical Propulsion

Electric & Hybrid‑Electric Propulsion

Cold‑Gas / Hall / Ion / EP

Additive Manufacturing Components - Platform Segmentation (In Value %)

Fixed Wing Military & Commercial

UAV / UAS

Space Launch & Orbital Systems

Missile & Strategic Systems

Experimental / Next‑Gen Platforms - End‑User Segmentation (In Value %)

Defense Forces

Space Agencies & Commercial Space

Commercial Aviation Integrators

OEM Tiered Suppliers - Component & Subsystem Segmentation (In Value %)

Core Engines / Thrusters

Power Electronics / Control Units

Fuel & Propellant Systems

Thermal Management

- Market Share of Major Players

- Cross‑Comparison Parameters (Thrust / Power Class, Propulsion Type Capability, Installed Base, Current Israel Export Licenses / Approvals Held, R&D Intensity & Patent Portfolio)

- SWOT Analysis of Key Players

- Pricing Analysis

- Detailed Profiles of Major Players

Israel Aerospace Industries

Bet Shemesh Engines Ltd

NewRocket

Tomer Propulsion Systems

Airobotics

UVision Air

AgriDrones Solutions

Airwayz Drones

AP Engineering

Honeywell Aerospace

Safran S.A.

General Electric Aerospace

Rolls‑Royce Holdings plc

Pratt & Whitney

MagniX

- Performance & Reliability Metrics

- Cost of Ownership / Lifecycle Support

- Compliance & Certification Requirements

- By Market Value, 2026‑2035

- By Volume, 2026‑2035

- By Average System Price, 2026‑2035