Market Overview

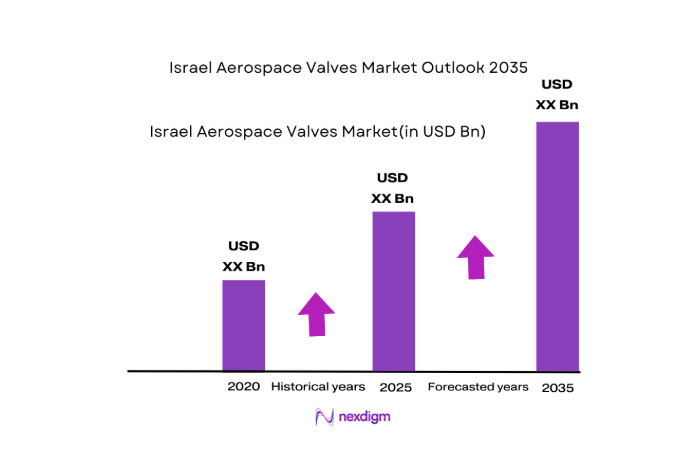

The Israel aerospace valves market is valued at USD ~, driven by the country’s robust aerospace sector and growing demand for high-performance valves used in both military and commercial applications. The market is supported by Israel’s strong defense budget, including aerospace advancements in military aircraft, UAVs, and satellite technologies. Furthermore, innovations in valve technologies, such as the integration of advanced materials for weight reduction and enhanced durability, have also contributed significantly to market growth.

The dominant players in the Israeli aerospace valves market are concentrated in Tel Aviv, Haifa, and Eilat. These cities host the majority of aerospace manufacturers and defense contractors, including major players like IAI (Israel Aerospace Industries) and Elbit Systems. The concentration of key defense agencies, aerospace OEMs, and MRO facilities in these regions, coupled with a strong focus on technological innovation and military procurement, has cemented their dominance in the aerospace market.

Market Segmentation

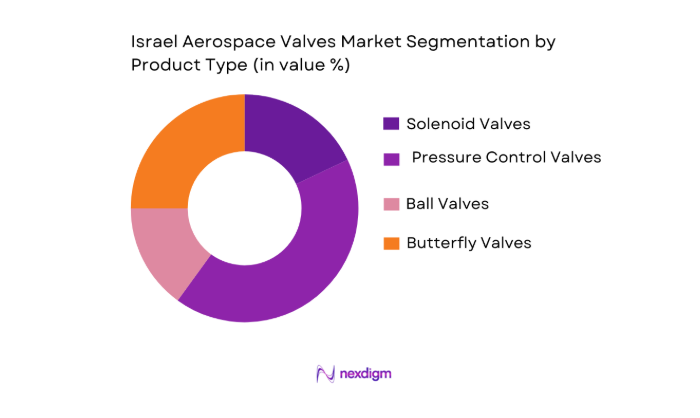

By Product Type

The Israel aerospace valves market is segmented by product type into solenoid valves, pressure control valves, ball valves, and butterfly valves. Among these, pressure control valves dominate the market due to their critical role in regulating hydraulic and pneumatic systems used in aerospace applications. They are essential in ensuring safe and efficient aircraft operations, particularly in commercial and military aviation systems. Their high demand stems from stringent regulatory standards and the growing adoption of advanced aerospace systems that require precise control of fluid pressure.

By Aircraft Platform

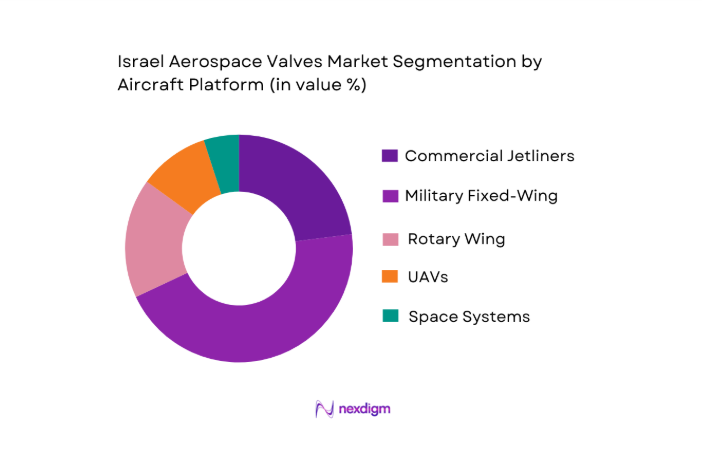

The market is segmented by aircraft platform into commercial jetliners, military fixed-wing aircraft, rotary wing (helicopters), UAVs, and space systems. Military fixed-wing aircraft hold the largest market share in the aerospace valves sector, driven by Israel’s substantial defense budget and its focus on advanced military technology. This segment includes critical applications in fighter jets, surveillance aircraft, and other defense platforms that require high-reliability valves for fluid and gas management under extreme conditions.

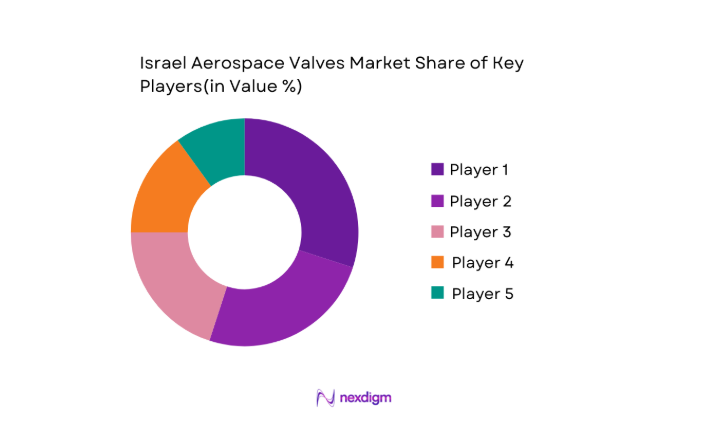

Competitive Landscape

The Israeli aerospace valves market is primarily driven by several key players, both domestic and international. The market is largely consolidated with a few dominant players providing advanced valve technologies to the defense and aerospace sectors. These include Israel Aerospace Industries (IAI), Elbit Systems, and international firms such as Honeywell and Parker Hannifin.

The dominant players in the Israeli aerospace valves market have established themselves as leaders due to their innovative product offerings, deep ties with local military and aerospace agencies, and robust R&D capabilities. The market is characterized by high entry barriers, including stringent certification requirements, high capital investment, and complex supply chain management.

| Company Name | Establishment Year | Headquarters | Technology Focus | Product Range | Key Customer Base |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ |

| Honeywell | 1885 | Morris Plains, USA | ~ | ~ | ~ |

| Parker Hannifin | 1917 | Cleveland, USA | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ |

Israel Aerospace Valves Market Analysis

Growth Drivers

Defense Procurement Trends

Defense procurement trends in Israel continue to be strong, with the Israeli Ministry of Defense (IMOD) allocating approximately USD ~ in its defense budget for 2024, marking an increase of ~ from the previous year. The country’s commitment to cutting-edge military technology, including advanced aerospace components, drives the demand for aerospace valves. Israel’s defense sector is known for its technological advancements in military aircraft, UAVs, and missile systems, which require high-performance valve systems. The government’s focus on bolstering military capabilities underpins the continued growth of defense-related aerospace applications.

Local OEM Integration

Israel’s aerospace sector benefits from robust local OEM integration, with leading manufacturers like Israel Aerospace Industries (IAI) and Elbit Systems playing pivotal roles in the production of aerospace systems. In 2024, Israel Aerospace Industries secured contracts worth over USD ~ to supply various aerospace technologies to both military and commercial customers. The collaboration between OEMs and domestic suppliers creates a thriving ecosystem for aerospace components, including valves. The integration of these components into domestic platforms ensures a strong, localized market for aerospace valves.

Market Challenges

Certification Barriers

Aerospace valve manufacturers face significant certification challenges in the Israel market due to strict requirements imposed by international regulatory bodies such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency). In 2024, the FAA alone issued over 7,000 certifications for aerospace components, highlighting the stringent regulatory environment that companies must navigate. For valves used in both commercial and military applications, meeting these certification standards requires rigorous testing, documentation, and quality control procedures, often extending development timelines and increasing costs for manufacturers.

Supplier Qualification Risk

Supplier qualification risk remains a significant challenge in the aerospace valve market. The procurement process for aerospace components involves multiple stages of testing, with a high level of scrutiny on suppliers. In 2024, the International Traffic in Arms Regulations (ITAR) will continue to enforce restrictions on the export of critical components, including valves, which must meet rigorous military specifications. The cost of qualifying suppliers for both military and commercial valve production can be substantial, with average qualification processes for military-grade components requiring over 18 months of documentation and audits.

Market Opportunities

UAV Expansion

The expansion of unmanned aerial vehicles (UAVs) offers significant opportunities for the Israel aerospace valves market. Israel is a global leader in UAV technology, with the Ministry of Defense allocating USD ~ in 2024 for UAV development, including new models for surveillance and defense purposes. UAVs require specialized valve systems for fluid control in both propulsion and hydraulic systems. As UAVs become increasingly integral to military and commercial applications, the demand for high-performance aerospace valves is expected to rise, creating a lucrative opportunity for suppliers in Israel’s aerospace industry.

Space Program Valve Expansion

Israel’s space program, led by the Israel Space Agency (ISA), is expanding rapidly, particularly with its focus on satellite technology and potential future lunar missions. In 2024, the ISA’s budget includes an allocation of over USD ~ for ongoing space research and satellite launches. Space missions require highly specialized aerospace valves for managing fluids in harsh environments, and as Israel’s space capabilities continue to grow, the demand for these advanced valve systems is projected to increase. The market for aerospace valves used in space programs offers considerable growth potential, given Israel’s commitment to expanding its presence in global space exploration.

Future Outlook

Over the next decade, the Israel aerospace valves market is poised for significant growth, driven by ongoing advancements in aerospace technology, including the development of next-generation aircraft and space systems. The continued investment in military and defense capabilities, along with the growing demand for high-performance valves, will propel market expansion. Furthermore, the push for innovative solutions like IoT-enabled valves and additive manufacturing is expected to enhance the market’s potential, making it a key player in the global aerospace industry.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Honeywell

- Parker Hannifin

- Moog Inc.

- Eaton Corporation

- Crane Aerospace & Electronics

- ITT Aerospace Controls

- Meggitt PLC

- Liebherr Aerospace

- Circor International, Inc.

- Safran Group

- Triumph Group

- BAE Systems

- Raytheon Technologies

Key Target Audience

- Aerospace Manufacturers

- Military and Defense Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Component Suppliers

- Military Procurement Units

- Aerospace MRO Providers

- International Aerospace Agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying all significant factors influencing the Israel aerospace valves market. It includes examining the product types, material types, customer preferences, and key regulatory bodies that impact the market. Desk research, involving a thorough analysis of secondary data sources such as company reports, government publications, and industry journals, is conducted.

Step 2: Market Analysis and Construction

In this phase, we gather historical data and conduct an in-depth market analysis, evaluating key parameters such as market size, growth potential, and demand dynamics. This includes analyzing data on military procurement and commercial aerospace expansion. We also assess the penetration of key technologies and the resultant revenue generation from various segments.

Step 3: Hypothesis Validation and Expert Consultation

We validate the market hypotheses through expert consultations via structured interviews with professionals from OEMs, suppliers, defense contractors, and regulatory bodies. These consultations help in gaining critical insights into operational challenges, technological advancements, and emerging trends in the aerospace valves market.

Step 4: Research Synthesis and Final Output

This phase includes direct engagement with manufacturers, aerospace agencies, and other stakeholders to validate the final data. We synthesize the information from primary research to ensure that the findings align with real-world industry dynamics. This process helps in refining market projections and understanding the competitive landscape for the Israel aerospace valves market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Defense Procurement Trends

Local OEM Integration

Market Challenges - Certification Barriers

Supplier Qualification Risk - Market Opportunities

UAV Expansion

Space Program Valve Expansion - Key Market Trends

Additive Manufacturing

IoT‑enabled Valve Diagnostics - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Selling Price, 2020-2025

- By Product Type (in Value %)

Solenoid Valves

Butterfly Valves

Ball & Gate Valves

Pressure Control Valves

Specialty Valves - By Aircraft Platform (in Value %)

Commercial Jetliners

Military Fixed‑Wing Aircraft

Rotary Wing

UAVs / Drones

Space & Satellite Launch Systems - By Material Type (in Value %)

Titanium Alloys

Stainless Steel

Nickel Alloys

Aluminum Alloys

Composite/Advanced Materials - By Pressure Rating (in Value %)

Ultra‑High Pressure

High Pressure

Medium Pressure

Low Pressure - By End User (in Value %)

OEM Integrators

MRO/Aftermarket

Defense Platform Suppliers

Export Engineering & Component Suppliers

- Market Share of Major Players

- Cross Comparison Parameters (Material Technology Adoption, Valve Pressure Performance , Certification Portfolio, Aftermarket Support & Global Service Footprint, Integration with Smart Diagnostics , Domestic Content Level , Supply Chain Resilience)

- SWOT Analysis of Key Competitors

- Pricing Analysis of Major Players

- Detail Profile of Major Players

AeroControlex Group, Inc.

Circor International, Inc.

Crane Aerospace & Electronics, Inc.

Eaton Corporation plc

Honeywell International Inc

ITT Aerospace Controls Inc.

Liebherr‑International Deutschland GmbH

Meggitt PLC

Moog Inc. – Valves & Servos

Parker Hannifin Corporation

Porvair plc – Aerospace Filtration & Valves

Precision Fluid Controls, Inc.

Safran S.A. – Valves & Controls

Sitec Aerospace GmbH – Valve & Actuation Systems

Triumph Group, Inc. – Aerospace Valves

- Technology Integration Requirements

- Certification & Qualification Requirements

- Price vs Performance Sensitivity

- Aftermarket Support & Service Networks

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Product Price, 2026-2035