Market Overview

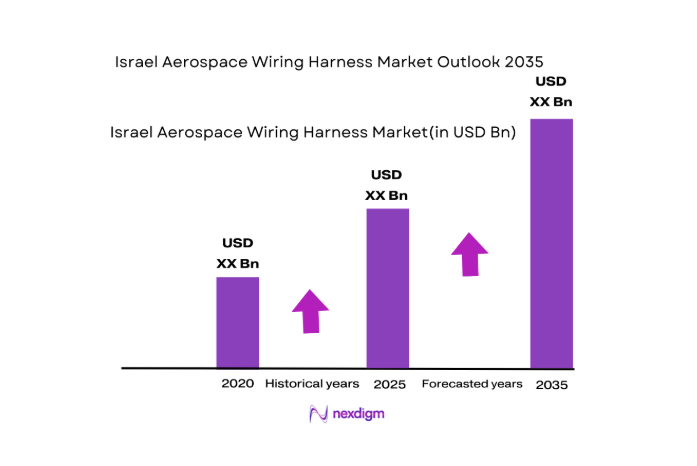

The Israel Aerospace Wiring Harness Market is driven by the increasing demand for advanced electrical systems in the aerospace sector. In 2024, the market was valued at approximately USD ~, with strong growth projections for 2024 due to the modernization of defense systems and increasing demand for UAVs (unmanned aerial vehicles) and commercial aircraft. The market’s growth is attributed to Israel’s leading aerospace companies, such as Israel Aerospace Industries (IAI), which contribute to global aerospace and defense supply chains. Additionally, the push toward electrification in aviation, including the use of advanced wiring harnesses for electrical systems, continues to stimulate market growth.

Israel remains a dominant player in the aerospace wiring harness market, largely due to the strong presence of key companies like IAI, Elbit Systems, and RAFAEL Advanced Defense Systems. These entities are responsible for producing cutting-edge aerospace technology for both commercial and military applications. Other influential markets include the United States and European countries, which maintain strong ties with Israel in defense and commercial aerospace collaborations. These countries’ emphasis on military procurement, aerospace electrification, and defense advancements, combined with Israel’s strong manufacturing capabilities, reinforce Israel’s leading position in the market.

Market Segmentation

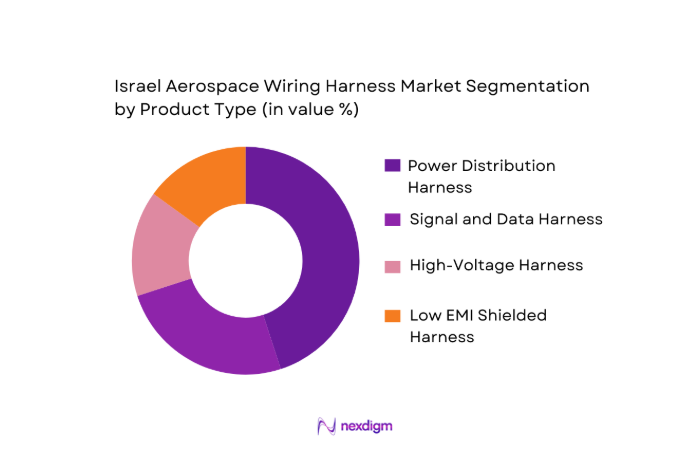

By Product Type

The Israel Aerospace Wiring Harness market is segmented by product type into power distribution harnesses, signal and data harnesses, high-voltage harnesses, and low EMI (electromagnetic interference) shielded harnesses. Among these, power distribution harnesses hold the dominant market share. This dominance is driven by their essential role in aircraft electrical systems, particularly in large commercial aircraft and military fighter jets, which require highly reliable and efficient power distribution networks. The increasing complexity of aircraft electrical systems and the push for all-electric and hybrid-electric aircraft further enhance the demand for advanced power distribution harnesses.

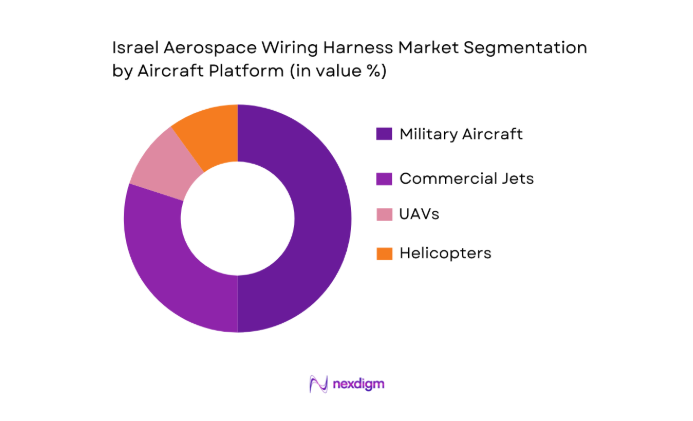

By Aircraft Platform

The market is also segmented by aircraft platform, which includes commercial jets, military aircraft, UAVs, and helicopters. Military aircraft harnesses represent the largest segment in terms of demand. This is largely due to Israel’s prominent defense industry and the continued development of advanced fighter jets and unmanned systems. Additionally, military aircraft require robust, highly specialized wiring solutions that can withstand extreme environmental conditions and ensure high performance, contributing to the dominance of this sub-segment.

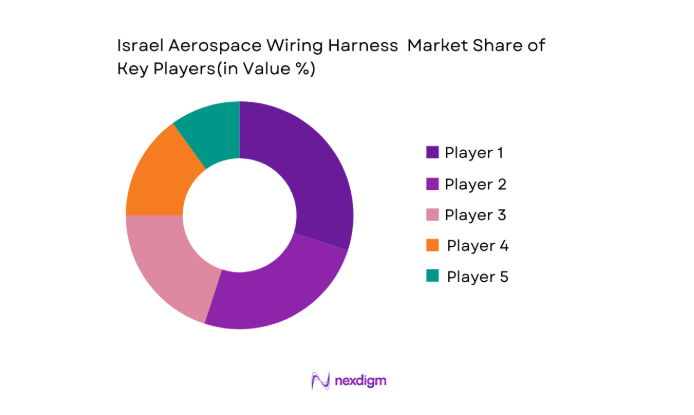

Competitive Landscape

The Israel Aerospace Wiring Harness market is highly competitive, with several key players having a significant presence in the market. Major players in this space include multinational companies like TE Connectivity, Amphenol Aerospace, and Collins Aerospace, alongside local giants like Israel Aerospace Industries (IAI) and Elbit Systems. These companies dominate due to their technological expertise, robust supply chains, and long-standing relationships with both domestic and international aerospace clients.

The market is also marked by strong competition in terms of product innovation, where companies are investing heavily in the development of lighter, more efficient wiring solutions that comply with the latest industry standards, including those required by the Israeli government for defense contracts.

| Company Name | Establishment Year | Headquarters | Product Specialization | Market Focus | Key Technology | Certifications |

| TE Connectivity | 1941 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | United States | ~ | ~ | ~ | ~ |

| Collins Aerospace (RTX) | 2018 | United States | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

Israel Aerospace Wiring Harness Market Analysis

Growth Drivers

Aircraft Fleet Electrification & MEA Requirements

The trend of aircraft fleet electrification is gaining traction across global aerospace markets. The increasing emphasis on electrification is largely driven by the need to reduce carbon emissions and improve fuel efficiency. As of 2025, electric aircraft developments have accelerated, particularly with the announcement of new projects like the all-electric Alice by Israeli startup Eviation Aircraft. Israel’s defense ministry and commercial aviation sectors are aligning with international goals for reducing emissions, as seen in the Israeli government’s push for hybrid-electric aircraft and UAVs. Additionally, Israel’s aerospace industry is influenced by the European Union’s “Fit for 55” initiative, aiming to reduce emissions by ~ by 2030. The shift toward electric aircraft is also supported by Israel’s adoption of MEA (More Electric Aircraft) technologies, where the country is advancing its local defense and aerospace projects to integrate high-efficiency electrical systems into aircraft. This transition contributes to the rising demand for aerospace wiring harnesses capable of supporting complex electrified systems.

UAV/UAS Defense Procurement Trends

Israel is a major global leader in unmanned aerial vehicle (UAV) and unmanned aircraft system (UAS) technology, with defense procurement trends showing a rapid increase in demand for advanced UAV systems. The Israeli Ministry of Defense (MOD) has significantly increased its UAV budget over the last few years, with projected increases in spending on defense UAV systems through 2026. In 2024, Israel’s defense industry, a global exporter of UAV technology, expects a ~ increase in UAV defense contracts, aligning with global military demands. Israel’s key UAV manufacturers, like Elbit Systems and IAI, are receiving record orders for advanced drones used in surveillance, reconnaissance, and combat missions. The Israeli MOD’s defense budget for UAV and UAS-related procurements is forecasted to grow by USD ~ annually over the next three years. This trend has led to an increased demand for specialized wiring harnesses, as UAVs rely on advanced electrical systems for avionics, sensors, and propulsion technologies.

Market Challenges

Raw Material Price Volatility

Raw material price volatility poses a significant challenge for the aerospace wiring harness market, as it directly impacts the cost structure of components. Copper, a primary material used in manufacturing wiring harnesses, has experienced price fluctuations due to global supply chain disruptions and changes in demand. As of 2025, the price of copper is expected to increase by approximately ~, as indicated by global commodity market trends. Additionally, the high price of specialized materials, such as aluminum for lightweight harnesses, also presents challenges in terms of supply chain cost management. According to the World Bank, copper prices are projected to remain volatile through 2025, as global demand continues to rise, driven by both industrial applications and the aerospace sector’s reliance on electrical systems for aircraft. The volatility in raw material prices creates uncertainty for manufacturers, leading to difficulties in pricing, production scheduling, and procurement.

Supply Chain Constraints & Certification Lag

Supply chain disruptions, caused by global events like the COVID-19 pandemic and geopolitical tensions, have caused delays in the delivery of raw materials and components. For the aerospace wiring harness industry, the lead times for materials like copper, thermoplastic insulation, and connectors have been extended due to production bottlenecks. In addition, the complexity of obtaining certification for aerospace products adds to the challenge. As of 2025, the FAA and other regulatory bodies report delays in the approval process for new components, including wiring systems. The certification of advanced materials and harness systems has been impacted by the stringent safety and quality standards required for aerospace applications. This delay in certification directly affects the timeline for product development and delivery, which in turn disrupts the overall production and supply chain.

Market Opportunities

Localized Production + Export to EU/US OEMs

Israel’s aerospace industry is increasingly focused on localizing production, which creates opportunities for growth in the wiring harness market. In 2025, Israel’s aerospace exports, particularly in defense and commercial sectors, have increased significantly, with the European Union and the United States being key destinations. Israel’s aerospace companies are capitalizing on the demand for high-quality, cost-effective wiring harnesses by localizing production to serve these key markets. The government of Israel is offering incentives to local manufacturers to increase production capacities, and this trend is expected to support long-term growth. As of 2025, the Israeli Ministry of Economy is facilitating partnerships between local manufacturers and global aerospace OEMs, which is expected to further boost Israel’s position as a key supplier to international markets.

High-Voltage/Lightweight Harness Advanced Solutions

The increasing demand for high-voltage and lightweight aerospace wiring harnesses presents a key opportunity for growth in the market. As the aerospace industry moves toward electric and hybrid-electric aircraft, there is a growing need for wiring harnesses that can handle higher voltage levels and lighter materials without compromising on performance. In 2025, global aerospace OEMs are increasing their focus on the development of hybrid and electric propulsion systems, which require advanced wiring solutions. Israel’s aerospace companies are investing heavily in the development of high-voltage, lightweight harnesses that meet the rigorous demands of these next-generation systems. These innovations are expected to drive the demand for advanced wiring harness solutions, with major players in Israel, such as IAI and Elbit Systems, leading the charge in supplying these components.

Future Outlook

The future of the Israel Aerospace Wiring Harness market is promising, with projections indicating continued growth driven by ongoing advancements in aircraft electrification, the increased reliance on UAVs, and the modernizing of defense systems. As Israel remains at the forefront of aerospace innovation, the market will continue to evolve with a greater emphasis on lightweight materials and high-efficiency power distribution systems. Innovations in hybrid-electric and fully electric aircraft technologies, as well as the continuous development of UAVs, will be key factors driving the market over the next decade.

Major Players

- TE Connectivity

- Amphenol Aerospace

- Collins Aerospace

- Israel Aerospace Industries

- Elbit Systems

- RAFAEL Advanced Defense Systems

- Honeywell Aerospace

- Safran Electrical & Power

- GKN Aerospace

- Zodiac Aerospace

- Northrop Grumman

- Meggitt PLC

- Samvardhana Motherson Aerospace

- ITT Inc.

- Latecoere

Key Target Audience

- Government and Regulatory Bodies

- Aerospace and Defense OEMs

- Tier-1 and Tier-2 Suppliers

- Military Procurement Agencies

- Investment and Venture Capitalist Firms

- Aircraft Maintenance, Repair, and Overhaul Companies

- Aerospace Technology Manufacturers

- Utility and Energy Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the research involves the identification and analysis of key market variables through extensive secondary research. This step includes mapping the stakeholders in the aerospace wiring harness ecosystem and identifying critical factors such as technological advancements, regulatory influences, and defense procurement dynamics.

Step 2: Market Analysis and Construction

In this step, historical market data is analyzed to identify trends in the demand for aerospace wiring harnesses, focusing on commercial and military aircraft platforms. Data related to production capacities, regulatory standards, and regional demand patterns are used to construct the market size and forecast for the coming years.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with industry professionals from key players in the aerospace sector. This phase involves interviews with engineers, procurement managers, and supply chain specialists to validate market assumptions and refine the analysis of demand drivers and challenges.

Step 4: Research Synthesis and Final Output

In the final step, all gathered data is synthesized into a comprehensive market report. This includes validating all findings through follow-up engagements with major industry players and using a triangulation approach to ensure accuracy and reliability of the market insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Aircraft Fleet Electrification & MEA Requirements

UAV/UAS Defense Procurement Trends

Modernization & Platform Retrofit Backlogs - Market Challenges

Raw Material Price Volatility

Supply Chain Constraints & Certification Lag

Legacy Aircraft Integration Complexity - Opportunities

Localized Production + Export to EU/US OEMs

High‑Voltage/Lightweight Harness Advanced Solutions

Strategic OEM Partnerships - Trends

Digital Twin Design & Automated Harness Manufacturing

Modular Harness Architecture & Reconfigurability - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Price Dynamics, 2020-2025

- By Product Architecture (In Value %)

Power Distribution Harness (Aircraft Electrical System Integration)

Avionics Signal & Data Harness

High‑Voltage/High‑Density Harness (MEA & EVAS compatibility)

Shielded/Low EMI Harness System - By Aircraft Platform (In Value %)

Commercial Jets

Defense Aircraft

UAV/UAS Platforms

MRO & Retrofit Programs - By Sales Channel (In Value %)

OEM Direct

Tier‑1 Suppliers

Aftermarket & MRO - By Certification Class (In Value %)

DO‑160F/G qualified

EN2997 / ARINC 600 class certified - By Material Composition (In Value %)

Copper Alloy & Lightweight Composite Conductors

Thermoplastic/Fluoropolymer Insulation

- Market Share of Major Players

- Cross‑Comparison Parameters(Certification Readiness, High‑Voltage/Shielded Harness Capability, Production Footprint & Lead Time Reliability, Aftermarket & MRO Support Network, Integrated Design/Simulation Capability, Material & Weight Optimization Index, Contract Win Rate in Defense Tenders)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

TE Connectivity

Safran Electrical & Power

Amphenol Aerospace

Collins Aerospace

GKN Aerospace

Latecoere

Honeywell Aerospace

IAI

Elbit Systems

Rafael/Subsystems Divisions

Interconnect Wiring LLP

Meggitt/ESG

Curtiss‑Wright

Samvardhana Motherson Aerospace

Heritage Aviation / Steinair Inc.

- Procurement Drivers

- OEM Integration Challenges

- Aftermarket/MRO Demand Drivers

- Defense & Security Procurement Specifications

- By Value, 2026-2035

- By Volume & Unit Complexity Index, 2026-2035

- By Average Price Evolution, 2026-2035