Market Overview

The Israel air and missile defense radar market is valued at approximately USD ~billion in 2026 This growth is primarily driven by Israel’s strategic need for advanced defense technologies to protect against emerging missile threats in the region. The country’s continuous investment in defense infrastructure, its robust military expenditure, and the increasing demand for sophisticated radar systems that can detect a wide range of aerial threats, from missiles to drones, are major factors driving this market. Israel’s advanced technological capabilities in defense systems also contribute significantly to the development and deployment of these radar systems.

The dominant players in the market are located within Israel, particularly in cities such as Tel Aviv, Herzliya, and Haifa, where defense contractors, such as Elbit Systems and Rafael Advanced Defense Systems, have established their research and manufacturing hubs. The defense industry in Israel is highly concentrated in these cities due to their proximity to key military bases and government agencies. These cities also host the majority of Israel’s defense R&D activities, fostering innovation and further reinforcing their dominance in the global radar and missile defense market.

Market Segmentation

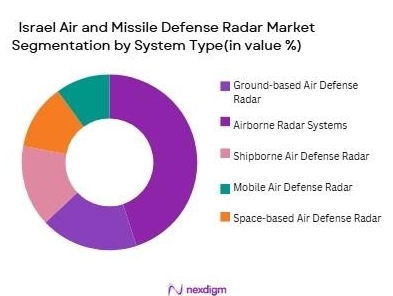

By System Type (In Value%)

The Israel air and missile defense radar market is segmented into several system types, including ground-based air defense radar, airborne radar systems, shipborne air defense radar, mobile air defense radar, and space-based systems. Ground-based air defense radar systems dominate the market due to their extensive use in monitoring airspace, providing early warning of aerial threats, and their role in various defense applications. These systems are essential for national security and are deployed across military bases and key strategic locations in Israel. Their versatility, cost-effectiveness, and ability to cover large areas have solidified their market position, making them the preferred choice for both defense agencies and contractors.

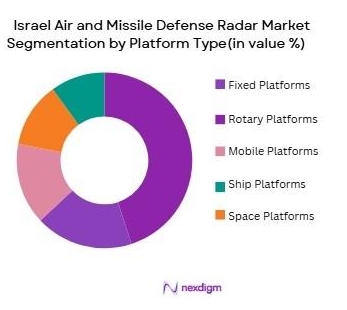

By Platform Type (In Value%)

The Israel air and missile defense radar market is also segmented by platform type, including fixed platforms, rotary platforms, mobile platforms, ship platforms, and space platforms. Fixed platforms dominate the market due to their strategic placement in key locations such as military bases and missile defense sites. These radars offer high reliability, advanced detection capabilities, and the ability to provide continuous surveillance. Fixed radars are critical for early detection of potential threats, ensuring that defense systems can respond rapidly to missiles or air attacks. Their permanence and coverage capacity make them the cornerstone of Israel’s defense radar infrastructure.

Competitive Landscape

The Israel air and missile defense radar market is dominated by a few major players, including Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries (IAI). These companies hold a significant share of the market, thanks to their long-established relationships with the Israeli government and military. They also benefit from Israel’s continuous investment in defense technologies, making them key players not only within Israel but also in international defense markets. The consolidation of power within these few companies highlights their strong presence and technological dominance in the radar and missile defense sector.

| Company Name | Year of Establishment | Headquarters | Radar System Expertise | Key Defense Systems | Geographical Coverage | Key Partnerships |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1950 | Herzliya, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, US | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

Israel Air and Missile Defense Radar Market Analysis

Growth Drivers

Urbanization

Urbanization is one of the primary drivers behind the demand for air quality monitoring systems in Indonesia. In 2024, more than 56% of the population resides in urban areas, which are particularly susceptible to high levels of air pollution. Cities like Jakarta, Surabaya, and Bandung face increasing air quality concerns due to heavy traffic, industrial activities, and construction. The rapid urbanization in these areas has raised the need for real-time monitoring systems to track pollution levels and ensure public health safety. Growing urban populations also increase energy consumption and vehicular emissions, exacerbating air pollution.

Industrialization

Indonesia’s industrial sector continues to expand rapidly, contributing significantly to its economic growth. In 2024, the industrial sector accounts for approximately 20% of the nation’s GDP. This rapid industrialization is accompanied by increased emissions from factories, power plants, and mining operations. Areas like Batam, Surabaya, and Jakarta are hotspots for industrial pollution. As industries grow, so does the need for effective air quality monitoring systems to meet environmental regulations and control pollution. These systems are vital for detecting pollutants and ensuring compliance with emission standards, driving the market for air quality monitoring technologies.

Restraints

High Initial Costs

The high upfront costs of deploying air quality monitoring systems represent a significant barrier to their widespread adoption in Indonesia. In 2024, advanced air quality monitoring equipment, including sensors, data analytics software, and maintenance costs, remains expensive. This cost makes it difficult for smaller municipalities and businesses to invest in such systems, particularly in less-developed regions. Although the government has been providing some funding for air quality initiatives, the financial burden of setting up these systems can still deter many from implementing comprehensive monitoring infrastructure.

Technical Challenges

Indonesia faces several technical challenges in implementing effective air quality monitoring systems. In 2024, issues such as calibration, data accuracy, and the integration of monitoring systems with existing environmental management frameworks continue to hinder the full potential of air quality monitoring. Moreover, many areas still lack reliable infrastructure, such as stable internet connectivity, to support the continuous transmission of air quality data. The lack of standardized protocols for data collection further complicates the situation, limiting the accuracy and comparability of air quality measurements across different regions.

Opportunities

Technological Advancements

Technological advancements present a major opportunity for the growth of air quality monitoring systems in Indonesia. In 2024, the development of cost-effective, IoT-based sensors and mobile monitoring units has made air quality monitoring more accessible. These advancements allow for real-time, continuous monitoring at a fraction of the cost of traditional systems, making it easier to deploy in remote areas. The integration of AI and machine learning for data analysis further enhances the efficiency of these systems, offering a significant opportunity for market expansion.

International Collaborations

Indonesia’s air quality monitoring efforts can benefit from international collaborations, which offer access to advanced technologies and funding. In 2024, Indonesia has partnered with global organizations such as the World Health Organization (WHO) to enhance air quality management and implement monitoring programs. These collaborations provide technical expertise, financial assistance, and best practices for air quality monitoring, which will help expand the reach and impact of monitoring systems across the country.

Expansion into Rural Areas

Expanding air quality monitoring systems into rural areas represents a significant growth opportunity in Indonesia. In 2024, about 40% of Indonesia’s population still resides in rural areas where air quality monitoring infrastructure is limited. With rising pollution levels from agricultural practices, forest fires, and transportation, the need for monitoring systems in these regions is growing. Government initiatives and international support are focusing on extending air quality monitoring to rural areas, thus broadening the market for such systems.

Future Outlook

Over the next decade, the Israel air and missile defense radar market is expected to see significant growth. This growth will be driven by continuous advancements in radar technology, including the development of multi-functional radars capable of detecting various types of threats such as drones, ballistic missiles, and aircraft. Additionally, increasing geopolitical tensions in the Middle East will continue to fuel the demand for enhanced defense systems, including radar systems. As Israel continues to invest heavily in its defense capabilities, both domestically and through international collaborations, the market for advanced air and missile defense radars is expected to expand significantly, reinforcing the country’s position as a leader in defense technology.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Lockheed Martin

- Thales Group

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Leonardo

- Saab Group

- Boeing

- General Dynamics

- L3 Technologies

- Harris Corporation

- Kongsberg Gruppen

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and system integrators

- Aerospace manufacturers

- Research and development agencies

- International defense organizations

- Military agencies from countries with defense collaborations with Israel

- Homeland security and defense technology companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying and mapping the key variables influencing the Israel Air and Missile Defense Radar market. Variables include geopolitical concerns, technological advancements, defense budgets, and military procurement patterns. This phase will use secondary research, including industry reports and government publications, to gather comprehensive data.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical market data and constructing a robust market model based on current and past trends. It will evaluate system installations, platform types, and application areas. A thorough analysis of existing radar systems and future demands will be used to forecast the market’s trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses will be validated through consultations with industry experts, including manufacturers, government defense officials, and military representatives. Interviews and surveys will provide insight into technological adoption, procurement processes, and future developments in radar systems.

Step 4: Research Synthesis and Final Output

The final phase consolidates the findings from desk research, expert consultations, and market analysis. This will culminate in a comprehensive report detailing market trends, competitive dynamics, and forecasts. Data synthesis will ensure that the final output accurately reflects the market’s current state and future growth.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in radar and missile defense systems

Rising geopolitical tensions and security concerns

Increased defense budgets and investments in national security - Market Challenges

High development and operational costs

Regulatory constraints and export restrictions

Dependence on specialized personnel and skilled workforce - Market Opportunities

Collaborations with international defense organizations

Advancements in radar miniaturization and system integration

Emerging markets in Asia-Pacific and the Middle East - Trends

Development of multi-functional radar systems for air and missile defense

Adoption of artificial intelligence and machine learning for radar system efficiency

Integration of radar systems with next-generation missile defense technologies

- Government regulations

International regulations on radar technology export

Defense procurement regulations in Israel

Environmental impact regulations for radar system installations - SWOT analysis

Strength: Israel’s strong defense capabilities and technological expertise

Weakness: High reliance on international defense contracts

Opportunity: Expansion into new markets with advanced radar technology

Threat: Escalating global tensions leading to unpredictable demand - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitute products: Low

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-based Air and Missile Defense Radar

Airborne Radar Systems

Shipborne Air and Missile Defense Radar

Mobile Air and Missile Defense Radar

Space-based Air and Missile Defense Radar - By Platform Type (In Value%)

Fixed Platforms

Rotary Platforms

Mobile Platforms

Ship Platforms

Space Platforms - By Fitment Type (In Value%)

Standalone Radar Systems

Integrated Radar Systems

Upgraded Radar Systems

Modular Radar Systems

Compact Radar Systems - By EndUser Segment (In Value%)

Government Defense

Commercial Defense Contractors

Private Sector Defense

International Defense Organizations

Research and Development Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement

Private Sector Procurement

International Defense Procurement

Leasing and Third-party Procurement

Cross Comparison Parameters(Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries (IAI)

IMI Systems

Elta Systems

Raytheon Technologies

Northrop Grumman

Lockheed Martin

Thales Group

Boeing

General Dynamics

Saab

Leonardo

BAE Systems

Kongsberg Gruppen

- Government defense agencies expanding missile defense systems

- Private defense contractors involved in radar system integration

- International defense organizations enhancing global radar coverage

- Research and development agencies investing in advanced radar technologies

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035