Market Overview

The Israel Air-Based Military Electro-Optical and Infrared Systems market is valued at approximately USD ~billion in 2024. The market’s growth is driven by the increasing demand for advanced military surveillance systems, especially in defense sectors looking for real-time intelligence, surveillance, and reconnaissance (ISR) capabilities. Israel, with its advanced defense technologies and military expertise, is a leader in developing electro-optical and infrared systems, which are used for various defense applications, including missile defense, border security, and intelligence gathering.

Israel’s defense sector is centered around cities like Tel Aviv and Haifa, where numerous defense contractors and research centers are located. The country’s long-standing focus on innovation in defense technology has allowed it to dominate the air-based electro-optical and infrared systems market. Israel’s geopolitical situation, requiring advanced surveillance and defense capabilities, further enhances its dominance. Additionally, partnerships with global military powers, such as the United States, play a significant role in strengthening its position as a leading supplier of military technology.

Market Segmentation

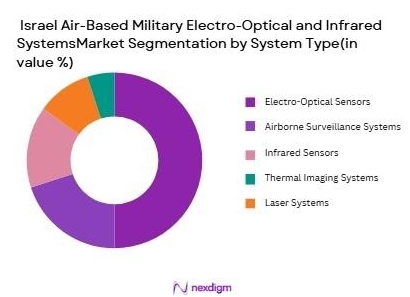

By System Type (In Value%)

The Israel Air-Based Military Electro-Optical and Infrared Systems market is segmented by system type into airborne surveillance systems, electro-optical sensors, infrared sensors, thermal imaging systems, and laser systems. Electro-optical sensors are the dominant sub-segment due to their critical role in providing precise imaging and tracking capabilities. These sensors are used for target acquisition, surveillance, and reconnaissance. The importance of electro-optical sensors in ensuring real-time data and high-resolution imaging in complex operational environments, especially in military operations, leads to their significant market share in the air-based ISR systems.

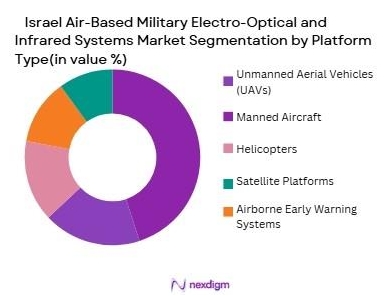

By Platform Type (In Value%)

The platform type segment within the Israel Air-Based Military Electro-Optical and Infrared Systems market includes unmanned aerial vehicles (UAVs), manned aircraft, helicopters, satellite platforms, and airborne early warning systems. UAVs dominate this segment due to Israel’s focus on developing advanced unmanned systems like the Heron UAV for reconnaissance and surveillance. UAVs are preferred for air-based ISR because they are cost-effective, flexible, and capable of operating in challenging environments without risking human lives. Their deployment in military operations, such as border surveillance and intelligence gathering, ensures that they continue to hold the largest share of the platform market.

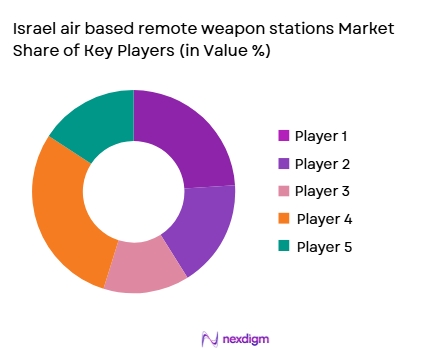

Competitive Landscape

The Israel Air-Based Military Electro-Optical and Infrared Systems market is highly competitive, with major players such as Elbit Systems, Israel Aerospace Industries (IAI), and Rafael Advanced Defense Systems. These companies provide advanced electro-optical, infrared, and ISR solutions for military forces worldwide. Israel’s established defense sector and its ongoing innovation in surveillance technology ensure that these companies maintain a significant presence in both domestic and international markets. The competitive landscape is also influenced by strategic collaborations with foreign defense companies, allowing Israeli firms to expand their reach globally.

| Company Name | Year of Establishment | Headquarters | Core Offerings | Technology Focus | Geographic Presence | Key Contracts |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 2002 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ |

~ |

Israel Air-Based Military Electro-Optical and Infrared Systems Market Analysis

Growth Drivers

Urbanization

Urbanization is accelerating the demand for advanced air-based military electro-optical and infrared systems in Israel. As of 2024, Israel’s urban population is over 90%, contributing to growing security concerns in metropolitan areas. The rise in urbanization and the need for enhanced surveillance systems to monitor borders, airspace, and critical infrastructure are driving this market. The urban centers like Tel Aviv and Haifa are focal points for deploying these advanced military systems, supporting both national security and strategic defense initiatives.

Industrialization

Industrialization in Israel has led to an increased need for surveillance systems to protect critical infrastructure. As of 2024, Israel’s manufacturing sector accounts for approximately 20% of its GDP. The growing number of industrial zones, especially in cities like Ashdod and Haifa, has intensified the demand for sophisticated defense systems, including air-based electro-optical and infrared technologies, to monitor industrial activities and guard against potential threats. These technologies are essential in safeguarding high-value assets, including factories and military bases.

Restraints

High Initial Costs

The high initial costs associated with developing and deploying air-based military electro-optical and infrared systems pose a significant restraint in Israel’s defense sector. These systems, which are critical for national security, require substantial investments in research, development, and maintenance. As of 2024, the procurement of advanced electro-optical sensors and related technologies is a major capital expenditure for the Israeli Ministry of Defense, which limits the accessibility of these systems to certain defense sectors and international buyers.

Technical Challenges

There are several technical challenges in implementing and maintaining air-based military electro-optical and infrared systems in Israel. The complexity of integrating high-resolution imaging, targeting, and surveillance technologies into existing military infrastructure is a significant barrier. In 2024, Israeli defense contractors face ongoing challenges in improving system calibration, sensor accuracy, and system resilience in hostile environments. These challenges increase the operational costs and time required for system deployment, hindering market growth.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for growth in the air-based military electro-optical and infrared systems market in Israel. Innovations in AI, machine learning, and miniaturization are leading to the development of more efficient, compact, and cost-effective systems. In 2024, Israeli defense companies are increasingly integrating AI into surveillance systems for improved real-time analysis, targeting, and decision-making. These advancements are expected to broaden the application of electro-optical and infrared systems, particularly in unmanned aerial systems (UAS) and autonomous vehicles.

International Collaborations

International collaborations are a key growth opportunity for Israel’s air-based military electro-optical and infrared systems market. As of 2024, Israel has established strong defense partnerships with countries such as the United States, India, and several European nations. These collaborations involve joint defense projects, including the development and deployment of advanced ISR systems. Furthermore, these partnerships facilitate the export of Israeli defense technology, contributing to the growth of the air-based systems market in international markets.

Future Outlook

The Israel Air-Based Military Electro-Optical and Infrared Systems market is set for significant growth in the coming years. As regional security concerns persist, Israel will continue to prioritize advancements in its defense technology, particularly in airborne surveillance, ISR systems, and advanced imaging solutions. Over the next decade, advancements in miniaturization, AI-driven analysis, and multi-sensor integration will drive further growth. Israel’s position as a global leader in defense technology, along with its continued defense modernization and strategic international partnerships, will ensure the ongoing expansion of this market.

Major Players

- Elbit Systems

- Israel Aerospace Industries (IAI)

- Rafael Advanced Defense Systems

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Leonardo

- BAE Systems

- Saab Group

- General Dynamics

- L3 Technologies

- Harris Corporation

- Kongsberg Gruppen

- Boeing

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- International defense organizations

- Military agencies from countries with defense collaborations with Israel

- Aerospace contractors

- Homeland security and defense technology companies

- Private sector defense contractors

Research Methodology

Step 1: Identification of Key Variables

This phase involves gathering data on defense spending, technological advancements, and Israel’s geopolitical strategies. Secondary research sources such as government publications and defense industry reports help identify the critical factors that influence the market.

Step 2: Market Analysis and Construction

Data on deployed air-based electro-optical and infrared systems within Israel’s defense sector is compiled. Historical data on procurement, system integration, and system performance is used to construct a market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert interviews with military officials, defense contractors, and technology developers involved in air-based military electro-optical and infrared systems. These consultations help ensure data relevance and accuracy.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive market report. Expert insights are integrated to provide an in-depth overview of the Israel Air-Based Military Electro-Optical and Infrared Systems market, including market dynamics, trends, and growth forecasts.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in electro-optical and infrared sensors

Increasing geopolitical tensions and security concerns

Rising defense budgets and investments in air-based defense systems - Market Challenges

High operational and maintenance costs

Regulatory constraints and export restrictions

Dependence on highly skilled personnel for operation and maintenance - Market Opportunities

Technological innovations in miniaturized electro-optical and infrared systems

Collaboration with international defense organizations

Growing demand for enhanced surveillance capabilities in air defense - Trends

Integration of artificial intelligence in surveillance systems

Increased adoption of UAVs for reconnaissance and intelligence gathering

Shift towards multi-functional and scalable air defense systems - Government regulations

Export control regulations for military technologies

Compliance with international defense standards

Regulations on the use of EO/IR systems in defense operations - SWOT analysis

Strength: Israel’s technological leadership in defense optics

Weakness: High reliance on external contracts

Opportunity: Expanding UAV applications for defense operations

Threat: Rising competition from global defense technology firms - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: Moderate

Bargaining power of buyers: High

Threat of substitute products: Moderate

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units ,2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier ,2020-2025

- By System Type (In Value%)

Airborne Surveillance Systems

Electro-Optical Sensors

Infrared Sensors

Thermal Imaging Systems

Laser Systems - By Platform Type (In Value%)

Manned Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters

Satellite Platforms

Airborne Early Warning Systems - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Modular Systems

Upgraded Systems

Compact Systems - By EndUser Segment (In Value%)

Defense Ministries

Aerospace Contractors

Private Sector Contractors

International Military Agencies

Research and Development Agencies - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement

Private Sector Procurement

International Defense Procurement

Leasing and Third-party Procurement

- Cross Comparison Parameters (Market Share, Service Type, Technology Adoption, Geographic Presence, Customer Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems

Israel Aerospace Industries (IAI)

Rafael Advanced Defense Systems

Lockheed Martin

Thales Group

Northrop Grumman

Raytheon Technologies

BAE Systems

Leonardo

Saab Group

Boeing

General Dynamics

L3 Technologies

Harris Corporation

Kongsberg Gruppen

- Defense ministries expanding air surveillance capabilities

- Aerospace contractors incorporating advanced electro-optical and infrared technologies

- International military agencies integrating Israeli technology into defense strategies

- R&D agencies developing next-generation surveillance systems

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier ,2026-2035

- Future Demand by Platform ,2026-2035