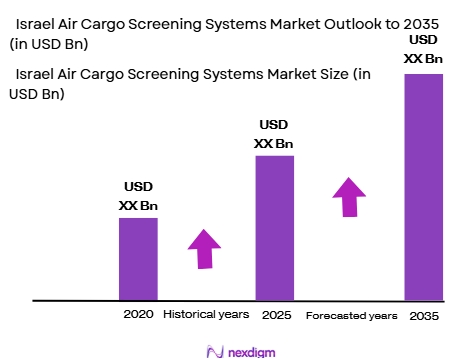

Market Overview

The Israel air cargo screening systems market has been growing steadily in recent years due to the increasing global trade and the rising demand for secure air cargo handling. The market size is influenced by the stringent regulations set by both local and international authorities to ensure safety in air cargo operations. Israel, being a hub for international air cargo and trade, has witnessed a significant increase in demand for advanced cargo screening systems. Key drivers include the advancement of screening technologies, heightened security concerns, and increased cargo volumes. The growth of e-commerce and the expansion of logistics networks further fuel the demand for sophisticated screening technologies

Israel stands as a dominant player in the air cargo screening systems market due to its robust international trade infrastructure, highly developed logistics sector, and strategic geographic location at the crossroads of Europe, Asia, and Africa. Major airports like Tel Aviv’s Ben Gurion International Airport play a significant role in driving the demand for high-tech air cargo screening solutions. Additionally, Israel’s strict security standards and advanced technological capabilities have positioned the country as a leader in the development and deployment of air cargo screening systems. The country’s emphasis on security and innovation in transportation infrastructure continues to bolster its dominance in the sector.

Market Segmentation

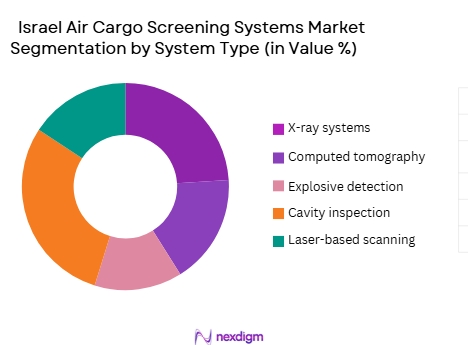

By System Type

The market for air cargo screening systems is segmented into various system types, including X-ray systems, computed tomography (CT) systems, explosive detection systems (EDS), cavity inspection systems, and laser-based scanning systems. Among these, X-ray systems are the most commonly deployed in air cargo screening, owing to their widespread adoption across airports and cargo hubs. Their ability to provide quick, cost-effective, and reliable screening of parcels has solidified their position as the dominant system type in the market. X-ray systems are particularly favored in airports that handle a high volume of cargo, as they can scan items rapidly, making them ideal for busy cargo terminals.

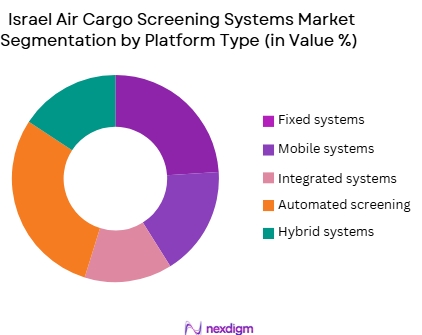

By Platform Type

The platform type segmentation includes fixed systems, mobile systems, integrated systems, automated screening systems, and hybrid systems. Fixed systems hold a dominant share of the market, especially in major international airports, due to their reliability, robustness, and high capacity for scanning cargo volumes. Fixed platforms are generally more stable and secure, making them suitable for long-term installation in airports and cargo hubs. Moreover, their ability to support heavy-duty screening operations and integration with other airport security infrastructure further drives their dominance in the sector.

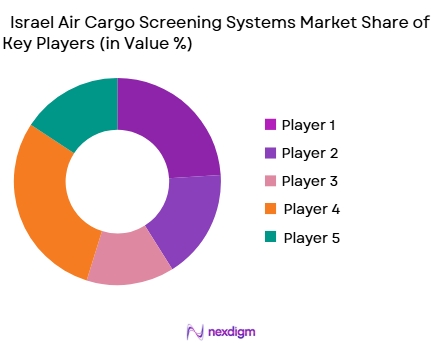

Competitive Landscape

The Israel air cargo screening systems market is highly competitive, with a few major players leading the market due to their technological expertise and global reach. Companies like Rapiscan Systems, Smiths Detection, and Leidos dominate the landscape by providing cutting-edge solutions that meet the security standards of airports worldwide. These key players have built a strong reputation for offering reliable, high-performance air cargo screening systems that adhere to both local and international regulatory requirements. Their strong presence in Israel is fueled by their deep integration with airport security infrastructure and long-standing partnerships with government agencies and airport authorities.

| Company Name | Establishment Year | Headquarters | Technology Innovation | Regulatory Compliance | Market Penetration | Product Portfolio | Strategic Partnerships |

| Rapiscan Systems | 1993 | California, USA | High-speed X-ray | ~ | ~ | ~ | ~ |

| Smiths Detection | 1981 | UK | Advanced CT scanners | ~ | ~ | ~ | ~ |

| Leidos | 1969 | Virginia, USA | Explosives Detection | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | New York, USA | Multi-sensor systems | ~ | ~ | ~ | ~ |

| Argus Systems | 2002 | Israel | Advanced X-ray | ~ | ~ | ~ | ~ |

Indonesia Air Quality Monitoring System Market Analysis

Growth Drivers

Urbanization

Indonesia has experienced rapid urbanization over the past few decades, with urban populations increasing significantly. In 2024, Indonesia’s urban population stands at approximately ~ with urban areas accounting for over ~ of the country’s GDP. This rapid urban growth contributes to rising air pollution, as densely populated cities like Jakarta and Surabaya face higher emissions from vehicles, industrial activities, and construction. The need for effective air quality monitoring systems to address pollution levels in these urban environments is critical. The Indonesian government’s push for improved air quality monitoring systems further supports the growing demand for air quality monitoring solutions in cities.

Industrialization

Indonesia’s industrial sector plays a significant role in driving air pollution due to emissions from power generation, manufacturing, and mining activities. As the country continues its industrial development, the level of pollution is expected to increase, prompting greater demand for air quality monitoring systems. In 2024, Indonesia’s industrial sector contributes to nearly 40% of its GDP, with key industries such as oil, natural gas, and mining being major contributors to air pollutants. The need for air quality monitoring systems becomes increasingly urgent as industrial activities expand, with the government’s regulations driving investments in environmental monitoring.

Restraints

High Initial Costs

The high initial cost of deploying air quality monitoring systems remains a significant restraint in Indonesia. The cost of purchasing and installing advanced air quality monitoring equipment, along with its maintenance, can be prohibitive for many local governments and businesses, especially in less affluent areas. Despite the need for air quality monitoring solutions, these systems can be expensive, with the cost of setting up a single station ranging between USD ~ to USD ~ depending on the technology. This financial barrier limits the widespread adoption of such systems, particularly in rural regions.

Technical Challenges

Despite advances in air quality monitoring technologies, several technical challenges remain. For example, ensuring the accuracy and consistency of air quality data across different monitoring locations is a significant concern. The harsh tropical climate in Indonesia, with its heavy rainfall and humidity, can cause technical malfunctions or reduce the lifespan of monitoring equipment. Additionally, calibration and integration of air quality monitoring systems with existing infrastructure pose challenges. These technical limitations hinder the smooth deployment and operation of these systems across the country.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the air quality monitoring systems market in Indonesia. The introduction of low-cost sensors, remote sensing technologies, and AI-driven data analytics makes it possible to deploy air quality monitoring solutions at scale. For instance, in 2024, more than ~of air quality monitoring systems in Indonesia are expected to incorporate IoT-enabled devices. These innovations help reduce the cost of deployment and improve data accuracy, making air quality monitoring more accessible to both public and private sectors.

International Collaborations

International collaborations offer valuable opportunities for the air quality monitoring systems market in Indonesia. Through partnerships with organizations such as the United Nations Environment Programme (UNEP) and the World Bank, Indonesia has access to funding and expertise to enhance its air quality monitoring infrastructure. These collaborations enable the sharing of best practices, technology transfers, and joint ventures, accelerating the adoption of advanced air quality monitoring systems in Indonesia’s urban and rural areas. These collaborations also help align Indonesia’s air quality monitoring practices with international standards.

Future Outlook

Over the next decade, the Israel air cargo screening systems market is expected to experience steady growth, driven by advancements in screening technologies, increasing security measures, and growing international trade. The development of more sophisticated and integrated screening systems, including AI-based technologies, is anticipated to drive innovation and enhance efficiency in the market. Additionally, the global push for tighter security regulations and the increasing volume of air cargo, particularly from e-commerce, are set to fuel further demand for state-of-the-art air cargo screening systems. As Israel continues to expand its logistics and cargo infrastructure, the need for advanced security measures will ensure that the market remains dynamic and evolving.

Major Players

- Rapiscan Systems

- Smiths Detection

- Leidos

- L3 Technologies

- Argus Systems

- CEIA

- Nuctech Company Limited

- Astrophysics Inc.

- Honeywell International

- Vanderlande

- Kromek Group

- Autoclear

- ISDE

- Macurco

- Arktis Radiation Detectors

Key Target Audience

- Air Cargo Operators

- Freight Forwarders

- Airport Authorities

- Government Agencies

- Security and Defense Contractors

- Cargo Handling Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology is to identify all critical variables that influence the Israel air cargo screening systems market. This involves gathering data from secondary research sources such as industry reports, government publications, and company data. We then construct a map of the air cargo screening ecosystem, identifying key market players, regulatory influences, and technological drivers.

Step 2: Market Analysis and Construction

We then analyze historical market data, focusing on variables such as market penetration rates, technological advancements, and regulatory frameworks. This phase also involves evaluating market demand, growth rates, and the integration of security systems within various airport infrastructures.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses regarding market trends, growth drivers, and challenges are validated through consultations with industry experts. These experts provide insights into operational dynamics, technological innovations, and the regulatory landscape, ensuring that the research findings are well-grounded and accurate.

Step 4: Research Synthesis and Final Output

In the final phase, the research data is synthesized, and consultations with key stakeholders like airport authorities and technology providers help refine the findings. This ensures the accuracy and reliability of the market analysis and the development of actionable insights for market participants.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air cargo traffic and volume

Increased emphasis on airport and cargo security

Technological advancements in screening systems - Market Challenges

High cost of installation and maintenance of screening systems

Integration challenges with existing airport infrastructure

Regulatory complexities and international compliance standards - Market Opportunities

Growing demand for non-intrusive screening technology

Expansion of airport and cargo hub infrastructure in emerging markets

Advancements in AI and machine learning to enhance screening efficiency - Trends

Shift towards CT-based and 3D imaging technologies

Automation and remote monitoring in cargo screening

Increased focus on sustainability and eco-friendly technologies in airport security - Government regulations

International Civil Aviation Organization (ICAO) standards for cargo screening

Bureau of Civil Aviation Security (BCAS) regulations

Customs regulations for cargo clearance and security - SWOT analysis

Strength: Technological advancements in cargo screening systems

Weakness: High operational costs and long ROI timelines

Opportunity: Emerging markets investing in airport security infrastructure

Threat: Competitive pricing pressure from low-cost suppliers - Porters 5 forces

Threat of new entrants: Low

Bargaining power of suppliers: High

Bargaining power of buyers: Moderate

Threat of substitute products: Low

Industry rivalry: High

- By Market Value ,2020-2025

- By Installed Units ,2020-2025

- By Average System Price ,2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

X-ray screening systems

Computed tomography (CT) scanners

Explosive detection systems (EDS)

Ion mobility spectrometers (IMS)

Manual screening devices - By Platform Type (In Value%)

Airport cargo terminals

Freight forwarding companies

Customs and border protection agencies

Commercial airlines

Security technology providers - By Fitment Type (In Value%)

OEM systems

Retrofit systems

Upgrades

Modular systems

Custom-fit systems - By EndUser Segment (In Value%)

Airports

Cargo handling and logistics companies

Freight operators

Government security agencies

Private security firms - By Procurement Channel (In Value%)

Direct government contracts

OEM sales

Third-party procurement

Distributor sales

Public tenders

- Cross Comparison Parameters(System Type, Platform Type, Procurement Channel, End-user Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rapiscan Systems

Smiths Detection

CEIA

L3 Technologies

Leidos

Nuctech

Kidde Fire Safety

Analogic Corporation

Scheidt & Bachmann|

Smiths Detection

Metrasens

Rapiscan Systems

Kongsberg Gruppen

Rohde & Schwarz

SAAB

- Airports investing in advanced screening systems

- Cargo and logistics companies focusing on faster processing times

- Government agencies tightening security measures for international trade

- Private sector involvement in upgrading airport and cargo security

- Forecast Market Value ,2026-2035

- Forecast Installed Units ,2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035