Market Overview

The Israel Air Defense Systems market is driven by the increasing need to counter aerial threats such as missiles, rockets, and drones. Israel’s defense industry has made significant advancements in air defense technologies, including systems like the Iron Dome, David’s Sling, and Arrow, which have proven effective in protecting national security. The market growth is further supported by the country’s strategic defense exports and government investments in cutting-edge technologies to safeguard national airspace. As a global leader in air defense solutions, Israel has positioned itself as a key supplier for both domestic and international defense markets.

Israel dominates the air defense systems market due to its advanced technological infrastructure and its strategic location in the Middle East. The country has become a critical player in the global defense market, not only because of its indigenous innovations but also due to its extensive defense export network. Israel’s defense systems, such as the Iron Dome, are globally recognized and have been deployed in various regions, including the United States and Europe, owing to their proven effectiveness. The country’s technological expertise, military requirements, and collaborations with international defense forces continue to cement its leading role in the air defense sector.

Market Segmentation

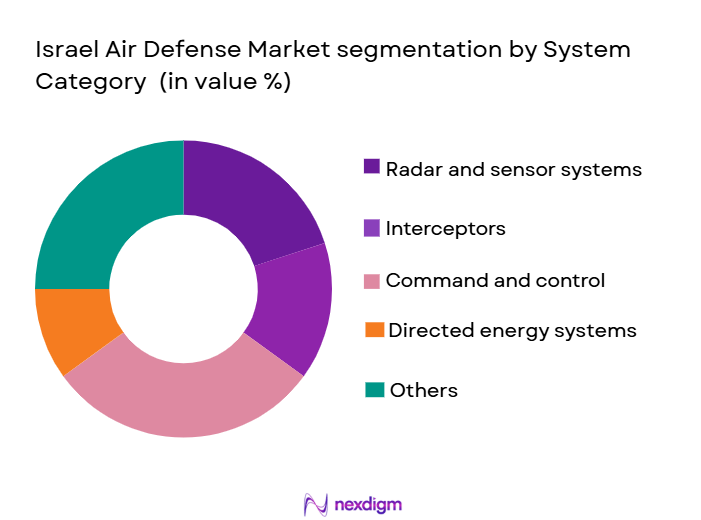

By System Category

The Israel Air Defense Systems market is divided into key categories, including radar and sensor systems, interceptors, command and control (C2) solutions, and directed energy systems. Among these categories, radar and sensor systems hold a prominent position. Israel’s radar technologies, such as the EL/M series, play a crucial role in the detection and tracking of airborne threats at long distances, allowing for early interception. The country’s continued focus on enhancing radar capabilities, combined with their integration into multi-layered defense systems, ensures their dominance within this category. Radar and sensor systems have become an essential part of Israel’s overall defense strategy, contributing to both domestic security and export success.

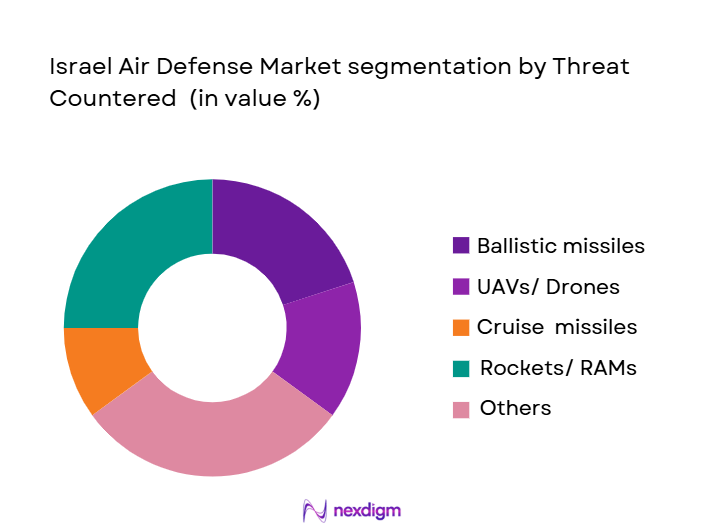

By Threat Countered

The Israel Air Defense Systems market is also segmented based on the type of threats countered, including ballistic missiles, UAVs, cruise missiles, and rockets. Ballistic missile defense systems, such as the Arrow and David’s Sling, are the dominant segment due to the increasing missile threats in the region. Israel’s advanced interceptors, including the Arrow-3, have successfully demonstrated their ability to intercept long-range ballistic missiles. The country’s strategic focus on missile defense, in response to regional threats, has propelled the dominance of ballistic missile defense systems in the market. These systems are not only critical to Israel’s defense but have also found global applications, driving their market leadership.

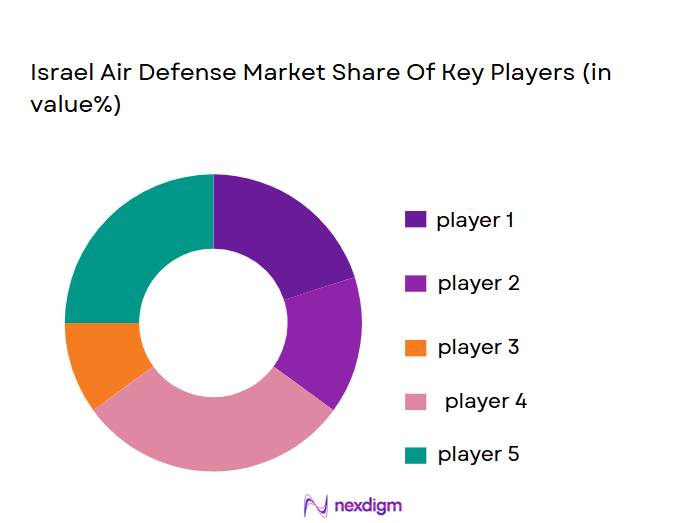

Competitive Landscape

The Israel Air Defense Systems market is highly competitive, with a few key players dominating the sector. Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), and Elbit Systems are the main contributors to the development and deployment of Israel’s air defense technologies. These companies hold a significant share of the market due to their innovative defense systems, strong government backing, and extensive export relationships. Rafael’s Iron Dome system is particularly well-known globally for its effectiveness in intercepting short-range rockets, while IAI’s Arrow system plays a key role in ballistic missile defense. Elbit Systems, on the other hand, focuses on advanced electronic warfare and command and control solutions, further solidifying Israel’s leadership in the air defense market.

| Company | Year Established | Headquarters | Technological Strength | Primary Systems | Global Presence | R&D Investment |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ||

| Lockheed Martin Israel | 1997 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Boeing Israel | 2007 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

Israel Air Defense Systems Market Analysis

Growth Drivers

Israel Air Defense Systems

Escalating Middle East Missile Threat Vectors (Iranian, Non‑State Actors)

The Israel Air Defense Systems market is heavily driven by the dramatic increase in missile threats from state and non‑state actors in the Middle East. In one recent conflict phase, Iranian forces launched about ~ ballistic missiles at Israel in a single offensive, marking one of the largest direct missile attacks on Israeli territory in modern history. These ballistic strikes followed earlier attacks where over ~ missiles and approximately ~ drones were launched against Israel during a short period of conflict, underscoring the evolving scale of aerial threats faced by Israeli defenses. This level of hostile activity has pressured Israeli defense planners and global buyers of air defense solutions to prioritize multi‑layer interception technologies capable of responding to high‑volume salvos. According to World Bank data on regional military dynamics, military expenditure in conflict‑affected regions of the Middle East reached approximately $~ billion, with Israel allocating a high proportion of its GDP to defense investment. These macroeconomic defense budget pressures directly support the expansion of the air defense systems market, as nations adopt technologies similar to those used by Israel to safeguard critical infrastructure against missile and aerial bombardment.

Combat‑Proven System Validation

Combat performance of Israeli air defense systems has become a foundational driver of market demand, as real engagements provide operational data that prospective buyers rely on when evaluating complex defense systems. During intense missile campaign periods, Israel’s integrated defense architecture reported high intercept rates, with defensive forces successfully stopping about ~ to ~ percent of incoming ballistic missiles in major conflict episodes. This real‑world performance validation is backed by ground and air defense operations, where advanced radar and interceptor combinations have repeatedly neutralized large numbers of incoming threats simultaneously. The visibility of these engagements, reported by Israeli authorities and defense analysts alike, enhances confidence among global military procurement agencies seeking proven effectiveness rather than theoretical performance figures. At the same time, continuing high levels of regional military expenditures — evidenced by global military spending surpassing $~ trillion in recent reports, with substantial portions allocated to advanced defense technologies — further reinforce the appeal of combat‑validated systems like those developed in Israel. Buyers increasingly value field‑tested system reliability when integrating into broader defense architectures, particularly in volatile geopolitical environments.

Market Challenges

High R&D and Production Cost Curves

One of the significant challenges facing the Israel Air Defense Systems market is the extremely high cost of research, development, and production associated with advanced defense technologies. The development of cutting‑edge interceptor missiles, multi‑frequency radar arrays, and integrated command‑and‑control systems requires long‑term investment in specialized engineering talent and high‑precision manufacturing facilities. These expenditures occur against a backdrop of global defense spending growth, where total world military expenditure surpassed approximately $~ trillion, increasing the competition for skilled personnel and advanced manufacturing capacity. Investment in these technologies must compete with other pressing national priorities, and rising material and labor costs exacerbate budget pressures even for well‑funded defense sectors. Moreover, long production lead times and the need for continuous upgrades to counter emerging threats like high‑speed cruise missiles and hypersonics further stretch budgets. These cost dynamics make it challenging for smaller defense manufacturers and buyer nations to commit to procurement cycles without long‑term financial planning and international cooperation. The necessity to balance R&D investment with affordability underscores the complexity of sustaining advanced air defense capabilities in a challenging fiscal context.

Export Regulations and National Security Approvals

Export controls and national security approval regimes represent another major challenge for the Israel Air Defense Systems market, as stringent regulations restrict the transfer of sensitive technologies to certain countries. These regulatory frameworks are designed to prevent misuse of advanced defense systems but can slow down international sales cycles, delay contract execution, and complicate export compliance for manufacturers. Export licensing often requires alignment with multiple government agencies and adherence to international protocols, which can deter potential buyers seeking rapid acquisition timelines. The complexity of navigating export controls is particularly acute for defense systems embedded with sensitive electronics, guidance systems, and cryptographic components. These challenges are compounded in a geopolitical environment where national security concerns influence export policy decisions, particularly in regions with shifting alliances and evolving threat perceptions. As a result, manufacturers and prospective buyers must invest significant resources in compliance and diplomatic engagement to advance export contracts, adding friction to market expansion efforts in key regions such as Asia and Europe.

Opportunity Landscape

Export Expansion in Europe & Asia

A significant opportunity for the Israel Air Defense Systems market lies in expanding exports to European and Asian defense markets, where nations face expanding aerial threats. Many European countries increased defense allocations in response to regional security concerns, contributing to a larger global environment where air defense technologies are prioritized. With total world military spending reaching nearly $~ trillion, demand for sophisticated air defense solutions that enhance national security infrastructures has grown accordingly. European buyers are increasingly interested in advanced radar, interceptor, and integrated command‑and‑control systems that can complement existing NATO defense frameworks. Meanwhile, Asian nations are investing heavily in defense modernization as part of broader security strategies, representing fertile markets for export of Israeli‑developed air defense technologies. This dynamic presents an opportunity for Israeli manufacturers to tailor solutions to region‑specific defense needs, leverage interoperability with allied systems, and participate in multinational defense programs that strengthen regional deterrence and response capabilities.

Multi‑Domain Integration (Air, Space, Cyber)

The integration of air defense systems across multiple domains — including air, space, and cyber — offers a compelling opportunity for market expansion. Multi‑domain defense strategies recognize that aerial threats increasingly intertwine with space‑based sensors and cyber vulnerabilities, necessitating holistic defense solutions. As nations allocate defense budgets toward cross‑domain integration and advanced threat analytics, opportunities arise for providers of unified defense platforms that can bridge data from airborne, orbital, and digital sensors. This evolutionary defense strategy reflects larger shifts in military doctrine that prioritize comprehensive situational awareness and rapid cross‑domain response. By developing solutions that seamlessly blend air defense capabilities with space situational data and robust cyber protection layers, vendors can address complex threat environments that traditional siloed systems cannot. This multi‑domain focus represents a strategic growth avenue for air defense technology providers aiming to meet the next generation of warfare challenges.

Future Outlook

The Israel Air Defense Systems market is expected to continue growing in the coming years due to the country’s ongoing investment in air defense technologies. The need to address emerging threats such as hypersonic missiles, drones, and sophisticated missile systems will drive innovation and market demand. Israel’s defense sector is likely to lead in the development of directed energy systems, such as the Iron Beam, which could revolutionize the way airborne threats are intercepted. With the continuous evolution of defense technologies and increasing global demand for robust air defense solutions, Israel is poised to maintain its position as a leading exporter of air defense systems.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Lockheed Martin Israel

- Boeing Israel

- Northrop Grumman Israel

- Thales Israel

- MBDA Israel

- Saab Group

- Raytheon Israel

- General Dynamics Israel

- BAE Systems Israel

- Dassault Aviation Israel

- Leonardo Israel

- OptiDefense

Key Target Audience

- Defense Ministries and National Security Agencies (Israeli Ministry of Defense, U.S. Department of Defense)

- Government Agencies (Israeli National Cyber Directorate)

- Military Procurement Agencies (IDF Procurement Department)

- Investments and Venture Capitalist Firms (Firms funding defense technologies and innovation)

- Defense Contractors (Companies providing manufacturing and integration services)

- Air Force Commanders (IDF, NATO Air Forces)

- Global Security Consultants (Specialized in defense technology and military integration)

- Regulatory Bodies (Defense Export Control Agencies, National Security Administration)

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the key stakeholders in Israel’s air defense systems market, including government agencies, manufacturers, and international partners. This involves gathering data from industry databases, government reports, and defense white papers to understand the variables that affect market dynamics.

Step 2: Market Analysis and Construction

The market data is compiled and analyzed using historical data regarding defense budgets, procurement cycles, and technological advancements in Israel’s air defense programs. We assess market penetration and identify key market drivers like government initiatives and technological breakthroughs.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses about the growth trajectory of the air defense systems market are tested through consultations with military experts, manufacturers, and defense analysts. These consultations help refine our understanding of operational needs and emerging trends in defense technology.

Step 4: Research Synthesis and Final Output

The final research stage involves synthesizing insights from market data, expert interviews, and primary research to construct a clear picture of the current and future state of the Israel Air Defense Systems market. The report is then validated through stakeholder feedback to ensure its accuracy and relevance.

- Executive Summary

- Research Methodology (Research Definitions and Assumptions; Market Data Sources; Primary & Secondary Research; Defense Procurement Data; Threat Vector Scenario Modelling; Segmentation Logic; Limitations)

- Definition and Scope

- Market Genesis & Historical Overview

- Geopolitical Demand Drivers

- Supply Chain & Value Chain Analysis

- Growth Drivers

Escalating Middle East Missile Threat Vectors (Iranian, Non‑State Actors)

Combat‑Proven System Validation

Export Acceleration (NATO, Asia, Middle East) - Market Challenges

High R&D and Production Cost Curves

Export Regulations and ITAR / National Security Approvals

Threat Evolution (Cruise & Hypersonic) - Market Trends

Directed Energy & Laser Interceptors (Iron Beam)

Sensor & Data Fusion Architecture

AI‑Driven Fire Control

Modular / Plug‑and‑Fight Systems - Opportunity Landscape

Export Expansion in Europe & Asia

Multi‑Domain Integration (Air, Space, Cyber)

Cost‑Per‑Intercept Economies - Regulatory & Government Policy

Defense Budget Allocation Mechanisms

Export Licensing & End‑Use Controls - SWOT Analysis

Strengths: Combat Proven; Tiered Architecture

Weaknesses: Production Bottlenecks

Opportunities: Global Export & Integration

Threats: Counter‑Stealth & Hypersonic Penetration - Porter’s Five Forces

- By Revenue, 2020‑2025

- By Unit Deployment Volume, 2020‑2025

- By Average System ASP, 2020‑2025

- By System Category (In Value %)

Ground Based Interceptors (GBI)

Radar & Sensor Systems

Command & Control (C2) Solutions

Directed Energy & Laser Defense

Electronic Warfare & Cyber Integrated Systems - By Interception Layer (In Value %)

Short‑Range (Point Defense)

Medium‑Range

Long‑Range

Exo‑Atmospheric - By Threat Countered (In Value %)

Rocket & RAM (Rocket/Artillery/Mortar)

Ballistic Missile

UAV / Drone

Cruise Missile

Hypersonic Threat - By End‑User Segment (In Value %)

Israeli Defense Forces (IDF)

Export Military Forces

Allied/NATO Deployments - By Deployment Mode (In Value %)

Static Homeland Defense

Mobile Field Units

Naval Modules - By Technology Intensity (In Value %)

Conventional Kinetic

Active Electronically Scanned Array (AESA)

Integrated Directed Energy

- Market Share by Revenue & Units (Domestic & Export)

Tier 1 vs. Tier 2 Competitive Positioning - Cross Comparison Parameters (Company Overview , Business Strategy & Growth Orientation, Recent Key Contracts & Export Wins, Technology Breadth (System Layers)

Interceptor Cost & ASP Trends

Production Capacity & Scale Global Partner Network / Supply Chai, R&D Investment & Pipeline Systems, Certifications / National Security Accreditations

Field Combat Performance Data) - SWOT of Key Competitors

Operational, Tech, Export, Cost - Pricing / Contractual Analysis

System ASP Bands, Missile Unit Cost, Lifecycle O&M Cost - Detailed Company Profiles

Rafael Advanced Defense Systems Ltd. (Iron Dome, David’s Sling, Iron Beam)

Israel Aerospace Industries (IAI) (Arrow Series, EL/M AESA Radars)

Elbit Systems Ltd. (Directed Energy, Integration)

IAI / ELTA Systems (Advanced Radar & EW)

Raytheon / IAI Partnerships (Arrow Co‑Dev)

Boeing / IAI (Joint Arrow Production)

Lockheed Martin Israel (Sensor / C2 Integration)

Northrop Grumman Israel Affiliates (EW / Systems)

Thales Israel (Sensor & Fire Control)

MBDA (Partnerships)

Dassault / Strategic Integrators

OptiDefense (Light Blade)

Local System Integrators & Tier‑2 Suppliers

Foreign Integrators / Resellers (Regional Partners)

Emerging Start‑Ups (Directed Energy / AI Systems)

- Threat Assessment & Operational Requirements

- Budgetary and Acquisition Cycles

- Procurement Preferences (Indigenous vs. Licensed)

- Interoperability & Integration Requirements

- Training & After‑Sales Support Factors

- By Revenue, 2026‑2035

- By Deployment Units & Interceptor Volume, 2026‑2035

- By Average System & Per‑Unit ASP, 2026‑2035