Market Overview

The Israel Air-to-Surface Missiles market has seen significant growth, driven by Israel’s robust defense sector and its continuous advancements in military technology. The market’s value has been increasing steadily, fueled by substantial investments in defense R&D and Israel’s strategic position in the Middle East, a region with ongoing security concerns. The strong demand for high-precision strike capabilities and the country’s focus on strengthening its defense systems contribute significantly to market growth. Additionally, defense budgets in Israel continue to prioritize missile procurement and upgrades. By the end of 2025, the market size is anticipated to surpass USD ~ billion and is expected to expand further in the coming years.

Israel is the dominant player in the air-to-surface missile market due to its technological leadership, defense expertise, and the constant threat landscape in the Middle East. Cities like Tel Aviv and Herzliya, home to Israel’s defense giants such as Rafael Advanced Defense Systems and Israel Aerospace Industries (IAI), continue to drive innovations in missile technologies. These cities, along with the broader Israeli defense ecosystem, benefit from a highly developed industrial base, strong government support, and significant R&D funding. Israel’s position as a key exporter of air-to-surface missile systems also adds to its dominance in the global market.

Market Segmentation

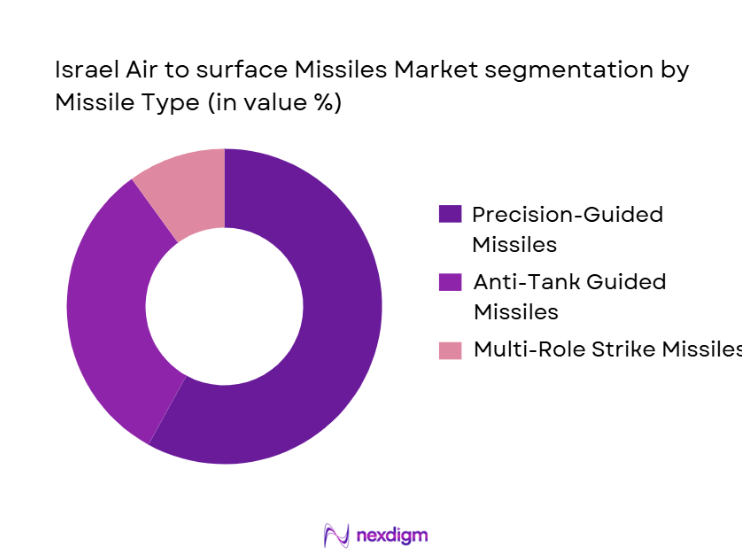

By Missile Type

The Israel Air-to-Surface Missiles market is segmented by missile type into precision-guided missiles, anti-tank guided missiles (ATGMs), and multi-role strike missiles. Among these, precision-guided missiles hold the largest share of the market. This dominance can be attributed to their ability to offer highly accurate and low-collateral damage strikes, making them the preferred choice for modern military forces. Israel’s reliance on precision strike capabilities, particularly in asymmetric warfare, and its investment in advanced technologies like GPS/INS guidance and imaging infrared (IIR) seekers, further boosts the adoption of these missiles.

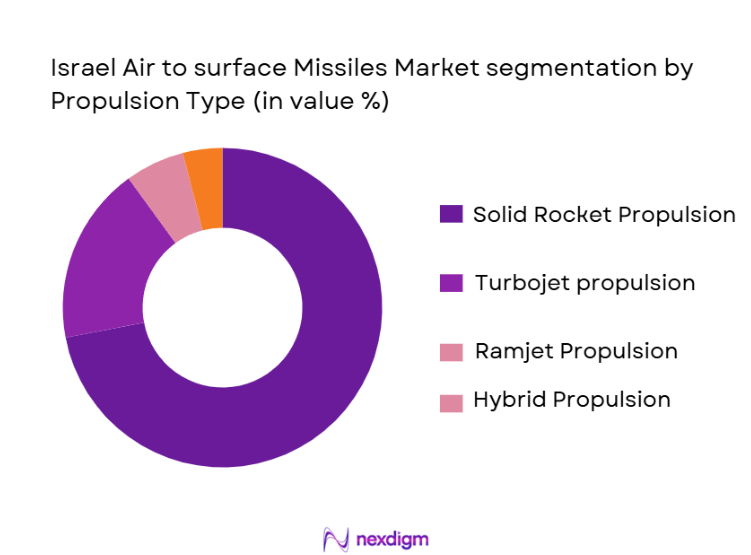

By Propulsion Type

The market is also segmented by propulsion type, which includes solid rocket propulsion, turbojet, ramjet, and hybrid systems. Solid rocket propulsion dominates this segment due to its widespread use in precision-guided munitions (PGMs) and its cost-effectiveness. Solid rocket-propelled missiles offer a reliable and efficient solution for air-to-surface strikes, particularly in scenarios where swift deployment and precise targeting are required. The simplicity and efficiency of solid propulsion also make it a preferred choice for integration with existing military platforms, such as fighter jets and drones.

Competitive Landscape

The Israel Air-to-Surface Missiles market is highly competitive, with a few dominant players shaping the industry. These companies benefit from strong government ties, advanced technological capabilities, and extensive defense contracts with Israel’s Ministry of Defense. Leading players like Rafael Advanced Defense Systems, Israel Aerospace Industries (IAI), and Elbit Systems continue to dominate due to their cutting-edge missile technologies and significant contributions to the Israeli military’s operational capabilities. The market is also influenced by international partnerships, with several companies securing major contracts in foreign markets, contributing to their sustained growth.

| Company | Establishment Year | Headquarters | Technological Edge | Export Market Reach | R&D Investment | Defense Contracts | Manufacturing Capacity |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Israel Air-to-Surface Missiles Market Analysis

Growth Drivers

Technological Advancements in Precision Targeting

Continuous innovations in precision-guided munitions (PGMs), including the integration of advanced guidance systems, have been a major growth driver for the Israel air-to-surface missiles market. Technologies such as GPS/INS guidance and multi-mode seekers enhance missile accuracy, making them highly desirable for modern military forces.

Geopolitical Tensions in the Middle East

Ongoing regional conflicts and security concerns in the Middle East have led to increased military expenditure and defense procurement, further accelerating the demand for advanced air-to-surface missiles. Israel’s strategic position in this volatile region drives its investments in missile defense systems.

Market Challenges

Export Control Regulations and Compliance

Stringent export control regulations, including the International Traffic in Arms Regulations (ITAR) and the Missile Technology Control Regime (MTCR), can limit the ability of manufacturers to expand in international markets, posing a significant challenge for growth.

High R&D and Manufacturing Costs

Developing cutting-edge missile technologies requires significant investment in research and development, as well as expensive manufacturing processes. The high costs associated with missile production can limit profitability and accessibility for some defense agencies.

Opportunities

Increased Military Spending in Emerging Markets

Several emerging countries are looking to modernize their defense capabilities, providing a significant opportunity for Israel’s missile systems. This includes a rising demand for advanced, precision strike capabilities, which is well-aligned with Israeli missile technologies.

Partnerships with NATO and Allied Nations

Israel’s strong defense relationships with NATO and allied countries open doors for joint development programs, technology transfers, and export opportunities. These collaborations can help mitigate market risks and expand the reach of Israeli air-to-surface missile systems in global defense markets.

Future Outlook

Over the next five years, the Israel Air-to-Surface Missiles market is expected to maintain a steady growth trajectory, driven by continuous advancements in missile technologies, particularly in precision guidance, autonomous targeting, and hypersonic capabilities. Israel’s position in the volatile Middle East will continue to shape demand for advanced air-to-surface missile systems as countries invest in modernizing their defense arsenals. Additionally, growing export activities and international defense partnerships are expected to expand the market’s reach beyond Israel’s borders. The market is also poised to benefit from the increasing demand for versatile, multi-role strike systems across various defense platforms.

Major Players

- Rafael Advanced Defense Systems

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Lockheed Martin

- MBDA

- Boeing Defense

- Northrop Grumman

- Raytheon Technologies

- Thales Group

- Kongsberg Defence

- LIG Nex1

- Roketsan

- Bharat Dynamics

- Leonardo Defence

- General Dynamics

Key Target Audience

- Defense Ministries

- Armed Forces Procurement Divisions

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defense Contractors and OEMs

- Strategic Defense Alliances

- Military System Integrators

- International Defense Equipment Buyers

Research Methodology

Step 1: Identification of Key Variables

The initial phase of the study involved mapping out the key stakeholders in the Israel Air-to-Surface Missiles market, which includes manufacturers, suppliers, government agencies, and military buyers. Secondary data was collected through industry reports, defense publications, and relevant government documents.

Step 2: Market Analysis and Construction

In this phase, historical data on missile procurement, technological advancements, and defense budgets were analyzed to determine market trends. A combination of primary and secondary sources was used to assess the potential for growth in missile exports and defense collaborations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding technological adoption and export trends were validated through interviews with defense experts, industry veterans, and stakeholders from major companies like Rafael and IAI.

Step 4: Research Synthesis and Final Output

The final stage involved consolidating market data and deriving insights on the future trajectory of the Israel Air-to-Surface Missiles market. This synthesis incorporated feedback from defense experts and manufacturers to ensure the accuracy and relevance of the report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Competitive Intelligence Approach, Source Triangulation, Primary & Secondary Defense Interviews, Projection Model Description, Data Quality Management)

- Definition and Scope

- Technological Genesis and Evolution

- Operational Value Chain & Defense Procurement Cycle

- Supply & Integration Chains

- Export Control Regimes and Defense Trade Classifications

- Growth Drivers

Procurement Funding Cycles

Geopolitical Threat Adjustment - Technology Push Factors

AI Acquisition

MultiMode Seeker Adoption - Demand Constraints

Export Control

Production Bottlenecks - Opportunity Spaces

International MRO

DataLink Software Licensing - Regulatory & Compliance Landscape

Export Control Regimes - Innovation Trends

StandOff Range Enhancements

Loitering Munition Integration - SWOT – Israel AirtoSurface Missiles

- Porter’s Five Forces

- Market Valuation 2020-2025

- Volume Indicators 2020-2025

- Price Metrics 2020-2025

- Spend Intensity 2020-2025

- By Missile Class (In Value%)

PrecisionGuided StandOff Missiles

Cruise Missiles

Ballistic & BoostGlide Missiles

AntiArmor/Point Target Missiles

MultiMission Integrated Payload Missiles - By Propulsion (In Value%)

SolidFuel Rocket

Turbojet / Turbofan Propulsion

DualMode Ramjet Propulsion

Hybrid Propulsion Systems

Emerging Hypersonic BoostGlide Propulsion - By Guidance & Seeker (In Value%)

GPS/INS Guidance

Imaging Infrared

MultiMode Seekers

AntiJam & ECCMHardened Systems

Autonomous/AIAssisted Targeting - By Launch Platform (In Value%)

FixedWing Combat Aircraft

Rotary Wing / Gunship Platforms

UAV/UCAV Launch Platforms

Joint Strike Capable Platforms

Export Variant Platforms - By End User (In Value%)

Israeli Defense Forces

Foreign Military Sales

Defense OEM Partners

Defense Integrators & System Integrators

- Market Share by Value / Units

- CrossComparison Parameters (Product Portfolio Breadth, Propulsion & Seeker Technology Levels, Production Capacity Utilization, Tier1 Supplier Relationships, Export Control Approvals & Licensing Footprint, R&D Investment Intensity, Defense Program Support & Sustainment Contracts, Unit Cost Efficiency / Procurement Unit Price)

- SWOT of Major Competitors

- Key Competitors

Rafael Advanced Defense Systems

Israel Aerospace Industries

Elbit Systems

Lockheed Martin

Raytheon Technologies

Boeing Defense

MBDA

Northrop Grumman

Thales Group

BAE Systems

Kongsberg Defence

Roketsan

Bharat Dynamics

LIG Nex1

Leonardo Defence

- Platform Integration Rates

- Deployment Patterns & Mission Use Cases

- Maintenance, Repair, Overhaul Demand

- Training & Simulation Spend

- PostDeployment Performance Analytics

- By Contract Value 2026-2035

- By Units 2026-2035

- By Tech Tier Adoption 2026-2035