Market Overview

The Israel airborne countermeasure system market is valued at approximately USD ~ billion in 2025. This market is primarily driven by Israel’s strategic defense policies, where air defense and electronic warfare (EW) solutions play a crucial role in national security. The dominance of Israel’s defense sector, including renowned defense technology firms such as Israel Aerospace Industries (IAI) and Elbit Systems, significantly contributes to the market’s growth. Furthermore, Israel’s defense exports to allied nations bolster the market, supported by increasing procurement of advanced airborne self-protection systems, including directed infrared countermeasures (DIRCM) and radar jamming systems.

Israel stands as the dominant player in the airborne countermeasure system market due to its advanced technological expertise in aerospace defense systems and its strategic geographic location in the Middle East. The country has a long-standing history of military innovation, with the Israel Defense Forces (IDF) being a significant driver for both research and deployment of cutting-edge airborne defense technologies. Additionally, Israel’s defense technology exports are robust, with global customers including NATO countries and other strategic allies. The country’s strong military-industrial base further solidifies its leadership in this sector.

Market Segmentation

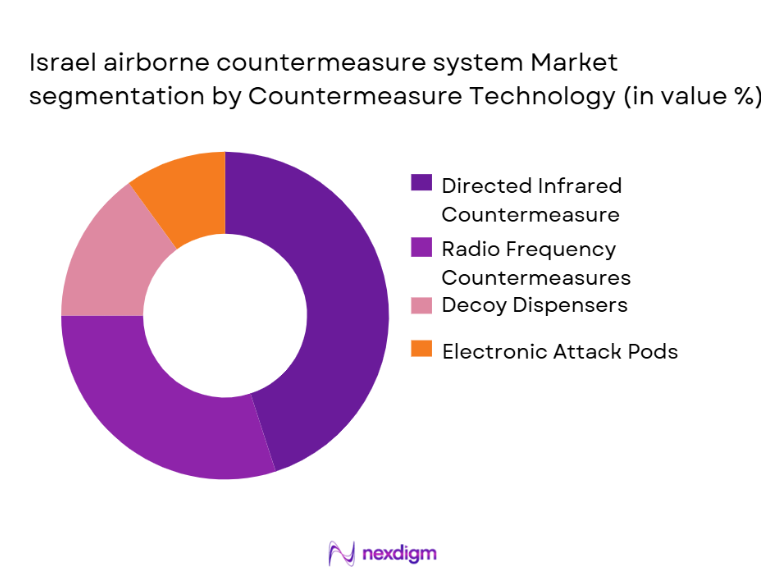

By Countermeasure Technology

The Israel airborne countermeasure system market is segmented by countermeasure technology into Directed Infrared Countermeasure (DIRCM), Radio Frequency (RF) Countermeasures, Decoy Dispensers, and Electronic Attack (EA) Pods. Among these, DIRCM systems dominate the market due to their highly effective counteraction against missile threats. DIRCM technology is widely used in Israel’s fighter aircraft, helicopters, and UAVs, driven by its proven ability to defeat infrared-guided missiles. The growing demand for advanced, multi-layered protection suites that integrate DIRCM into broader electronic warfare (EW) solutions is a key factor in this segment’s leadership. This is particularly relevant to the IDF’s modernization programs, which increasingly incorporate DIRCM systems across all air platforms.

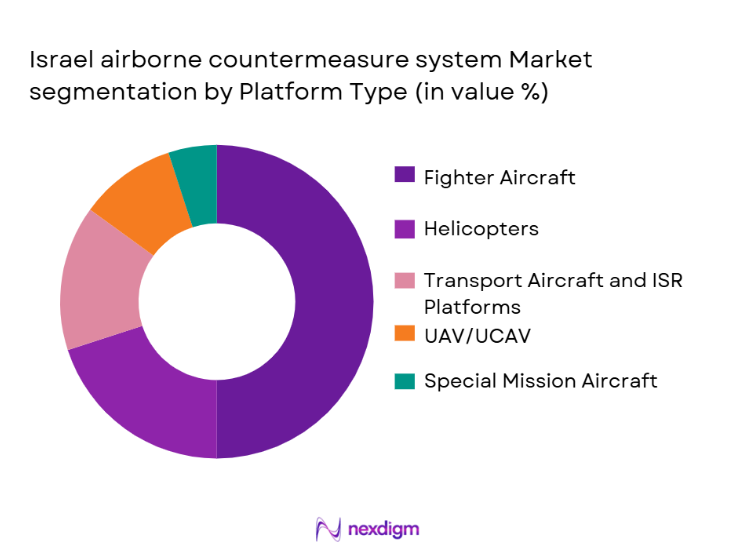

By Platform Type

The market is also segmented by platform type into fighter aircraft, helicopters, transport aircraft, UAVs (Unmanned Aerial Vehicles), and special mission aircraft. Among these, fighter aircraft account for the largest market share in airborne countermeasure systems. This dominance is attributed to the critical role of fighter jets in national defense strategies, where advanced countermeasure systems like DIRCM and RF jammers are integral to mission success and survivability in hostile environments. Israel’s fleet of advanced fighter jets, including the F-35, is equipped with sophisticated airborne self-protection systems, contributing significantly to this platform segment’s growth.

Competitive Landscape

The Israel airborne countermeasure system market is dominated by several major defense technology firms, including Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems. These companies have a strong presence in both domestic and international markets, providing advanced self-protection solutions for various aircraft platforms. The consolidation of these key players within the market highlights the significance of technological innovation and government collaboration in sustaining dominance.

| Company | Establishment Year | Headquarters | Market-specific Parameters |

| Israel Aerospace Industries (IAI) | 1953 | Lod, Israel | ~ |

| Elbit Systems Ltd. | 1966 | Haifa, Israel | ~ |

| Rafael Advanced Defense Systems | 1948 | Haifa, Israel | ~ |

| BAE Systems plc | 1999 | London, UK | ~ |

| Lockheed Martin | 1995 | Bethesda, Maryland, USA | ~ |

Israel Airborne Countermeasure Systems Market Analysis

Growth Drivers

Increasing Geopolitical Tensions and Security Needs

Rising tensions in the Middle East and other global hotspots are driving the demand for advanced airborne countermeasure systems. Nations, especially in defense-sensitive regions like Israel, are investing heavily in technologies that can enhance the survivability of their aircraft, including fighters, UAVs, and helicopters. This growing focus on air defense has led to an increased adoption of sophisticated self-protection systems, such as DIRCM and RF jammers, to counter missile and radar threats.

Technological Advancements in Electronic Warfare

The continuous development of EW technologies, particularly in the integration of AI, machine learning, and multi-spectral sensors, is fueling market growth. The ability to detect, identify, and neutralize threats in real time is enhancing the effectiveness of airborne countermeasures. This includes advancements in automated systems, reducing the need for manual intervention, and increasing the speed and accuracy of threat response.

Market Challenges

High Costs of Advanced Systems and Integration

The complex and high-cost nature of developing and integrating cutting-edge airborne countermeasure systems poses a significant barrier to growth. The cost of advanced systems such as DIRCM and radar jammers, along with their integration into existing aircraft, is a major challenge for many defense forces, particularly those with budget constraints. This limits the adoption of advanced solutions, especially for smaller defense budgets in allied countries.

Export Restrictions and Regulatory Hurdles

Export controls, such as those imposed by the U.S. and Israel, along with stringent international regulations on defense technology sales, pose significant challenges. Companies operating in the airborne countermeasure market face hurdles in distributing and selling their systems globally due to compliance with ITAR (International Traffic in Arms Regulations) and other government-imposed restrictions, limiting market expansion.

Opportunities

Emerging UAV and UCAV Markets

The increasing use of UAVs (Unmanned Aerial Vehicles) and UCAVs (Unmanned Combat Aerial Vehicles) for surveillance, reconnaissance, and combat missions creates significant opportunities for airborne countermeasure systems. With UAVs becoming an integral part of modern defense strategies, the need for effective self-protection solutions against hostile fire, including anti-aircraft missiles and jammers, is expected to rise rapidly.

Modular and Upgradable Systems for Legacy Platforms

There is an opportunity to expand the market by offering modular and upgradable countermeasure systems for legacy aircraft. Many defense organizations are looking to upgrade older platforms rather than invest in entirely new ones. Providing retrofitting options for existing aircraft, especially for nations with aging fleets, could offer a lucrative avenue for growth in both the defense and commercial sectors.

Future Outlook

Over the next five years, the Israel airborne countermeasure system market is expected to witness continued growth, driven by the ongoing modernization of Israel’s air defense capabilities and increasing demand from allied nations. As geopolitical tensions persist in the Middle East, there is a heightened focus on enhancing the survivability of aircraft in complex and hostile environments. Technological advancements in Directed Infrared Countermeasures (DIRCM), coupled with the integration of Artificial Intelligence (AI) in electronic warfare systems, will also contribute significantly to the market’s expansion. Additionally, the growing adoption of advanced countermeasures by UAVs and special mission aircraft will open new avenues for market growth.

Major Players

- Israel Aerospace Industries Ltd. (IAI)

- Elbit Systems Ltd.

- Rafael Advanced Defense Systems

- BAE Systems plc

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- Raytheon Technologies

- SAAB AB

- Chemring Countermeasures Ltd.

- Cobham Limited

- L3Harris Technologies

- Safran S.A.

- ASELSAN AS

- Leonardo S.p.A.

Key Target Audience

- Defense Ministries & Armed Forces

- Defense OEMs

- Airborne System Integrators

- Military Procurement Agencies

- Private Military Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airborne Defense System Developers

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying critical factors impacting the Israel airborne countermeasure system market, including technological developments, defense budgets, and platform-specific needs. Comprehensive secondary data collection, supplemented by interviews with defense experts, aids in defining these variables.

Step 2: Market Analysis and Construction

We will compile and analyze historical market data, focusing on defense budget allocation, airborne countermeasure system adoption rates, and sales performance across platforms like fighter jets and UAVs. This analysis will offer a clear view of market penetration and sector growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market dynamics and technological shifts will be validated through direct consultations with key industry leaders and defense system experts, ensuring our analysis is both accurate and reliable.

Step 4: Research Synthesis and Final Output

The final research synthesis will involve engaging with defense contractors and system integrators to verify findings, assess consumer demand, and ensure that all data is corroborated through interviews and secondary data sources.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Data Triangulation Methods, Primary & Secondary Research Scope, Interview Panels with Defense OEMs & Military EndUsers, Forecast Modeling Approach, Limitations)

- Definition and Scope of Israel Airborne Countermeasure Systems

- Strategic Importance in National Defense & Export Ecosystem

- Genesis and Evolution of Airborne SelfProtection & Electronic Warfare in Israel

- Defense Procurement Cycle Dynamics

- Value Chain

- Growth Drivers

Rising Geopolitical Tensions & Combat Proven Demand

Modernization of Aircraft SelfProtection Suites

Rapid Adoption of MultiSpectral & AIDriven Countermeasures - Market Restraints

High Integration & Lifecycle Costs

Export Control & ITARStyle Regulation Challenges - Market Opportunities

UAV/Loitering Munition SelfProtection Solutions

AI & Cognitive EW for Adaptive Threat Environments

Modular Open Architecture & SoftwareDefined EW Suites - Market Trends

Transition from Conventional Flares to DIRCM

EW & Countermeasure Suites Integrated with ISR & SIGINT Sensors

Growth of Retrofit Market for Legacy Platforms - Israel Airborne Countermeasure System Market Value Chain & Cost Structure

Supplier Ecosystem (RF Components, Laser Sources, Countermeasure Dispensers)

System Integrators & Prime Contractors

Tier1 & Tier2 Supplier Roles

Lifecycle Support & Maintenance Economics - Regulatory & Trade Environment

Export Control Framework (Israel MOD, International Compliance)

Offset & Industrial Participation Requirements

Certification & Field Validation Requirements

International Defense Procurement Barriers

- By Revenue 2020-2025

- By Unit Shipments 2020-2025

- By Installed Base 2020-2025

- Price Trend & ASP Analysis 2020-2025

- Countermeasure Technology (In Value%)

Directed Infrared Countermeasures

Radio Frequency Countermeasure Systems

Decoy Dispenser Systems

Electronic Attack Pods

Integrated Self-Protection Suites - Platform Type (In Value%)

Fighter Aircraft

Helicopters

Transport & ISR Aircraft

UAV/UCAV

Special Mission Aircraft - Deployment Mode (In Value%)

OEM Line-Fit

Retrofit & Upgrade Programs - End-User (In Value%)

Israeli Defense Forces

Export Military Forces

Defense Contractors & System Integrators - Integration Layer (In Value%)

EW Suite

MAWS

Laser Warning Sensors

Counter-Countermeasure Packages

AI-Augmented EW Systems

- Israel airborne countermeasure system Market Competitive Landscape

- Cross Comparison Parameters (Company Overview, Product Portfolio Breadth, R&D Investment Intensity, Technology Differentiators, Certification/Field Proven Deployments, Export Footprint & AfterSales Support, Strategic Partnerships & System Integrations, Compliance & Regulatory Credentials)

- Key Players

Israel Aerospace Industries Ltd.

Elbit Systems Ltd.

Rafael Advanced Defense Systems

ELTA Systems

BAE Systems plc

Lockheed Martin Corporation

Northrop Grumman Corporation

Thales Group

Raytheon Technologies

SAAB AB

Chemring Countermeasures Ltd.

Cobham Limited

L3Harris Technologies

Safran S.A.

ASELSAN AS

- Israel Defense Forces — Mission Requirements & Specifications

- Export Customer Requirements & Qualification Pathways

- Tender Evaluation Criteria (Performance, Survivability Metrics, Interoperability)

- Budget Allocation & Program Scheduling

- Market Revenue Projections 2026-2035

- Unit Deployment Forecasts 2026-2035

- ASP & Technology Trend Impact 2026-2035