Market Overview

The Israel airborne ISR (Intelligence, Surveillance, and Reconnaissance) market is expected to witness substantial growth in 2030, with a market size reaching approximately USD ~ billion. This market growth is primarily driven by Israel’s strategic focus on enhancing its defense capabilities, particularly in areas like border surveillance, anti-terrorism operations, and intelligence gathering. As of 2025, the demand for advanced ISR platforms, including unmanned aerial systems (UAS), manned ISR aircraft, and sensor payloads, has increased, fueled by the growing need for real-time intelligence and battlefield awareness. The Israeli defense sector continues to prioritize cutting-edge technologies in ISR, driving investments in sensor integration, UAV development, and AI-powered analytics, which is expected to contribute to a steady market expansion through 2026.

Israel, home to some of the most prominent global defense contractors like Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems, dominates the airborne ISR market. The country’s technological expertise, coupled with its experience in security challenges, has positioned it as a leader in ISR solutions. The military demand for ISR platforms is consistently strong, especially in areas of real-time surveillance and counterterrorism operations. Tel Aviv, Herzliya, and Haifa serve as hubs for the country’s defense technology ecosystem. Israel’s commitment to advanced ISR systems for military and commercial use is supported by its government defense agencies and export initiatives, ensuring a steady market presence.

Market Segmentation

By Platform Type

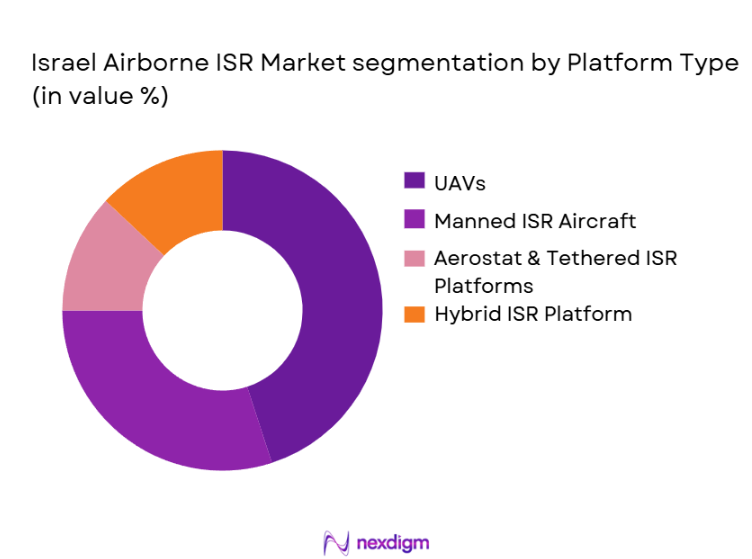

The Israel airborne ISR market is segmented by platform type, consisting of unmanned aerial vehicles (UAVs), manned ISR aircraft, aerostat & tethered ISR platforms, and hybrid ISR platforms. UAVs dominate the market due to their flexibility, lower operational costs, and suitability for a variety of surveillance tasks, including tactical reconnaissance, border control, and maritime surveillance. In 2024, UAVs are expected to account for the largest market share due to their ability to conduct real-time intelligence operations in high-risk environments. Major Israeli manufacturers like IAI’s Heron UAVs and Elbit’s Skylark drones lead this segment by offering state-of-the-art solutions for both military and commercial applications. The increasing demand for autonomous systems and lighter, more portable ISR units is further enhancing the role of UAVs in this market.

By Sensor Payload

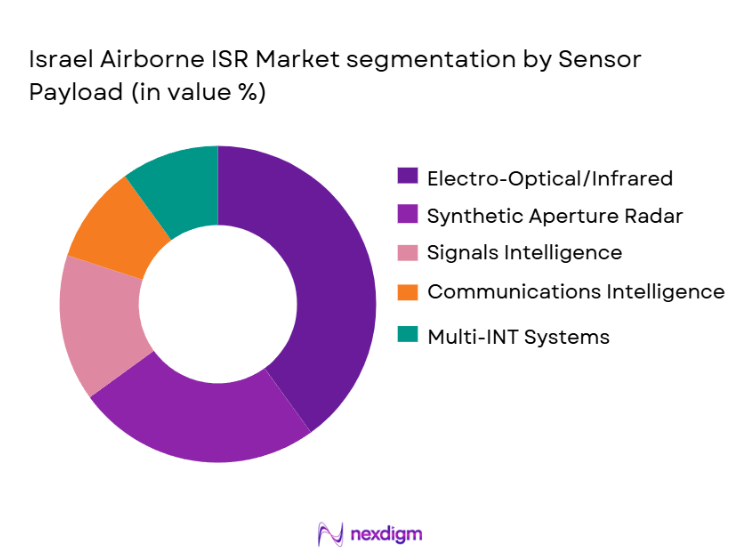

In the Israel airborne ISR market, the sensor payload segment includes electro-optical/infrared (EO/IR) systems, synthetic aperture radar (SAR), signals intelligence (SIGINT), communications intelligence (COMINT), and multi-intelligence (Multi-INT) systems. EO/IR systems dominate due to their effectiveness in providing high-resolution imagery and real-time video feeds, crucial for precision surveillance in military and security operations. The adoption of EO/IR systems is driven by Israel’s expertise in optical and infrared technologies, providing superior intelligence capabilities in both day and night-time conditions. In 2024, EO/IR systems are expected to command a significant portion of the sensor payload market, particularly with UAV platforms, which are heavily equipped with EO/IR sensors for tactical ISR and border security operations.

Competitive Landscape

The Israeli airborne ISR market is highly competitive, with a combination of domestic players and international defense companies providing cutting-edge solutions. Israel Aerospace Industries (IAI) and Elbit Systems dominate the market, leveraging their strong R&D capabilities and their established defense contracts with the Israeli Ministry of Defense (MoD) and global clients. The competition is driven by the demand for increasingly sophisticated ISR platforms capable of autonomous operation, long endurance, and multi-sensor integration. While Israeli companies hold a significant market share, international players like General Atomics and Northrop Grumman are also competing for contracts, especially in the export market.

| Company | Year of Establishment | Headquarters | Platform Types | Sensor Types | Revenue in ISR Segment | International Partnerships | Major Defense Contracts |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1984 | Israel | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | U.S.A. | ~ | ~ | ~ | ~ | ~ |

| General Atomics | 1955 | U.S.A. | ~ | ~ | ~ | ~ | ~ |

Israel Airborne ISR Market Analysis

Growth Drivers

Technological Advancements in UAVs

The rise of UAV technology is a key growth driver for the Israel Airborne ISR market. The development of smaller, more efficient, and cost-effective UAVs with high-end surveillance capabilities is leading to their widespread adoption in both military and civilian applications. This trend is especially visible in the defense sector, where UAVs are used for reconnaissance missions, surveillance, and target acquisition. Israel has long been a pioneer in UAV technology, and its expertise in miniaturizing and optimizing drone systems for ISR purposes is unparalleled. As countries seek to enhance their aerial surveillance capabilities, Israel’s technological innovations in UAVs are becoming increasingly sought after by international markets. The ability of UAVs to operate in complex environments with minimal risk and at a reduced operational cost compared to manned platforms makes them an attractive option for surveillance operations. With UAVs playing a central role in modernizing ISR operations, their adoption is expected to continue to drive market growth.

Rising Security Concerns and Geopolitical Tensions

Another significant growth driver for the Israel Airborne ISR market is the growing concern over national and regional security, particularly in areas facing geopolitical instability. Countries around the world, especially in the Middle East, are increasing their investment in defense technologies, with airborne ISR systems being a central component of these efforts. The increasing prevalence of asymmetric warfare, terrorism, and border security issues has elevated the need for real-time intelligence gathering. ISR systems, particularly those that are airborne, provide critical situational awareness, enabling governments to respond swiftly to threats. As military budgets grow and the demand for enhanced surveillance capabilities rises, Israel’s airborne ISR technology continues to meet the needs of nations prioritizing security and defense preparedness. This increased demand for high-tech defense solutions across the globe contributes to the sustained growth of the market.

Market Challenges

High Cost of Development and Integration

One of the primary challenges facing the Israel Airborne ISR market is the high cost of developing and integrating advanced surveillance systems. The sophisticated technology behind airborne ISR platforms, including radar systems, sensors, and UAVs, involves significant investment in research and development. For many countries, the high capital expenditure required to procure and maintain such systems may limit the broader adoption of these technologies. Additionally, integrating these advanced systems into existing defense infrastructure poses technical and financial challenges, as it requires compatibility with various communication and surveillance platforms. The need for continuous upgrades and maintenance further increases the financial burden, which may deter some potential buyers from investing in state-of-the-art ISR solutions.

Operational Limitations in Complex Environments

Despite the advanced capabilities of airborne ISR systems, their performance can be limited in complex operational environments. Issues such as weather conditions, limited flight endurance, and range constraints can hinder the effectiveness of ISR platforms. Additionally, the need for constant communication between the airborne platforms and ground stations introduces potential vulnerabilities in surveillance operations. As ISR systems become increasingly integrated into national defense strategies, operational limitations become a critical challenge, particularly in remote and hostile regions where terrain and environmental factors can impact performance. These operational constraints may delay the adoption of certain ISR technologies or result in higher costs for system modification and optimization.

Opportunities

Expanding Commercial Applications of ISR

While the Israel Airborne ISR market has traditionally been driven by military applications, there is significant potential for growth in the commercial sector. With advancements in drone technology, airborne ISR systems are now being explored for use in a wide range of commercial applications, including agricultural monitoring, disaster response, and environmental surveillance. Israel’s expertise in UAV development positions the country to capitalize on this growing demand for non-defense-related ISR applications. As more industries recognize the value of real-time data and surveillance capabilities, commercial sectors are increasingly adopting airborne ISR technologies. This shift presents a new growth opportunity, expanding the market for airborne ISR systems beyond traditional defense uses and into emerging markets where these technologies can have a significant impact.

Collaborations with Global Defense Contractors

Another promising opportunity for the Israel Airborne ISR market is the continued collaboration with global defense contractors. Israel has established strong ties with several international defense forces, providing them with advanced ISR solutions for counter-terrorism, border security, and military intelligence. These collaborations allow Israel to expand its market reach and enhance its product offerings. As global defense spending continues to rise, particularly in emerging markets, Israel’s role as a key supplier of airborne ISR systems is likely to grow. Strategic partnerships with foreign governments and defense contractors not only strengthen Israel’s position in the market but also open new avenues for growth in international markets. By maintaining strong relationships with key global defense players, Israel is well-positioned to capitalize on future opportunities in the airborne ISR sector.

Future Outlook

Over the next five years, the Israel airborne ISR market is poised for significant growth. The market’s expansion will be driven by ongoing technological advancements in autonomous UAVs, the increased integration of AI and machine learning in ISR data processing, and a heightened focus on national security amid evolving geopolitical threats. Israel’s strategic position as a defense technology leader, coupled with the growing demand for real-time intelligence gathering, will continue to propel the market. Additionally, exports of ISR technologies to NATO countries and other allied forces will fuel long-term market growth, with UAVs and multi-intelligence systems being critical enablers of this expansion.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Rafael Advanced Defense Systems

- Northrop Grumman

- General Atomics

- Lockheed Martin

- Boeing

- Thales Group

- Leonardo

- BAE Systems

- Saab

- Kratos Defense & Security Solutions

- L3Harris Technologies

- Textron Systems

- AeroVironment

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defense Contractors

- Aerospace OEMs

- ISR Service Providers

- Defense Technology Consultants

- Military Strategic Planners

- Intelligence Agencies

Research Methodology

Step 1: Identification of Key Variables

In this step, the research team identifies the key variables that influence the Israel airborne ISR market. This includes understanding the technological advancements in ISR platforms, government defense spending, procurement cycles, and geopolitical risks that affect Israel’s defense strategies.

Step 2: Market Analysis and Construction

The market analysis phase involves gathering historical data on airborne ISR technology adoption, focusing on the share of UAVs and manned aircraft. Data is derived from secondary sources like government defense budgets and public contracts, alongside proprietary databases.

Step 3: Hypothesis Validation and Expert Consultation

The research hypotheses are validated through consultations with industry experts, including military officials, defense contractors, and technology providers. These interviews are conducted via telephone and face-to-face meetings to ensure data validity.

Step 4: Research Synthesis and Final Output

The final output integrates market data from top-down and bottom-up approaches. Experts are consulted to verify trends, validate revenue generation estimates, and refine segmentations such as UAVs, sensors, and service models.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Defense Procurement Lifecycle, ISR Platform Taxonomy, Military Stakeholder Mapping, Data Sources, Primary Research Coverage, Limitations)

- Definition and Scope

- Historical Evolution of Israel ISR Doctrine

- ISR Architecture & Force Integration

- Airborne ISR Mission Profiles

- Value Chain

- National Export Control Regime & Offset Obligations

- Growth Drivers

Increased Defence Expenditures in ISR Capabilities

Demand for Persistent Border ISR

Export Demand from Allied Forces

Technological Innovation in Sensors & Autonomy - Market Challenges

Regulatory Barriers & ITAR/EAR Export Constraints

High Upfront Development & Integration Costs - Opportunities

AI/ML Enhanced ISR Data Fusion Services

ISRaaS & Managed ISR Offerings

ISR Integration with Space and Cyber - Market Trends

Shift Toward Open Architecture & COTS Integration

Increased Autonomy & AI Analytics

ISR Network Interoperability (AirLandSea)

- By Revenue 2020-2025

- By Platform Units 2020-2025

- By Sensor Payload Value 2020-2025

- By Service & Support Value 2020-2025

- By Platform Type (In Value%)

Unmanned Aerial Vehicles (UAVs)

Manned ISR Aircraft

Aerostat & Tethered ISR Platforms

Hybrid/Loitering ISR Platforms

ISRaaS (ISR as a Service) Deliverables - By Sensor Payload (In Value%)

EO/IR ElectroOptical & Infrared Systems

SAR/GMTI Synthetic Aperture Radar / Ground Moving Target Indicator

SIGINT

COMINT

MultiINT Fusion Systems - By End User (In Value%)

Israel Defence Forces

Ministry of Defence

Homeland Security & Border Units

Allied Government Customers

Commercial/NonDefense - By Application (In Value%)

Border & Coastal Surveillance

Battlefield ISR

Target Acquisition & Tracking

Signals & Electronic Warfare Support

Intelligence Processing & Dissemination - By Service Type (In Value%)

Platform Integration & Installation

Data Analytics & AIDriven ISR Fusion

Lifecycle Maintenance & Upgrades

Training & Simulation

Subscription & ISRaaS Models

- Market Share by Revenue & Platform Units

- CrossComparison Parameters (Business Focus, Platform Endurance Metrics, Average Payload Weight, Sensor Suite Capability, Data Processing Architecture, Certification & Export Licenses, Lifecycle Service Contracts, R&D Investment, ISRaaS Footprint)

- Major Companies

Israel Aerospace Industries

ELTA Systems Ltd.

Elbit Systems Ltd.

RT Aerostats Systems

UVision Air

Aeronautics Ltd.

Rafael Advanced Defense Systems

General Atomics Aeronautical Systems

Northrop Grumman

Boeing Defence ISR Divisions

Thales ISR Division

Leonardo ISR Systems

Saab AB ISR

L3Harris ISR Technologies

Kratos Defense & Security Solutions

- IDF Mission Requirements & Utilization Patterns

- Budget Allocation & Procurement Cycle

- Pain Points & Deployment Constraints

- Operational Readiness & Maintenance Profiles

- DecisionMaking Criteria (Capability, Reliability, Interoperability)

- By Revenue 2026-2035

- By Platform Units & Sensor Adoption Rates 2026-2035

- By ISR Service Revenues 2026-2035