Market Overview

The Israel Airborne Radars market is valued at USD ~ billion, with growth driven by substantial investments in defense technologies and the increasing reliance on advanced radar systems for both military and civilian applications. The market is primarily fueled by technological advancements such as the integration of synthetic aperture radar (SAR) and improvements in radar miniaturization. With the continuous defense budget allocation from Israel, the market’s expansion is expected to be robust. In addition, global demand for airborne surveillance and reconnaissance capabilities further accelerates the sector’s development.

Israel, being a leader in defense innovation, dominates the market, with key manufacturers such as Israel Aerospace Industries (IAI) and Rafael Advanced Defense Systems. The country benefits from its strategic location, geopolitical needs, and longstanding expertise in radar technologies. Israel’s robust defense and aerospace sectors, combined with strong partnerships with countries like the United States and India, provide a significant competitive edge. Additionally, leading defense hubs in Tel Aviv and Herzliya act as central locations for research and production, further solidifying Israel’s dominance in the airborne radar market.

Market Segmentation

By System Type

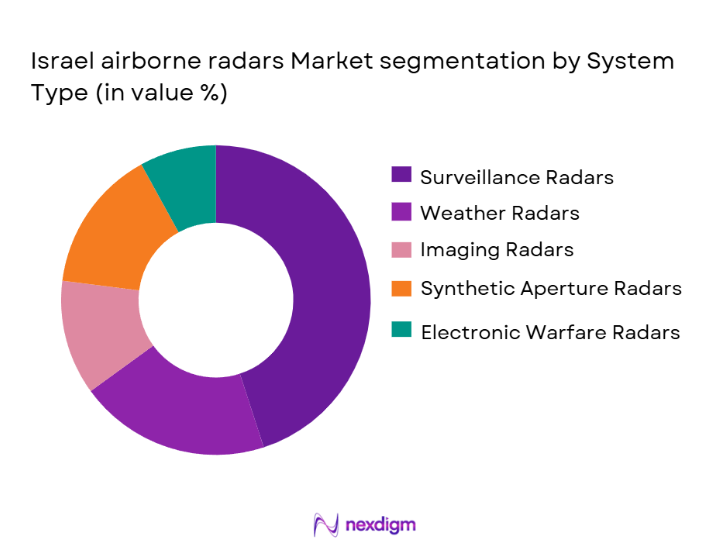

The Israel Airborne Radars market is segmented by system type into surveillance radars, weather radars, imaging radars, synthetic aperture radar (SAR), and electronic warfare radars. Surveillance radars have a dominant market share due to their broad application in both military and civilian sectors, particularly for defense, border security, and monitoring air traffic. The persistent need for airborne surveillance systems in military operations and homeland security further drives the demand for these systems. These systems provide real-time data for situational awareness, making them crucial for strategic operations.

By Platform Type

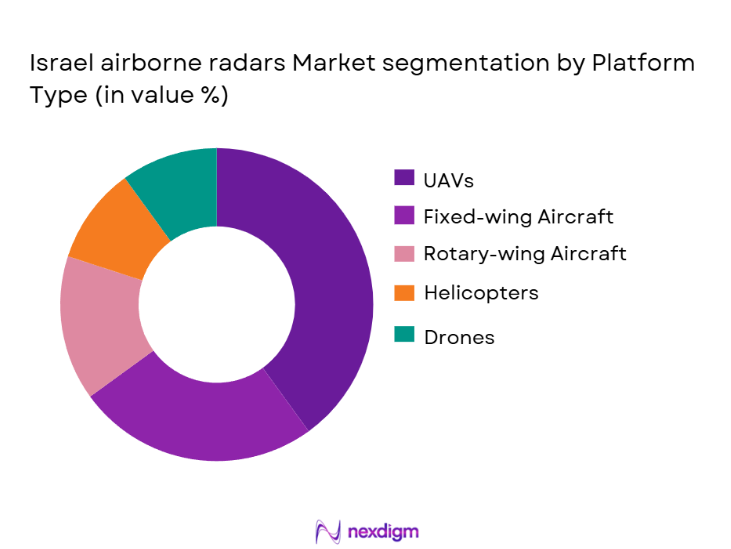

The market is also segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), helicopters, and drones. UAVs are expected to dominate in 2024 as they provide a flexible and cost-effective solution for airborne surveillance. The increasing deployment of UAVs in both military and civilian applications, including surveillance, reconnaissance, and border patrol, makes this platform type highly attractive. UAVs offer operational efficiency by minimizing operational costs while maintaining high-performance capabilities for radar-based missions.

Competitive Landscape

The Israel Airborne Radars market is dominated by key players such as Israel Aerospace Industries (IAI), Elbit Systems, and Rafael Advanced Defense Systems. These companies are known for their advanced radar technologies, strategic partnerships with international defense organizations, and continuous innovation in airborne radar systems. IAI leads with a strong portfolio in radar systems for military applications, while Elbit Systems has a significant presence in both defense and civil applications. Other international players like Northrop Grumman and Thales Group also contribute to the competitive landscape.

| Company | Establishment Year | Headquarters | Annual Revenue | Radar Systems | Market Focus | Strategic Partnerships |

| Israel Aerospace Industries (IAI) | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1984 | Haifa, Israel | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ |

Israel Airborne Radars Market Analysis

Growth Drivers

Increased Defense Spending

Governments across the world, especially in regions like Israel, the U.S., and Europe, continue to increase defense budgets, prioritizing the procurement of advanced surveillance and radar systems to enhance national security and military capabilities.

Technological Advancements

The continuous innovation in radar technologies, such as the integration of Synthetic Aperture Radar (SAR) and miniaturization of radar systems, has fueled the demand for more efficient and powerful airborne radar solutions, contributing to market growth.

Market Challenges

High System Costs

The high cost associated with developing and maintaining advanced radar systems, especially those integrated with cutting-edge technologies, presents a significant barrier for wide-scale adoption, particularly for smaller nations or defense contractors with limited budgets.

Integration Complexity

The integration of advanced radar systems with existing platforms (e.g., UAVs, fixed-wing aircraft) can be complex and costly, requiring significant customization and technical expertise, which may slow down market adoption and deployment.

Opportunities

Rising Demand for UAVs and Drones

The increasing reliance on unmanned aerial vehicles (UAVs) for military and civilian applications presents a substantial growth opportunity for airborne radar systems, as they are critical for enhancing the surveillance and reconnaissance capabilities of these platforms.

Emerging Civilian Applications

Beyond defense, airborne radar systems are increasingly being adopted for civilian uses, such as weather forecasting, air traffic control, and border surveillance, opening up new markets and applications for radar technology.

Future Outlook

Over the next five years, the Israel Airborne Radars market is expected to witness significant growth due to increasing defense budgets, advancements in radar technologies, and the growing adoption of UAVs and drones for surveillance operations. The demand for advanced radar systems, including synthetic aperture radar (SAR) and electronic warfare radars, will further propel market expansion. The continuous need for superior surveillance capabilities in military, border security, and civil aviation applications is set to drive market growth.

Major Players

- Israel Aerospace Industries (IAI)

- Elbit Systems

- Rafael Advanced Defense Systems

- Northrop Grumman

- Thales Group

- Lockheed Martin

- Raytheon Technologies

- L3Harris Technologies

- BAE Systems

- Leonardo

- General Electric

- AeroVironment

- Saab Group

- Mitsubishi Electric

- Honeywell Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense contractors

- UAV manufacturers and developers

- Surveillance and security solution providers

- Civil aviation agencies

- Border control agencies

- Air traffic management authorities

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all critical factors that impact the Israel Airborne Radars market, including technological trends, defense sector investments, and the influence of geopolitical factors. Secondary research, including the use of databases like Statista and government reports, will help identify these variables.

Step 2: Market Analysis and Construction

In this phase, historical data from defense contracts, market penetration of airborne radar systems, and regional variations will be analyzed. Data will be sourced from reputable government and industry reports to build accurate market construction models.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses about market trends will be validated through in-depth interviews with industry experts, defense contractors, and key stakeholders. The consultations will offer insights into the operational feasibility and forecasted growth for the market.

Step 4: Research Synthesis and Final Output

After the hypothesis validation, the final analysis will be derived by synthesizing the insights gathered. Engagement with manufacturers and end-users will ensure the validity of the market data and offer accurate future projections for the Israel Airborne Radars market.

- Executive Summary

- Israel Airborne Radars Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense spending in Israel

Advancements in radar technology and miniaturization

Rising demand for UAVs and drones in defense applications - Market Challenges

High cost of advanced radar systems

Geopolitical tensions affecting market growth

Technological complexity and integration issues - Market Opportunities

Growth of commercial UAVs in airspace monitoring

Emerging demand for synthetic aperture radar (SAR) in civil applications

Strategic collaborations with global aerospace companies - Trends

Integration of AI and machine learning in radar systems

Development of lightweight, compact radar systems

Focus on enhancing radar system capabilities for surveillance and reconnaissance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Surveillance Radars

Weather Radars

Imaging Radars

Synthetic Aperture Radar (SAR)

Electronic Warfare Radars - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters

Drones - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket Retrofit

Modular Systems

Mobile Systems

Upgrades & Enhancements - By EndUser Segment (In Value%)

Defense & Military

Aerospace & Aviation

Government & Homeland Security

Search & Rescue

Meteorology - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Partnerships

Distributors & Resellers

Online Marketplaces

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, Region, Application Area)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

IAI ELTA Systems

IAI Tamam Division

AeroVironment

Northrop Grumman

Lockheed Martin

Thales Group

Raytheon Technologies

L3Harris Technologies

General Electric

BAE Systems

Rockwell Collins

Leonardo

- Increased demand for surveillance systems in defense sectors

- Growing integration of airborne radars with UAVs and drones

- Shift towards cost-effective, multifunctional radar solutions

- Emerging interest from meteorological agencies for weather radar applications

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035