Market Overview

The Israel Aircraft Fuel Tanks Market is USD ~ million big and has been expanding in recent years due to the steady increase in the aviation sector and the modernization of both military and commercial fleets. Israel’s aviation industry, led by Israel Aerospace Industries (IAI) and major carriers, has been focusing on fleet upgrades, which drives the demand for advanced fuel tank technologies. With Israel’s strategic role in the Middle East and an estimated global air traffic of over 4 billion passengers in 2024, the demand for efficient fuel tanks grows in line with regional security and commercial flight growth. Fuel systems remain a central focus due to Israel’s leading role in aerospace innovation.

Israel, particularly Tel Aviv and Haifa, is a key player in the Middle Eastern aircraft fuel systems market. Israel is known for its robust aerospace and defense industry, with companies such as Israel Aerospace Industries (IAI) and Elbit Systems leading the charge in aircraft manufacturing and maintenance. The country’s geopolitical significance further fuels its military aviation market, increasing demand for advanced fuel tank systems for military and commercial aircraft. Furthermore, its continuous push for innovation in fuel efficiency and sustainable aviation ensures its continued dominance in this market.

Market Segmentation

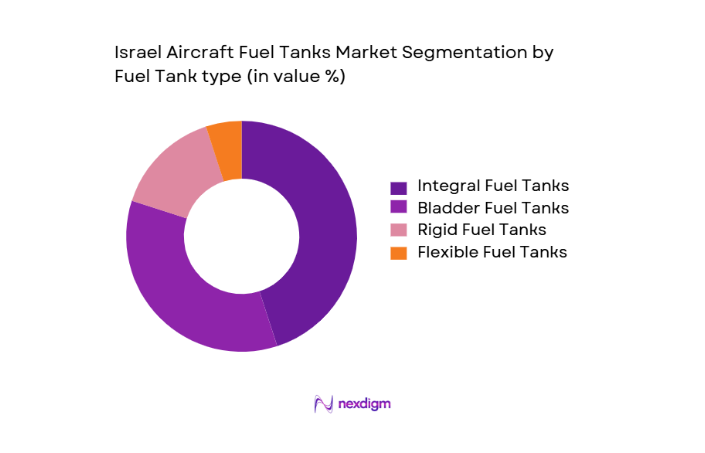

By Fuel Tank Type

The market for aircraft fuel tanks in Israel is segmented by fuel tank type, which includes Integral Fuel Tanks, Bladder Fuel Tanks, Rigid Fuel Tanks, and Flexible Fuel Tanks. The Integral Fuel Tanks segment leads the market due to their integration into the structure of aircraft, enhancing fuel storage capacity without additional weight. These tanks are commonly used in both commercial and military aircraft, providing long-range capacity and higher durability. This trend is particularly prominent among Israeli aircraft manufacturers, which prioritize long-range, mission-critical capabilities.

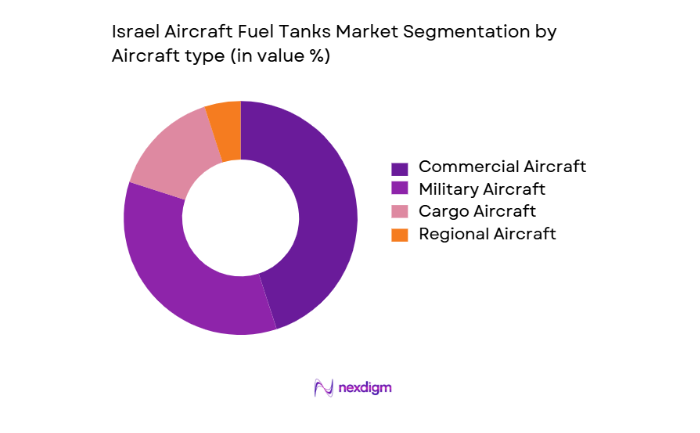

By Aircraft Type

The market is also segmented by aircraft type, including Commercial Aircraft, Military Aircraft, Cargo Aircraft, and Regional Aircraft. The Commercial Aircraft segment is the dominant player, primarily driven by demand from international airlines operating in and through Israel’s Ben Gurion Airport. The growing number of global passengers traveling through the Middle East bolsters the demand for larger, more fuel-efficient aircraft. Israeli airlines and companies like El Al continue to expand their fleets, with an increasing focus on sustainability, fueling demand for advanced fuel tanks in newer aircraft models.

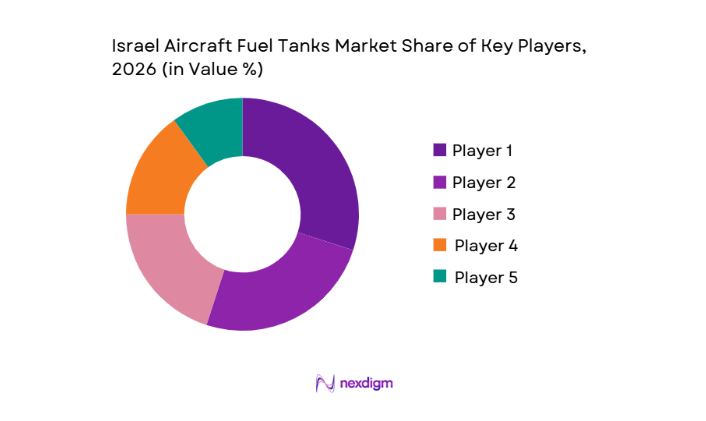

Competitive Landscape

The Israel Aircraft Fuel Tanks Market is competitive and led by a few key global players, including Honeywell Aerospace, GE Aviation, Safran Aircraft Engines, Rolls-Royce, and Israel Aerospace Industries (IAI). These companies are instrumental in developing and providing cutting-edge fuel tanks for military and commercial aircraft. Their established presence in Israel’s defense and aerospace sectors gives them a competitive advantage, allowing them to meet the growing demand for advanced fuel system solutions. Innovation and adherence to stringent aviation standards continue to be essential for maintaining a competitive position.

| Company | Establishment Year | Headquarters | Technology Focus | R&D Investment | Market Focus | Strategic Partnerships |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ |

| GE Aviation | 1917 | USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | UK | ~ | ~ | ~ | ~ |

| Safran Aircraft Engines | 2005 | France | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries (IAI) | 1953 | Israel | ~ | ~ | ~ | ~ |

Israel Aircraft Fuel Tanks Market Analysis

Growth Drivers

Increase in Air Traffic and Fleet Modernization

Israel’s aviation sector continues to demonstrate strong activity, directly influencing demand for advanced aircraft fuel tanks necessary to support increased flight operations and larger fleets. BenGurion International Airport handled ~ passengers and ~ aircraft operations in 2024, reaffirming its role as Israel’s primary aviation hub with high aircraft usage that requires robust fuel storage systems capable of meeting continuous operational demands. Passenger traffic figures show recovery from earlier disruptions, driving airlines such as El Al, Israir, and Arkia to modernize aircraft fleets with more efficient widebody and narrowbody aircraft to support longer routes and increased traffic volumes, further reinforcing demand for modern, durable integral and rigid fuel tank solutions tailored for varied aircraft types.

Focus on Fuel Efficiency and Environmental Regulations

Israel’s aviation environment is increasingly shaped by regulatory and operational imperatives to improve fuel efficiency and reduce environmental impact, which drives the adoption of advanced fuel tank technologies. National action plans aligned with ICAO’s CO₂ emissions reduction strategies emphasize the entry of more fuelefficient aircraft into service — including Boeing ~ and Airbus A321neo models — that significantly lower fuel consumption and emissions compared with earlier generations, requiring compatible fuel tank designs that optimize weight and durability while adhering to environmental standards. These regulatory frameworks push airlines and manufacturers to invest in lightweight composite tanks and improved monitoring systems to comply with international environmental and safety expectations.

Market Challenges

High Initial Investment in Fuel Tank Technologies

The advancement and integration of modern fuel tank technologies in Israel’s aviation sector is constrained by high upfront capital requirements for research, certification, and production. Developing lightweight, high strength composite tanks — which must endure stress, vibration, and variable environmental conditions — involves substantial engineering and testing costs. Airlines and original equipment manufacturers (OEMs) operating in Israel’s competitive air transport environment must balance these investments alongside other major operational expenditures, such as aircraft acquisitions and maintenance infrastructure. Moreover, advanced fuel tank systems often demand specialized manufacturing facilities and materials, further elevating the initial cost threshold required before realizing long term operational benefits and performance improvements.

Regulatory Hurdles in Certification of Fuel Tanks

Fuel tanks used in civil and military aircraft must satisfy stringent certification protocols governed by the Civil Aviation Authority of Israel (CAAI) and aligned with international airworthiness standards. The bilateral Airworthiness Implementation Procedures between Israel and the FAA formalize processes for design approval, production oversight, and compliance validation, ensuring that components — including fuel tanks — meet rigorous safety and environmental criteria before entry into service. Navigating these complex certification pathways requires extensive documentation, testing under diverse operating scenarios, and often multiple rounds of revision, which can lengthen time to market and increase development overheads for manufacturers seeking to introduce innovative tank designs tailored to modern aircraft performance and sustainability goals.

Opportunities

Advancement in Lightweight and Composite Fuel Tank Technologies

The shift toward lightweight materials and composite technologies presents meaningful opportunities for Israel’s aircraft fuel tanks market as industry players seek ways to reduce aircraft weight and improve fuel efficiency. Composite tanks — made from advanced carbon fiber and resin systems — can significantly reduce structural weight compared with traditional aluminum designs, enhancing payload capacity and reducing overall fuel burn. In an aviation context where fuel consumption constitutes a major component of operating costs, the adoption of composite fuel tanks can provide measurable operational advantages. Israel’s aerospace ecosystem, known for innovation and materials engineering, is well positioned to develop and integrate these technologies, especially given the country’s emphasis on high performance defense and commercial aircraft systems.

Increasing Demand for Hybrid Aircraft Fuel Systems

As the aviation industry explores transitional propulsion solutions that bridge conventional jet fuel engines and future electric or hybrid powertrains, the demand for adaptable fuel systems that can integrate with hybrid architectures rises. Hybrid aircraft concepts, which combine traditional combustion engines with electric propulsion for certain phases of flight, require fuel tanks that not only store conventional aviation fuel but are compatible with auxiliary power systems. This technological shift is supported by broader industry initiatives to reduce emissions and enhance fuel economy without fully relying on batteryonly propulsion. Israel’s strategic focus on aerospace innovation makes it a potential hub for developing hybridcompatible fuel tank solutions that support both conventional and emerging propulsion technologies.

Future Outlook

The Israel Aircraft Fuel Tanks Market is expected to grow significantly, driven by continuous advancements in fuel efficiency technologies and Israel’s strong aerospace and defense sector. The increasing demand for lightweight and sustainable fuel tanks, coupled with advancements in hybrid and electric aircraft technologies, will fuel this growth. Additionally, the Israel Air Force’s modernisation programs and expanding commercial aviation industry in Israel further bolster demand for high-performance, durable fuel systems. This trend is expected to continue as the need for long-range aircraft capable of meeting global environmental standards increases.

Major Players

- Honeywell Aerospace

- GE Aviation

- Rolls-Royce

- Safran Aircraft Engines

- Israel Aerospace Industries

- Boeing

- Mitsubishi Heavy Industries

- UTC Aerospace Systems

- Power Cell Sweden AB

- Ballard Power Systems

- Plug Power

- Doosan Fuel Cell

- Toyota Industries Corporation

- Airbus

- Zero Avia

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft Manufacturers

- Fuel Tank Technology Providers

- Aerospace Equipment Suppliers

- Airline Operators

- Environmental Agencies

- Aviation Sustainability Advocates

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the key stakeholders in the Israel Aircraft Fuel Tanks Market. This includes primary data from aircraft manufacturers, airlines, military stakeholders, and fuel tank technology providers. Data is gathered from trusted sources, including government publications and industry reports.

Step 2: Market Analysis and Construction

In this phase, historical data and market trends are analyzed to understand the growth trajectory of the fuel tanks market. This includes an evaluation of demand drivers such as increased air traffic, fleet modernization, and environmental regulations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and opportunities are validated through in-depth interviews with experts in the aerospace sector, including manufacturers, regulators, and technology providers. These consultations help refine the market’s key drivers and challenges.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research findings into actionable insights. The report is generated with a focus on delivering accurate, data-driven projections and strategic recommendations for stakeholders in the Israel Aircraft Fuel Tanks Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis of Israel Aircraft Fuel Tanks Market

- Timeline of Major Players

- Business Cycle and Market Evolution

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in Air Traffic and Fleet Modernization

Focus on Fuel Efficiency and Environmental Regulations - Market Challenges

High Initial Investment in Fuel Tank Technologies

Regulatory Hurdles in Certification of Fuel Tanks - Opportunities

Advancement in Lightweight and Composite Fuel Tank Technologies

Increasing Demand for Hybrid Aircraft Fuel Systems - Trends

Shift Towards Sustainable Aviation Fuel Technologies

Adoption of Advanced Monitoring and Leak Detection Systems - Government Regulation

- SWOT Analysis

- Porter’s Five Forces

- Market Value, 2020-2025

- Market Volume, 2020-2025

- Average Price Trends, 2020-2025

- By Fuel Tank Type (In Value %)

Integral Fuel Tanks

Bladder Fuel Tanks

Rigid Fuel Tanks - By Aircraft Type (In Value %)

Commercial Aircraft

Military Aircraft

Cargo Aircraft

Regional Aircraft - By Material Type (In Value %)

Aluminum

Titanium

Composite

Other Materials - By Distribution Channel (In Value %)

OEMs

Aftermarket - By Region (In Value %)

Central Region

Northern Region

Southern Region

Western Region

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenues by Type of Fuel Tank, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plants, Capacity, Unique Value Offering)

- SWOT Analysis

- Pricing Analysis

- Detailed Profiles of Major Companies

Honeywell Aerospace

GE Aviation

Rolls-Royce

Safran Aircraft Engines

Embraer

Boeing

Mitsubishi Heavy Industries

UTC Aerospace Systems

PowerCell Sweden AB

Ballard Power Systems

Plug Power

Doosan Fuel Cell

Toyota Industries Corporation

Airbus

ZeroAvia

- Market Demand and Utilization in Civil Aviation

- Budget Allocations for Fuel Tank Development in Airlines

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Projected Market Value, 2026-2035

- Projected Market Volume, 2026-2035

- Projected Average Price Trends, 2026-2035