Market Overview

The Israel airspace and procedure design market is valued at approximately USD ~ million in 2024, reflecting a steady increase in demand for modern airspace management solutions. The market is driven by the expanding air traffic in Israel, both domestic and international, and the government’s continuous investment in upgrading air traffic control (ATC) infrastructure. With a focus on modernizing airspace management systems, enhancing operational efficiency, and improving safety, these factors collectively contribute to the growth of the market. As Israel continues to expand its air traffic control capabilities, the adoption of advanced procedure design tools and systems is expected to increase significantly.

Israel’s airspace management market is primarily dominated by its major airports, particularly Ben Gurion International Airport in Tel Aviv, the country’s busiest airport. As Israel’s hub for both domestic and international flights, Ben Gurion’s continuous modernization efforts, including the integration of state-of-the-art airspace management technologies, drive market demand. Additionally, the Tel Aviv metropolitan area is at the center of the country’s air traffic control developments. The government’s proactive approach to advancing airspace infrastructure and adopting new technologies in response to growing air traffic volumes also contributes to the dominance of these cities in the airspace market.

Market Segmentation

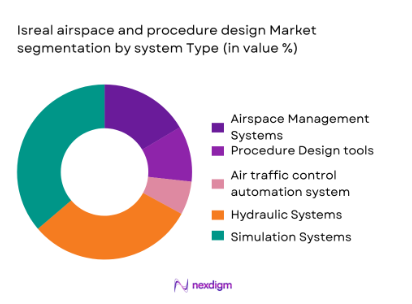

By System Type

The Israel airspace and procedure design market is segmented into airspace management systems, procedure design tools, air traffic control automation systems, safety and compliance systems, and simulation systems. The airspace management systems segment holds a dominant position in the market, driven by the increasing complexity of Israel’s airspace due to high levels of air traffic and the need for optimization. As more airlines and airports rely on automation and real-time data to manage traffic efficiently, airspace management systems are critical in reducing congestion and enhancing operational safety. The continuous upgrades to radar and communication systems contribute to the robust growth of this segment.

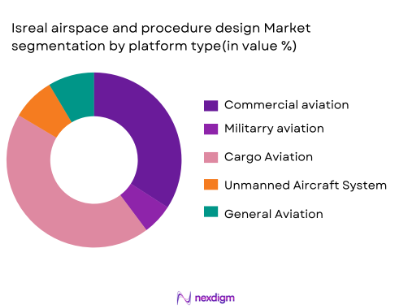

By Platform Type

The Israel airspace and procedure design market is also segmented by platform type into commercial aviation, military aviation, cargo aviation, unmanned aircraft systems (UAS), and general aviation. The commercial aviation segment dominates the market, driven by the robust growth of Israel’s airline industry and international flights. Israel’s strategic location as a hub between Europe, Asia, and Africa makes it a key player in global air traffic, leading to an increased demand for efficient airspace management. The government’s emphasis on enhancing air traffic control systems in commercial aviation is further accelerating the growth of this segment.

Competitive Landscape

The Israel airspace and procedure design market is characterized by a few key players, both local and international, that provide innovative air traffic management solutions. Companies like Thales Group, Honeywell Aerospace, and Israel’s own Elbit Systems are at the forefront, providing airspace management systems, air traffic control automation, and procedure design tools to optimize air traffic operations. These companies are well-positioned due to their extensive technological expertise, strong relationships with Israel’s Civil Aviation Authority, and focus on developing cutting-edge solutions tailored to the region’s airspace needs.

| Company Name | Establishment Year | Headquarters | Product Offering | Market Reach | Innovation Focus | Major Partnerships | Revenue | Product Quality | R&D Investment | Certifications |

| Thales Group | 1893 | France | – | – | – | – | – | – | – | – |

| Honeywell Aerospace | 1906 | United States | – | – | – | – | – | – | – | – |

| Elbit Systems | 1966 | Israel | – | – | – | – | – | – | – | – |

| Indra Sistemas | 1986 | Spain | – | – | – | – | – | – | – | – |

| L3Harris Technologies | 2019 | United States | – | – | – | – | – | – | – | – |

Israel Airspace and Procedure Design Market Dynamics

Growth Drivers

Expanding Air Traffic in Israel and the Broader Middle East Region Driving the Need for Efficient Airspace Management and Procedure Design Solutions

Israel’s air traffic has experienced steady growth, with Ben Gurion International Airport handling over 25 million passengers annually in recent years. This growing air traffic demand is reflective of broader trends in the Middle East, where regional air traffic is expected to reach 460 million passengers by 2025, according to the International Air Transport Association (IATA). This surge in passenger volume directly translates into the need for enhanced airspace management systems to handle more flights safely and efficiently. Consequently, the demand for advanced airspace design and management solutions has risen to ensure that air traffic flows seamlessly and safely across Israel’s increasingly congested airspace.

Government Initiatives Focusing on Modernization of Air Traffic Management Systems and Airspace Infrastructure

The Israeli government continues to prioritize the modernization of air traffic control systems through substantial investments in airspace infrastructure. The implementation of new air traffic control systems, like the recent integration of radar and satellite technologies, is part of the national strategy to enhance airspace capacity and efficiency. These investments are in line with Israel’s Vision 2030 plan, which allocates significant funding toward upgrading air navigation systems and airspace management tools to cope with rising air traffic demands. In 2023, the government allocated approximately 2 billion ILS to improve infrastructure and safety systems at major airports.

Market Challenges

High Cost of Advanced Systems for Smaller Airports and Regional Airspace Management

While Israel’s major airports have the financial capacity to adopt cutting-edge airspace management systems, smaller regional airports face significant challenges in funding these advanced systems. The costs associated with radar systems, satellite-based navigation, and modern air traffic management software can be prohibitive for regional operators. This financial barrier limits the widespread implementation of advanced airspace and procedure design solutions, particularly in smaller airports located outside of Tel Aviv. As Israel seeks to upgrade its regional airspace management infrastructure, balancing these costs with the needs of smaller airports remains a challenge.

Complexity of Integrating New Systems with Existing Air Traffic Control Infrastructure

Israel’s existing air traffic control infrastructure, which includes older radar systems and traditional procedures, faces integration challenges when adopting newer technologies. For example, incorporating satellite-based navigation tools with the country’s traditional radar-based system has proven to be a complex and expensive process. Furthermore, upgrading systems without disrupting ongoing air traffic operations presents logistical difficulties. The high costs associated with such integrations, along with the need for staff retraining, have made the transition to advanced systems more difficult. This complexity hampers the full-scale adoption of modern airspace management technologies across the country.

Market Opportunities

Growing Demand for UAS Management Systems Due to the Rise in Unmanned Air Traffic, Especially in Israel’s Defense Sector

Israel’s increasing use of unmanned aerial systems (UAS) presents significant opportunities in airspace and procedure design. The country’s defense sector has heavily invested in drones and unmanned aircraft for surveillance and security purposes, with Israel being one of the world’s largest producers of UAS. In 2023, the Israeli Ministry of Defense allocated approximately 1.5 billion ILS for drone technology investments. The rising use of drones in both military and commercial applications requires advanced airspace management and procedure design systems that can safely integrate these unmanned aircraft into the national airspace, driving demand for specialized UAS management systems.

Government Investments in Modernizing Air Traffic Control Infrastructure and Enhancing Airspace Management Systems

Israel’s continued investment in modernizing its air traffic control infrastructure is a key driver for the market. The Israeli government is committed to enhancing airspace capacity and operational efficiency, with a focus on cutting-edge technologies like satellite navigation and real-time data sharing. In 2023, the government approved a budget of 1.2 billion ILS to upgrade radar systems, implement NextGen procedures, and streamline the flow of air traffic in Israeli airspace. These investments will provide the necessary foundation for future market growth, making Israel’s airspace management systems more efficient and capable of handling increased traffic.

Future Outlook

The Israel airspace and procedure design market is expected to experience steady growth over the next decade, driven by the expansion of air traffic, technological advancements in air traffic control systems, and ongoing government support for modernizing airspace infrastructure. The increasing demand for unmanned aerial systems (UAS) integration into national airspace will be a major driver for new airspace design procedures and systems. Furthermore, the emphasis on automation and AI in air traffic management will continue to drive innovation in the market, positioning Israel as a leader in airspace management technology. Government policies focused on expanding air traffic capacity and ensuring safety are likely to spur continued investment in modern airspace systems.

Major Players

- Thales Group

- Honeywell Aerospace

- Elbit Systems

- Indra Sistemas

- L3Harris Technologies

- Raytheon Technologies

- Saab Group

- Collins Aerospace

- Lockheed Martin

- Israel Aerospace Industries

- Aireon

- Northrop Grumman

- Boeing

- SITA

- Rockwell Collins

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Airports and Air Navigation Service Providers

- Airlines and Aviation Operators

- Aerospace Manufacturers

- Military and Defense Contractors (e.g., Israel Air Force, Elbit Systems)

- Air Traffic Management Solution Providers

- System Integrators and MRO Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify and map the key variables impacting the Israeli airspace and procedure design market. We focus on regulatory frameworks, technological advancements, and stakeholder relationships to understand how these elements drive demand in airspace management and procedure design.

Step 2: Market Analysis and Construction

Historical data on air traffic growth, airspace system developments, and government investments are compiled to build a comprehensive view of the market. This analysis helps gauge the scale of current investments and outlines future growth trajectories based on past trends.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of market predictions, we validate our hypotheses by consulting with experts from Israel’s airspace management agencies, airport authorities, and system providers. These interviews offer valuable insights that fine-tune our approach.

Step 4: Research Synthesis and Final Output

The final output synthesizes findings from data analysis and expert consultations to generate a comprehensive market forecast. This report covers key growth drivers, challenges, and opportunities, providing a complete picture of the Israel airspace and procedure design market’s future potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expanding air traffic in Israel and the broader Middle East region driving the need for efficient airspace management and procedure design solutions.

Government initiatives focusing on modernization of air traffic management systems and airspace infrastructure.

Technological advancements in air traffic control and procedure design systems, improving operational efficiency and capacity. - Market Challenges

High cost of advanced systems for smaller airports and regional airspace management.

Complexity of integrating new systems with existing air traffic control infrastructure.

Regulatory challenges related to the certification of new airspace management technologies and procedures. - Market Opportunities

Growing demand for UAS management systems due to the rise of unmanned air traffic, especially in Israel’s defense sector.

Government investments in modernizing air traffic control infrastructure and enhancing airspace management systems.

Adoption of smart airport technologies leading to more advanced airspace and procedure design solutions. - Trends

Increasing adoption of AI and automation in airspace management systems to optimize flight paths and enhance safety.

Focus on integrating UAS into national airspace systems, requiring new airspace design procedures.

Growth in satellite-based navigation systems to improve air traffic management and reduce congestion.

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airspace Management Systems

Procedure Design Tools

Air Traffic Control Automation Systems

Safety and Compliance Systems

Simulation Systems - By Platform Type (In Value%)

Commercial Aviation

Military Aviation

Cargo Aviation

Unmanned Aircraft Systems (UAS)

General Aviation - By Fitment Type (In Value%)

OEM Installations

Retrofit Solutions

Aftermarket Systems

Upgrades and Maintenance

Custom Solutions - By End User Segment (In Value%)

Government and Regulatory Bodies (e.g., Israel Civil Aviation Authority)

Airlines

Airports and Air Traffic Management Agencies

Aerospace Manufacturers

Air Navigation Service Providers (ANSPs) - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Procurement Tenders

Private Sector Contracts

Integrated Solutions Providers

Online and Distributor Networks

- Market Share Analysis

- Cross Comparison Parameters (Product Innovation, Market Reach, Technological Advancements, Regulatory Compliance, Client Base)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Thales Group

Honeywell Aerospace

Indra Sistemas

Boeing

Raytheon Technologies

Saab Group

Collins Aerospace

L3Harris Technologies

Elbit Systems

Northrop Grumman

Lockheed Martin

Israel Aerospace Industries

Aireon

Tata Consultancy Services

Bharat Electronics Limited (BEL)

- Airlines requiring more efficient airspace utilization to minimize operational costs and delays.

- Government bodies and regulatory authorities focused on safety, compliance, and airspace optimization.

- Airports seeking to manage growing passenger and cargo traffic with minimal delays.

- Aerospace manufacturers focusing on creating efficient solutions to optimize air traffic and procedure management.

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035