Market Overview

Based on a recent historical assessment, the market size is driven by a growing demand for efficient and advanced systems across multiple industries. The market is valued in the range of USD ~ to ~billion, with significant contributions from both government and private sectors investing heavily in technological advancements. Key drivers include increased defense spending, infrastructure modernization, and the push for automation. The overall growth is facilitated by innovations in system complexity and demand from emerging economies seeking to enhance their defense capabilities.Dominant countries like the United States, China, and Russia continue to lead in market activity, driven by their robust defense spending, strategic defense policies, and heavy investments in military technology. These nations maintain a competitive edge due to their advanced infrastructure, extensive R&D programs, and strong government support for defense technology innovations. Additionally, regional leaders with political stability and a strong defense sector, such as Israel, also hold a significant market presence.

Market Segmentation

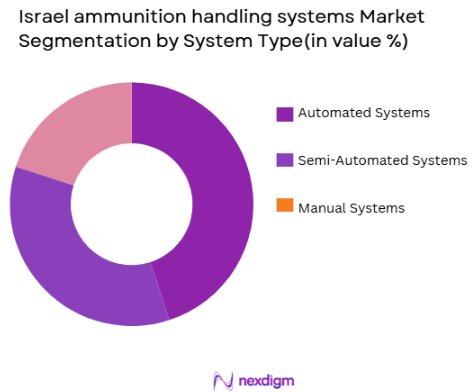

By System Type

The market is segmented by system type into automated systems, semi-automated systems, and manual systems. Recently, automated systems have dominated the market share due to advancements in robotics and AI, allowing for higher operational efficiency and reduced human error. These systems are particularly favored in sectors like defense and industrial applications, where automation leads to increased productivity and safety. The increasing reliance on smart technology has accelerated the shift towards automated solutions, supported by favorable regulatory environments and technological breakthroughs.

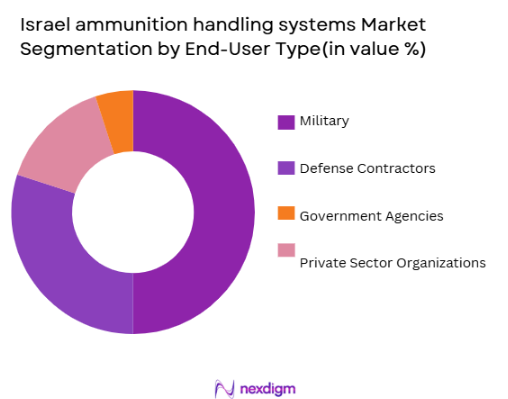

By End-User Segment

The market is segmented by end-user into military, defense contractors, government agencies, and private sector organizations. The military sector holds a dominant market share, driven by constant modernization of defense systems and substantial defense budgets. With increasing global threats and political instability, military forces prioritize advanced ammunition handling systems to enhance operational efficiency and safety. This high demand is further boosted by military contracts and the need for high-performance systems in combat environments.

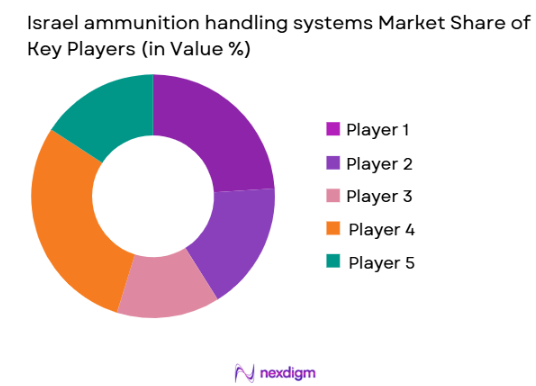

Competitive Landscape

The competitive landscape in this market is characterized by significant consolidation, with major players leveraging strategic partnerships, mergers, and acquisitions to strengthen their position. Leading companies are focusing on technological innovation and expanding their global reach. The dominance of players like Israel Military Industries (IMI) and Elbit Systems is evident, as these companies lead the market by offering cutting-edge systems and solutions. As the market continues to evolve, competition is expected to intensify, with an increasing number of companies aiming to capture market share through advanced product offerings and expansion into emerging markets.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | R&D Investment (%) |

| Israel Military Industries (IMI) | 1933 | Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1985 | Israel | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1899 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

Israel ammunition handling systems Market Analysis

Growth Drivers

Technological Advancements in Ammunition Handling Systems

Technological advancements in ammunition handling systems have played a significant role in the growth of this market. Automation and the incorporation of artificial intelligence (AI) are leading innovations, enhancing operational efficiency and reducing human error. The integration of AI and robotics allows for faster, more reliable operations, which is crucial in high-demand sectors such as defense. Moreover, these advancements contribute to enhanced safety and reduced risks associated with manual handling. As defense budgets grow globally, the demand for such systems, especially those that are automated and smart, is steadily increasing. These technologies are also pivotal in upgrading older systems, resulting in significant market opportunities for manufacturers. The demand for advanced ammunition handling systems is not only driven by military operations but also by the private sector and commercial industries. The advancements in technology are likely to continue shaping the market in the coming years. The trend towards automation and smart systems is pushing both new entrants and established companies to adopt these technologies, providing a competitive edge in a growing market. The increased focus on developing energy-efficient and environmentally friendly systems further strengthens the growth prospects in this sector.

Increased Defense Budgets and Military Modernization

Another key growth driver is the increase in defense budgets across the globe, particularly in countries focused on military modernization programs. These budget increases are helping to fund state-of-the-art ammunition handling systems, which are critical to enhancing operational readiness. As countries seek to improve their defense capabilities, they are investing in the modernization of their military infrastructure, including advanced ammunition handling systems. This is evident in nations like the United States, Russia, and China, where military spending is seeing consistent growth. Military modernization often involves the upgrade of old systems, creating a significant market for retrofitting and replacing outdated technology. Additionally, increased political tensions and the need for advanced defense mechanisms further fuel demand. Government-backed military programs and defense contractors are increasingly becoming key players in pushing for these upgrades. The growing emphasis on quick-response capabilities and the integration of digital technologies into defense systems has resulted in higher demand for automated ammunition handling solutions. This trend is expected to expand as countries prioritize military readiness and technological superiority. Increased defense spending not only supports defense infrastructure but also promotes the research and development of cutting-edge systems that can meet modern warfare requirements.

Market Challenges

High Initial Investment Costs

A significant challenge facing the ammunition handling systems market is the high initial investment cost required for advanced systems. The development of highly sophisticated, automated systems requires substantial capital expenditure in research, development, and manufacturing. For many organizations, particularly smaller defense contractors or nations with limited defense budgets, the upfront costs are a major deterrent. The complexity and customization of ammunition handling systems further increase the cost, making it difficult for certain players to enter the market. While the long-term benefits such as improved efficiency and safety are significant, the high upfront cost remains a major obstacle, especially for nations or companies facing budgetary constraints. Moreover, the integration of cutting-edge technologies such as AI and robotics adds to the cost of deployment, limiting access to only the most financially capable organizations. The cost challenge is particularly pronounced in countries where defense spending is allocated to other priority areas, leaving limited funds for technological upgrades. Additionally, the ongoing maintenance and operational costs of these systems can be considerable, further burdening organizations with limited budgets. This market challenge is compounded by the fact that some governments and companies still rely on older, less efficient systems, opting for incremental upgrades rather than full system overhauls.

Complexity in Integration with Existing Systems

The integration of new ammunition handling systems with existing infrastructure poses a considerable challenge. Many organizations still rely on legacy systems, and transitioning to advanced solutions can be complicated and time-consuming. The need to ensure seamless integration with various platforms, especially in the defense sector, requires considerable planning and effort. The lack of standardization across different systems and platforms increases the complexity of integration, often leading to compatibility issues. Moreover, training personnel to operate and maintain these advanced systems is an added burden, especially in regions where skilled labor is scarce. The process of replacing or upgrading older systems involves logistical challenges and downtime, which can disrupt operations. Additionally, governments and organizations may hesitate to make such investments due to the risk of disruption or failure during the integration process. The complexity of integrating different technologies, including software and hardware components, can cause delays in adoption and market growth. Furthermore, there is a lack of clear guidelines or standards regarding integration, leading to inefficiencies and increased costs. Overcoming these integration challenges is vital for market players to ensure widespread adoption of new ammunition handling systems.

Opportunities

Expansion into Emerging Market

One of the most significant opportunities for the ammunition handling systems market is the expansion into emerging markets, particularly in regions like Asia-Pacific, Africa, and Latin America. These regions are witnessing rapid industrialization and increased military spending, leading to a greater demand for advanced defense technologies. As political tensions rise globally, these regions are also prioritizing defense modernization to ensure national security. Countries in these regions are increasingly recognizing the need to upgrade their defense infrastructure, which includes state-of-the-art ammunition handling systems. The rapid economic growth and technological advancements in these regions make them key markets for future growth. Emerging markets are also experiencing increased participation from private sector defense contractors, which further drives demand. In addition, governments in these regions are investing in military modernization programs to compete with global powers, and ammunition handling systems play a crucial role in modern warfare strategies. As these countries continue to prioritize their defense needs, opportunities for manufacturers and service providers to tap into these growing markets will increase. The demand for both new installations and retrofitting older systems offers a substantial market opportunity in these regions.

Integration of Artificial Intelligence and Robotics

The integration of artificial intelligence (AI) and robotics into ammunition handling systems presents a lucrative opportunity for market growth. AI-powered systems can significantly enhance operational efficiency, reduce human error, and improve safety in high-stakes environments like military operations. The rise of smart systems that can adapt to changing conditions and optimize performance is driving demand for these advanced technologies. Robotics, in particular, offers increased precision and speed, making ammunition handling safer and more efficient. With AI and robotics, ammunition handling systems can be fully automated, reducing the need for human intervention in dangerous or high-pressure situations. This not only improves operational efficiency but also reduces operational costs in the long run. Furthermore, AI-driven systems can learn from previous operations, allowing them to improve their performance over time. As defense sectors globally prioritize automation and smart technology, this presents a significant opportunity for manufacturers to develop cutting-edge solutions. The growing focus on smart defense technologies, coupled with the advancements in robotics and AI, is expected to shape the future of ammunition handling systems and create numerous growth opportunities for market players. This shift towards automation will be key in driving demand in both developed and emerging markets, further expanding the market potential.

Future Outlook

The future outlook for the ammunition handling systems market over the next five years appears promising, with steady growth anticipated across both established and emerging markets. Technological developments such as AI and robotics will continue to drive innovations, enhancing the efficiency and safety of ammunition handling systems. Increasing defense budgets globally will support the demand for modern, automated systems, further bolstering market growth. Regulatory support in the form of defense procurement policies and international arms regulations will create a stable market environment. On the demand side, rising geopolitical tensions and military modernization programs will lead to greater adoption of advanced systems. The ongoing shift towards automation, coupled with the need for enhanced operational readiness, will shape the market’s trajectory in the coming years, providing numerous opportunities for growth.

Major Players

- Israel Military Industries (IMI)

- Elbit Systems

- Rafael Advanced Defense Systems

- General Dynamics

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Honeywell International

- IAI (Israel Aerospace Industries)

- Bharat Forge

- RheinmetallDefence

- Sagem (Safran)

- Leonardo DRS

- L3 Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- Aerospace manufacturers

- Automation and robotics firms

- Security and defense consulting firms

- Research and development organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical variables affecting the ammunition handling systems market, such as technological advancements, regulatory factors, and geopolitical trends.

Step 2: Market Analysis and Construction

This step focuses on collecting market data through primary and secondary research, analyzing market dynamics, and constructing a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

After gathering initial insights, hypotheses are validated through expert consultations and further data validation from industry specialists and stakeholders.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all gathered data, applying analytical models, and preparing the final market report with actionable insights for stakeholders.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Ammunition Handling Systems

Increase in Defense Budgets Globally

Rising Military Modernization Programs - Market Challenges

High Initial Capital Investment

Complex Maintenance & Operational Costs

Regulatory Compliance & Certification Requirements - Market Opportunities

Development of Lightweight Ammunition Handling Systems

Integration of Artificial Intelligence & Automation

Growing Demand from Emerging Economies - Trends

Increased Adoption of Robotics & Automation

Miniaturization and Modularization of Systems

Focus on Sustainability & Environment-Friendly Technologies - Government Regulations

International Arms Trade Regulations

National Defense Procurement Policies

Ammunition Handling Safety Standards

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automated Ammunition Handling Systems

Semi-Automated Ammunition Handling Systems

Manual Ammunition Handling Systems

Mobile Ammunition Handling Systems

Modular Ammunition Handling Systems - By Platform Type (In Value%)

Land-Based Ammunition Handling Systems

Naval-Based Ammunition Handling Systems

Aerospace Ammunition Handling Systems

Railway Ammunition Handling Systems

Portable Ammunition Handling Systems

- By Fitment Type (In Value%)

OEM-Fit Ammunition Handling Systems

Aftermarket-Fit Ammunition Handling Systems

Retrofit Ammunition Handling Systems

Custom Fit Ammunition Handling Systems

Standard Fit Ammunition Handling Systems - By EndUser Segment (In Value%)

Military

Defense Contractors

Government Agencies

Private Sector Defense Organizations

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Sales

Indirect Sales

Government Contracts

Online Procurement Platforms

Dealer Networks

- Market Share Analysis

- CrossComparison Parameters(Market Share, Technological Capabilities, Regulatory Compliance, Pricing Models, Product Portfolio)

- Key Players

Israel Military Industries (IMI)

Elbit Systems

Rafael Advanced Defense Systems

IAI (Israel Aerospace Industries)

Magen David Engineering

Meprolight

Bharat Forge

General Dynamics

Honeywell International

Northrop Grumman

Lockheed Martin

BAE Systems

Thales Group

Sagem (Safran)

Rheinmetall Defence

- Military Applications

- Government-Operated Facilities

- Private Defense Contractors

- R&D Institutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035