Market Overview

The ammunition market has been consistently expanding, driven by increased defense spending and geopolitical uncertainties across various regions. As of recent assessments, the market size stands at USD ~, with significant contributions from defense contracts, modernization programs, and defense system upgrades. The growth of military and law enforcement agencies has also bolstered market demand. This steady increase is primarily due to the demand for high-quality and advanced ammunition products, coupled with the development of more sophisticated weapons systems across various platforms such as land, air, and sea.

The dominance of regions like North America, Europe, and Asia-Pacific can be attributed to their robust defense infrastructure and military expenditures. North America leads the market, driven by the U.S.’s substantial defense budget and constant military upgrades. Europe follows closely, with a strong defense presence from countries like the UK, France, and Germany. Asia-Pacific’s dominance is propelled by defense advancements in nations such as China, India, and Japan, which have prioritized ammunition procurement due to ongoing regional security concerns. These regions continue to make substantial investments in defense capabilities, driving the market’s upward trajectory.

Market Segmentation

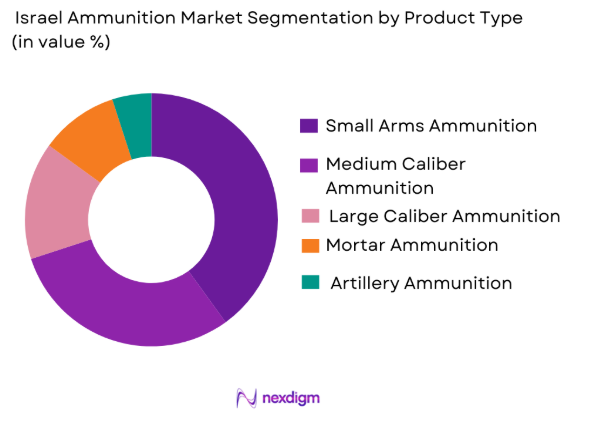

By Product Type

The ammunition market is segmented by product type into small arms ammunition, medium caliber ammunition, large caliber ammunition, mortar ammunition, and artillery ammunition. Recently, small arms ammunition has emerged as the dominant sub-segment, primarily driven by high demand from military forces, law enforcement, and civilian shooters. Small arms ammunition is widely used due to its versatility, low cost, and the fact that it serves as the standard for personal and operational defense weapons. The growing need for personal security and increasing military engagements globally has led to the continued demand for small arms, further pushing the market share in this sub-segment.

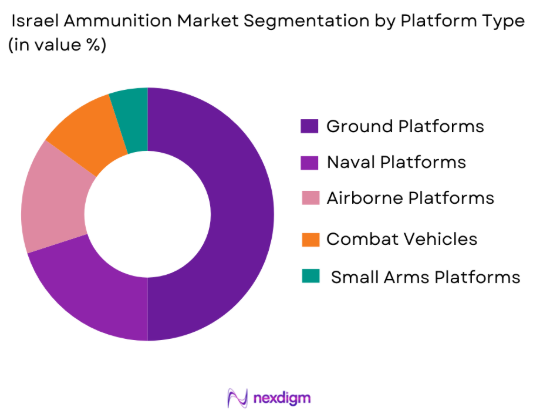

By Platform Type

The market is segmented by platform type into land platforms, naval platforms, airborne platforms, combat vehicles, and small arms platforms. Among these, land platforms have the highest market share due to the continuous need for ammunition for infantry weapons, light and heavy artillery, and other land-based combat systems. The demand for land-based weapons systems is fueled by military spending in various countries, particularly in regions with ongoing conflicts or heightened security concerns. This segment’s prominence is supported by the vast number of troops worldwide, requiring a significant volume of ammunition to maintain operational readiness.

Competitive Landscape

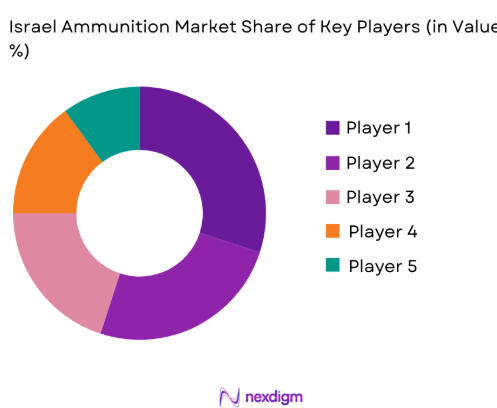

The ammunition market is highly competitive, with a significant number of players in the industry. Large defense contractors dominate the market, continuously innovating and expanding their portfolios to cater to military, law enforcement, and civilian needs. Market consolidation is occurring through mergers and acquisitions, as companies look to expand their technological capabilities and global reach. Major players are also collaborating with governments to secure long-term defense contracts, which continues to shape the market dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Product Performance |

| General Dynamics | 1952 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

Israel Ammunition Market Analysis

Growth Drivers

Increasing Military Expenditures

The growth of military expenditures is a critical driver for the ammunition market. Nations worldwide are focusing on strengthening their defense capabilities due to rising geopolitical tensions, regional conflicts, and the need for updated military infrastructure. The increased allocation of resources toward defense spending ensures that ammunition remains in high demand. Countries such as the U.S., Russia, China, and India continue to enhance their armed forces with modern weapons systems, which rely on an efficient supply of high-quality ammunition. Additionally, many countries are upgrading their military assets and introducing new defense systems that necessitate higher volumes of specialized ammunition. This ongoing trend of military modernization is pushing the demand for ammunition across various platforms, including small arms, mortars, and artillery systems, which is expected to continue in the coming years. With national security becoming a priority, ammunition is seen as a vital component of defense readiness, leading to consistent demand in both developed and emerging economies. This steady investment ensures growth in the ammunition market.

Technological Advancements in Ammunition

The development of advanced ammunition technology is significantly boosting the ammunition market. Innovations such as smart ammunition, guided projectiles, and precision-guided munitions have revolutionized the industry, making ammunition more effective and accurate. These technological advancements are particularly relevant in modern warfare, where precision and reliability are paramount. Furthermore, the integration of electronic components into ammunition systems has improved their performance, especially in areas such as targeting, trajectory correction, and range. As defense budgets grow, military forces are increasingly investing in advanced ammunition solutions to meet the evolving demands of modern combat, ensuring soldiers have the best equipment available. Additionally, the trend toward environmentally friendly and sustainable ammunition is gaining traction, with new materials and designs being developed to reduce environmental impact. These technological developments are driving both demand and market expansion, offering new avenues for growth in the ammunition sector.

Market Challenges

Stringent Government Regulations

One of the major challenges facing the ammunition market is the stringent government regulations and controls on the production, distribution, and sale of ammunition. Governments around the world impose rigorous laws to prevent the misuse of ammunition, especially in civilian markets. These regulations include strict licensing, background checks, and oversight for manufacturers, distributors, and end-users. These legal frameworks, though necessary for public safety, create barriers for companies looking to expand or introduce new products. In many regions, especially in the EU and the U.S., the regulatory landscape can be complex, requiring compliance with multiple standards, which adds to the operational cost and delays market entry. Additionally, export restrictions and the control of sensitive military technologies further limit the global trade of ammunition, presenting significant hurdles for companies aiming to tap into new markets. These regulations necessitate careful navigation and continuous monitoring to ensure compliance, making it a key challenge for market players.

Supply Chain Disruptions

The ammunition market faces significant challenges related to supply chain disruptions, which have become more prominent in recent years due to various global factors such as the COVID-19 pandemic, raw material shortages, and geopolitical conflicts. The production of ammunition relies on a complex supply chain that includes the sourcing of raw materials, manufacturing, and logistics to deliver products to end-users. Disruptions in any part of this chain can cause delays, price increases, and inventory shortages. For instance, delays in the delivery of critical materials such as brass, copper, and explosives can lead to production halts, reducing the availability of ammunition in the market. Additionally, political instability, trade restrictions, and natural disasters can further disrupt supply lines, impacting the timely availability of ammunition for defense contractors and military forces. These supply chain vulnerabilities pose a significant challenge for the ammunition market, as companies must adapt and find innovative ways to mitigate risks and maintain production continuity.

Opportunities

Emerging Markets for Military Exports

One of the most promising opportunities in the ammunition market is the growing demand from emerging markets for military exports. As developing nations increase their defense spending, they are seeking modern weaponry and ammunition to bolster their military capabilities. This trend is particularly evident in regions such as the Middle East, Asia-Pacific, and Africa, where security concerns, internal conflicts, and territorial disputes drive the need for advanced ammunition systems. Countries like Saudi Arabia, India, and Brazil are investing heavily in upgrading their armed forces and require significant quantities of ammunition. This presents a substantial opportunity for ammunition manufacturers to expand their market reach and secure long-term contracts with these emerging economies. Additionally, as these countries modernize their military infrastructure, they are also looking for cutting-edge ammunition solutions, providing ammunition producers with the chance to innovate and tailor products to these new markets. This growing demand for military exports is expected to drive the market’s growth in the coming years.

Technological Advancements in Sustainable Ammunition

The push for sustainability in the ammunition market presents another significant opportunity. As governments and defense contractors increasingly focus on reducing their environmental footprint, there is a growing demand for eco-friendly ammunition. Innovations such as biodegradable casings, reduced-emission projectiles, and lead-free ammunition are gaining traction in the market. This shift is driven by environmental concerns and stricter regulations aimed at reducing the environmental impact of traditional ammunition, particularly in training and testing environments. Ammunition manufacturers are investing in the development of sustainable alternatives that do not compromise performance while meeting environmental standards. This opportunity aligns with the broader trend toward green technologies in defense and could lead to a new wave of product development and market expansion. As sustainability becomes a key factor in defense procurement decisions, companies that adapt early to these demands will be well-positioned for success in the future.

Future Outlook

Over the next five years, the ammunition market is expected to continue its steady growth trajectory, driven by technological advancements, increasing defense budgets, and heightened security concerns. The market will likely see innovations in smart and precision-guided ammunition, along with increasing demand for sustainable products. Geopolitical tensions and military modernization programs will keep the demand for ammunition strong across various regions. Regulatory frameworks will evolve to accommodate the growing market, creating new opportunities for market participants. Furthermore, emerging markets in Asia-Pacific, the Middle East, and Africa will provide additional avenues for growth, with an increasing focus on defense exports and strategic partnerships.

Major Players

- General Dynamics

- BAE Systems

- Lockheed Martin

- Rheinmetall

- Thales Group

- Northrop Grumman

- Leonardo DRS

- Hanwa Defense

- Saab

- L3 Technologies

- Nexter Systems

- Raytheon Technologies

- Ammunition Tech

- ATK Orbital

- Ruag Ammotec

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and manufacturers

- Military forces and law enforcement agencies

- Private security firms

- International defense organizations

- Arms trade associations

- Aerospace and defense suppliers

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the most critical variables, including market size, growth drivers, and technology trends. This step involves reviewing key literature, historical data, and industry reports.

Step 2: Market Analysis and Construction

A detailed market analysis is conducted by studying trends, competitive dynamics, and consumer behavior. The market structure is then mapped to understand market segmentation and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, stakeholders, and company executives. Insights from these consultations refine the market outlook.

Step 4: Research Synthesis and Final Output

The final output is synthesized, integrating data, expert insights, and market analysis to produce a comprehensive and actionable market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Expenditures

Modernization of Armed Forces

Rising Geopolitical Tensions - Market Challenges

Stringent Regulations

High Cost of Manufacturing

Supply Chain Disruptions - Market Opportunities

Emerging Markets for Military Export

Technological Advancements in Ammunition

Increased Demand for Specialized Ammunition - Trends

Shift to Advanced Ammunition Technologies

Integration of Smart Ammunition

Growing Focus on Sustainability in Production - Government Regulations

Defense Procurement Policies

International Trade Agreements

Environmental Standards in Ammunition Manufacturing

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Small Arms Ammunition

Medium Caliber Ammunition

Large Caliber Ammunition

Mortar Ammunition

Artillery Ammunition - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Combat Vehicles

Small Arms Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Custom Fitment

Retrofit Fitment

Upgrade Fitment - By End User Segment (In Value%)

Military

Law Enforcement

Defense Contractors

Private Security

Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Through Defense Contractors

Government Tenders

Private Procurement

Export Channels

- Market Share Analysis

- Cross Comparison Parameters (Market Value, System Complexity, EndUser Type, Procurement Channel, Platform Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Military Industries

Rafael Advanced Defense Systems

Elbit Systems

IAI

Taurus Ammunition

SABR Technologies

Magal Security Systems

Nexter Systems

General Dynamics

Harris Corporation

Northrop Grumman

Lockheed Martin

BAE Systems

Thales Group

Leonardo DRS

- Military Forces

- Security Forces

- Private Contractors

- International Clients

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035