Market Overview

The Israel ammunition storage market is expected to reach a significant size driven by increasing defense investments and enhanced security protocols. Based on a recent historical assessment, the market size in USD ~ is influenced by both domestic and regional defense requirements, with an increasing focus on ammunition safety and operational efficiency. As military spending rises, the need for secure and reliable ammunition storage solutions grows, ensuring enhanced operational preparedness and defense readiness.

Israel has a prominent position in the ammunition storage market due to its robust defense sector and technological advancements in military infrastructure. Key cities such as Tel Aviv and Haifa serve as central hubs for the defense industry, where state-of-the-art technologies in ammunition storage are developed and deployed. This dominance is further driven by Israel’s strategic location, technological expertise, and consistent defense collaborations with global allies. The nation’s growing defense spending continues to fuel demand for innovative and secure storage solutions in the region.

Market Segmentation

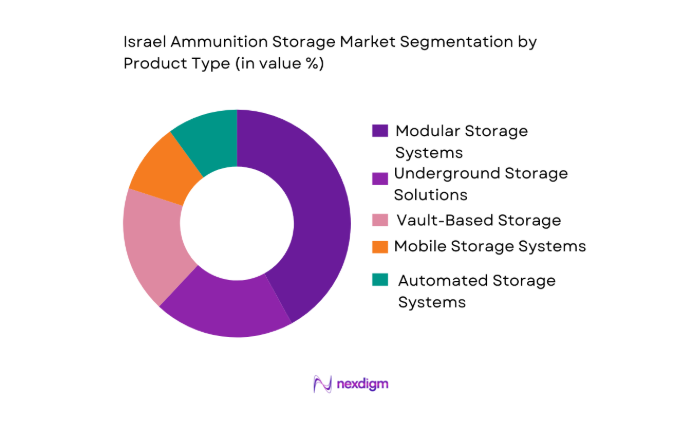

By Product Type:

The Israel ammunition storage market is segmented by product type into modular storage systems, underground storage solutions, vault-based storage, mobile storage systems, and automated storage systems. Recently, modular storage systems have a dominant market share due to their scalability, cost-effectiveness, and flexibility in meeting various storage needs. Modular systems are highly favored by military and defense contractors due to their ease of installation and maintenance, allowing for expansion as needed. This type of storage solution is well-suited for the dynamic demands of defense infrastructure, offering robust security and access management features, contributing to its widespread adoption.

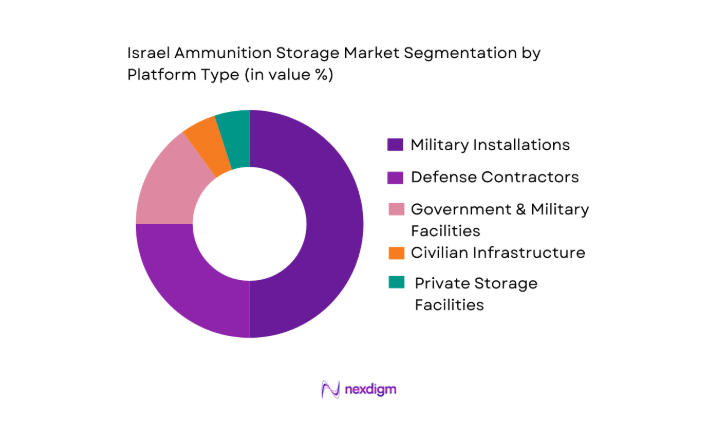

By Platform Type:

The market for ammunition storage in Israel is segmented by platform type into military installations, defense contractors, government and military facilities, civilian infrastructure, and private storage facilities. Military installations currently dominate the market, largely due to the high demand for secure, long-term storage of ammunition. These platforms require specialized infrastructure designed to meet stringent security standards. Additionally, government and military facilities contribute significantly to the demand for advanced storage solutions to maintain operational efficiency and ensure that military stockpiles remain well-managed and protected.

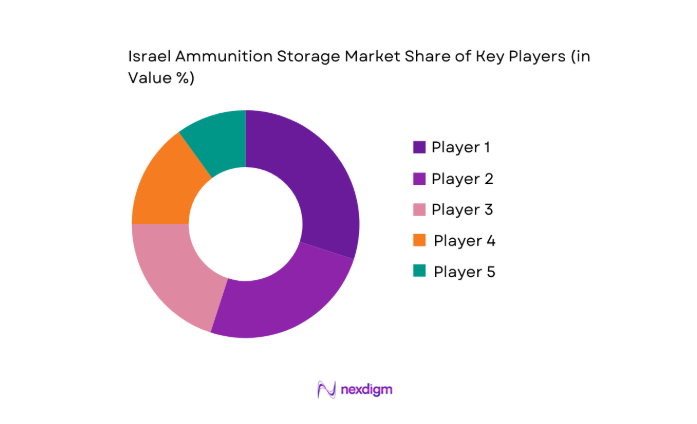

Competitive Landscape

The Israel ammunition storage market is highly competitive, with consolidation occurring among leading players in the defense sector. The dominance of military contractors and technology developers specializing in secure storage solutions reflects the high barriers to entry and the specialized nature of the market. Major players focus on innovation, security, and compliance with strict regulations to maintain a competitive edge in this growing market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Israel Military Industries | 1933 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1984 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~ | ~ | ~ | ~ | ~ |

| MAGAL Security Systems | 1976 | Petah Tikva, Israel | ~ | ~ | ~ | ~ | ~ |

Israel Ammunition Storage Market Analysis

Growth Drivers

Increase in Defense Budget

The primary growth driver for the Israel ammunition storage market is the substantial increase in defense spending. This surge is due to rising security concerns, regional conflicts, and the need for enhanced defense capabilities. As military budgets grow, so does the need for secure and advanced storage systems to safeguard ammunition supplies. Israel has allocated a significant portion of its GDP to defense, which directly drives the demand for high-tech ammunition storage solutions. Furthermore, the continuous modernization of the Israeli Defense Forces (IDF) has led to an increased demand for systems that meet stringent security and technological standards. The development of innovative storage technologies, such as automated systems and secure vaults, further supports market growth by offering efficient and scalable solutions to military and defense contractors. Additionally, regional instability and military tensions prompt nations to prioritize the security of their defense resources, further escalating demand for secure storage infrastructure. As global defense spending continues to rise, Israel is poised to lead in the development of advanced ammunition storage systems, solidifying its position as a key player in the defense market.

Technological Advancements in Storage Solutions

The second growth driver is the rapid pace of technological advancements in ammunition storage solutions. With the increasing sophistication of military operations, the demand for smart, automated, and environmentally-friendly storage systems has surged. Israel, known for its innovative defense technology, has been at the forefront of developing advanced storage systems that incorporate features such as real-time monitoring, automated inventory management, and environmental controls. These technological innovations help reduce the risk of accidents, ensure the longevity of ammunition, and improve overall operational efficiency. Additionally, advancements in material science and security technologies have made it possible to create storage solutions that are more secure, durable, and resistant to threats. These systems not only meet the growing security demands of the Israeli military but are also in high demand globally, as other nations seek to modernize their defense storage capabilities. The integration of AI, IoT, and machine learning into ammunition storage systems allows for predictive maintenance, inventory optimization, and enhanced monitoring, making them more efficient and cost-effective. As technology continues to evolve, the ammunition storage market will benefit from further innovations, solidifying its growth trajectory in the coming years.

Market Challenges

High Initial Investment

One of the significant challenges facing the Israel ammunition storage market is the high initial investment required for advanced storage systems. While these systems offer superior security and efficiency, they often come with high upfront costs, making them financially challenging for smaller defense contractors and government bodies with limited budgets. The complexity of these storage solutions, including the need for specialized infrastructure and ongoing maintenance, adds to the overall cost. The price of raw materials for constructing storage units, along with the integration of cutting-edge technologies such as automated systems and real-time monitoring, further drives up the cost of deployment. This financial barrier can deter potential clients from investing in state-of-the-art ammunition storage systems, particularly in countries with limited defense budgets. Additionally, the lengthy procurement process for defense-related infrastructure often delays the deployment of these systems, hindering market growth. Despite these challenges, the continued emphasis on security and technological advancement ensures that investment in high-quality storage solutions remains a priority for the Israeli government and defense contractors, pushing the market forward.

Complex Regulatory Compliance

Another challenge faced by the Israel ammunition storage market is the stringent regulatory compliance required for the storage, handling, and transport of ammunition. Israel, like many countries, has strict regulations in place governing the safety standards for ammunition storage, ensuring that these systems adhere to national and international security protocols. The complexity of these regulations can create delays in the approval and installation of new storage solutions, as manufacturers and clients must navigate the bureaucratic processes involved in obtaining the necessary certifications and clearances. Furthermore, as new technologies are integrated into storage systems, ensuring compliance with evolving safety standards and environmental regulations becomes increasingly difficult. This regulatory burden can slow down market adoption, particularly for smaller players who may lack the resources to keep up with the compliance demands. Despite these challenges, the high standards set by Israel’s regulatory bodies ensure that only the most secure and reliable ammunition storage solutions are deployed, which helps to maintain the integrity of the country’s defense infrastructure.

Opportunities

Growing Regional Military Collaborations

A significant opportunity for the Israel ammunition storage market is the growing number of regional military collaborations. Israel has established strong defense relationships with several nations in the Middle East, as well as with European and Asian powers. These collaborations often involve joint military exercises, defense contracts, and technology sharing, all of which increase the demand for advanced ammunition storage solutions. As Israel continues to play a pivotal role in regional defense strategy, its ammunition storage technologies are being adopted by allied nations seeking to enhance their military capabilities. This trend opens up new markets for Israeli storage solutions, creating opportunities for both direct sales and international partnerships. Moreover, as tensions in the region persist, nations are looking to strengthen their defense infrastructure, particularly in areas that require secure and efficient ammunition storage. Israel’s proven track record in developing high-tech defense solutions positions it as a key supplier for countries seeking to modernize their military storage systems.

Expanding Demand for Eco-friendly Storage Solutions

Another opportunity lies in the rising demand for eco-friendly ammunition storage systems. With growing global concerns about sustainability and environmental impact, there is an increasing need for storage solutions that minimize energy consumption and reduce environmental hazards. Israel has been proactive in developing green technologies that address these concerns, integrating renewable energy sources and sustainable materials into ammunition storage systems. The push towards sustainability in defense infrastructure aligns with global trends towards reducing carbon footprints and complying with environmental regulations. As defense organizations and governments prioritize sustainability, the demand for eco-friendly ammunition storage solutions is expected to rise. Israel’s expertise in developing innovative technologies positions it well to meet this demand, offering eco-friendly alternatives that not only meet regulatory standards but also contribute to the global movement towards sustainable defense practices.

Future Outlook

The future outlook for the Israel ammunition storage market is positive, with continued growth driven by technological advancements, expanding defense budgets, and rising regional security concerns. Over the next five years, we expect to see greater demand for modular and automated storage systems that can scale with the evolving needs of defense infrastructure. Technological innovations such as IoT integration and enhanced security features will continue to shape the market, offering more efficient and secure storage solutions. Additionally, ongoing government support for defense modernization, coupled with increasing regional military collaborations, will further fuel market growth. As global defense spending continues to rise, Israel’s ammunition storage solutions are set to become even more essential for securing military resources.

Major Players

- Israel Military Industries

- Rafael Advanced Defense Systems

- Elbit Systems

- Israel Aerospace Industries

- MAGAL Security Systems

- IMI Systems

- Cyberbit

- Carmor

- ORT Technologies

- BAE Systems

- Raytheon

- General Dynamics

- Lockheed Martin

- Northrop Grumman

- Thales Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Defense infrastructure development agencies

- Private security firms

- Global defense equipment manufacturers

- Defense technology developers

- International defense organizations

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that will impact the ammunition storage market, such as technological advancements, defense spending, and regional security factors.

Step 2: Market Analysis and Construction

Market analysis is conducted by collecting data from primary and secondary sources to construct a comprehensive overview of the market’s size, growth, and trends.

Step 3: Hypothesis Validation and Expert Consultation

The gathered data is validated through consultation with industry experts, market stakeholders, and government agencies to ensure accuracy and reliability.

Step 4: Research Synthesis and Final Output

The final output is synthesized, ensuring all data is thoroughly analyzed and presented in a structured format for market insights and strategic planning.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in defense spending by Israel

Advances in ammunition storage technology

Rising demand for secure military assets - Market Challenges

High costs of advanced storage infrastructure

Complex regulatory frameworks for ammunition storage

Security concerns related to storage and logistics - Market Opportunities

Technological innovation in ammunition storage

Expanding defense contracts in the Middle East

Government focus on enhancing military storage capacity - Trends

Shift towards automated and modular storage solutions

Rising use of integrated security systems

Increasing focus on environmentally safe storage technologies - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Modular Storage Systems

Underground Storage Solutions

Vault-Based Storage

Mobile Storage Systems

Automated Storage Systems - By Platform Type (In Value%)

Military Installations

Defense Contractors

Government & Military Facilities

Civilian Infrastructure

Private Storage Facilities - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Custom Fitment

Upgraded Fitment

Aftermarket Fitment - By EndUser Segment (In Value%)

Military Forces

Defense Contractors

Government Organizations

Private Security Agencies

Logistics & Supply Chain Operators - By Procurement Channel (In Value%)

Direct Procurement

Government Procurement

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (Market Value, Installed Units, System Complexity, Platform Type, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Israel Military Industries

Rafael Advanced Defense Systems

Elbit Systems

TAAS Israel

Israel Aerospace Industries

Israel Defense Forces

MAGAL Security Systems

IAI Elta Systems

Tomcar

Caracal International

Ziv-Av Aviation

Berlian Laju Tanker

Steadfast Defense Solutions

Comtec Systems

Ben Shemen Military Solutions

- Military and defense sector demand

- Private sector demand for secure storage

- Growth in ammunition storage at governmental facilities

- Logistics and transportation sector expansion

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035