Market Overview

The Israel anti-drone market is valued at approximately USD ~ billion, driven by the increasing prevalence of drone threats across military, civilian, and critical infrastructure sectors. The market’s expansion is fueled by advancements in counter-drone technologies such as jamming systems, radar, and directed energy weapons. Israel’s defense sector plays a pivotal role in the market, providing cutting-edge solutions to address security threats posed by drones. These technologies, alongside the growing demand for non-lethal, rapid-response systems, are propelling the market forward.

Israel continues to dominate the anti-drone market due to its strong defense infrastructure and leadership in technological innovations. Cities such as Tel Aviv and Herzliya are key hubs for research and development, providing an environment conducive to cutting-edge solutions. The government’s substantial investment in defense technologies, along with Israel’s strategic geographic positioning, ensures that the country remains a global leader in drone defense. The increasing need for protection from security threats such as surveillance and terrorism drives Israel’s market dominance.

Market Segmentation

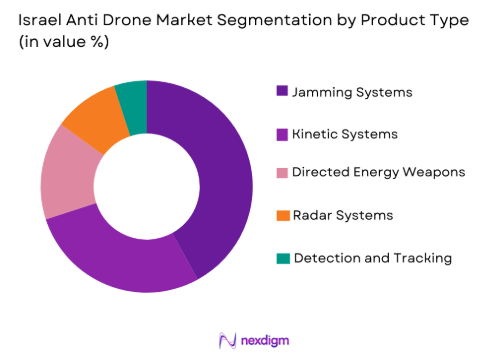

By Product Type

The Israel anti-drone market is segmented by product type into jamming systems, kinetic systems, directed energy weapons, radar systems, and detection and tracking systems. Jamming systems currently dominate the market, largely due to their cost-effectiveness and non-destructive capabilities. These systems are highly preferred across both military and commercial sectors for neutralizing drones by disrupting communication signals without causing environmental damage. The widespread adoption of jamming systems, especially in urban settings and government facilities, has made them the most effective and accessible solution for countering drone threats.

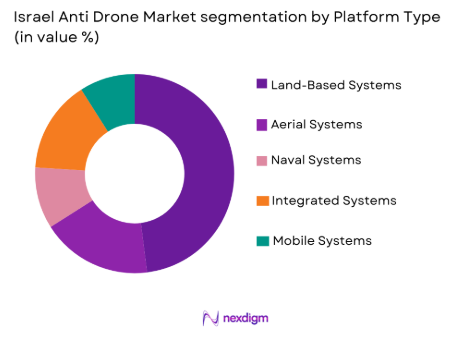

By Platform Type

The Israel anti-drone market is further segmented by platform type into land-based systems, aerial systems, naval systems, integrated systems, and mobile systems. Land-based systems dominate the market, primarily due to their versatility and ability to be deployed in various settings, from military bases to airports. These systems are often integrated into existing security infrastructures, making them a cost-effective solution for perimeter defense. The ability to quickly deploy these systems in high-risk areas, particularly in regions with sensitive infrastructure, further enhances their market presence, solidifying their position as the preferred solution.

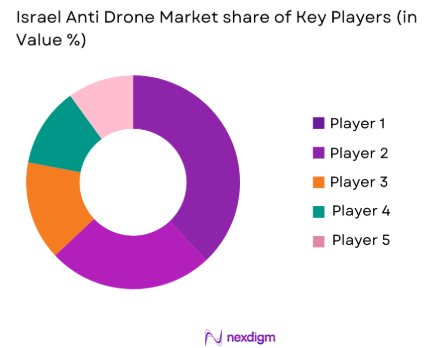

Competitive Landscape

The competitive landscape in the Israel anti-drone market is characterized by consolidation, with a few key players leading the charge in technological development and global market reach. Major companies are continuously enhancing their product offerings and engaging in strategic partnerships to stay ahead of the evolving threat posed by drones. With strong government support for defense R&D, companies in Israel have access to substantial resources, allowing them to push the boundaries of innovation in anti-drone technology.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | ~

|

~ | ~ | ~ | ~ |

| Rafael Advanced Defense | 1958 | Haifa, Israel | ~

|

~

|

~

|

~

|

~

|

| Elbit Systems | 1966 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ |

| Aeronautics Ltd. | 1997 | Herzliya, Israel | ~

|

~

|

~

|

~

|

~

|

| Skylock Systems | 2013 | Tel Aviv, Israel | ~

|

~

|

~

|

~

|

~

|

Israel Anti Drone Market Analysis

Growth Drivers

Technological Advancements

The Israel anti-drone market is significantly driven by continuous advancements in counter-drone technologies. Israel’s longstanding position as a global leader in defense innovation has positioned it at the forefront of anti-drone development. New technologies such as advanced radar, jamming systems, and directed energy weapons are being integrated into anti-drone solutions, enhancing their capabilities and effectiveness. Additionally, the rise of artificial intelligence (AI) in these systems has increased the automation of detection, tracking, and neutralization processes. This allows for more accurate, rapid, and autonomous responses to drone threats, making Israel’s anti-drone solutions highly sought after across various sectors, including defense, security, and infrastructure protection. The Israeli government’s strong backing for military research and development ensures a continuous flow of innovation, reinforcing the growth of the anti-drone market.

Government Support and Regulation

Government support for the development of anti-drone technologies is another significant driver in Israel. The country’s geopolitical position and security concerns have made it a priority for Israel to develop advanced defense systems, including counter-drone technologies. Israel’s defense sector benefits from substantial government funding, enabling continuous R&D in this area. The government’s investment in technological innovation helps sustain the growth of the anti-drone market, as it provides both financial and regulatory support for companies operating in this field. Additionally, Israel has a well-established regulatory framework that facilitates the deployment of advanced defense technologies, providing a conducive environment for market growth. The government’s proactive stance in addressing emerging security threats further fuels the demand for advanced anti-drone systems, ensuring the market’s continued expansion.

Market Challenges

High Production and Maintenance Costs

A key challenge in the Israel anti-drone market is the high cost of manufacturing and maintaining advanced anti-drone systems. These technologies require significant investment in research, development, and materials, leading to high production costs. While these systems are crucial for national security, their high price point limits accessibility, particularly for smaller businesses or organizations in emerging markets. Additionally, the cost of maintaining and upgrading these systems further increases the financial burden on users. This challenge is particularly evident in non-defense sectors, where the budget constraints may deter organizations from adopting advanced anti-drone technologies. To address this challenge, manufacturers are working on reducing the costs through advancements in manufacturing processes and the development of modular solutions that can be more cost-effective for smaller-scale applications.

Complex Integration with Existing Systems

Another challenge faced by the Israel anti-drone market is the complexity of integrating anti-drone technologies into existing security and defense systems. Many organizations, particularly in the commercial sector, already have established security infrastructures, which may not be easily compatible with new anti-drone solutions. Integrating these advanced systems requires time, effort, and resources, potentially delaying deployment and increasing costs. Moreover, the need for specialized personnel to operate and maintain these systems further complicates their adoption. Ensuring seamless integration with legacy systems while maintaining high performance is a significant challenge for companies operating in the market. Overcoming this issue requires innovation in system design, allowing anti-drone solutions to be more easily integrated into various operational environments.

Opportunities

Expansion into Emerging Markets

As drones become more widely used in both commercial and military sectors globally, there is a growing demand for anti-drone solutions in emerging markets. These regions, which include parts of Asia, Africa, and Latin America, are increasingly adopting drone technologies for surveillance, logistics, and agriculture. However, the growth of drone usage has also led to a rise in drone-related security threats, creating an opportunity for anti-drone system providers to expand into these markets. Israel’s advanced anti-drone technology is well-positioned to meet the demands of these emerging markets, where governments and private companies are looking to enhance security infrastructure. As these regions increase their investments in defense and security technologies, Israel’s expertise and reputation in providing reliable, effective counter-drone systems will be instrumental in capturing market share. By establishing partnerships and focusing on cost-effective, scalable solutions, companies can tap into these high-growth markets.

Integration with Smart City Technologies

The integration of anti-drone systems with smart city technologies presents another significant opportunity for the Israel anti-drone market. With the global trend towards urbanization and the development of smart cities, the demand for integrated security solutions has risen. Drones are becoming a major security concern in urban areas due to their potential for surveillance, smuggling, and unauthorized flights over sensitive infrastructure. Anti-drone systems are increasingly being integrated with existing smart city infrastructure to provide real-time, automated responses to drone threats. Israel’s expertise in both defense and technology makes it uniquely positioned to lead this integration, providing scalable and adaptive anti-drone solutions for smart cities. As more cities embrace the Internet of Things (IoT) and other advanced technologies, the need for comprehensive, automated security systems will continue to drive the demand for anti-drone technologies, creating new growth opportunities for Israel’s defense sector.

Future Outlook

The Israel anti-drone market is poised for sustained growth in the coming years, driven by advancements in technology and increasing security threats. Technological developments in radar systems, jamming solutions, and directed energy weapons will continue to improve the effectiveness and affordability of anti-drone solutions. The government’s strong support for defense R&D and the increasing adoption of anti-drone systems in both military and civilian sectors will further fuel market expansion. Additionally, emerging markets and smart city projects represent lucrative growth opportunities, positioning Israel’s defense sector to capitalize on global demand for advanced security solutions.

Major Players

- Israel Aerospace Industries

- Rafael Advanced Defense

- Elbit Systems

- Aeronautics Ltd.

- SkylockSystems

- IMI Systems

- D-Fend Solutions

- DroneShield

- Aerovision

- Plasan

- Tactical Robotics

- Zain Robotics

- Percepto

- Skybotix

- Airobotics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors and integrators

- Critical infrastructure providers

- Security agencies

- Airports and aviation authorities

- Technology developers and startups

- Military defense divisions

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing market trends are identified, including technological advancements, regulatory factors, and consumer demand. Expert consultations provide insights into the drivers of market growth. This stage establishes a foundation for the research model. The identified variables are then used to inform market analysis and forecasting.

Step 2: Market Analysis and Construction

The market is segmented based on product types, platform types, and end-user sectors. Historical market data is analyzed to develop accurate market models and forecasts. This stage also includes an in-depth examination of the competitive landscape. Insights from key industry players help shape market construction.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses and market assumptions are validated through expert interviews and industry consultations. This step ensures that the initial assumptions are in line with market realities. Additional secondary data is gathered to support these findings. Expert feedback is integrated into the final model for greater accuracy.

Step 4: Research Synthesis and Final Output

The research results are synthesized into a comprehensive market report. Key insights on growth drivers, challenges, opportunities, and market trends are presented. The final output includes both strategic and operational recommendations for stakeholders. The report is structured for clarity and actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Drone Threats to Security

Technological Advancements in Detection & Interception

Government Funding & Investments in Defense

Public Safety & Event Security Needs

Increasing Military Applications - Market Challenges

High Development & Integration Costs

Regulatory and Certification Barriers

Technological Gaps in Non-lethal Interception

Global Political Tensions

Diverse Environmental Constraints - Market Opportunities

Development of Multi-layered Anti-Drone Systems

Collaboration with Civil Aviation Authorities

Expansion into Emerging Markets - Trends

Rise of Counter-Drone Technology in Military Operations

Shift Towards Autonomous Anti-Drone Solutions

Integration with Other Security Systems

Miniaturization and Portability of Anti-Drone Systems

Growth of Commercial and Civil Applications - Government Regulations & Defense Policy

National and International Drone Laws & Regulations

National Defense Security Initiatives

International Collaboration on Counter-Drone Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Counter-UAV Interceptor Systems

Jamming Systems

Directed Energy Systems

Radar Systems

Electro-optical / Infrared (EO/IR) Systems - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Portable Systems

Hybrid Systems - By Fitment Type (In Value%)

Military Installations

Civil Infrastructure

Critical Infrastructure Protection

Border Security

Public Events Security - By EndUser Segment (In Value%)

Military & Defense

Homeland Security

Commercial

Government & Law Enforcement

Private Security - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Defense Contractors

Private Sector Procurement

Collaborative Procurement - By Material / Technology (In Value%)

Radar Technology

Electro-optical / Infrared (EO/IR) Technology

Acoustic Technology

Jamming Technology

Directed Energy Technology

- Market share snapshot of major players

- CrossComparison Parameters (Technological Innovation, System Efficiency, Cost-effectiveness, Market Penetration, Product Integration)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

Magal Security Systems

Airbus Group

Lockheed Martin

Northrop Grumman

Thales Group

L3 Technologies

Raytheon Technologies

BAE Systems

Leonardo

Saab AB

General Atomics

Israel Defense Forces

- Government and Military Contracts

- Private Security Sector Integration

- Commercial Use for Infrastructure Protection

- Regulatory & Policy-driven Market Expansion

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035