Market Overview

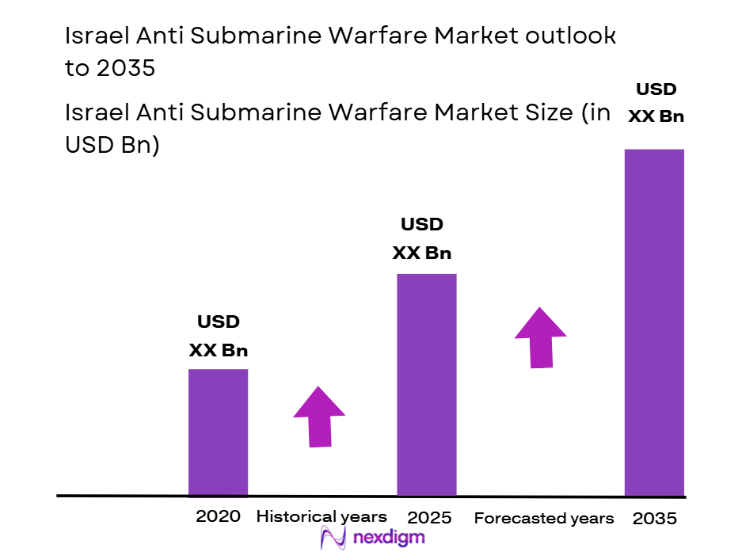

The market size for anti-submarine warfare technologies is growing steadily, driven by increasing defense budgets and regional security concerns. Based on a recent historical assessment, the market is valued in the billions of USD, with a significant focus on military applications and high-tech solutions like sonar systems, radar technologies, and advanced weaponry. Investments in naval defense are propelling this market forward, particularly in countries with strategic military interests in the maritime domain. Key drivers include technological advancements and rising demand for defense modernization across global naval forces.

Israel and its neighboring countries dominate the market due to strategic geopolitical factors and technological advancements. Israel’s strong defense infrastructure and a reputation for cutting-edge military technology in anti-submarine warfare significantly influence the regional market. The country’s advanced capabilities in naval defense, bolstered by state-of-the-art systems such as radar, sonar, and unmanned platforms, ensure its position at the forefront of anti-submarine warfare solutions. These dynamics, alongside a robust defense policy, make Israel a leading player in this space.

Market Segmentation

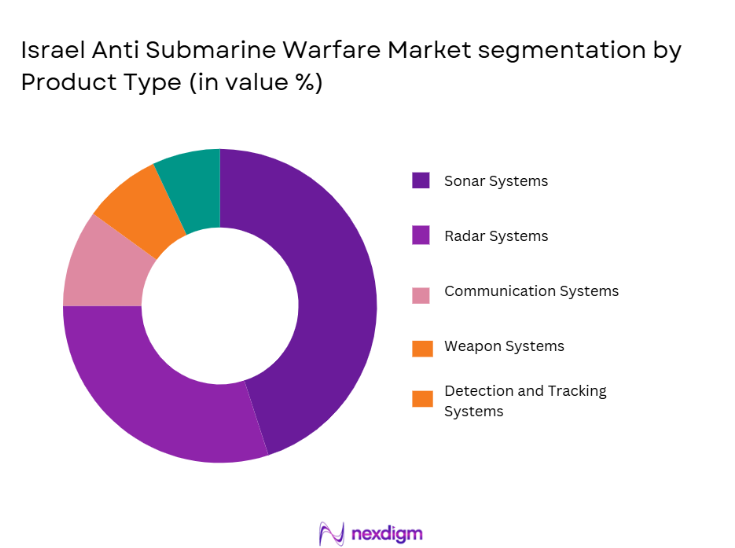

By Product Type

The anti-submarine warfare market is segmented by product type into sonar systems, radar systems, communication systems, weapon systems, and detection and tracking systems. Recently, sonar systems have gained a dominant market share due to their increasing importance in detecting submerged threats in complex marine environments. Sonar technologies are widely adopted because of their precision, reliability, and integration with advanced computational systems that enhance their functionality in multi-threat detection scenarios. With naval forces increasingly focusing on stealth and underwater detection capabilities, sonar systems continue to lead the market, benefiting from innovations that allow for deeper penetration and clearer imagery in detecting submarines and other underwater assets.

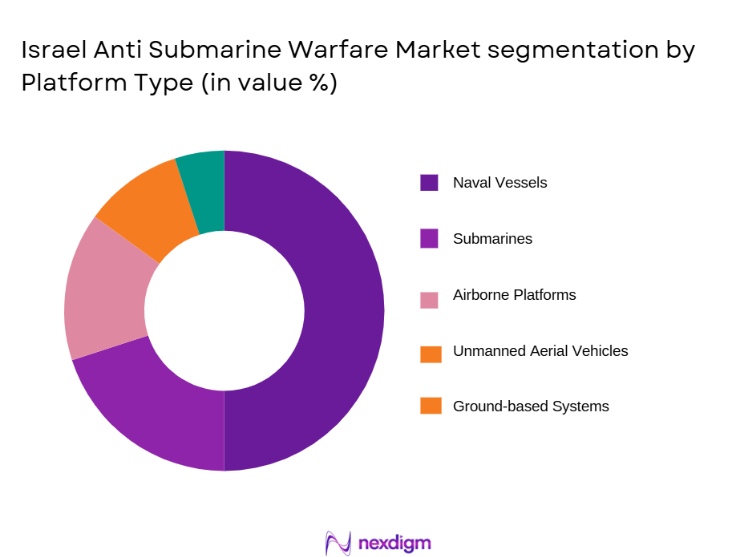

By Platform Type

The anti-submarine warfare market is segmented by platform type into naval vessels, submarines, airborne platforms, unmanned aerial vehicles (UAVs), and ground-based systems. Recently, naval vessels have dominated the market share due to their versatile application in anti-submarine operations, offering greater stability, firepower, and advanced operational capabilities. These platforms, such as destroyers and frigates, are equipped with sophisticated sonar and radar systems, making them highly effective in tracking and neutralizing underwater threats. With increasing investments in modernizing naval fleets, naval vessels remain the preferred platform for most anti-submarine warfare operations, as they offer a well-rounded solution for defense forces.

Competitive Landscape

The anti-submarine warfare market is highly competitive, with both global defense contractors and regional players dominating the landscape. Market consolidation is evident through mergers and acquisitions among the leading companies. Key players, with their focus on technological innovations and strategic partnerships, play a significant role in shaping the market. These companies are actively involved in advancing sonar, radar, and weapons systems, ensuring their dominance by securing defense contracts and forming collaborations with governments and military agencies worldwide.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Israel Aerospace Industries | 1953 | Israel | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ |

Israel Anti Submarine Warfare Market Analysis

Growth Drivers

Rising Geopolitical Tensions

The increasing geopolitical tensions in various parts of the world have become a significant growth driver for the anti-submarine warfare market. As nations face rising security concerns and threats to maritime trade routes, the demand for anti-submarine warfare systems is intensifying. The growing need to secure strategic chokepoints and protect naval assets has spurred defense investments, particularly in advanced sonar and radar technologies. Furthermore, countries with expansive coastlines and territorial waters, such as those in Asia and the Middle East, are making considerable investments in maritime defense, focusing on anti-submarine capabilities to enhance national security. The rising frequency of military confrontations and territorial disputes, particularly in the South China Sea and the Mediterranean, further highlights the need for robust anti-submarine warfare systems to secure critical assets. Additionally, the expansion of military modernization programs globally is accelerating the development and procurement of advanced defense systems, especially anti-submarine warfare technologies. Such developments contribute to the continued growth of the market, driving both technological advancements and the increasing integration of automated and unmanned systems in naval fleets. The rising emphasis on strategic defense in high-risk maritime regions is creating a more secure and competitive environment for companies operating in the anti-submarine warfare market, fueling expansion opportunities.

Technological Advancements in Sonar and Radar Systems

Technological advancements in sonar and radar systems are significantly driving growth in the anti-submarine warfare market. Sonar systems, particularly those equipped with advanced detection and tracking capabilities, have become increasingly sophisticated, allowing naval forces to detect and neutralize underwater threats more effectively. These innovations enhance the accuracy and range of sonar systems, enabling them to operate in deeper and more challenging underwater environments. In addition, the integration of artificial intelligence (AI) and machine learning into these systems is optimizing threat detection, reducing human error, and providing real-time situational awareness. The advent of advanced radar systems, which offer higher resolution and greater sensitivity, is also contributing to market growth. These developments are being coupled with the growing demand for unmanned and autonomous vehicles, which can be deployed to carry out anti-submarine operations in high-risk areas. As defense budgets rise and military modernization efforts intensify, nations are increasingly relying on advanced sonar and radar technologies to strengthen their naval defense capabilities, further driving the growth of the anti-submarine warfare market.

Market Challenges

High Development and Maintenance Costs

One of the significant challenges facing the anti-submarine warfare market is the high cost of developing and maintaining advanced systems. The complexity of sonar, radar, and weapon systems used in anti-submarine operations requires significant investment in research, development, and testing. For many countries, particularly those with smaller defense budgets, this can pose a substantial barrier to acquiring and maintaining cutting-edge technology. Moreover, these systems require regular maintenance and updates to stay effective, which further adds to the financial burden. The need for continuous system upgrades to stay ahead of evolving threats results in increased operational costs, creating a challenge for military organizations to balance cost with capability. As defense spending priorities shift toward other areas, such as cyber security and space defense, funding for anti-submarine warfare systems may become more limited, affecting the market’s growth potential. Furthermore, the scarcity of specialized technicians and experts needed to maintain these complex systems adds an additional layer of difficulty. These high costs have led some countries to seek cost-effective solutions, including collaboration with defense contractors and participation in multinational defense projects. However, the cost challenges remain a key impediment to broader adoption, particularly for developing nations.

Regulatory Hurdles and Export Restrictions

Regulatory hurdles and export restrictions present another significant challenge for the anti-submarine warfare market. Many advanced anti-submarine warfare technologies, such as sonar systems and underwater weaponry, are subject to strict export controls due to their sensitive nature and strategic importance. Governments impose regulations to ensure that these technologies do not fall into the wrong hands, particularly in regions of geopolitical concern. Export restrictions often complicate the ability of manufacturers to enter new markets and secure international contracts, limiting their growth potential. Additionally, stringent certification processes for military systems can delay product development and deployment, further restricting market expansion. The need to comply with both domestic and international regulations requires companies to invest significant resources in ensuring their products meet all legal requirements, which can increase costs and slow down innovation. These regulatory barriers are especially challenging for smaller companies or those operating in countries with less-established defense industries. As a result, manufacturers in the anti-submarine warfare market must navigate a complex regulatory landscape, which may hinder their ability to scale and reach new markets effectively.

Opportunities

Increasing Naval Defense Modernization Programs

Increasing naval defense modernization programs present a significant opportunity for growth in the anti-submarine warfare market. Many countries are focusing on modernizing their naval fleets to address emerging threats and enhance their maritime security. This includes the procurement of advanced anti-submarine warfare systems, which are essential for ensuring the effectiveness and survivability of naval forces in modern combat scenarios. With rising defense budgets globally, there is a growing focus on replacing outdated systems with more advanced technologies, including next-generation sonar and radar systems. This modernization trend is especially evident in countries with large naval forces, such as the United States, China, and India, which are investing heavily in upgrading their fleets to maintain a competitive edge in underwater warfare. Additionally, smaller countries that face specific regional security challenges are also prioritizing naval modernization to protect their territorial waters from potential threats. As these modernization efforts continue, the demand for anti-submarine warfare solutions will increase, providing significant opportunities for manufacturers in the market. Moreover, with increasing geopolitical tensions and the rising frequency of naval conflicts, nations are likely to continue investing in anti-submarine warfare systems, further propelling the market’s growth.

Emergence of Autonomous Systems and AI Integration

The emergence of autonomous systems and AI integration offers substantial opportunities for growth in the anti-submarine warfare market. Autonomous underwater vehicles (AUVs) and unmanned aerial vehicles (UAVs) are becoming more prevalent in anti-submarine operations due to their ability to carry out complex missions with minimal human intervention. These systems are particularly valuable in high-risk environments, where the use of manned platforms may be hazardous or impractical. By integrating AI technologies, these systems are becoming more efficient at detecting and tracking underwater threats, enabling faster response times and improving the overall effectiveness of anti-submarine missions. AI-driven systems also provide enhanced decision-making capabilities, allowing for real-time analysis of complex data and the ability to predict and counteract potential threats. As defense organizations continue to seek ways to reduce human risk and enhance operational efficiency, the adoption of autonomous systems and AI will continue to rise, opening up new avenues for growth in the anti-submarine warfare market. Additionally, these technologies offer the potential for cost savings, as they reduce the need for human operators and the associated training and operational costs. The development of such advanced technologies is expected to drive innovation in the anti-submarine warfare space, creating exciting opportunities for both established players and new entrants.

Future Outlook

The future outlook of the anti-submarine warfare market is highly positive, with sustained growth expected over the next several years. Technological advancements, particularly in sonar, radar, and autonomous systems, will continue to shape the market’s trajectory, enabling more efficient and effective underwater threat detection and neutralization. Additionally, as defense budgets grow globally, especially in regions with rising security concerns, demand for anti-submarine warfare systems is set to increase. Increased investments in modernization programs will ensure that countries upgrade their naval fleets with the latest anti-submarine technologies, driving market expansion. Furthermore, growing geopolitical tensions and the rising need for maritime security in key global regions will support ongoing market growth. Regulatory support, particularly for AI and unmanned systems, will also play a crucial role in facilitating the adoption of next-generation technologies. Overall, the market is poised for strong, steady growth, with both technological and geopolitical factors acting as primary catalysts.

Major Players

- Israel Aerospace Industries

- Elbit Systems

- Raytheon Technologies

- BAE Systems

- Lockheed Martin

- Leonardo S.p.A.

- Thales Group

- General Dynamics

- Northrop Grumman

- Saab Group

- L3 Technologies

- Rolls-Royce

- Huntington Ingalls Industries

- Leonardo DRS

- Rafael Advanced Defense Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval defense contractors

- Military agencies

- Defense technology developers

- Aerospace and defense manufacturers

- System integrators

- Defense procurement managers

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the key market variables that influence growth, including technological developments, market demand, and geopolitical factors.

Step 2: Market Analysis and Construction

This stage focuses on collecting relevant data, identifying trends, and constructing a market model based on historical assessments and current developments.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate the hypotheses formed in the previous stages, ensuring the reliability of the findings.

Step 4: Research Synthesis and Final Output

The research findings are synthesized to create a comprehensive market report, ready for publication and distribution.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising geopolitical tensions and regional instability

Increased investments in naval defense systems

Advancements in anti-submarine warfare technologies - Market Challenges

High development and maintenance costs of anti-submarine systems

Complexity of integration with existing defense platforms

Regulatory hurdles and certification issues - Market Opportunities

Growing defense budgets in Israel and neighboring countries

Emergence of new technologies such as AI in anti-submarine warfare

Increased demand for naval modernization - Trends

Shift towards integrated, multi-sensor anti-submarine systems

Adoption of unmanned systems for anti-submarine operations

Rising focus on sustainable and energy-efficient solutions - Government Regulations

Strict certification and export control regulations for defense products

Regulations governing the use of unmanned systems in military operations

International maritime law impacting anti-submarine warfare systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Sonar Systems

Radar Systems

Weapon Systems

Communication Systems

Detection and Tracking Systems - By Platform Type (In Value%)

Naval Vessels

Submarines

Airborne Platforms

Ground-based Systems

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Upgrades

Custom Fitment - By EndUser Segment (In Value%)

Military

Naval Forces

Coast Guards

Private Sector

Other Government Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Procurement

Contractual Procurement

Third-party Procurement

Online Procurement

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Israel Aerospace Industries

Elbit Systems

Rafael Advanced Defense Systems

IAI ELTA Systems

Thales Group

Raytheon Technologies

Lockheed Martin

Northrop Grumman

Boeing

BAE Systems

Leonardo S.p.A.

Harris Corporation

General Dynamics

L3 Technologies

BAE Systems Submarines

- Military Applications

- Naval Defense Upgrades

- Government Agencies’ Role

- Private Sector Involvement

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035